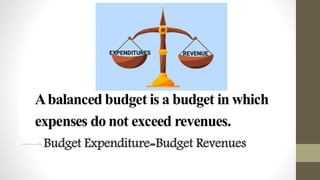

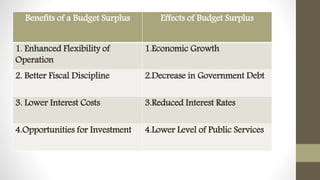

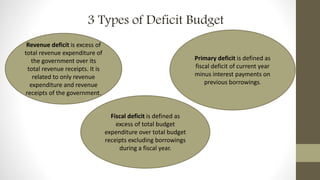

A budget is an estimate of revenues and expenses over a period of time, usually compiled periodically. There are three types of budgets: balanced, surplus, and deficit. A balanced budget occurs when expenditures equal revenues. A surplus budget happens when revenues exceed expenditures. A deficit budget is when expenditures are greater than revenues. Deficit budgets can be further classified as revenue deficit, fiscal deficit, or primary deficit based on the types of revenues and expenditures considered.