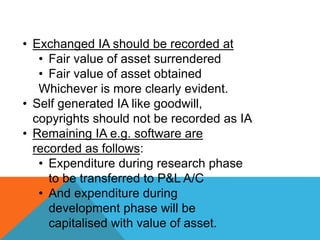

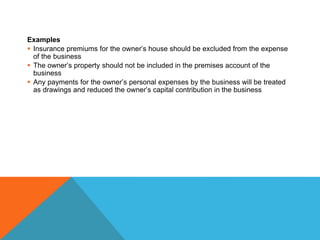

This presentation provides an overview of accounting principles and standards. It defines accounting as identifying, measuring, and communicating financial information to allow for informed decisions. Accounting standards provide common principles, procedures, and policies to improve transparency. Specific standards cover revenue recognition, asset valuation, cash flow reporting, inventory costs, leases, taxes, intangible assets, and more. The accounting standards board of India issues standards following ICAI principles with input from advisory committees.