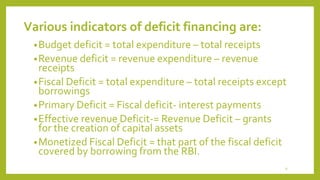

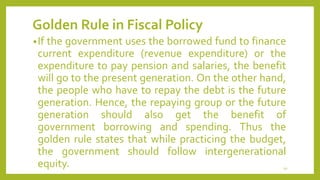

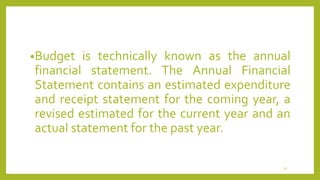

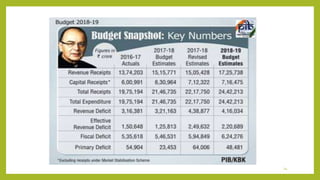

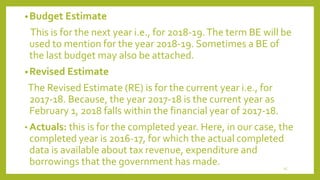

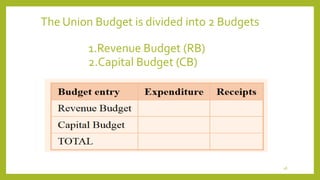

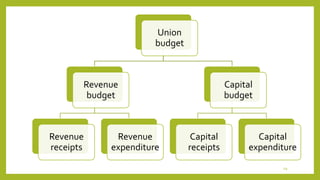

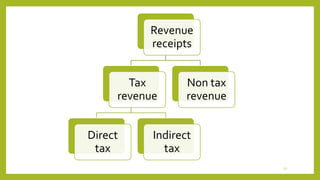

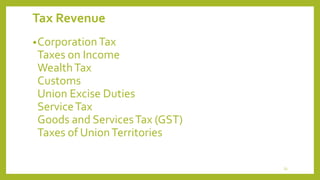

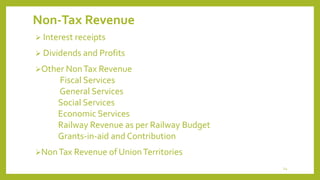

This document discusses key aspects of fiscal policy in India. It defines fiscal policy as the government's approach to taxation, spending, and borrowing to achieve economic objectives like growth. The main objectives of fiscal policy are promoting growth, stabilizing the economy during recessions and booms, creating jobs, and redistributing income. It describes countercyclical fiscal policy, which aims to counter economic cycles through tax and spending adjustments. It also discusses concepts like the revenue budget, capital budget, budget deficits, and deficit financing.

![Constitutional provision for budget

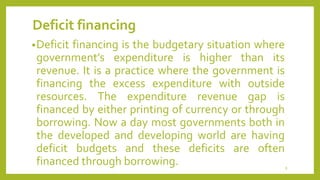

•Article 112: President shall, in respect of every financial year,

cause to be laid before Parliament, Annual Financial

Statement.

•Article 265: provides that ‘no tax shall be levied or collected

except by authority of law’. [ie. Taxation needs approval of

Parliament.]

•Article 266: provides that ‘no expenditure can be incurred

except with the authorisation of the Legislature’ [ie.

Expenditure needs approval of Parliament.]

16](https://image.slidesharecdn.com/fiscalpolicy-181024141841/85/Fiscal-policy-17-320.jpg)

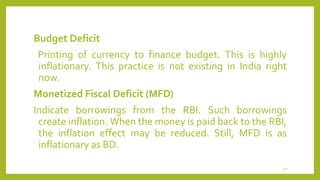

![Fiscal Deficit

• FD is the difference between the total expenditure and

[revenue receipts plus non-debt capital receipts]. It indicates

the amount the Govt has to borrow to meet its annual

targets.

• FD= Total Expenditure - (Revenue Receipts+ Non-Debt

Creating Capital Receipts)

The most popular indicator to show the health of

government finances. It is actually borrowings of the

government to run the budget. FD results in future interest

payments. It also adds to inflation.

35](https://image.slidesharecdn.com/fiscalpolicy-181024141841/85/Fiscal-policy-36-320.jpg)