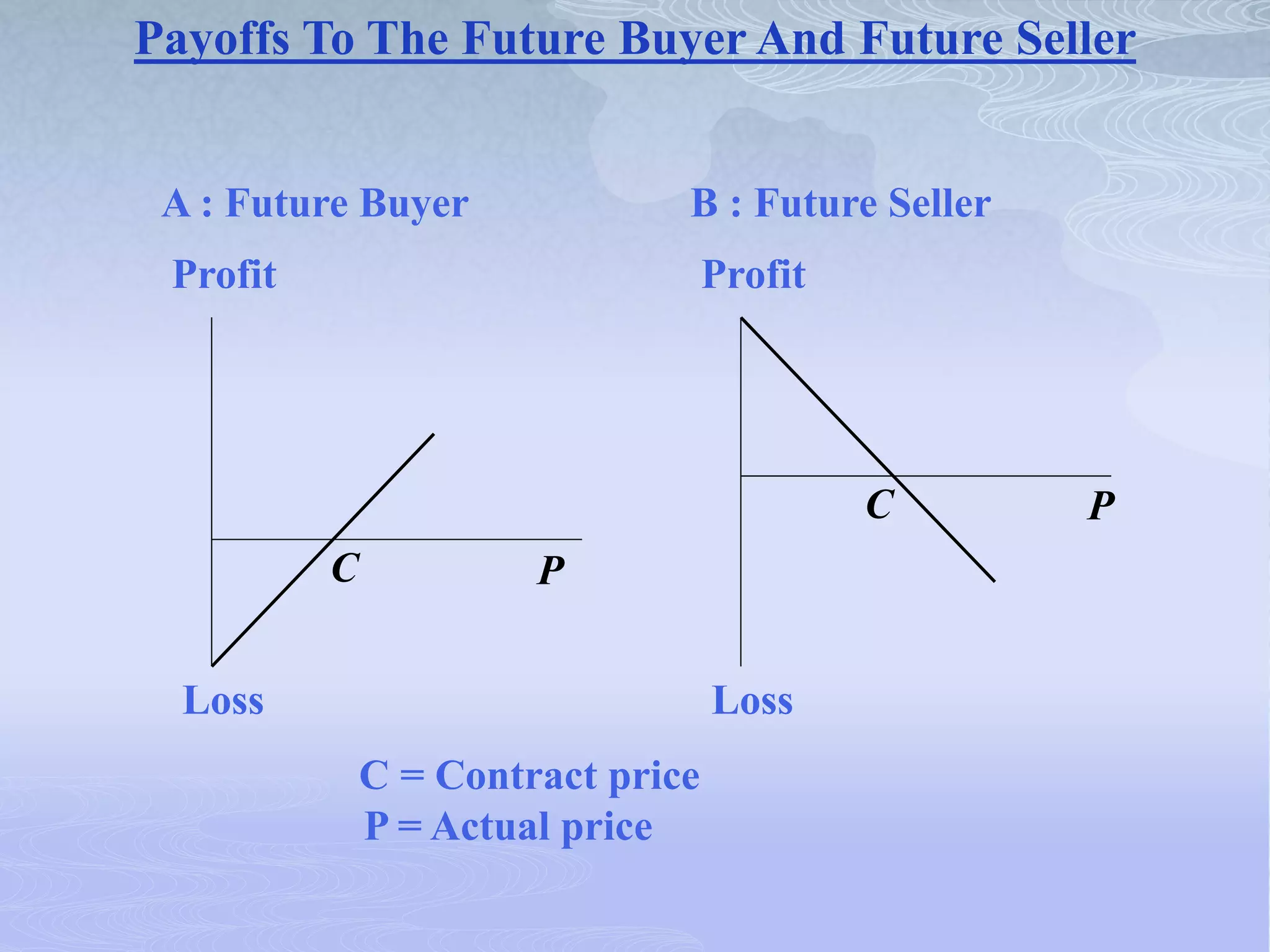

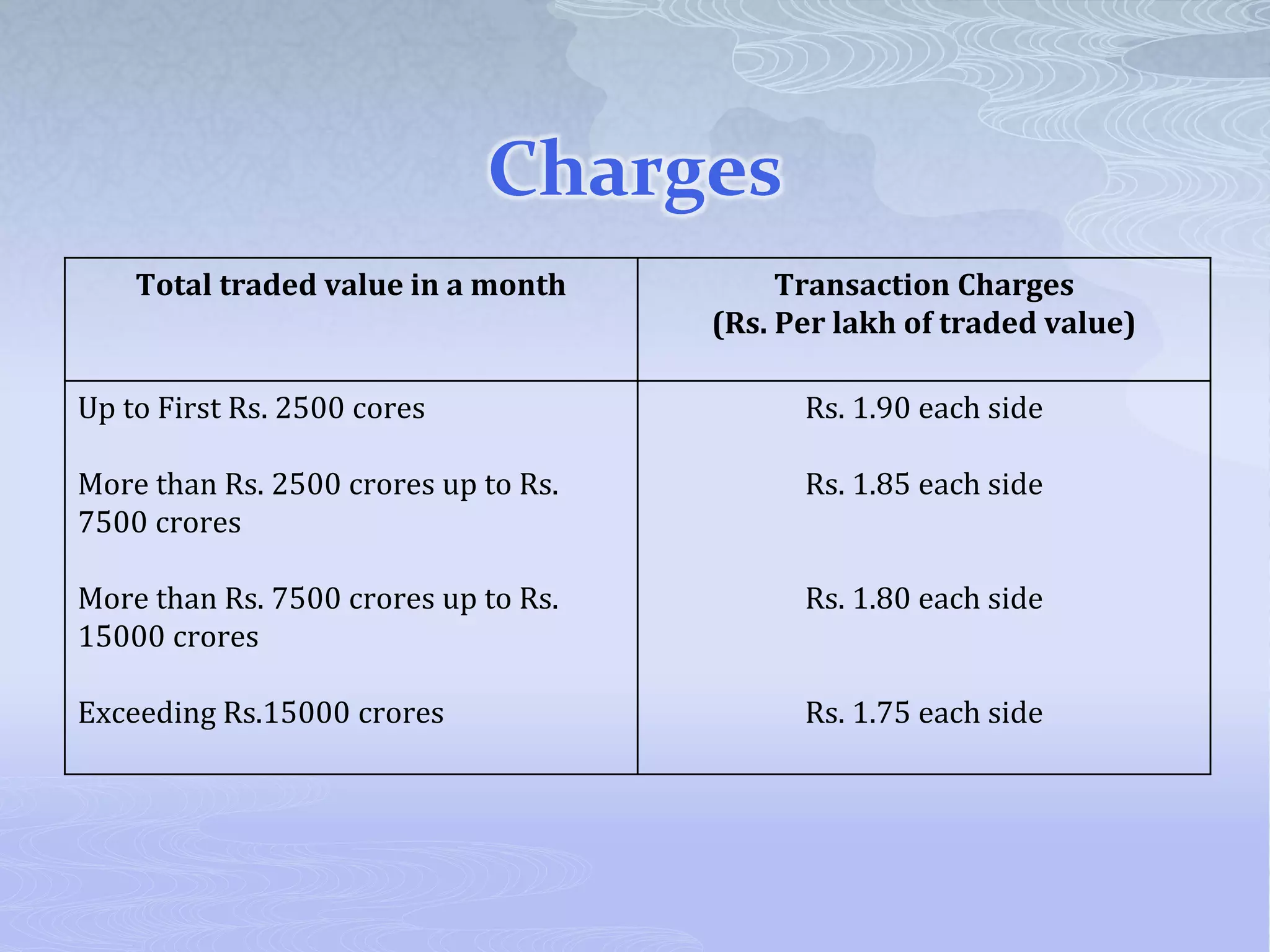

