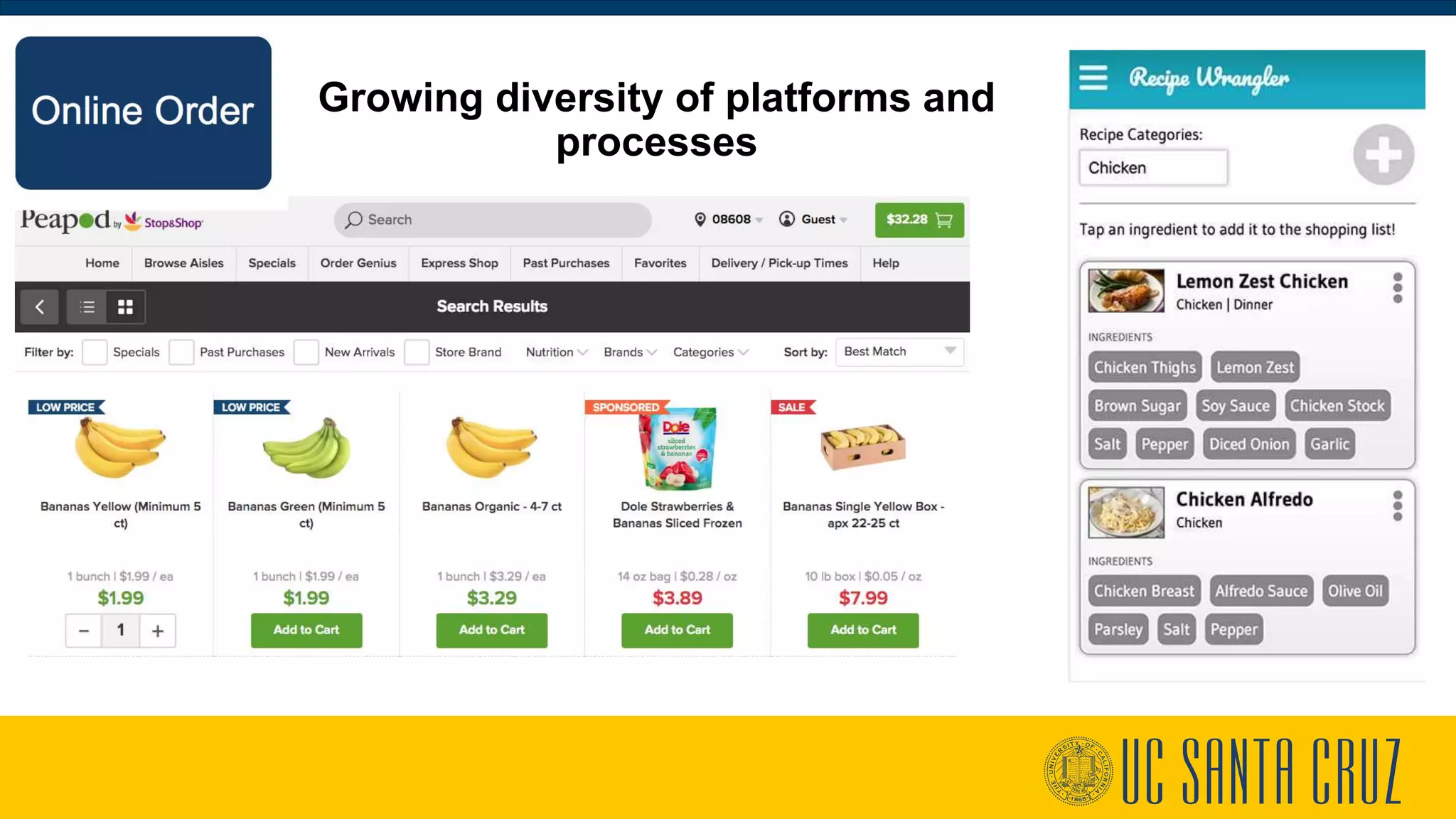

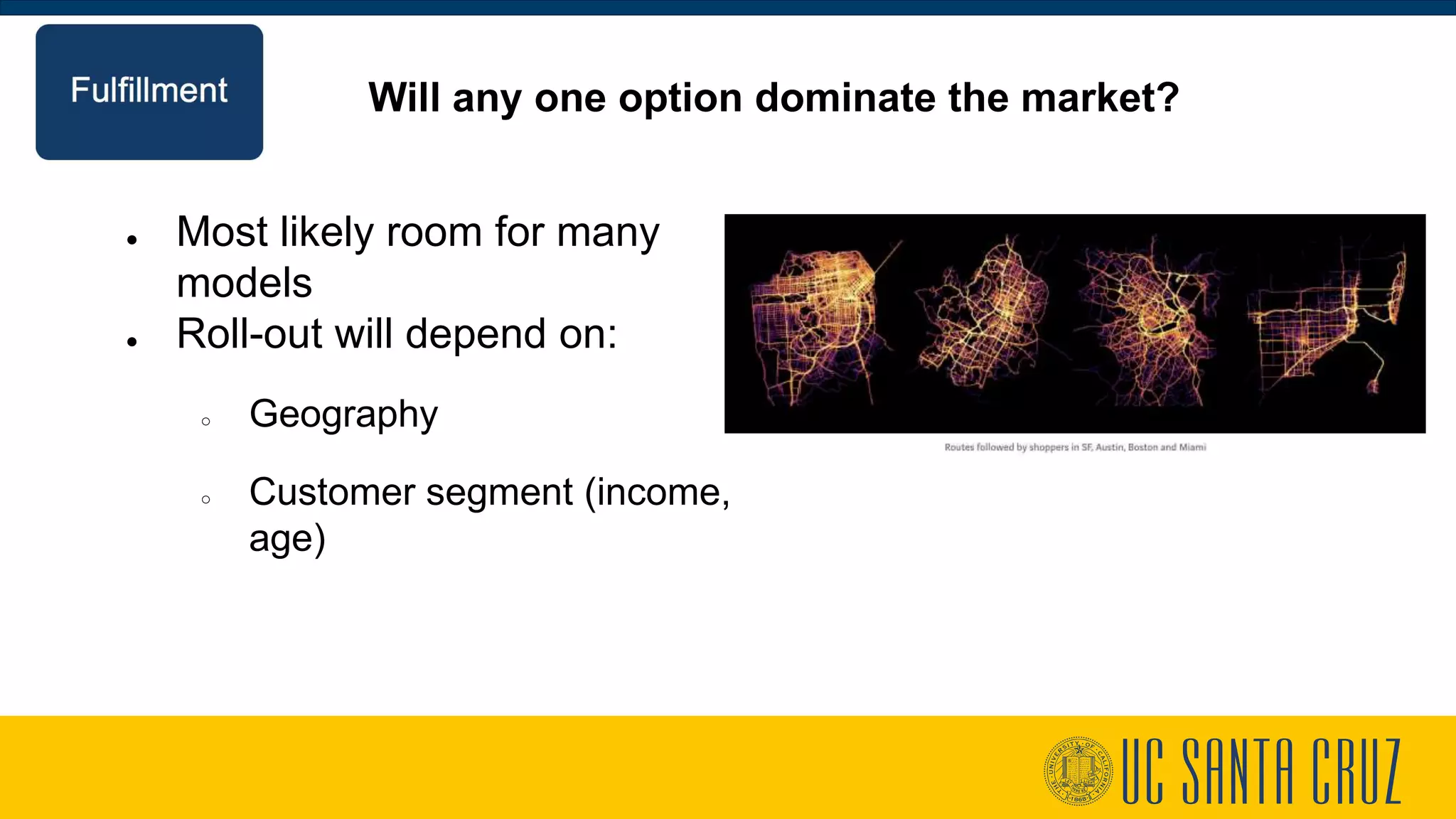

The document discusses the evolving landscape of the grocery retail industry in the U.S., highlighting the impact of e-commerce and food delivery services on traditional grocery store employment and operations. Analysts predict that while grocery stores will adapt to new delivery channels, the nature of grocery jobs will change, leading to a decline in cashiers and an increase in roles like pickers and drivers, often characterized by poor wages. It also emphasizes the importance of leveraging existing store infrastructure and location for competitive advantage amidst ongoing technological advancements.