The document discusses key aspects of government budgets including:

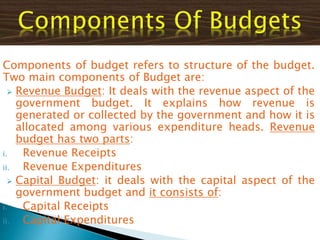

- Budgets show estimated annual receipts and expenditures and are divided into revenue and capital components.

- Objectives include reallocating resources, managing public enterprises, and promoting economic stability.

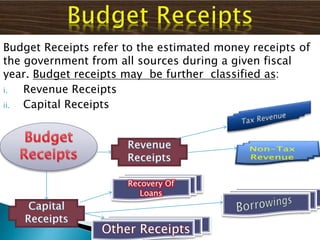

- Receipts are classified as revenue or capital, and expenditures are classified as revenue or capital.

- Budgets can be balanced, in surplus, or in deficit depending on a comparison of estimated receipts to expenditures.

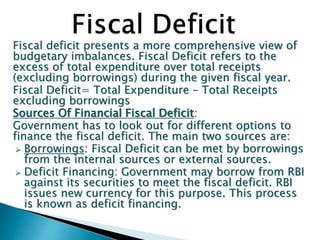

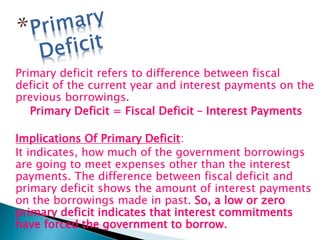

- Deficits include revenue deficit, fiscal deficit, and primary deficit, with fiscal deficit being the broadest measure of imbalance.