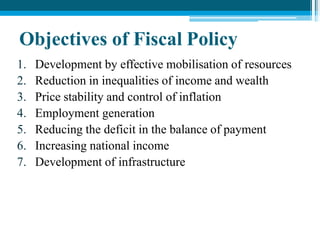

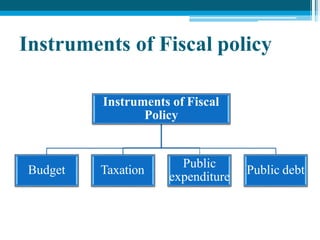

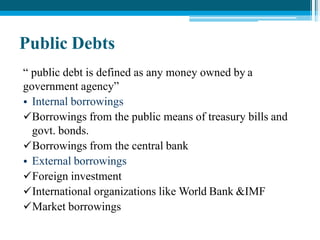

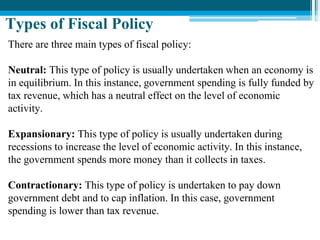

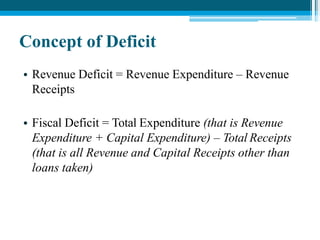

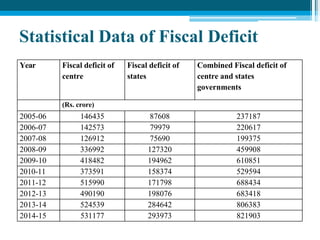

Fiscal policy refers to the government's use of spending and tax policies to influence economic conditions. The key instruments of fiscal policy are the budget, taxation, public expenditure, and public debt. Governments use fiscal policy to achieve macroeconomic goals like employment generation and economic growth. India's fiscal policy aims to stabilize the economy and reduce fiscal deficits. Recent reforms have aimed to simplify taxes, lower rates, and reduce non-essential spending.