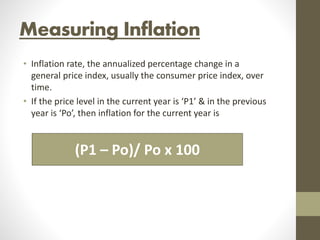

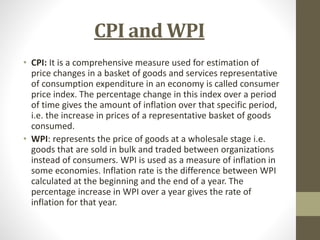

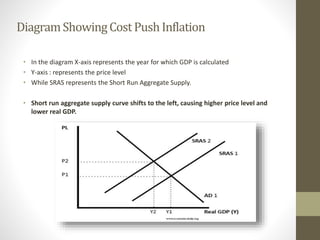

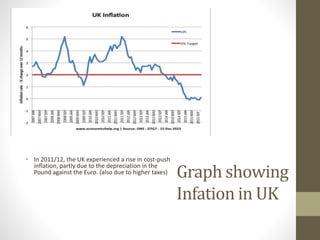

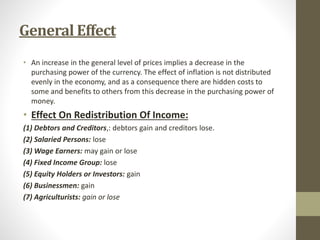

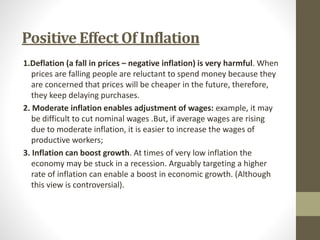

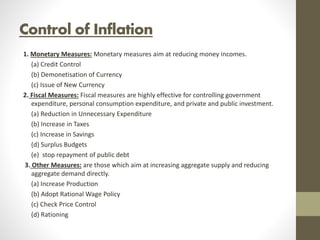

The document provides a comprehensive overview of inflation, including its definition, measurement, types, causes, effects, and control methods. It explains cost-push and demand-pull inflation, alongside concepts like deflation, disinflation, reflation, and stagflation. Additionally, the document discusses inflation's impact on the economy, income redistribution, and specific details regarding inflation in India.