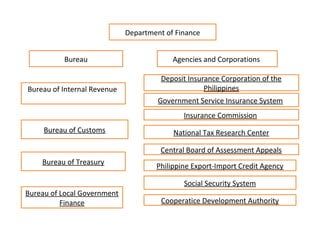

The document discusses fiscal policy and public finance in the Philippines. It describes the government agencies responsible for fiscal administration, including the Department of Finance and bureaus that handle tax collection, treasury, and government corporations. It then discusses how different presidential administrations in the Philippines approached fiscal policy through taxes, spending, and management of fiscal deficits and debt.