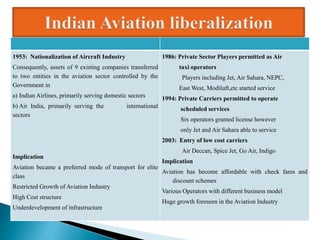

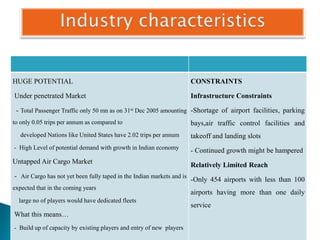

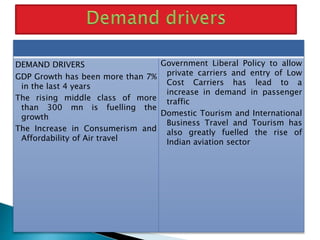

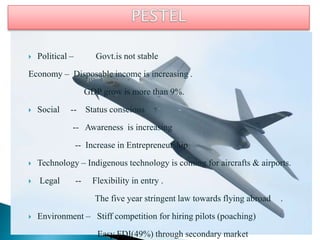

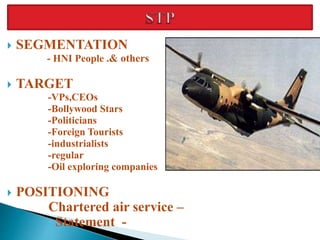

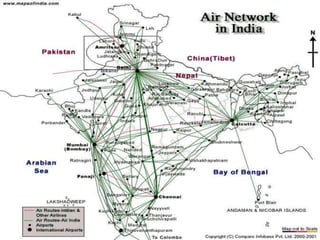

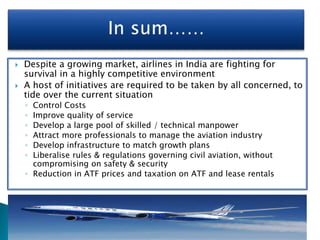

The Indian aviation industry has experienced rapid growth and transformation over the past two decades, moving from a government-owned sector to one dominated by private airlines. While domestic passenger traffic has grown at over 18% annually, infrastructure constraints and high costs continue to challenge airline profitability in the competitive Indian market. Further reforms and investments are needed to develop infrastructure and support continued growth in the aviation industry.