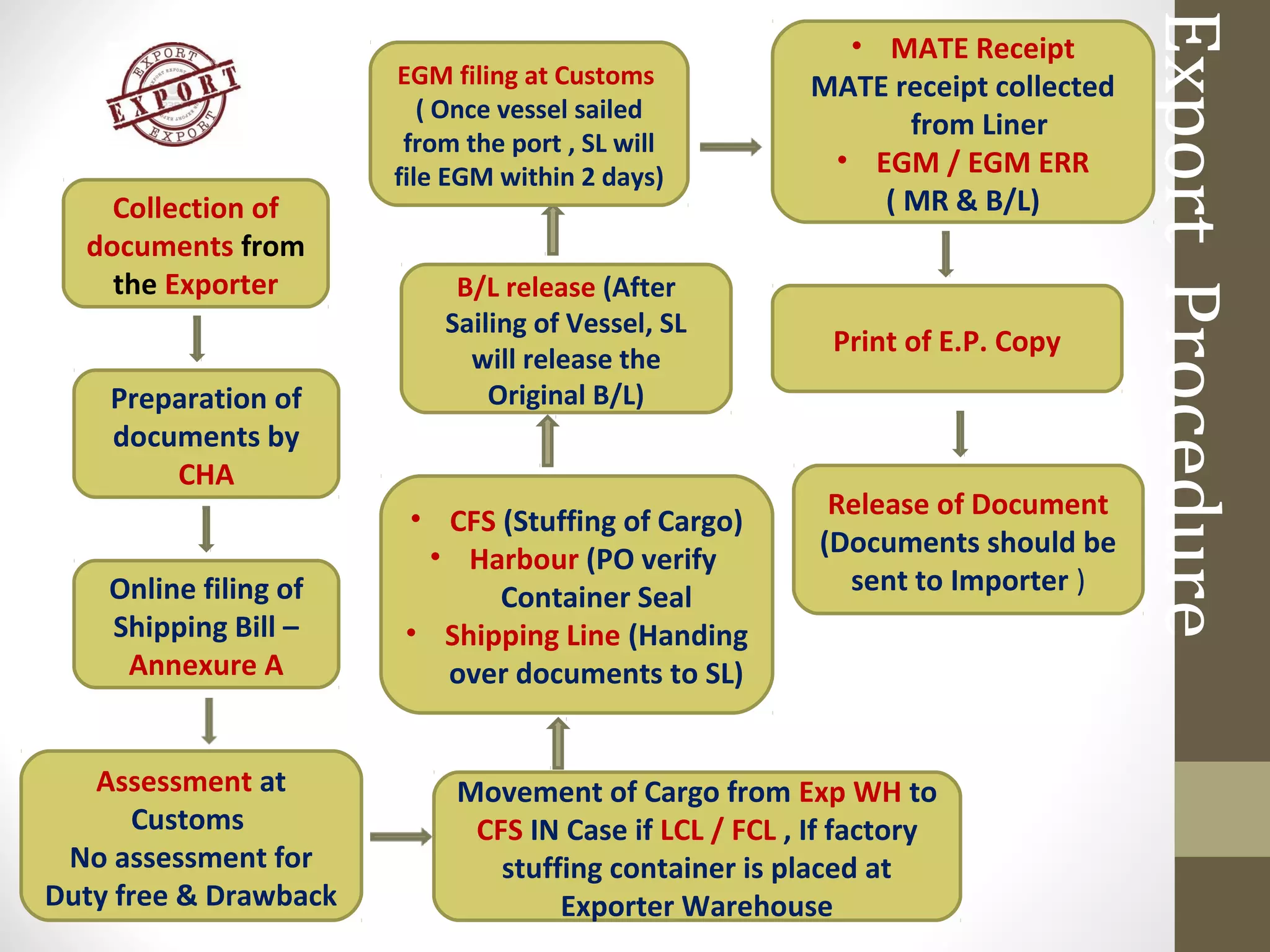

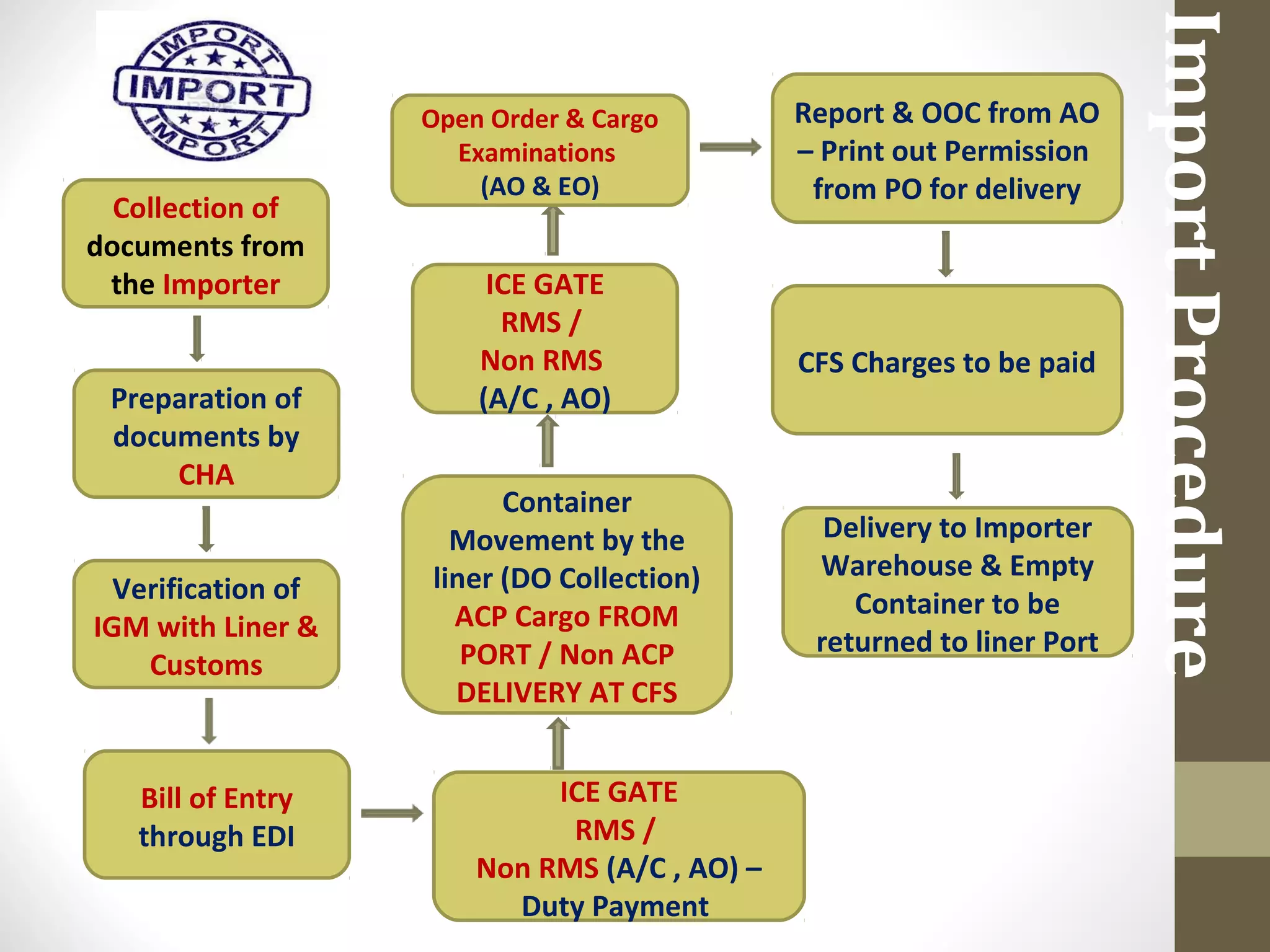

This document outlines export and import procedures in India, including required documentation, customs clearance processes, and recent customs initiatives. For exports, it describes collecting documents from the exporter, document preparation by a customs house agent, online filing of shipping bills, customs assessment, and cargo movement. For imports, it discusses collecting importer documents, customs house agent document preparation, verifying shipping manifests, bill of entry filing, duty payment, cargo movement and delivery, and examinations and permissions for release. Recent customs initiatives to facilitate trade are also listed, such as risk management software, accredited client programs, e-payments, and tracking updates.