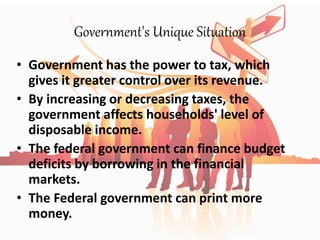

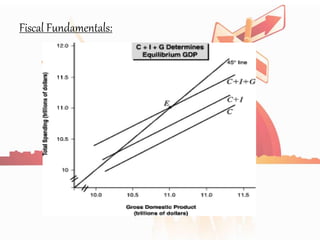

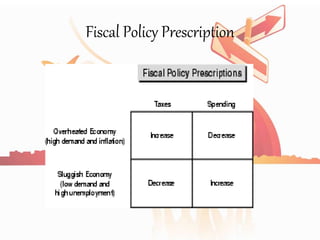

Fiscal policy encompasses government decisions on taxation and spending that influence economic activity, with higher taxes used to stabilize overheated economies during inflation. In Pakistan, fiscal deficits have impacted inflation and economic growth, highlighting the need for a rules-based fiscal policy to achieve sustainability and stability. Key objectives of fiscal policy include increasing savings, encouraging investment, ensuring equitable wealth distribution, controlling inflation, and promoting economic stability.