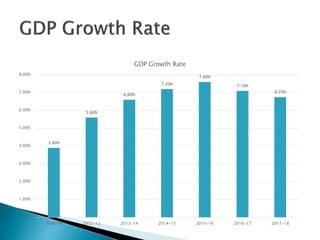

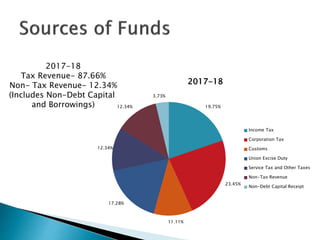

The document provides an overview of the key aspects of the Indian Union Budget for 2017-18 that was presented on February 1, 2017. Some of the major points covered include:

- The budget size was ₹21.47 lakh crore with a focus on transforming governance, energizing various sections of society, and eliminating corruption.

- Key reforms included merging the Railway and Union budgets and removing the distinction between plan and non-plan expenditure.

- The fiscal deficit target was set at 3.2% of GDP for 2017-18, down from 3.5% in the previous budget estimates.

- Expenditure priorities included agriculture, rural development, infrastructure, education, healthcare