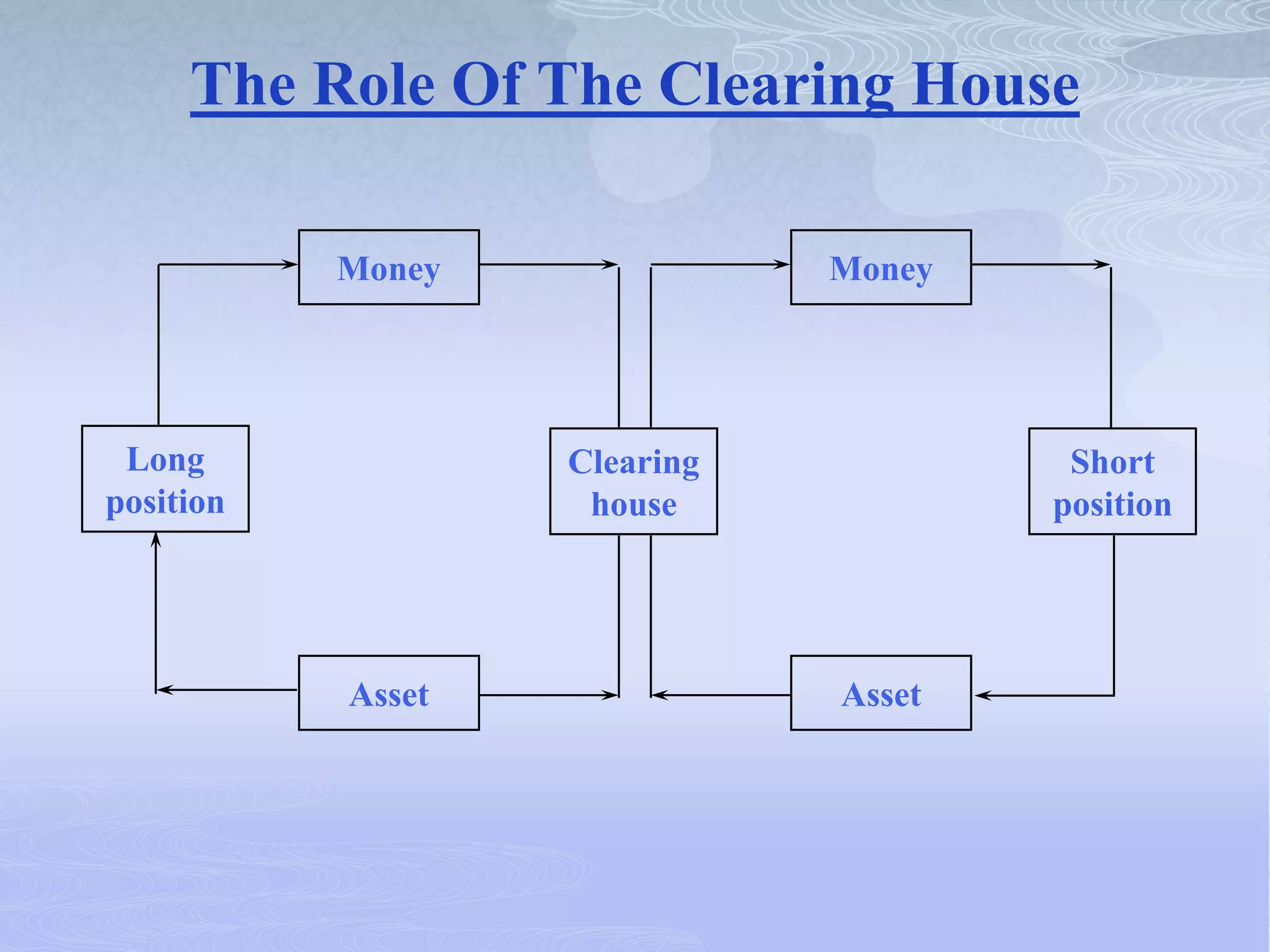

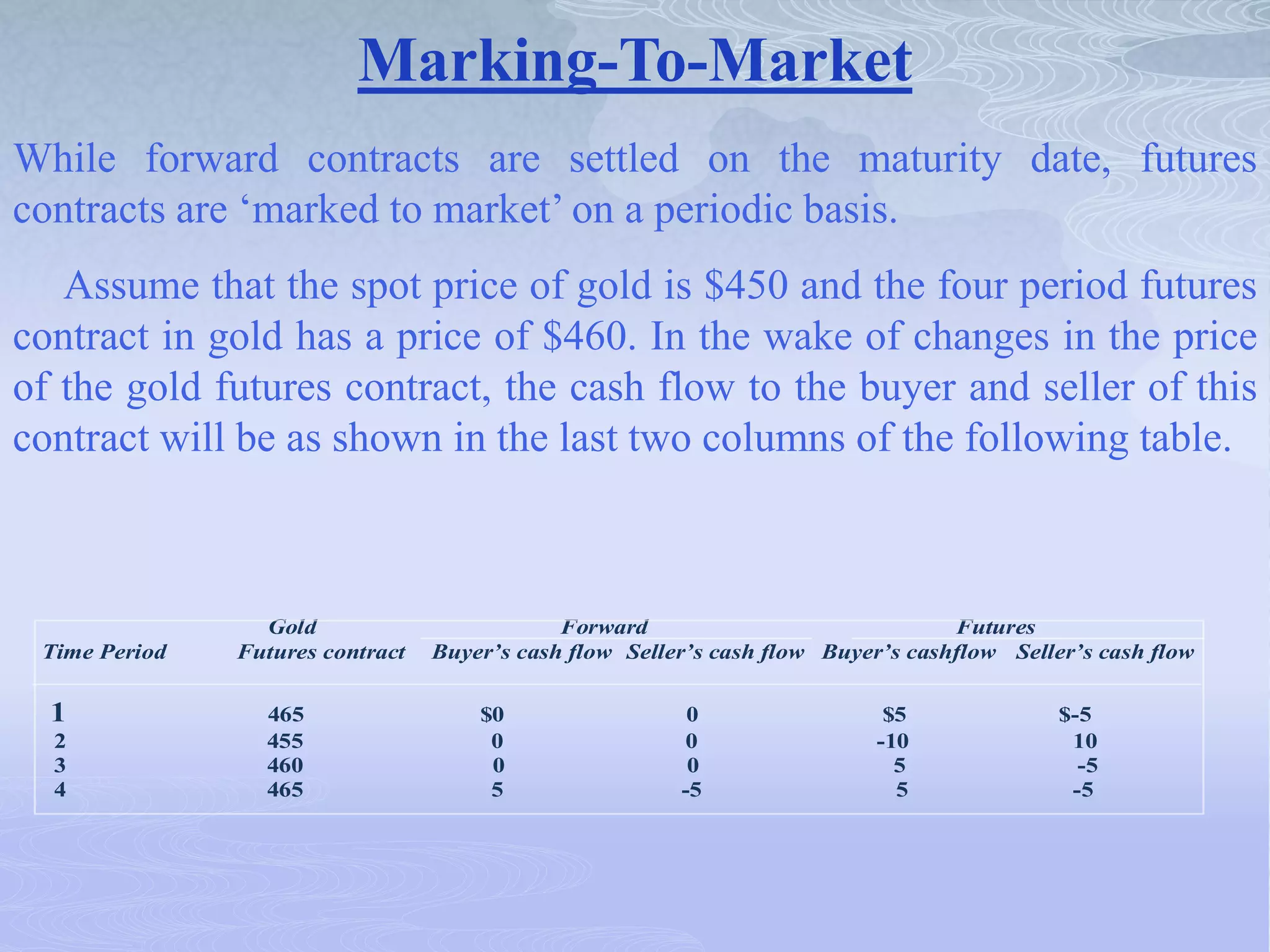

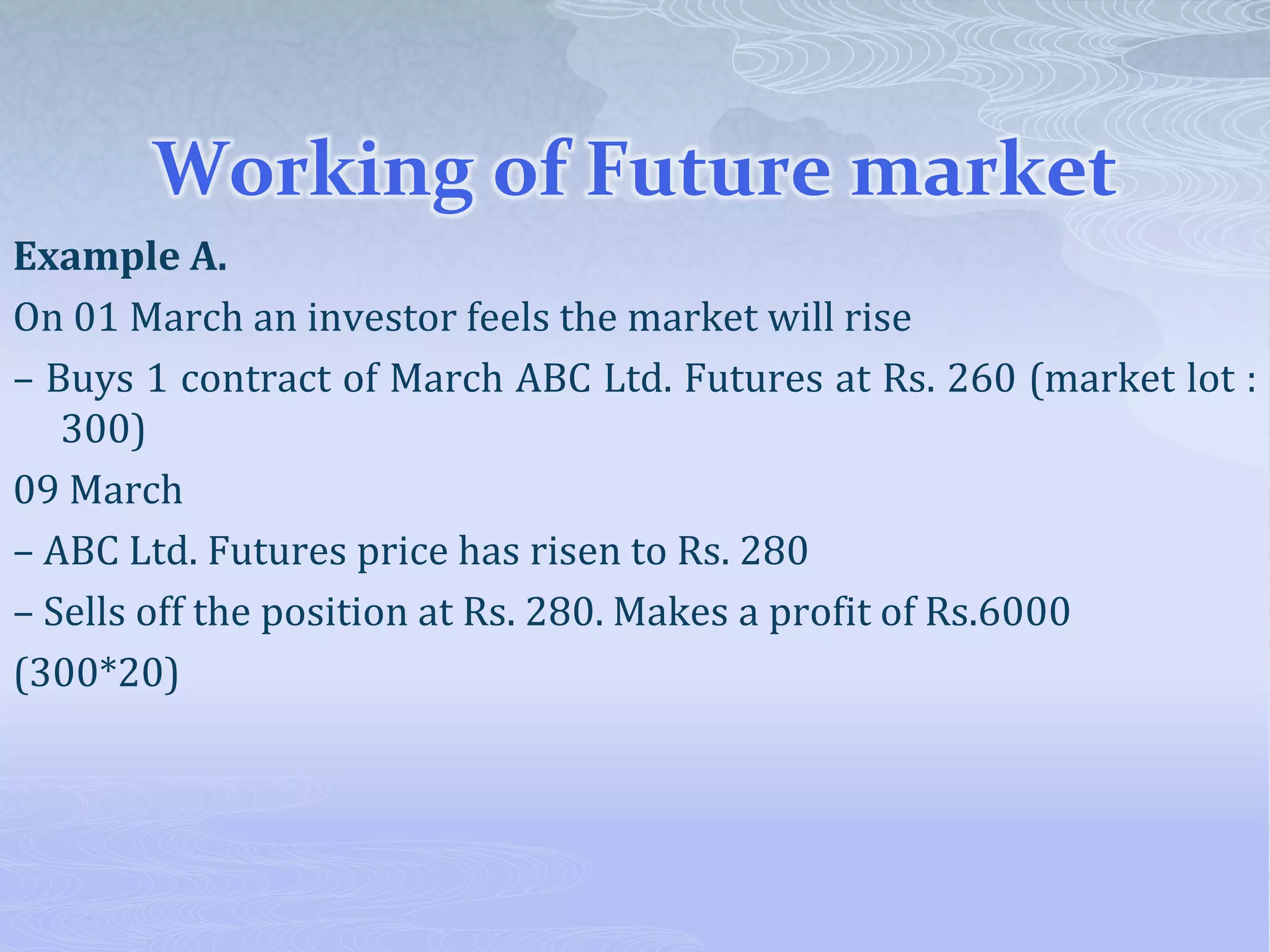

