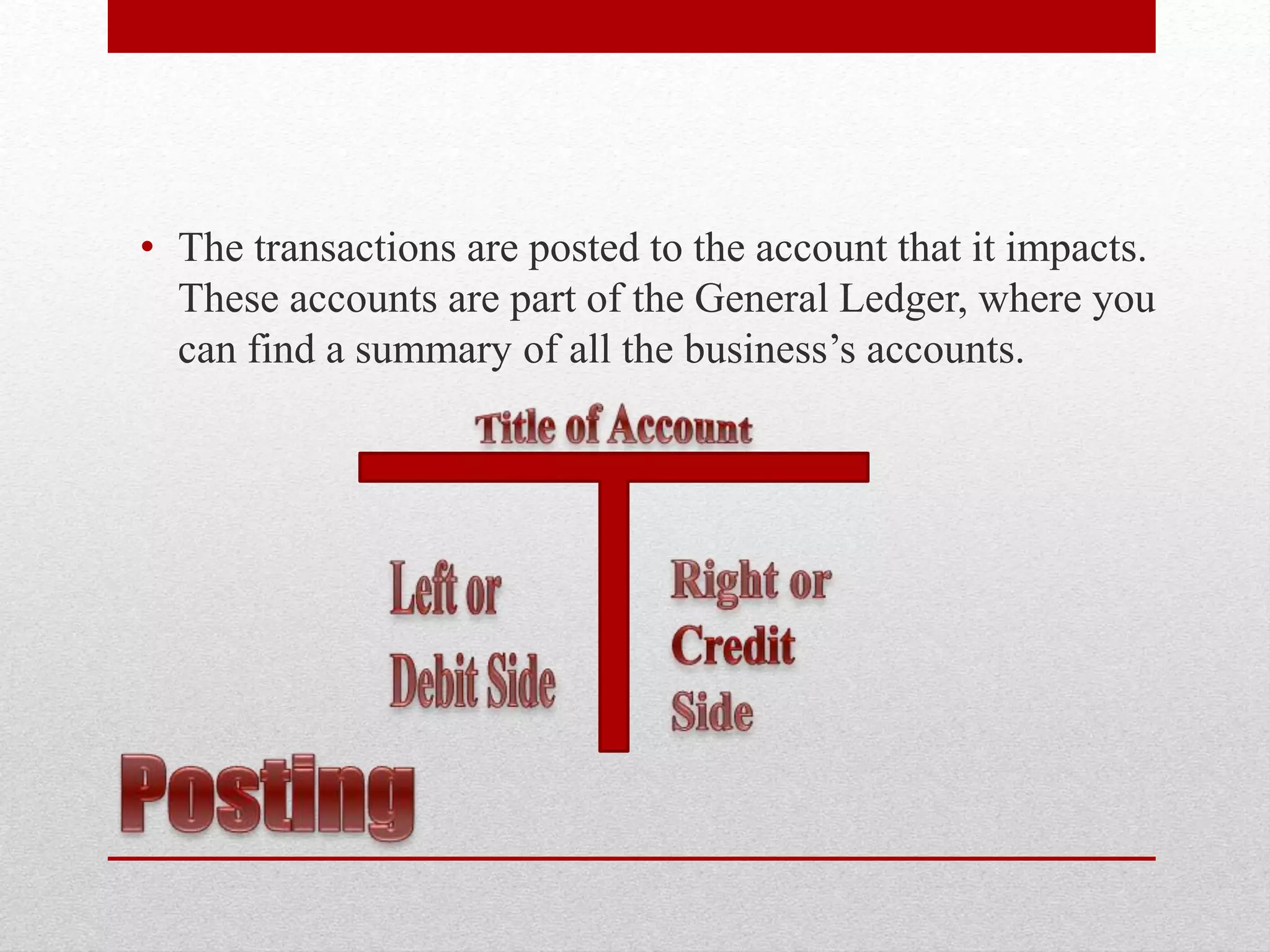

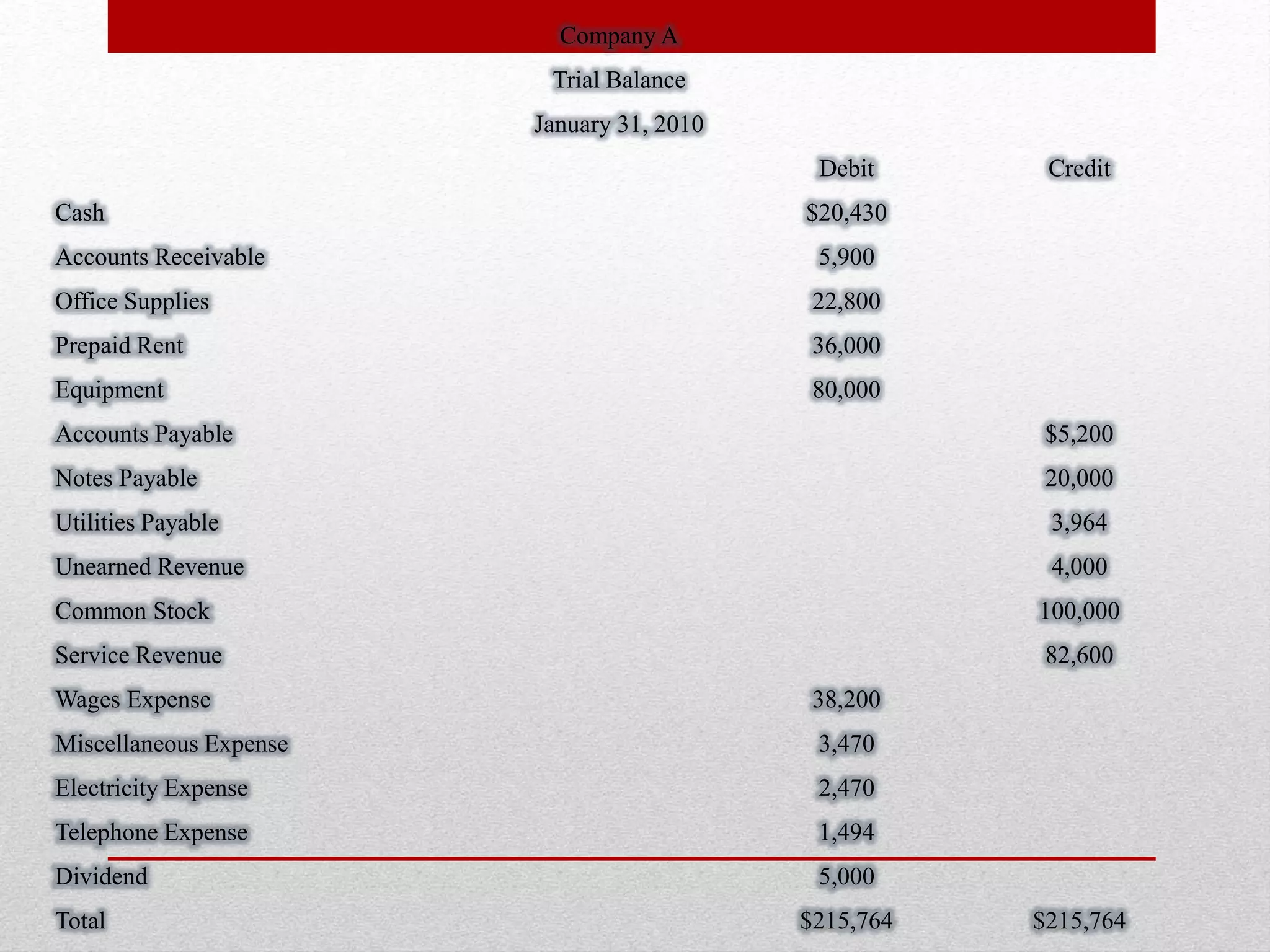

The document discusses the key steps in the accounting cycle: 1) Financial transactions are recorded by debiting and crediting the appropriate accounts; 2) The transactions are posted to accounts in the general ledger; 3) At the end of the period a trial balance is prepared to ensure debits equal credits; 4) Adjusting entries are made if needed and an adjusted trial balance is prepared; 5) Financial statements are created using the adjusted account balances; 6) Revenue and expense accounts are closed out to begin the next accounting period.