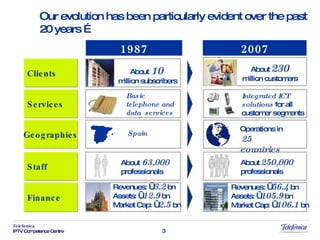

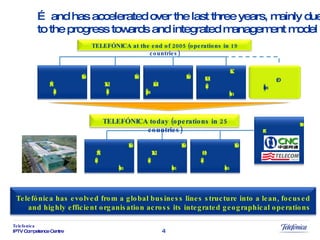

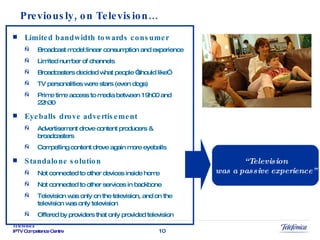

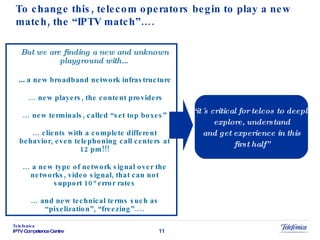

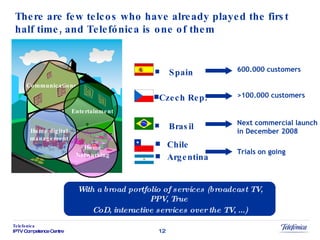

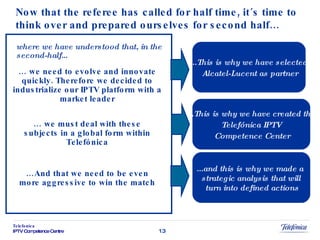

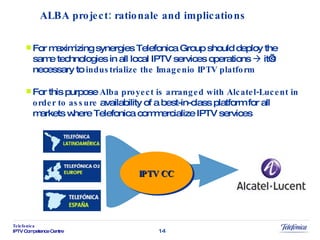

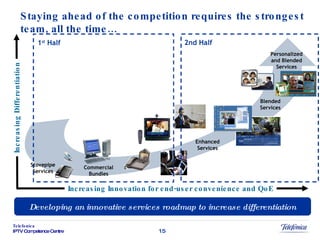

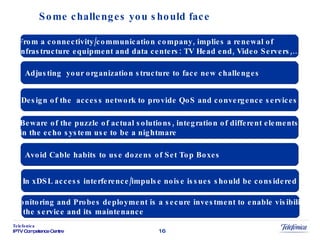

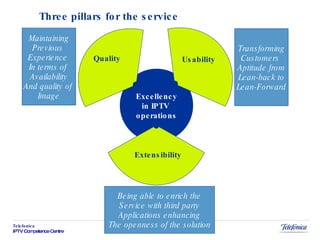

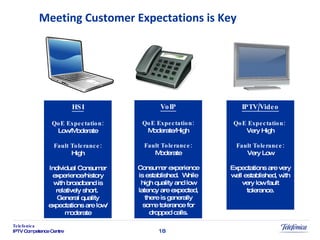

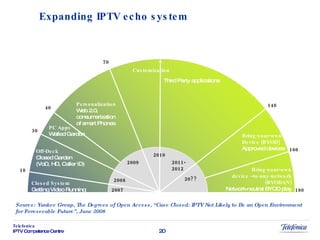

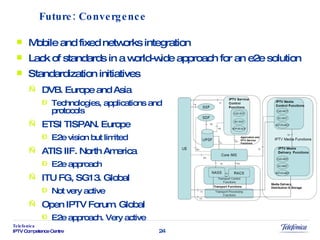

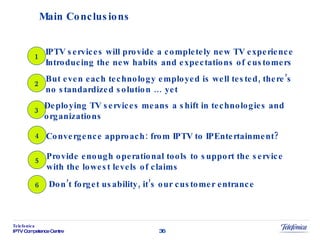

The document discusses the opportunities and challenges for Telefonica in providing IPTV services. It notes that Telefonica has already launched IPTV trials and services in several countries. However, IPTV represents new challenges as Telefonica transitions from a connectivity provider to a provider of entertainment services. These challenges include upgrading network infrastructure, integrating different elements, and ensuring high quality of experience for customers. The document advocates an approach of continually innovating, ensuring excellent operations, and focusing on usability to provide the best customer experience for IPTV.