NATURE & SCOPE OF BUSINESS FINANCEEe.ppt

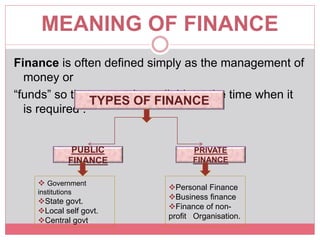

- 1. MEANING OF FINANCE Finance is often defined simply as the management of money or “funds” so that money is available at the time when it is required . TYPES OF FINANCE PUBLIC FINANCE PRIVATE FINANCE Government institutions State govt. Local self govt. Central govt. Personal Finance Business finance Finance of non- profit Organisation.

- 2. BUSINESS FINANCE Business finance refers to money and credit employed in business. It involves procurement and utilization of funds so that business firms may be able to carry out their operations effectively and efficiently. Business finance involves estimation of funds. It is concerned with raising funds from different sources as well as investment of funds for different purposes. Busine ss Financ e Sole- Proprietary Finance Partnershi p Firms Finance Company or Corporatio n Finance

- 3. CORPORATE FINANCE / FINANCIAL MANAGEMENT Wheeler defines business finance as “that business activity which is concerned with the acquision and conservation of capital funds in meeting the financial needs and overall objectives of business enterprise. FINANCIAL MANAGEMENT refers to that part of management activity which is concerned with the planning and controlling of the firms financial resources. It deals with finding out various sources for raising funds for the firm.

- 4. EVOLUTION OF CORPORATE FINANCE Corporate finance emerged as a distinct field of study only in the early part of this century as a result of consolidation movement and formation of large sized business undertakings. In the initial stages of the evolution, emphasis was placed on the study of sources and forms of financing the large sized business enterprise. Economic recession of 1930 rendered difficulties in raising finance from banks and other financial institutions. Thus, emphasis was

- 5. IMPORTANCE OF CORPORATION FINANCE/FINANCIAL MANAGEMENT Finance is very essential for smooth running of business. It is the life blood and nerve centre of business. The importance of corporation finance has arisen because of the fact that present day business activities are predominantly carried on company or corporate form of business. The advent of corporate enterprises has resulted into: the increase in size and influence of the business enterprises, wide distribution of corporate ownership, Separation of ownership and management. As the owners in a corporate enterprise are widely scattered and the management is separated from the

- 6. The importance of financial management can well be described as the importance of corporate finance . Financial management is indispensable to any organization as it helps in: financial planning and successful promotion of an enterprise, acquisition of funds at minimum possible cost, proper use and allocation of funds, taking sound financial decisions, increasing the wealth of the investors and the nation, Improving the profitability through financial controls,

- 7. FINANCE FUNCTION Finance function is the most important of all business functions. Business will close down because of absence of finance thus this function cannot be ignored. The need for money is continuous. The management should have an idea of using the money profitably. The inflows and outflows of cash should

- 8. APPROACHES TO FINANCE FUNCTION 1. THE TRADITIONAL APPROACH: According to this approach, the scope of finance function was confined to only procurement of funds needed by a business on most suitable terms. The utilization of funds was considered beyond the purview of finance function. LIMITATIONS The traditional approach to the scope and functions of finance has now been discarded as it suffers from many serious limitations 1. Ignores internal decisions making as to proper utilization of funds, 2. Focus on long term funds and ignores the important issue of working capital finance and management. 3. Allocation of funds is ignored. 4. Does not focus on day to day financial problems of

- 9. THE MODERN APPROACH: The modern approach views finance function in broader sense. It includes both raising of funds as well as their effective utilization of finance. The techniques models, mathematical programming, simulations and financial engineering are used in financial management to solve complex problems of present day finance. The modern approach considers the three basic management decisions, i.e. investment decisions, financing decisions and dividend decisions within the scope of finance function.

- 10. AIMS OF FINANCE FUNCTION Acquiring sufficient finance: The main aim of finance is to assess the financial needs of an enterprise and then finding out suitable sources for raising them. Proper utilization of funds: Effective utilization of funds is very important. It should be used in such a way that maximum benefit is derived from them. Increasing Profitability: The planning and control of finance function aims at increasing profitability of the concern. Finance function should be so planned that the concern neither suffers from inadequacy of funds nor wastes more funds than required. Maximizing Firm’s value: Finance function also aims at maximizing the value of the firm. Besides profits, the type of sources used for raising funds, the cost of funds, the condition of money market, the demand for products are some other considerations which also influence a firm’s value.

