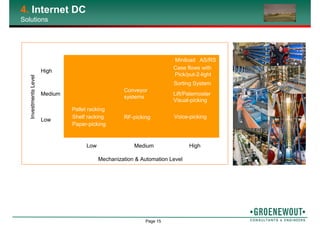

Logistics is crucial for the success of webshops. While one third of Dutch online shoppers would shop more online if delivery service improved, only 17% would pay more for better service. Many retailers have added webshops alongside physical stores but often shut them down quickly due to failures in combined fulfillment. A webshop only succeeds if logistics like pick strategies are carefully planned beforehand. Webshops proliferate but often fail due to poor management of logistics chains.