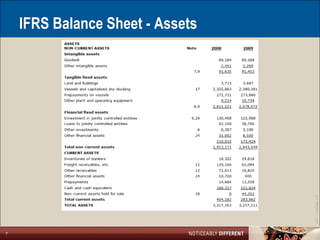

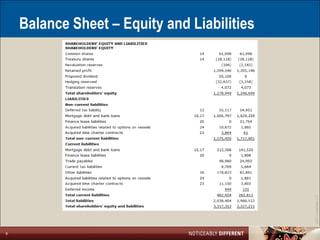

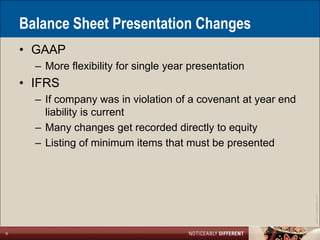

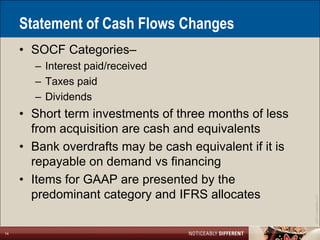

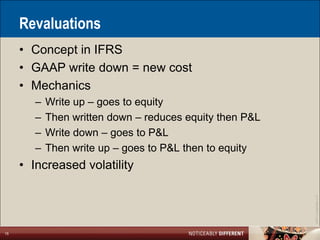

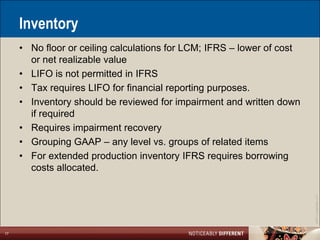

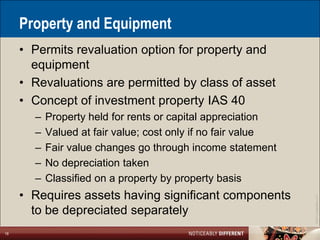

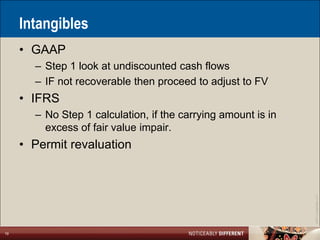

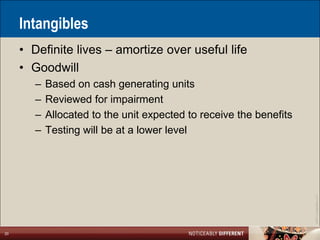

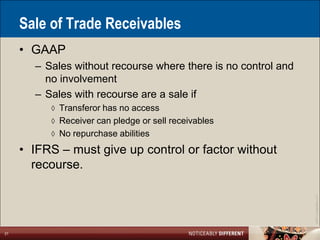

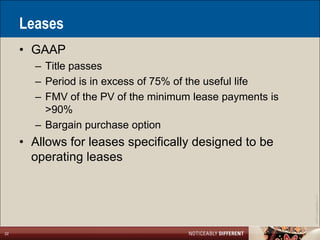

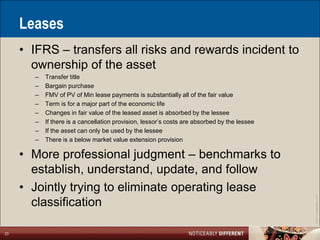

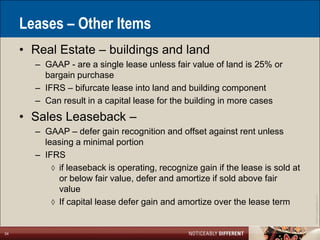

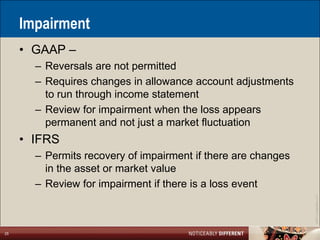

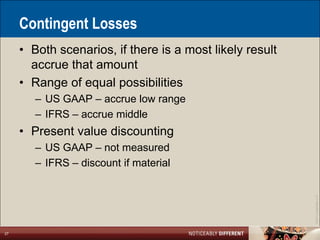

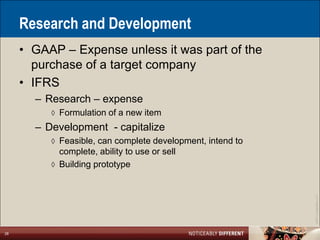

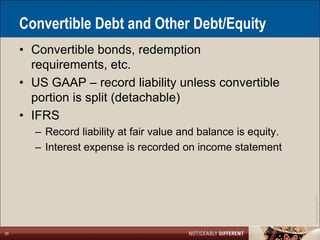

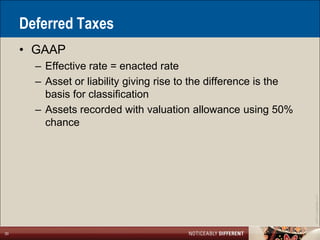

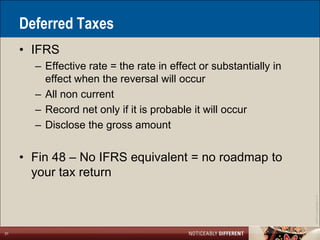

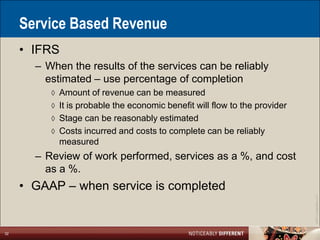

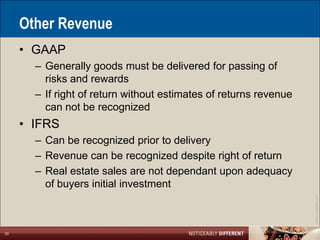

