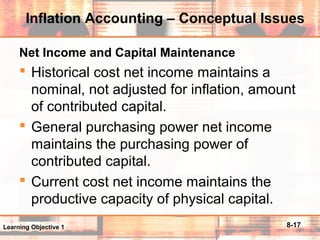

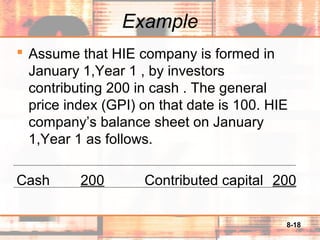

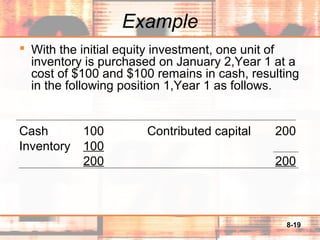

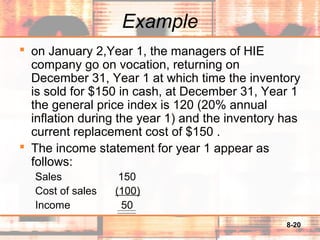

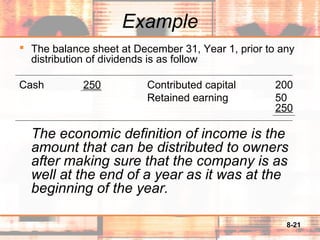

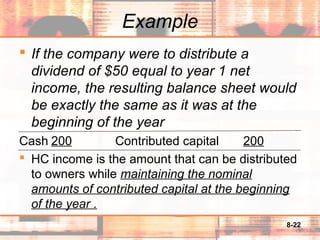

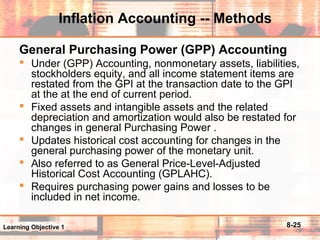

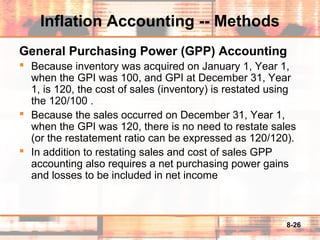

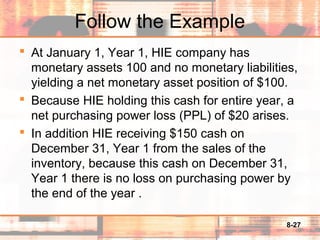

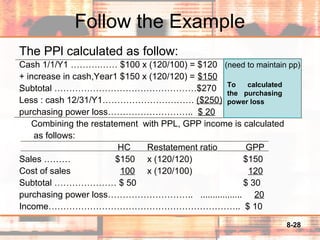

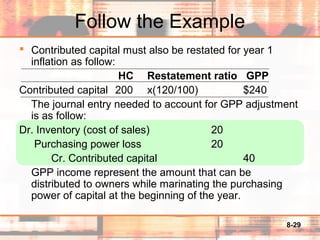

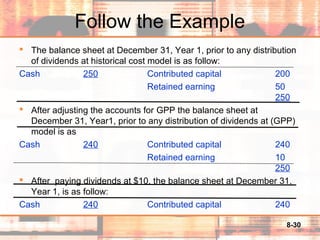

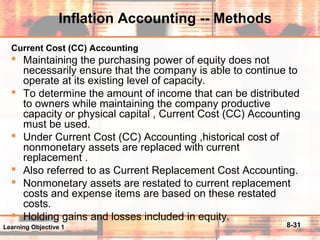

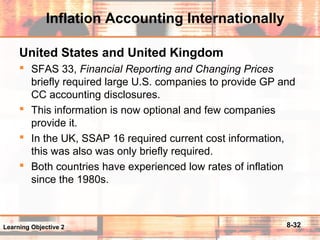

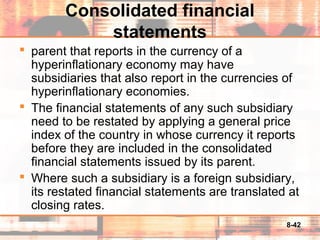

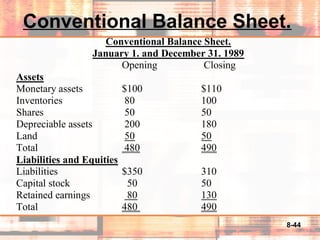

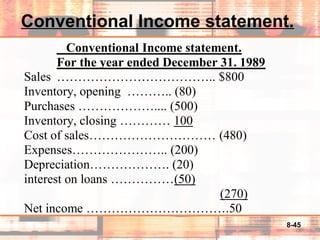

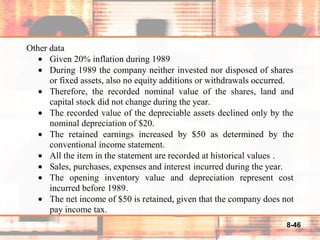

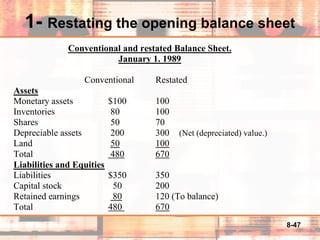

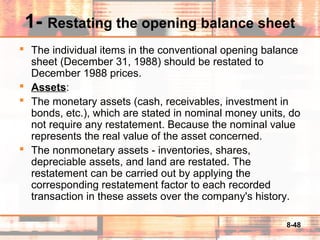

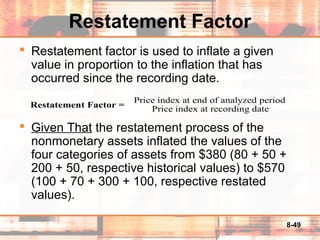

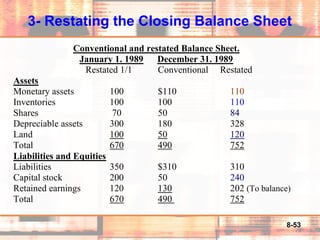

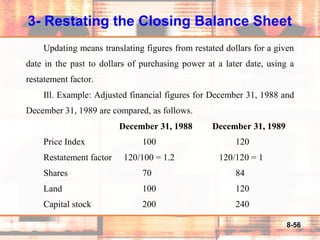

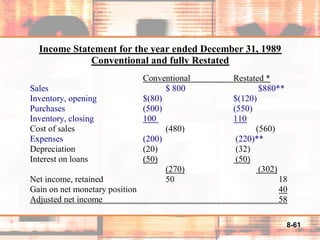

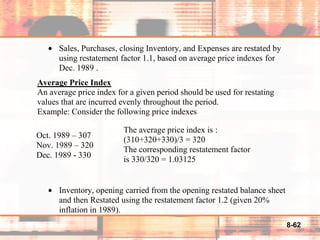

This document discusses accounting for inflation and changing prices. It introduces two main methods for inflation accounting: general purchasing power accounting and current cost accounting. General purchasing power accounting restates historical financial statement amounts for changes in the general price level or purchasing power of the currency. Current cost accounting updates asset values from historical cost to their current replacement costs. The document uses an example to illustrate capital maintenance under historical cost and inflation-adjusted accounting. It also discusses the concepts of capital maintenance in the IASB Framework and defines income under different approaches.