The document provides information on various monetary policy concepts including:

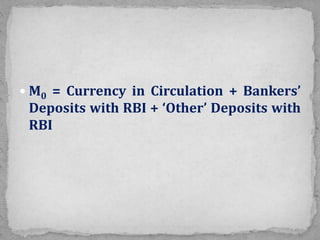

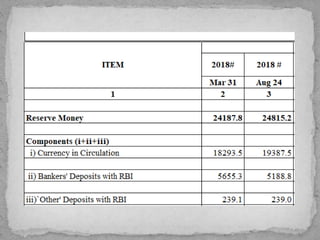

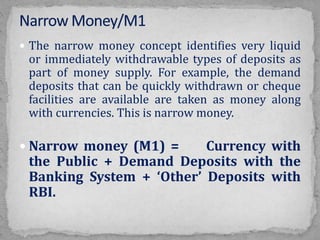

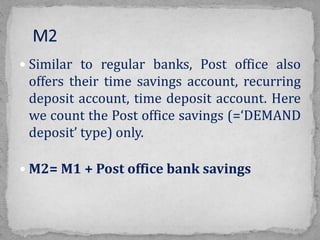

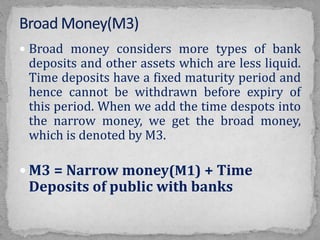

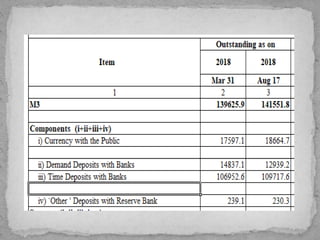

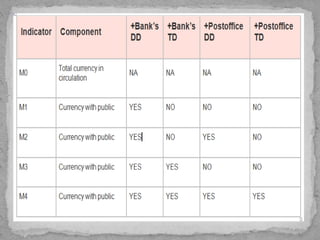

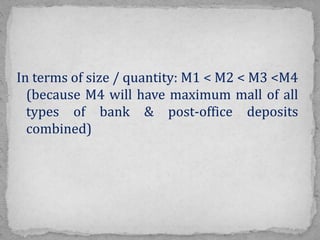

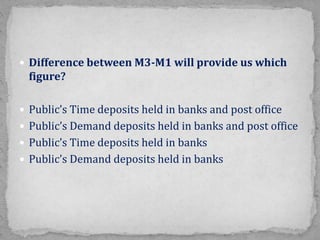

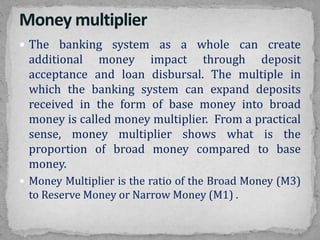

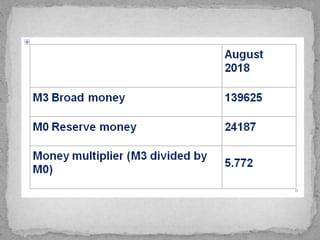

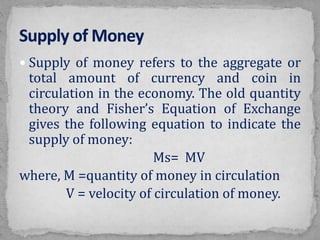

- Definitions of different types of money such as narrow money (M1), broad money (M3), and reserve money (M0).

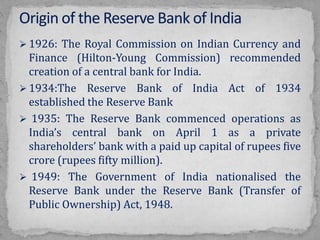

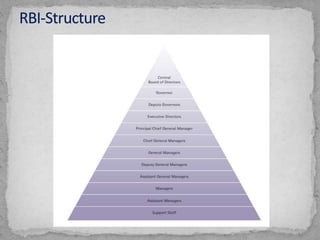

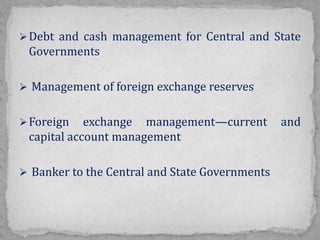

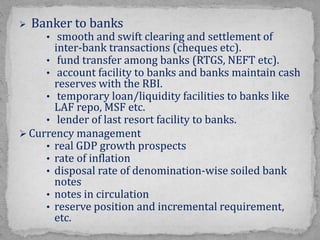

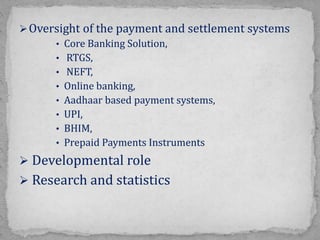

- The functions of a central bank like the Reserve Bank of India (RBI), which include implementing monetary policy, regulating banks, managing foreign exchange reserves, and acting as a banker to the government.

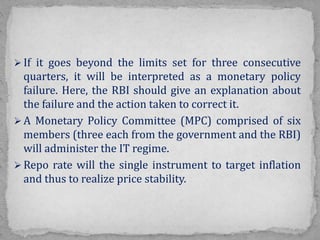

- Key monetary policy tools used by the RBI like repo rate, reverse repo rate, cash reserve ratio, and open market operations.

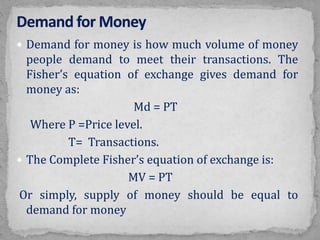

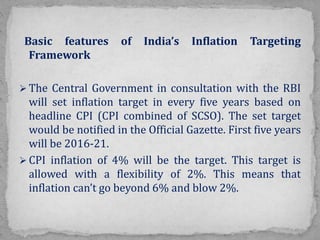

- India's inflation targeting monetary policy framework, which involves setting an inflation target of 4% with a 2% flexibility band and using the repo rate as the