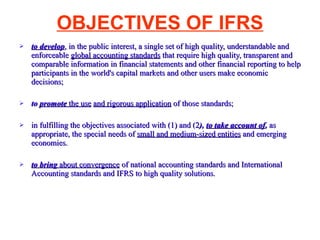

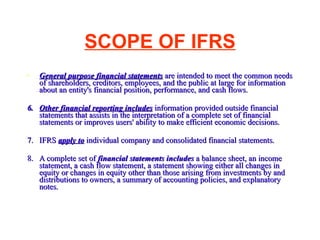

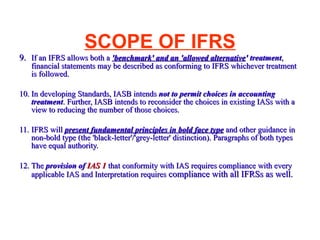

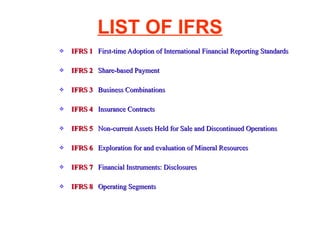

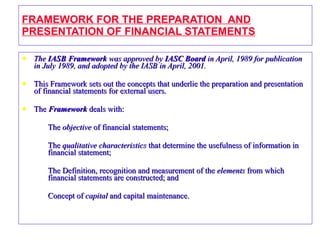

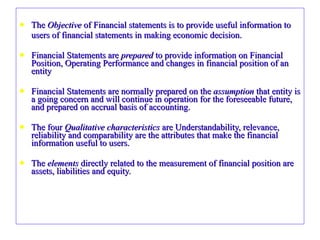

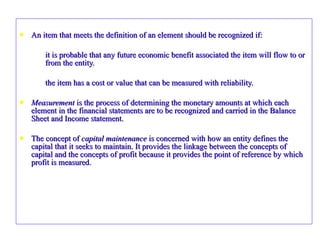

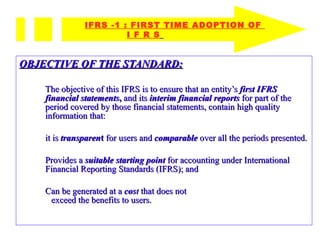

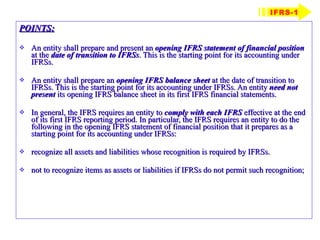

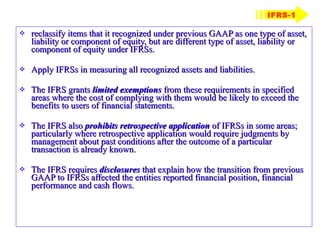

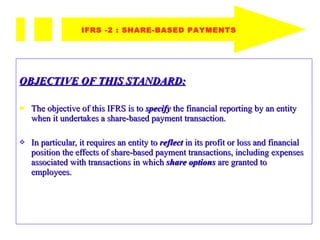

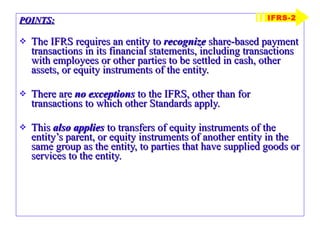

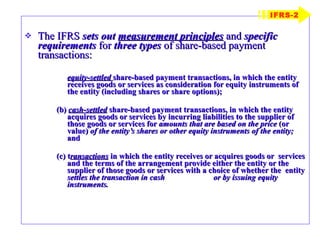

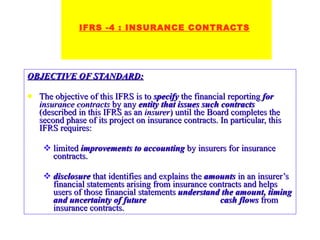

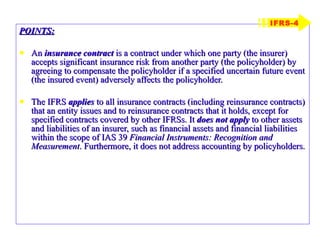

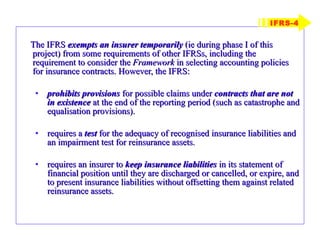

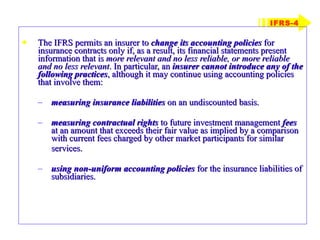

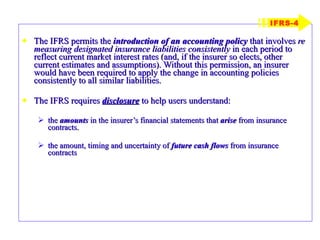

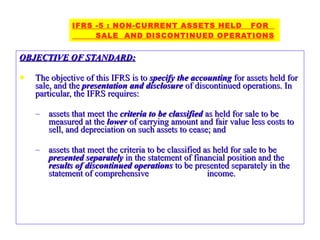

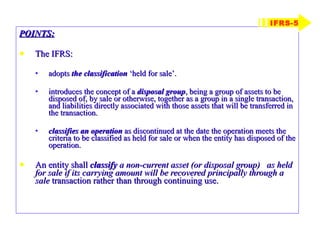

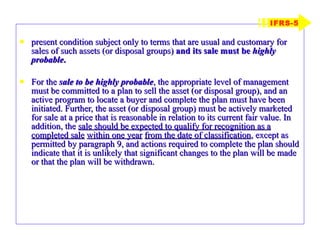

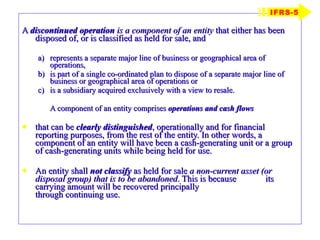

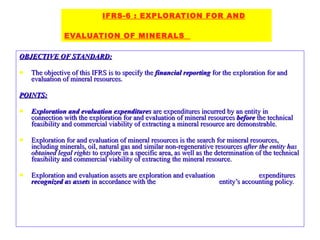

The document introduces International Financial Reporting Standards (IFRS). It discusses the objectives of IFRS which are to develop a single set of high-quality global accounting standards to help participants in capital markets make economic decisions. It also covers the scope of IFRS, listing some IFRS standards and outlining what types of entities and financial reports IFRS applies to.