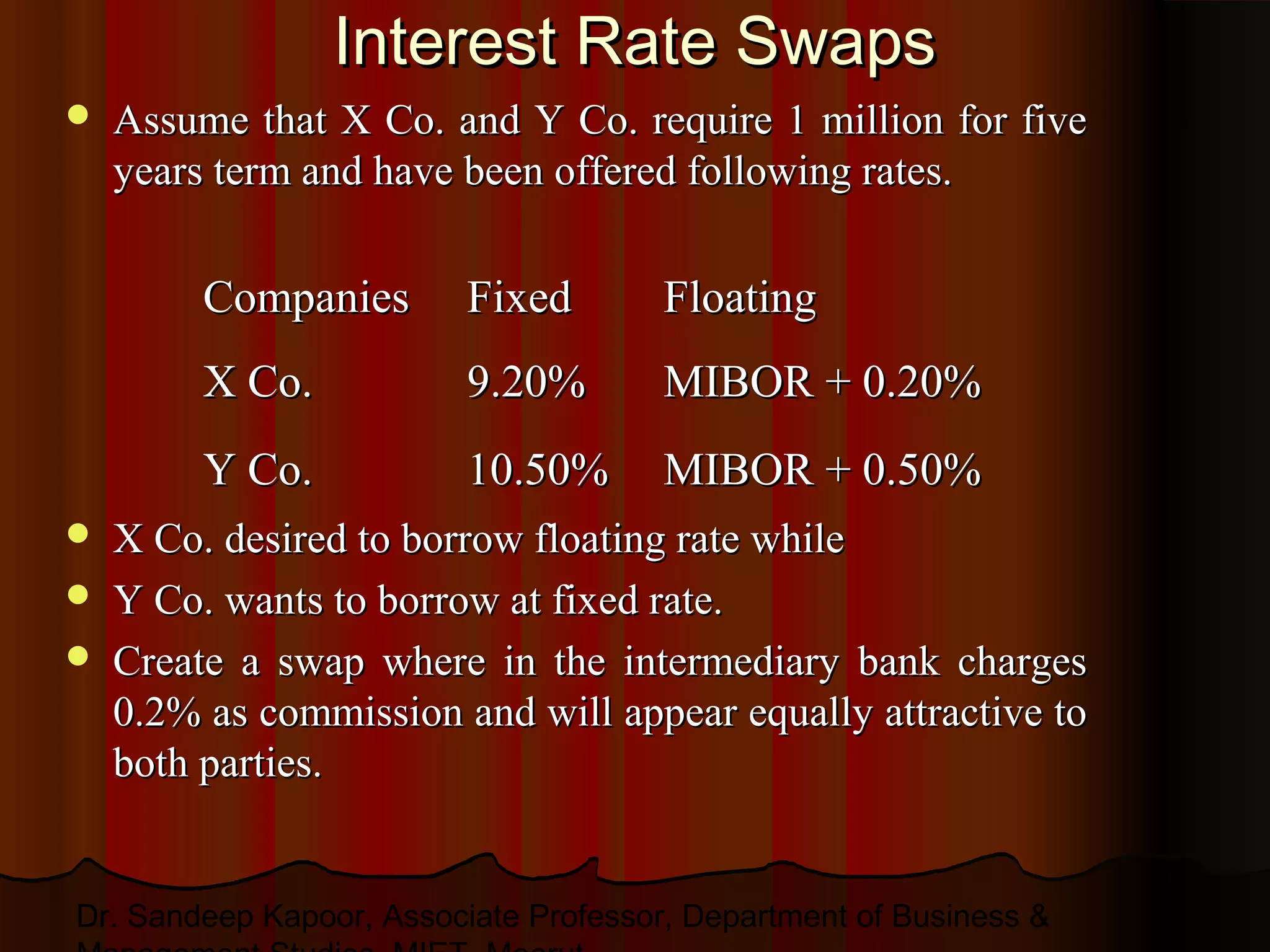

The document discusses various types of interest rate swaps and currency swaps, explaining how companies can benefit from these agreements. It provides examples of fixed and floating rate loans for two companies, illustrating potential gains from swap agreements and the effective cost of borrowing. Additionally, it touches on equity swaps, where returns from investments can be exchanged between parties.