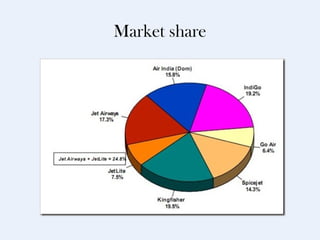

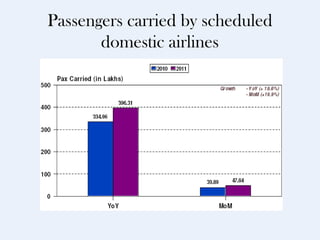

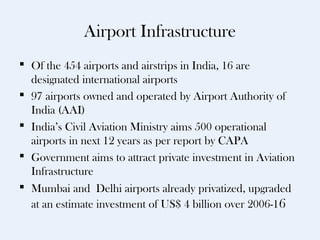

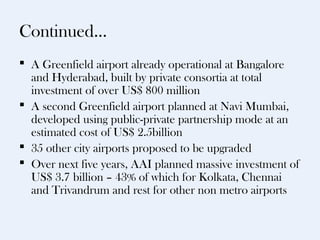

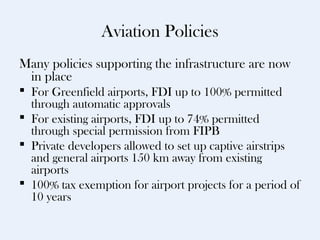

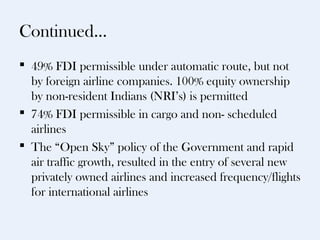

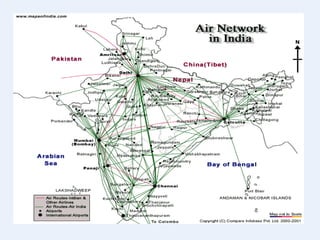

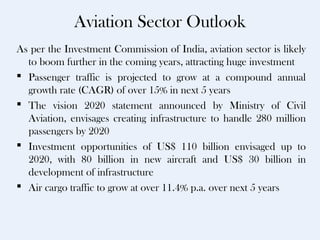

The Indian aviation industry is one of the fastest growing in the world. It has undergone rapid transformation from being primarily government-owned to now being dominated by privately owned airlines. The domestic aviation market is growing at around 25-30% annually. There are currently over 450 airports and airstrips in India. The government has introduced policies to boost aviation infrastructure development and attract private investment. The aviation sector is expected to continue booming, with passenger traffic projected to grow over 15% in the next 5 years, representing huge investment opportunities.