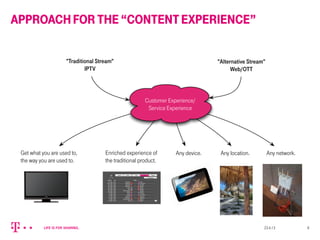

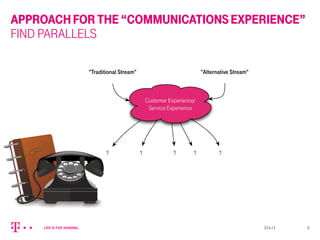

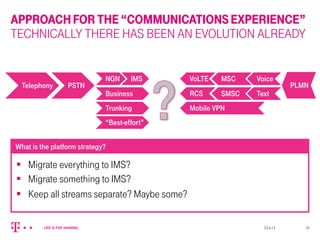

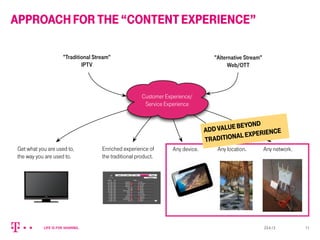

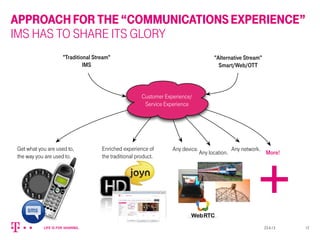

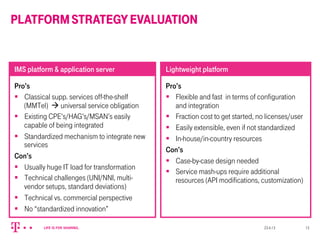

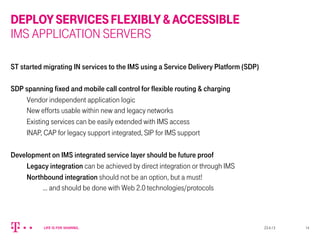

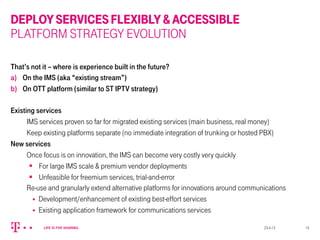

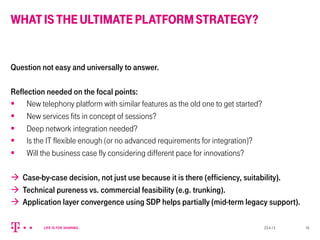

The document discusses the evolution and migration of Slovak Telekom's communication platforms towards IMS technology, highlighting its status as a leader in fixed and mobile telecommunication services in Slovakia. It emphasizes the challenges and strategies for integrating legacy systems with new IP-based services while focusing on improving customer experience and driving innovation. The conclusion stresses the need for telcos to prioritize user needs over architectural concerns to remain competitive in a rapidly changing market.

![REFERENCES

[1] Open Clipart

[2] Flickr

23.4.13 20](https://image.slidesharecdn.com/ims-world-forum2013-130717125058-phpapp01/85/Enabling-Enhanced-Services-Through-IMS-Technology-20-320.jpg)