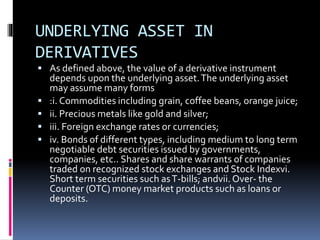

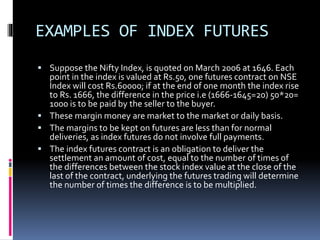

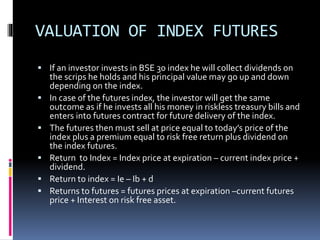

Derivatives are financial contracts whose value is derived from an underlying asset such as a stock, bond, commodity, currency or market index. There are several types of derivatives including forwards, futures, options, and swaps. Futures contracts are standardized exchange-traded derivatives that allow participants to speculate on or hedge against the future price of the underlying asset. Index futures are futures contracts based on a stock or financial index, allowing traders to bet on the overall direction of a market index. Stock futures are futures contracts where the underlying asset is an individual stock.