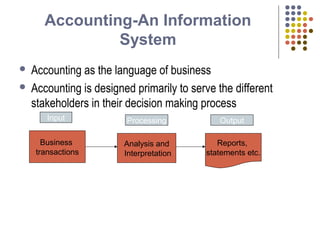

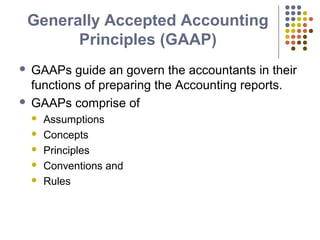

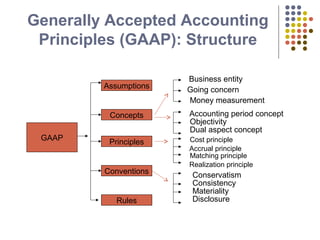

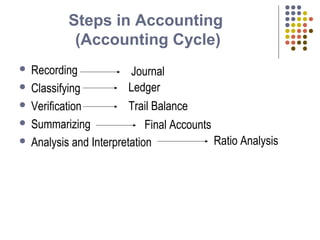

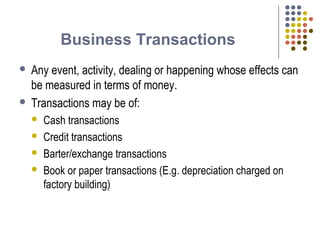

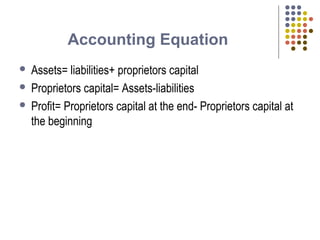

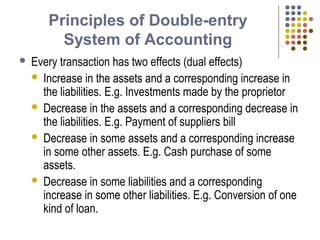

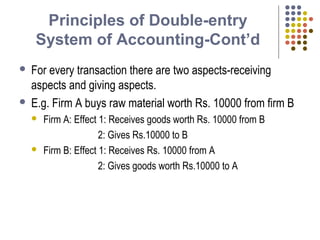

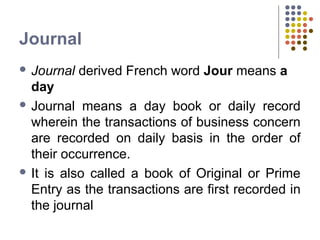

This document provides an overview of accounting concepts for managers. It defines accounting as recording, classifying, and summarizing financial transactions and events. Accounting serves to guide and control business activities, analyze results, and provide information for decision making. It distinguishes between bookkeeping and accounting, and describes the branches of accounting. The accounting cycle and basic principles like the accounting equation and double-entry system are also summarized.