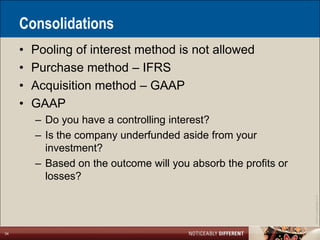

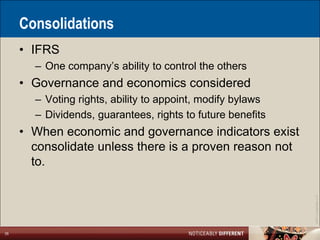

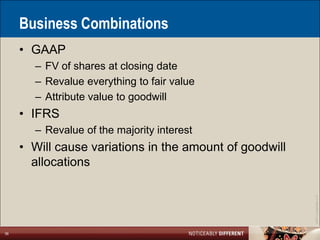

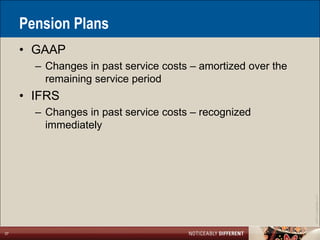

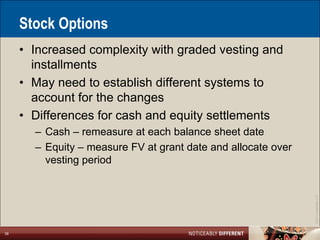

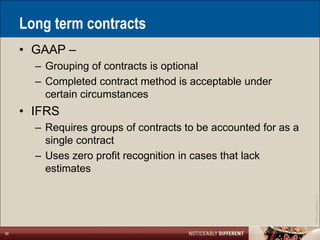

This document compares International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP) across several areas. There is a push to converge standards due to increasing globalization and multinational corporations. Key differences include IFRS being more principles-based and allowing fair value accounting, while GAAP relies more on historical costs. IFRS also requires more detailed note disclosures and adjustments that directly impact equity. The document outlines differences in financial statement presentation, inventory valuation, lease accounting, impairment testing and other topics between the two standards.