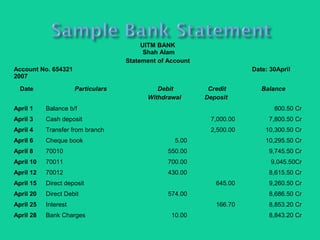

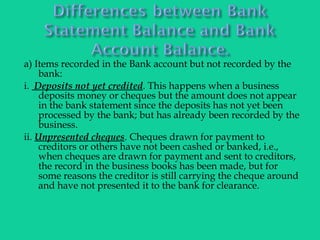

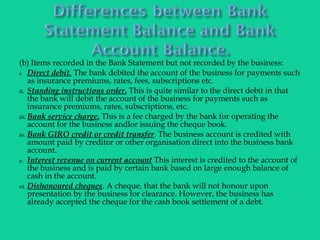

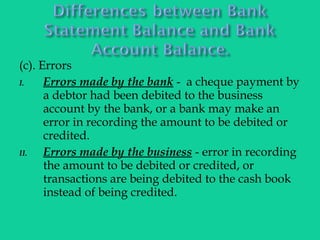

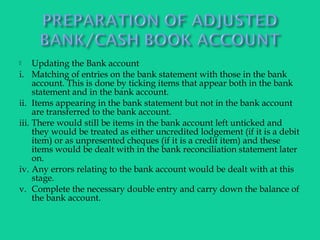

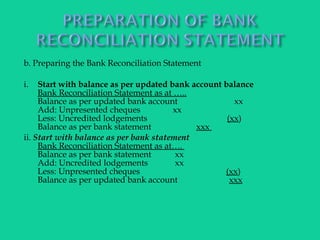

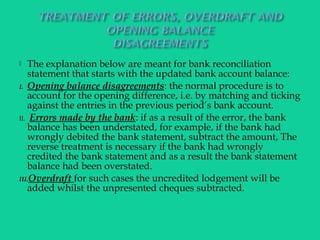

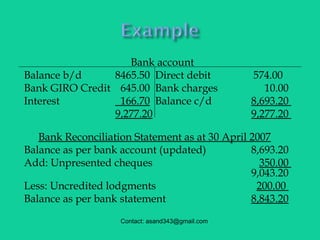

The document discusses bank reconciliation, which is the process of ensuring the bank statement balance matches the business's records. It explains items that may appear in only one record like deposits not cleared. The purpose is to identify and correct discrepancies by preparing a bank reconciliation statement that lists unpresented checks, uncredited deposits, and other adjustments to calculate the correct balance. Instructions are provided on updating records, identifying reconciling items, and preparing the final reconciliation statement to match the business and bank records.