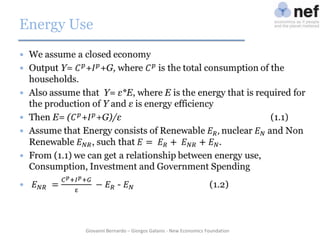

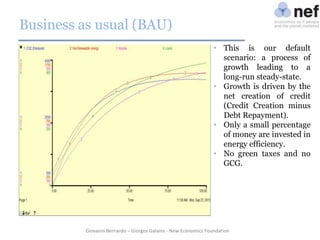

1. The document presents a new modeling framework that links finance, growth, income distribution, and the environment.

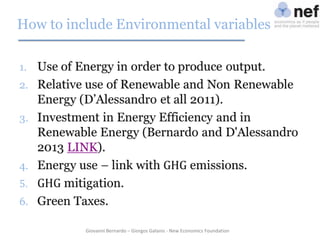

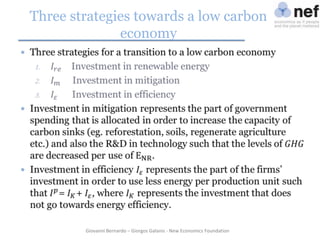

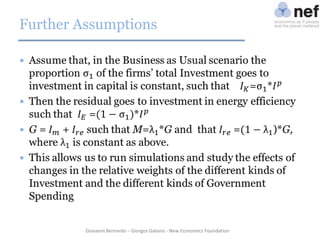

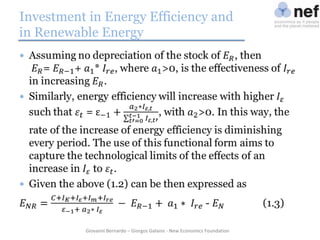

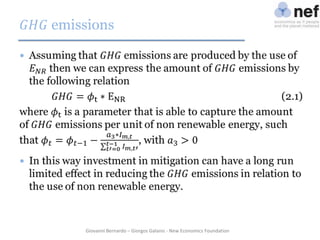

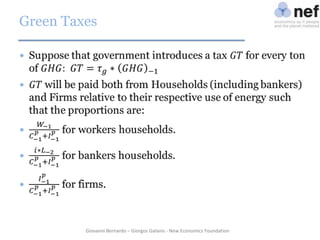

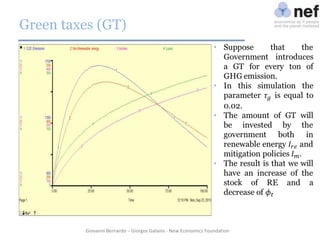

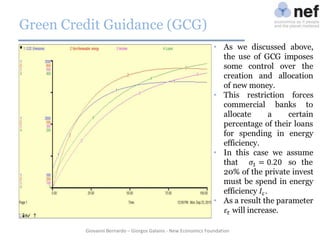

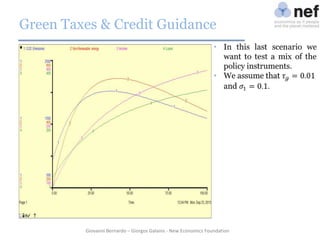

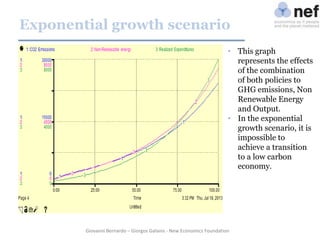

2. It models strategies for a low-carbon economy like green taxes, green credit guidance, and investment in energy efficiency and renewables.

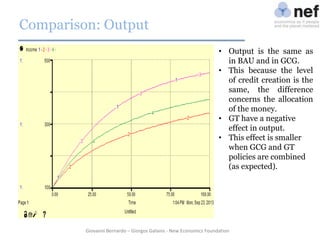

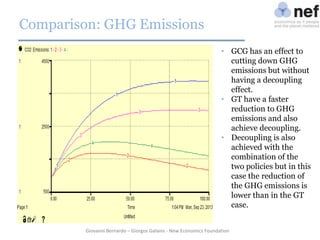

3. Simulations show that green taxes most rapidly reduce emissions but hurt output, while green credit guidance alone has limited emission cuts; combining the two policies balances emission cuts and economic growth.