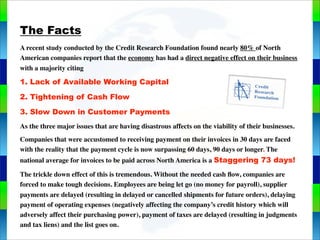

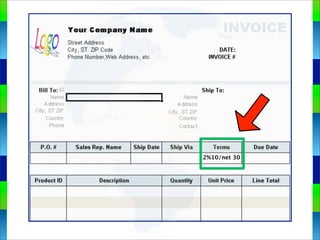

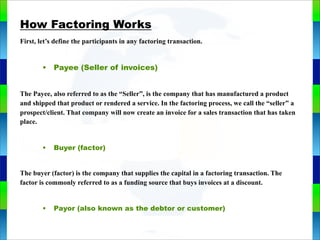

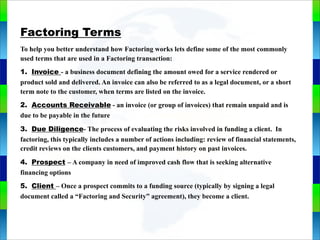

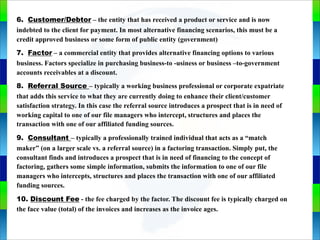

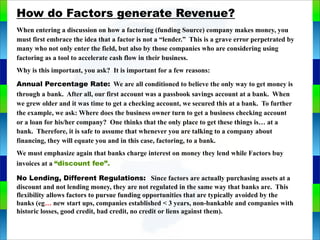

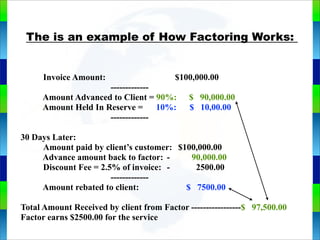

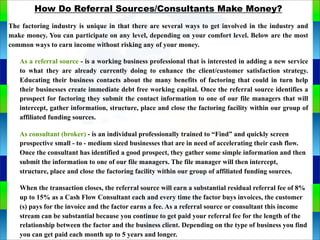

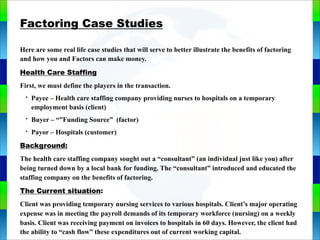

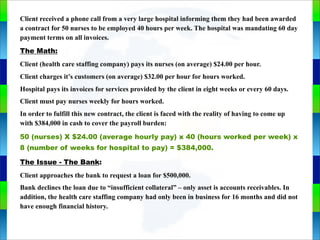

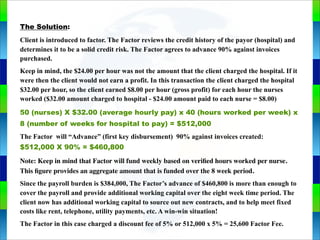

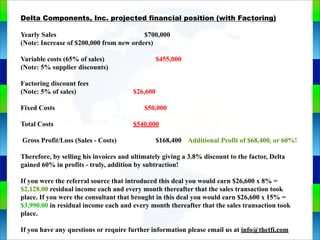

The document provides background information on factoring and how it works. It defines key terms like invoices, accounts receivable, clients, customers, and factors. It explains that factors generate revenue not through interest on loans, but by purchasing invoices from clients at a discount fee. Factors provide upfront advances to clients and release reserves once invoices are paid, helping clients improve their cash flow.