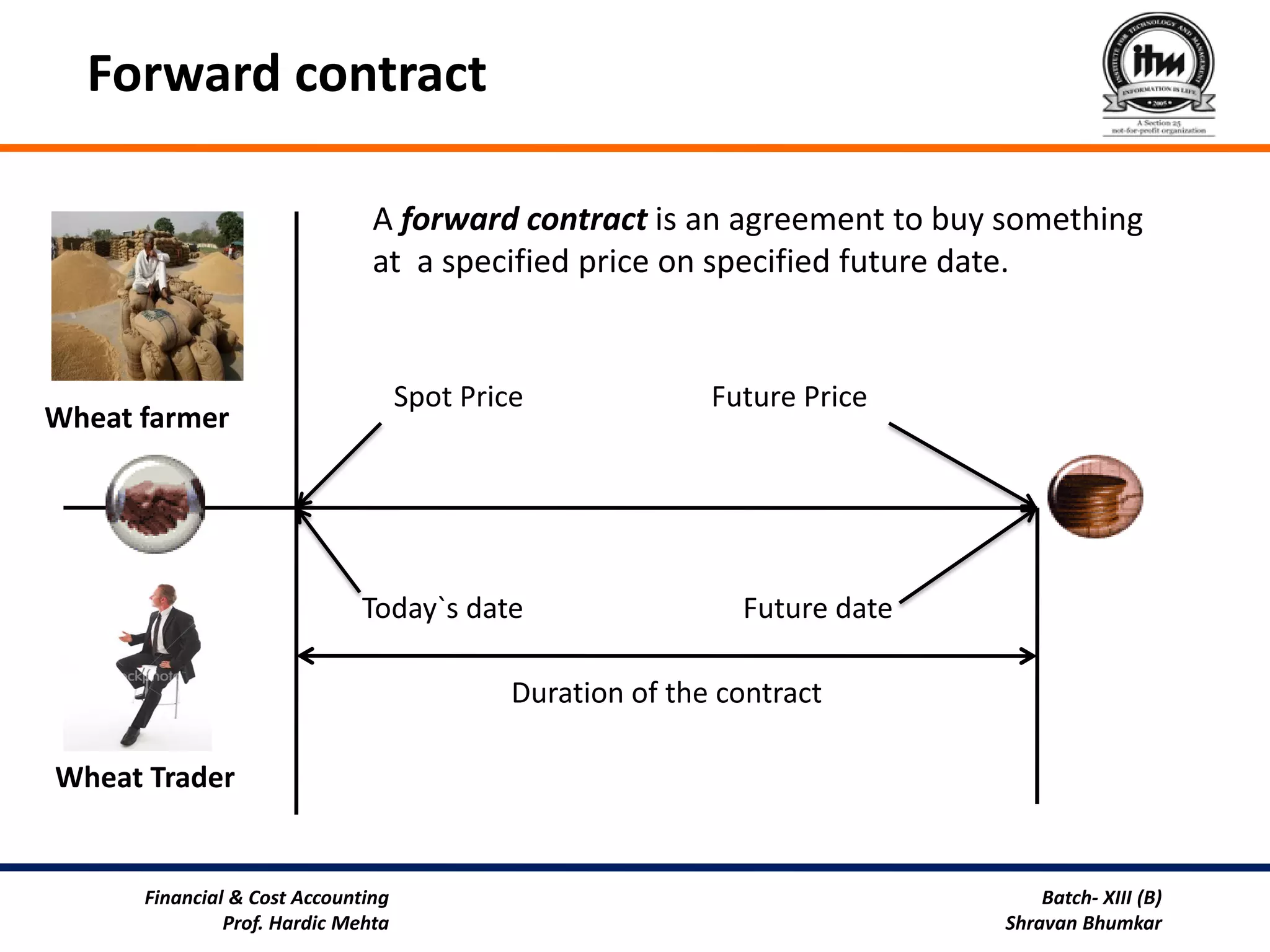

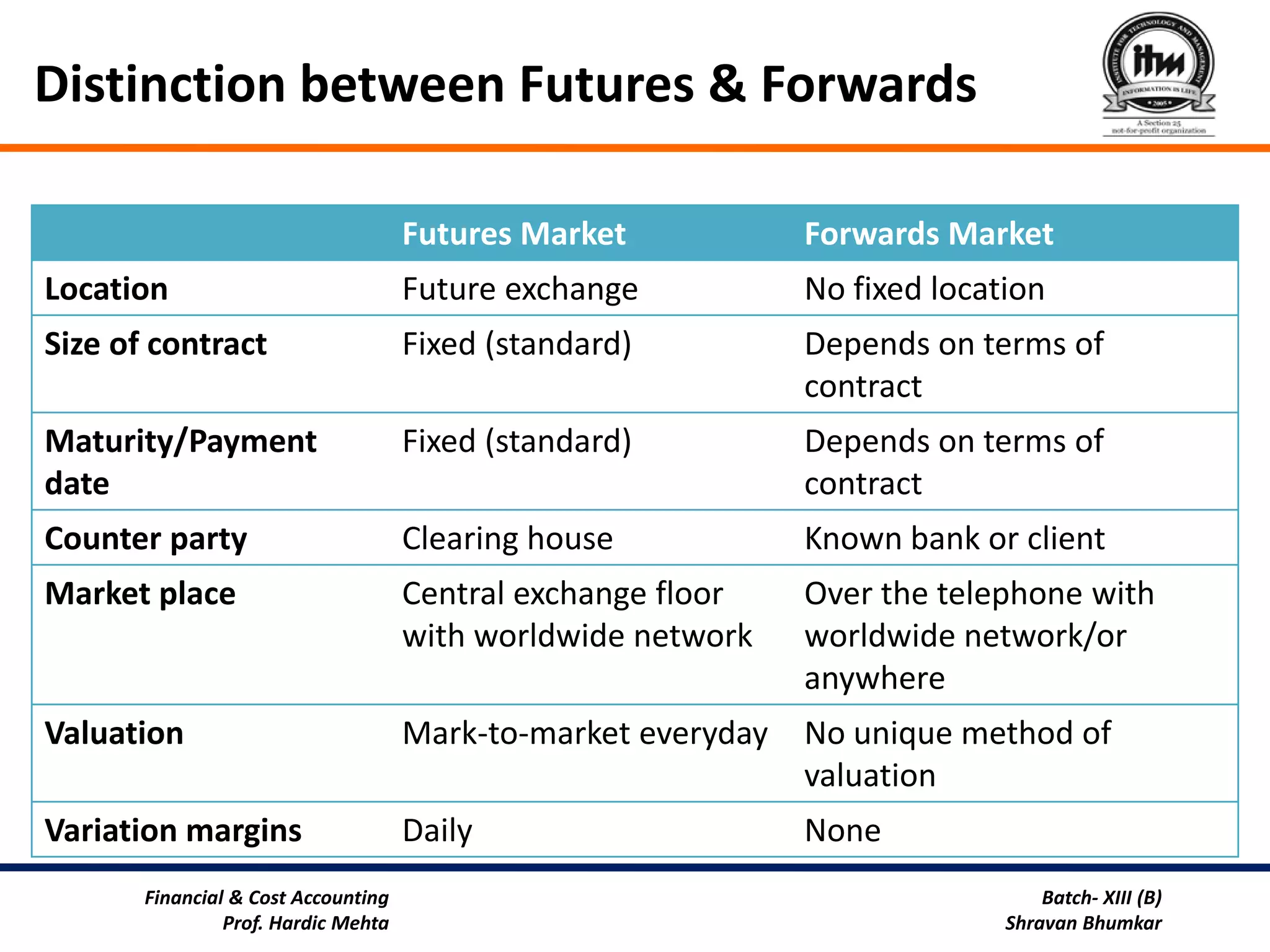

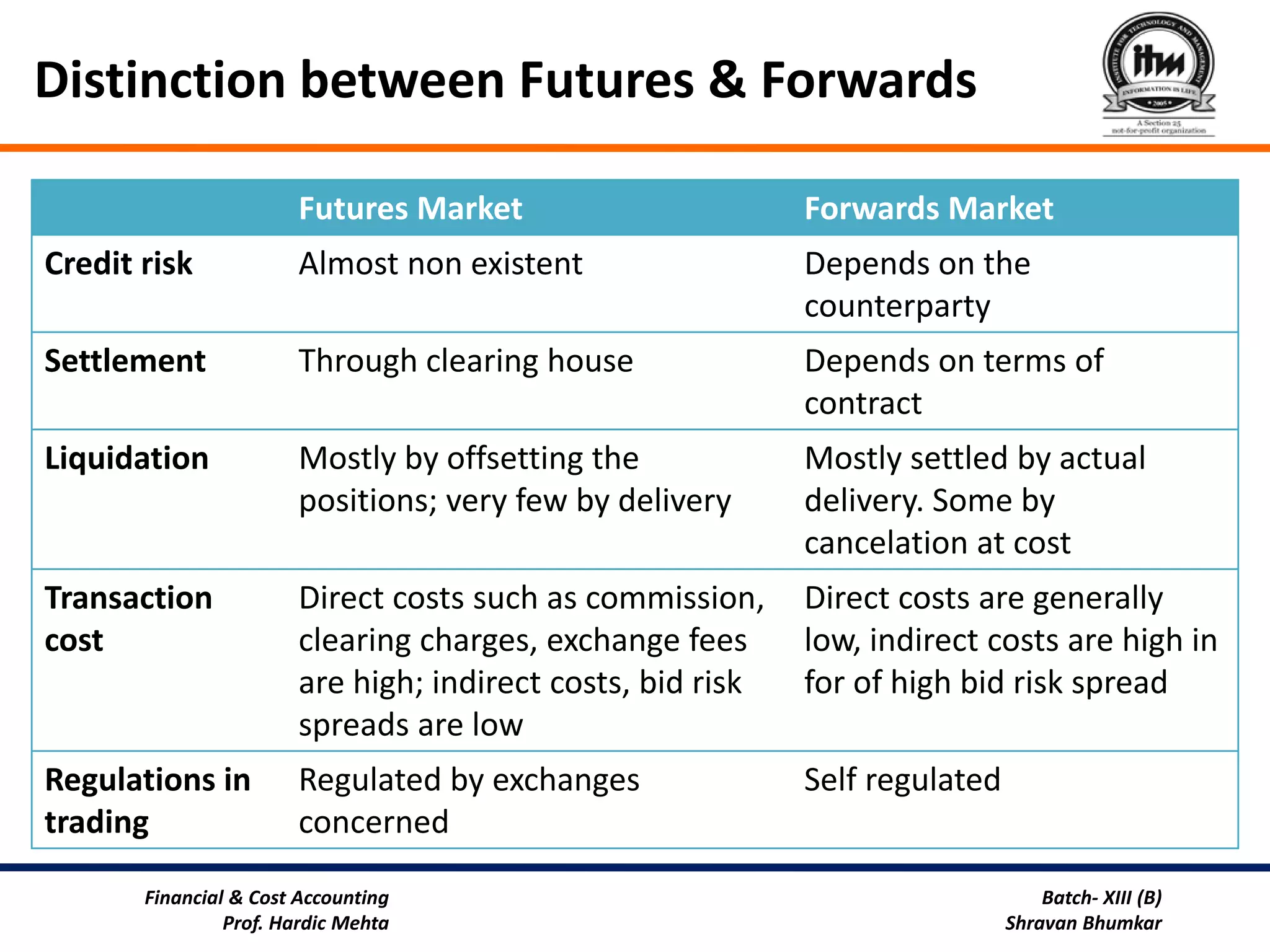

Futures and forwards contracts are types of derivatives that allow parties to lock in a price for an asset to be exchanged at a future date. A forward contract is a customized over-the-counter agreement between two parties, while a futures contract is standardized and traded on an exchange. Key differences are that futures contracts have daily margin settlements and lower counterparty risk. Derivatives are used by hedgers to manage risk, speculators to wager on price movements, market-makers to facilitate trading, and arbitrageurs to exploit temporary price differences across markets.