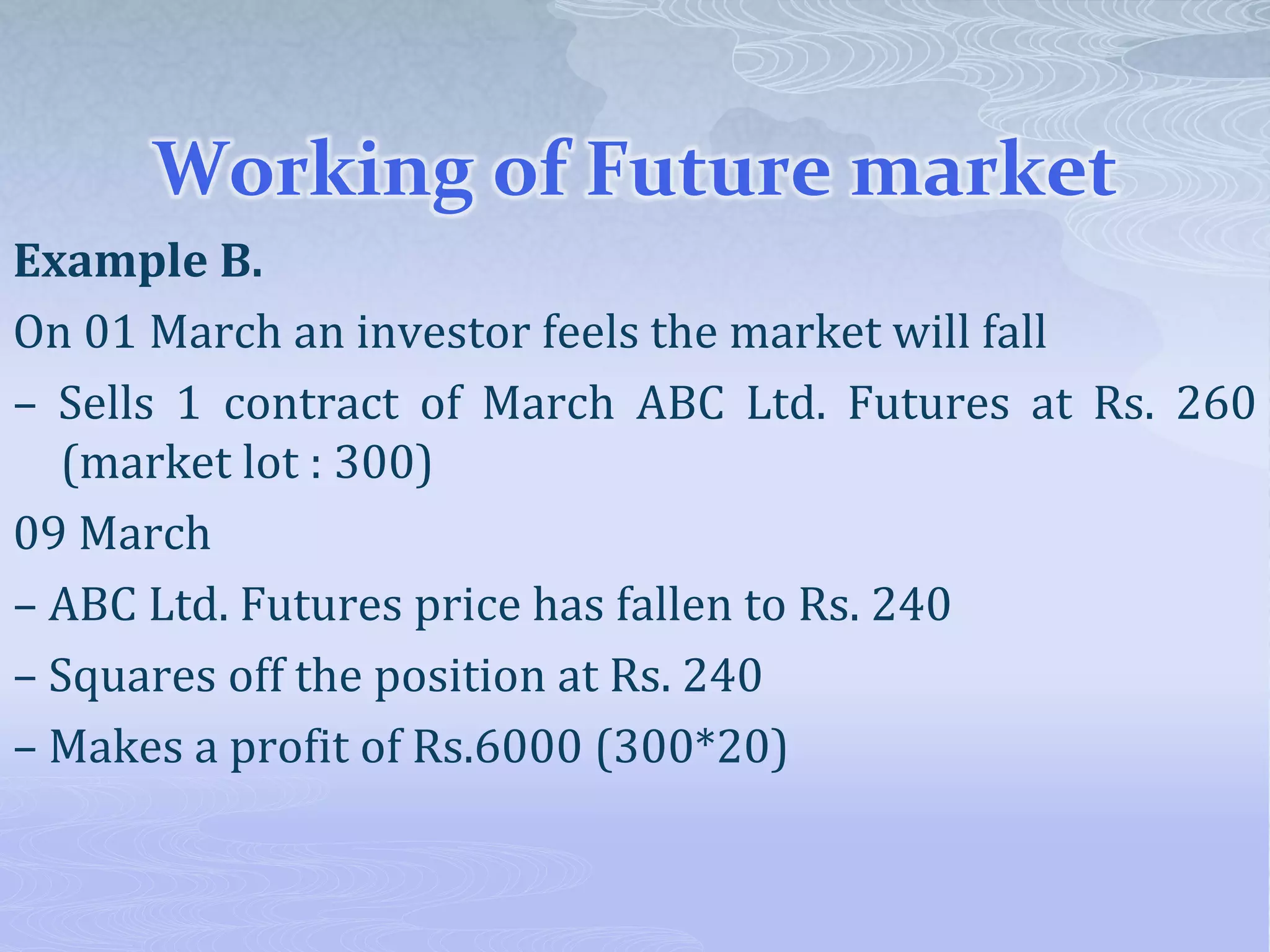

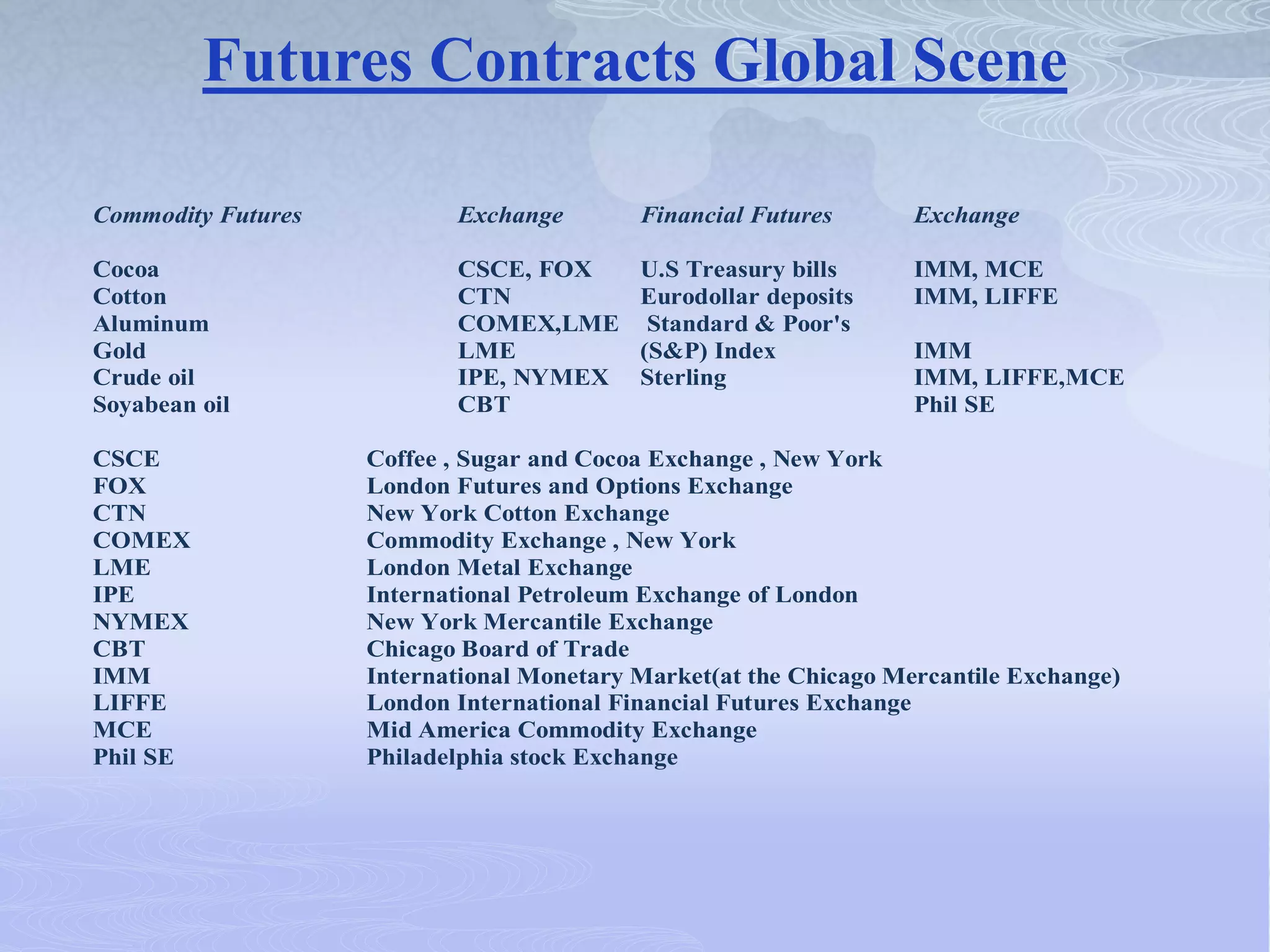

