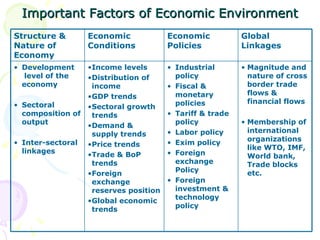

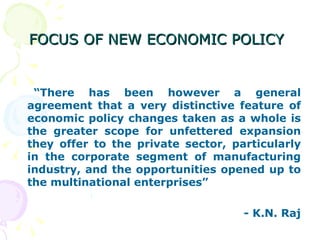

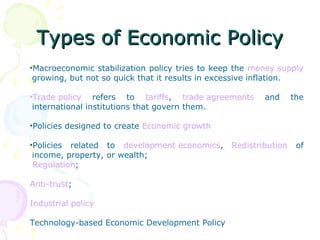

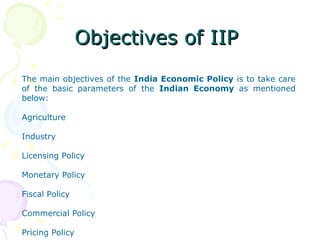

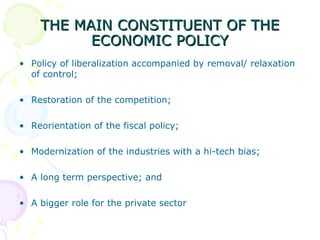

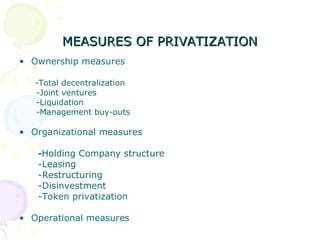

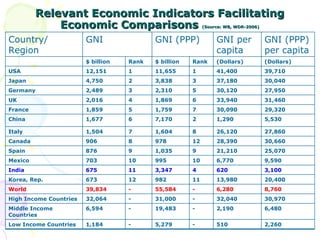

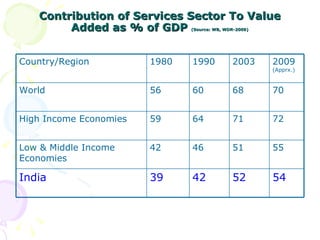

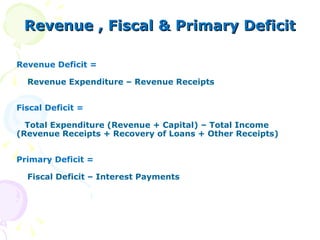

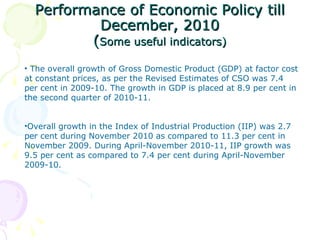

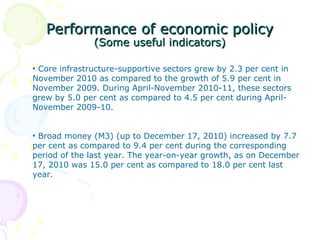

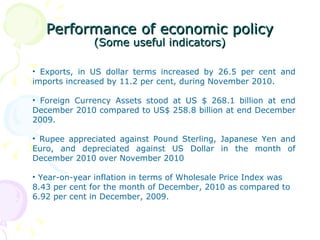

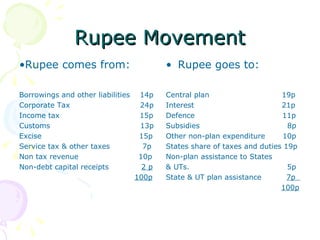

The document discusses India's economic policy, including important factors like the structure and nature of the economy, economic conditions, policies, and global linkages. It outlines the objectives of economic policy like promoting agriculture, industry, and development. Key aspects of economic policy discussed include liberalization, privatization, fiscal and monetary policy, and indicators like GDP, industrial production, and inflation. It also provides an overview of India's economic performance in recent years based on various economic indicators.