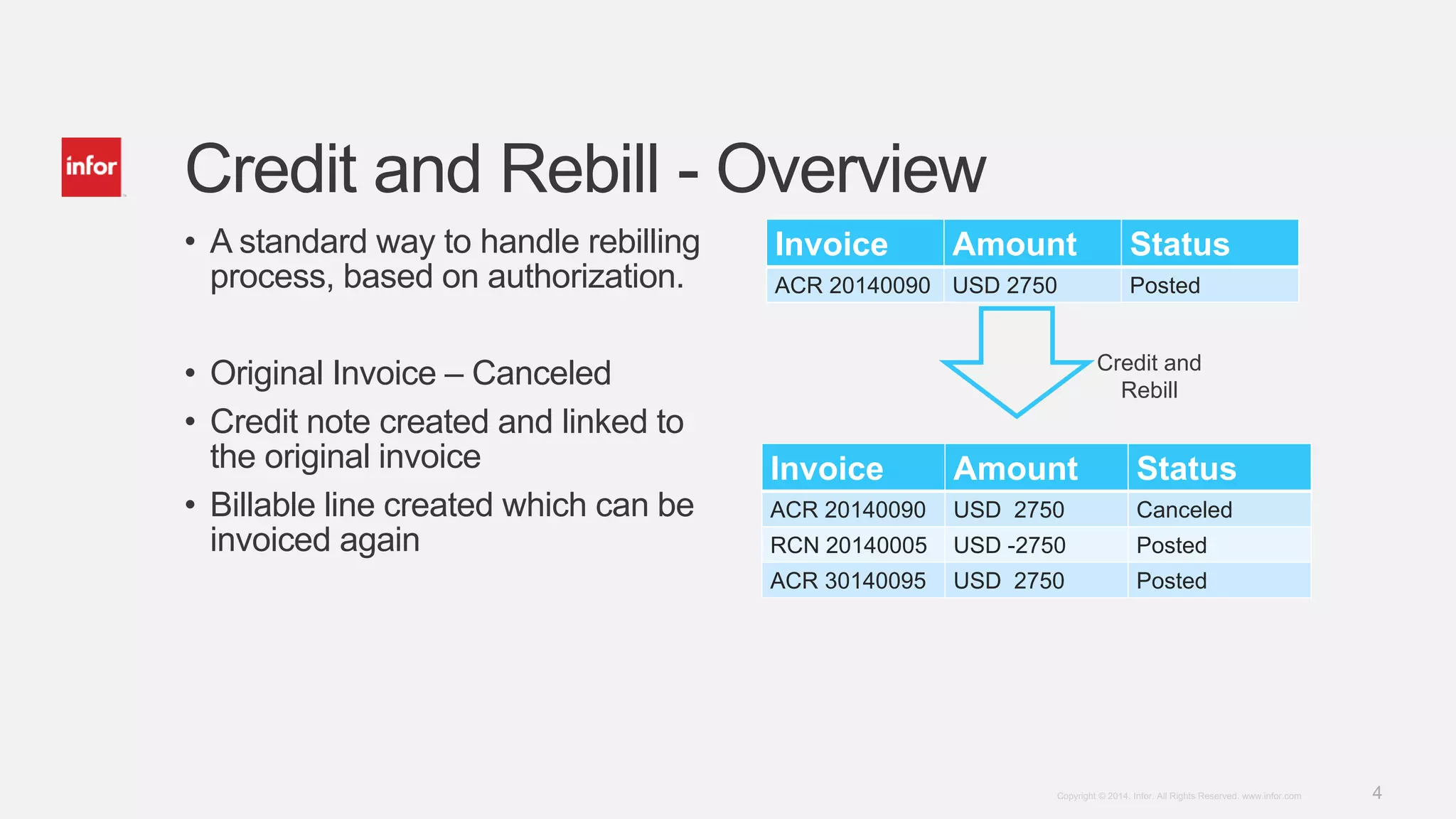

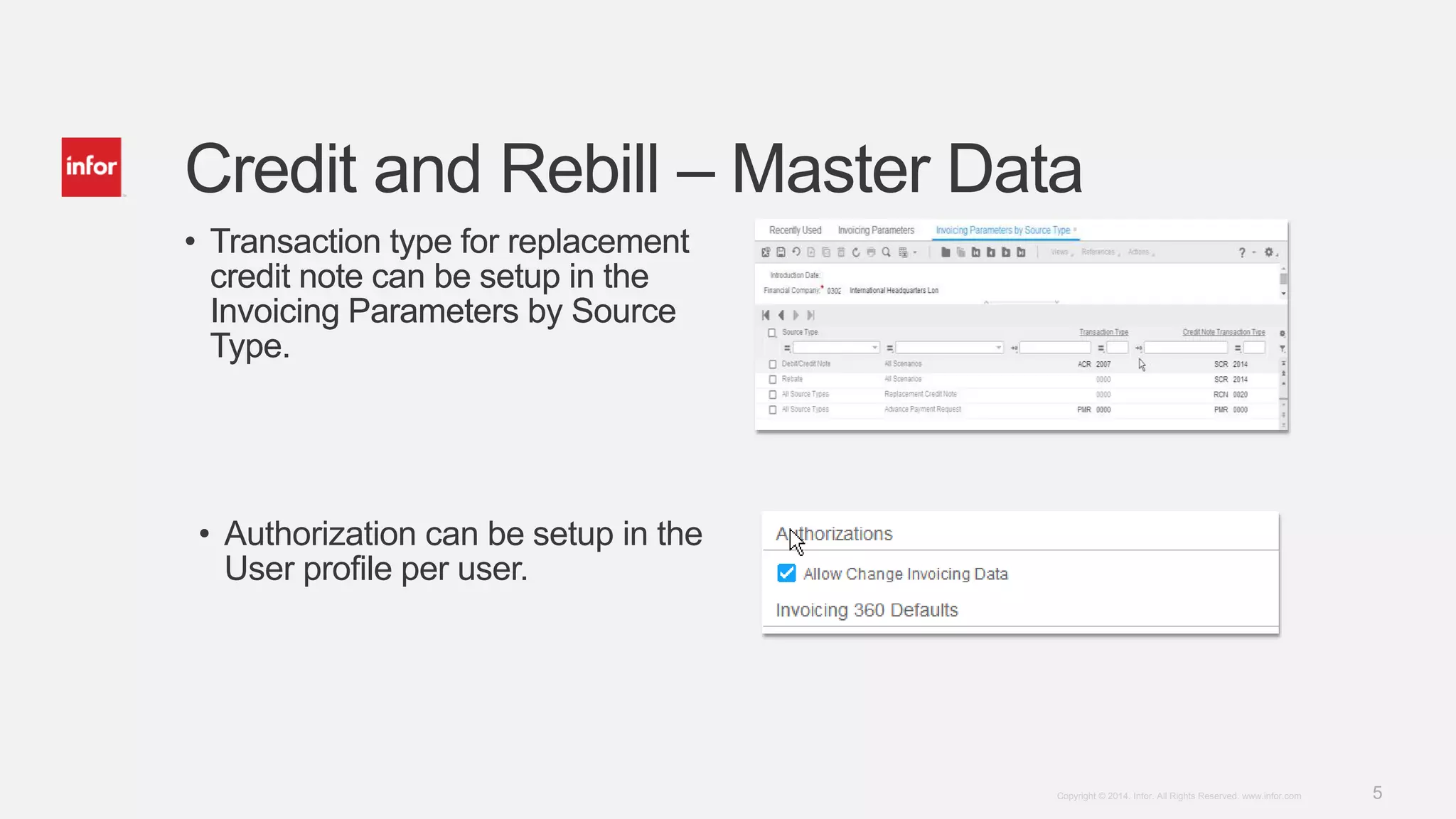

The document describes Infor LN's new credit and rebill functionality. It allows users to cancel an issued invoice if an error is noticed, create a credit note to close the original invoice, and generate new billable lines that can be re-invoiced. The solution overview, details of master data, conditions, process, and limitations are covered. A demo of the credit and rebill process is also provided.