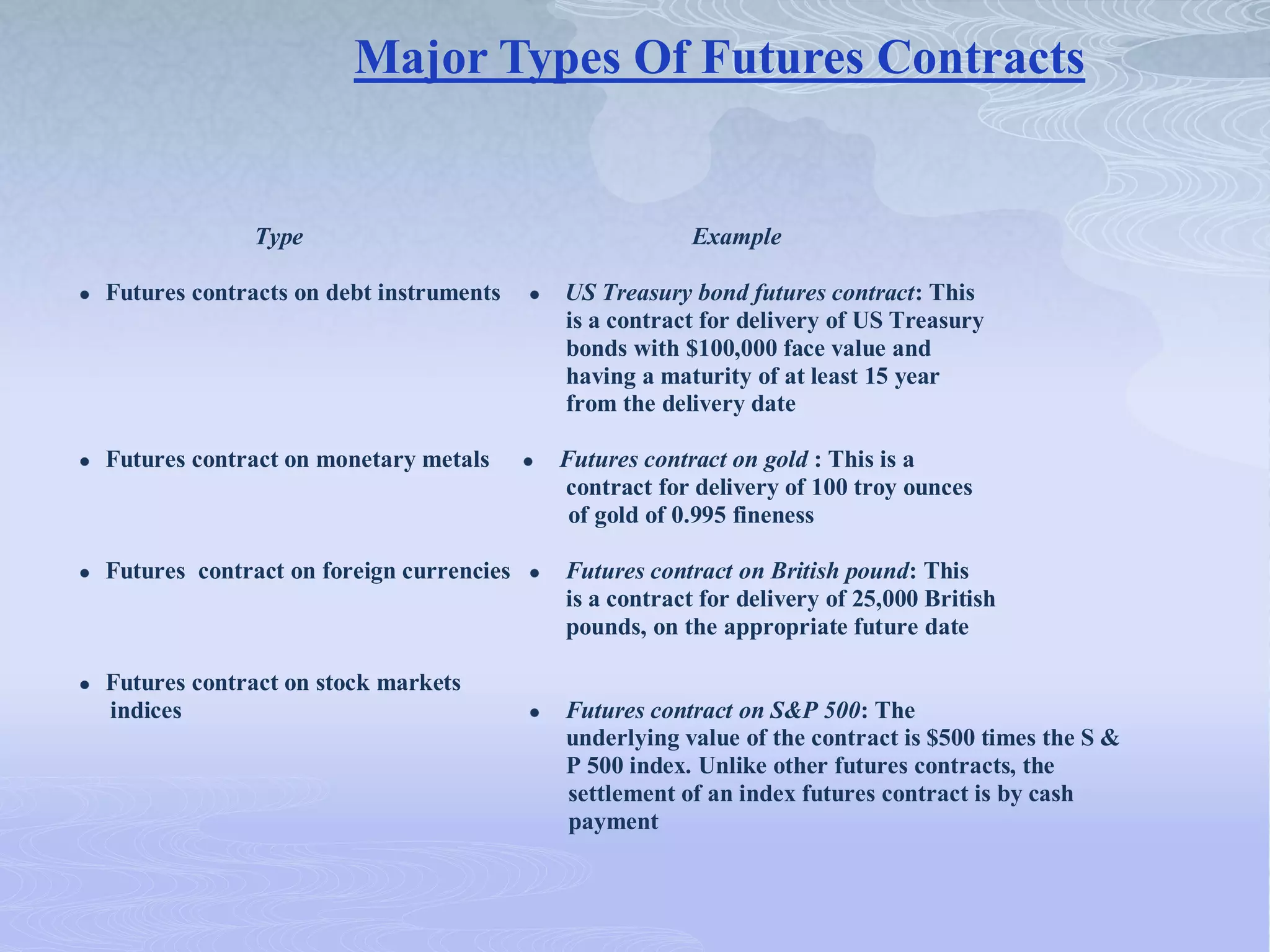

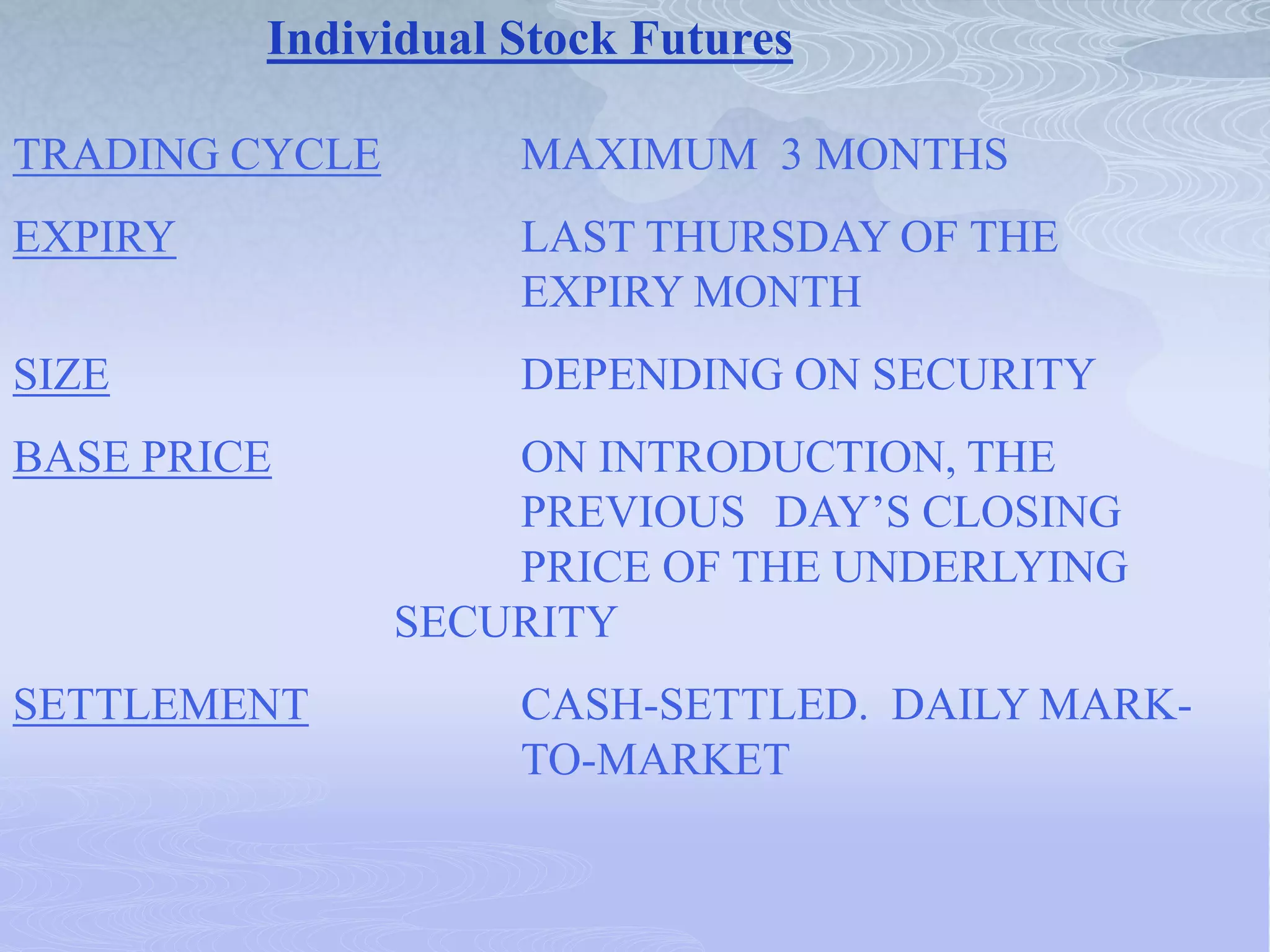

The document provides an overview of futures contracts and futures trading on stock exchanges. It defines key terms like futures contracts, forwards contracts, and differences between the two. It describes the trading mechanism for derivatives, including standardized contracts, delivery dates, and margins. It also outlines order types, market participants, trading processes, and types of instruments traded on futures and options markets.