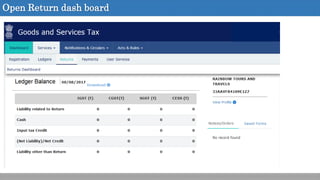

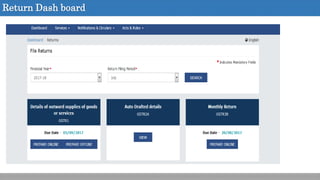

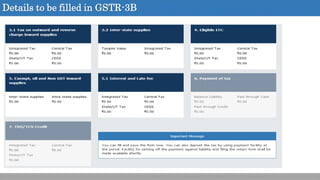

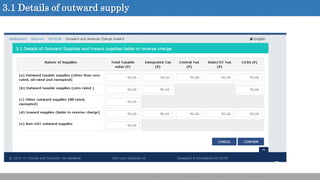

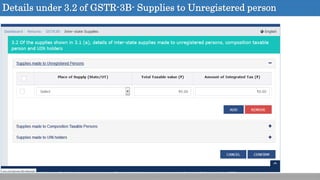

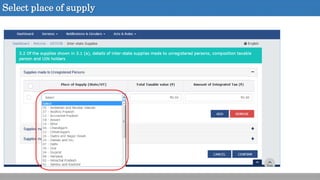

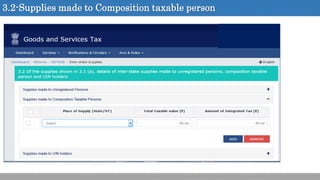

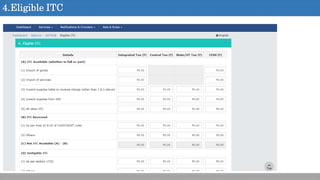

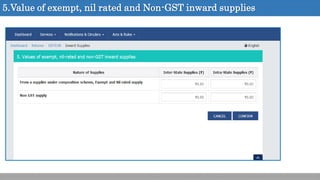

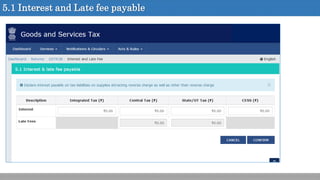

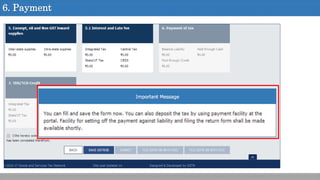

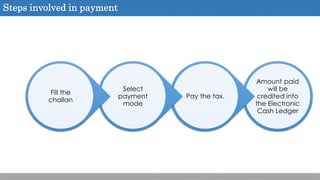

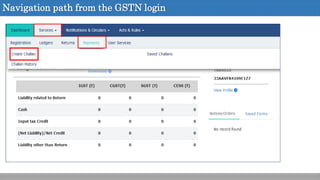

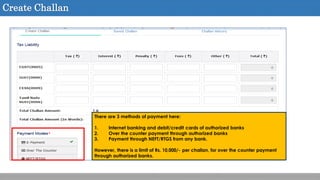

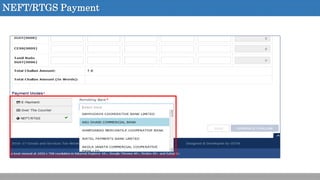

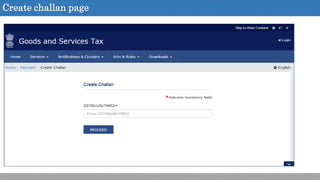

The document outlines the online filing process for GSTR-3B returns mandated by GST regulations, emphasizing that all returns must be filed online via the GSTN portal or authorized service providers. It includes important filing dates for July and August 2017, details on filling the return, and payment methods available, such as internet banking and authorized bank counters. The document also promotes ProfitBooks, a service that assists with GST compliance and financial management.