- 11. SCOPE OF FINANCE FUNCTION/FINANCIAL MANGEMENT 1.Estimating financial requirements 2. Deciding capital structure 3. Selecting a source of finance 4. Selecting a pattern of investment 5. Proper cash management 6. Implementing financial controls 7. Proper use of surpluses

- 12. Business Finance MAXIMIZE OWNER’S ECONOMIC WELFARE: It can be achieved by: PROFIT MAXIMIZATION WEALTH MAXIMIZATION

- 13. PROFIT MAXIMIZATION Main objective of business Survival is not possible Earn profit to cover its costs Provide fund for growth Measure of efficiency and economic prosperity of business Fulfill social goals Protection against risk. CRITICISM 1. Exploitation of works and consumers 2. Ambiguity 3. Ignore time value of money 4. Ignores risk factor 5. Dividend policy

- 14. WEALTH MAXIMIZATION • Appropriate objectives of business • Stock holders current wealth in a firm= Number of shares owned* Current stock price per share. • Helps in long run survival and growth of business • Leads towards maximizing stock holders utility CRITICISM 1. Not necessarily socially desirable 2. Controversy 3. Possibility of conflict of interest

- 15. Measuring Shareholders Value Creation The two new measures use to determine whether an investment positively contributes to the shareholders wealth : Economic Value Added (EVA) Market Value Added (MVA) ECONOMIC VALUE ADDED (EVA):- Economic value added is a measure of performance evaluation that was originally employed by Stern Stewart & Co. it is very popular measure today which is used to measure the surplus value created by an investment or a portfolio of investments. EVA can be calculated as below:- EVA = (Net Operating profit after tax - cost of capital x capital invested) Or, EVA = (Return on Investment – cost of capital x capital employed)

- 16. MARKET VALUE ADDED (MVA):- The market value added (MVA) is the sum total of all the present values of future EVAs. MVA = EVA1 + EVA2 + EVA3 + ……………….. (1+C)1 (1+C)2 (1+C)3 The market value added (MVA) can also be defined as the difference between the current market value of the firm and the book of capital employed by the firm.

- 17. FINANCIAL DECISIONS Financial decision refers to decision concerning financial matters of a business firm. There are many kinds of financial management decisions that the firm makes in pursuit of maximizing shareholder’s wealth, viz.., kind of assets to be acquired, pattern of capitalization, distribution of firms income etc. we can classify these decisions into three major groups:- Investment decisions Financing decisions Dividend decisions

- 18. INVESTMENT DECISIONS Investment decisions relates to the determination of total amount of assets to be held in the firm, the composition of these assets and the business risk complexions of the firm as perceived by its investors. It is the most important financial decision. The investment decisions can be classified under to broad groups:- Long-term investment decision Short-term investment decision The long-term investment decision is referred to as the

- 19. FINANCING DECISION Once the firm has taken the investment decision and committed itself to new investment, it must decide the best means of financing these commitments. Since, firms regularly make new investments, the needs for financing and financial decisions are on going. Hence, a firm will be continuously planning for new financial needs. The third major financial decision relates to the disbursement of profits back to investors who supplied capital to the firm. The term dividend refers to that profits of a company which is distributed by it among its shareholders. It is the reward of shareholders for DIVIDEND DECISION

- 20. INTER-RELATION OF FINANCIAL DECISIONS We have studied above the three major groups of financial decisions. Although these are different kinds of financial management decisions yet these decisions are inter-related because the underlying objective of all these decisions is the same, i.e. maximization of shareholders wealth. All these decisions influence one another and are inter-dependent. (INTER-RELATION OF FINANCIAL DECISION) INVESTMENT DECISION DIVIDEND DECISION FINANCING DECISION

- 21. FACTORS INFLUENCING FINANCIAL DECISIONS There are a number of factors that influence the financial decisions. A list of the important factors influencing the decisions is given below: Cost Risk Cash flow position Control considerations Floatation cost Fixed operating cost State of capital market

- 22. RISK-RETURN TRADE OFF Financial decisions of a firm often involve alternative courses of action. A finance manager has to select amongst the various alternatives available to him. For example, while making an investment decision, he has to decide whether, the firm should go in for a machinery having capacity of 50,000 units or 2,00,000 units. In the same manner the financing decision may involve a choice between a debt equity ratios of 1:1 or 2:1, the dividend decision may be concerned with the quantum of profits to be distributed. The following figure shows the relationship between various financial decisions and the risk return trade off and market value of the firm.

- 23. INVESTMENT DECISIONS CAPITAL BUDGETING WORKING CAPITAL MANAGEMENT FINANCING DECSIONS CAPITAL STRUCTURE DIVIDEND DECISIONS DIVIDEND POLICY RISK RETURN MARKET VALUE OF THE FIRM (RISK- RETURN TRADE OFF) The following figure shows the relationship between various financ the risk return trade off and market value of the firm.

- 24. FINANCIAL MANGEMENT PROCESS Financial planning and control FEED BACK Shareholders wealth Market price of shares Risk and Returns characteristics of the firm Financial Decision: 1. Investment decision 2. Dividend decision 3. Financing decision

- 25. FUNCTIONAL AREAS OF FINANCIAL MANAGEMENT Determining financial needs Selecting the source of funds Financial analysis and interpretation Cost Volume Profit analysis Capital Budgeting Working Capital Management Profit Planning Control Dividend Policy

- 26. FUNCTION OF FINANCE MANAGER Financial Forecasting and Planning Acquisition of funds Investment of funds Helping in valuation decisions Maintain proper liquidity