This document provides an overview of introductory accounting concepts including:

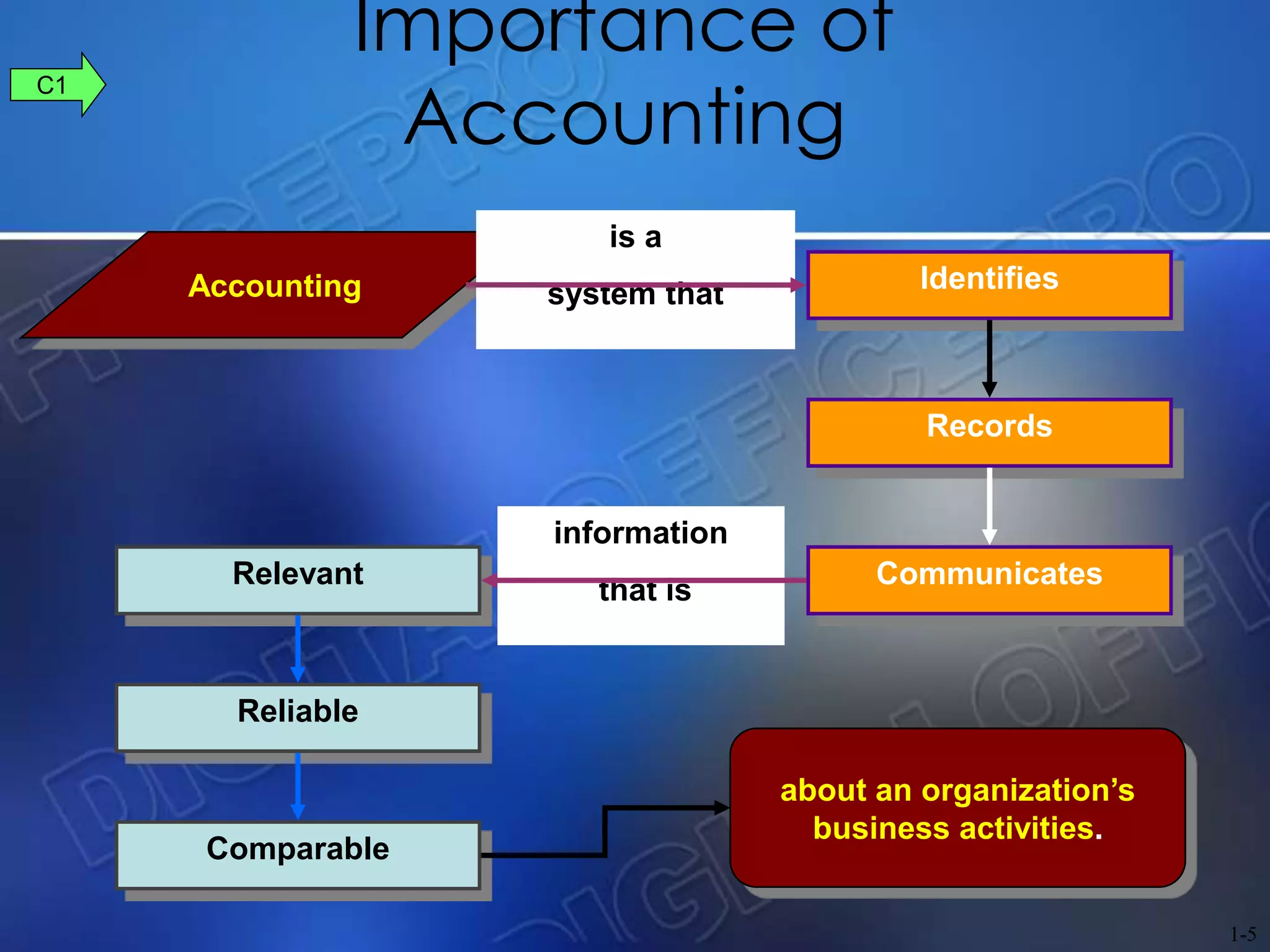

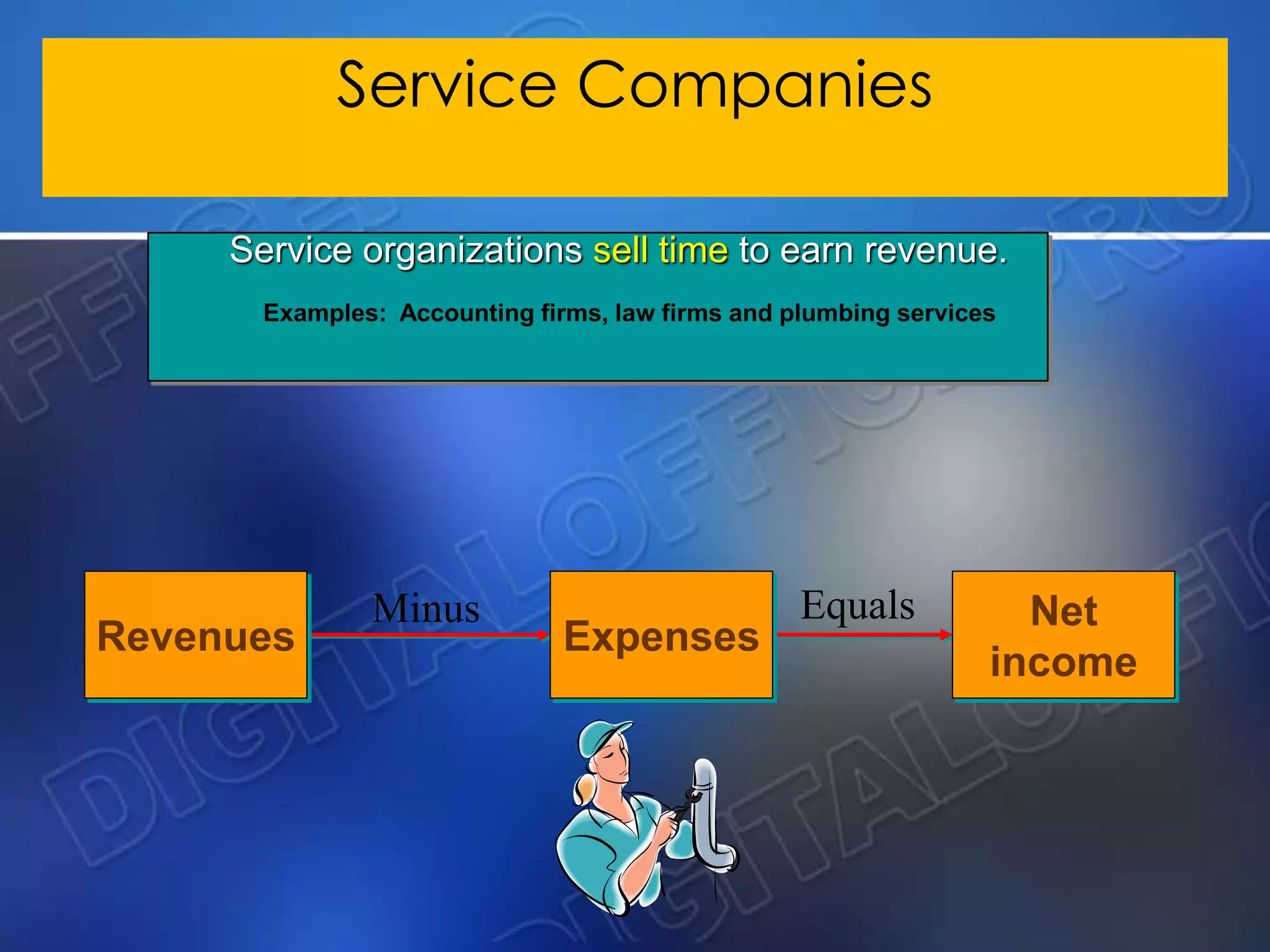

- The definition and objectives of accounting as an information system that measures, processes, and communicates financial information.

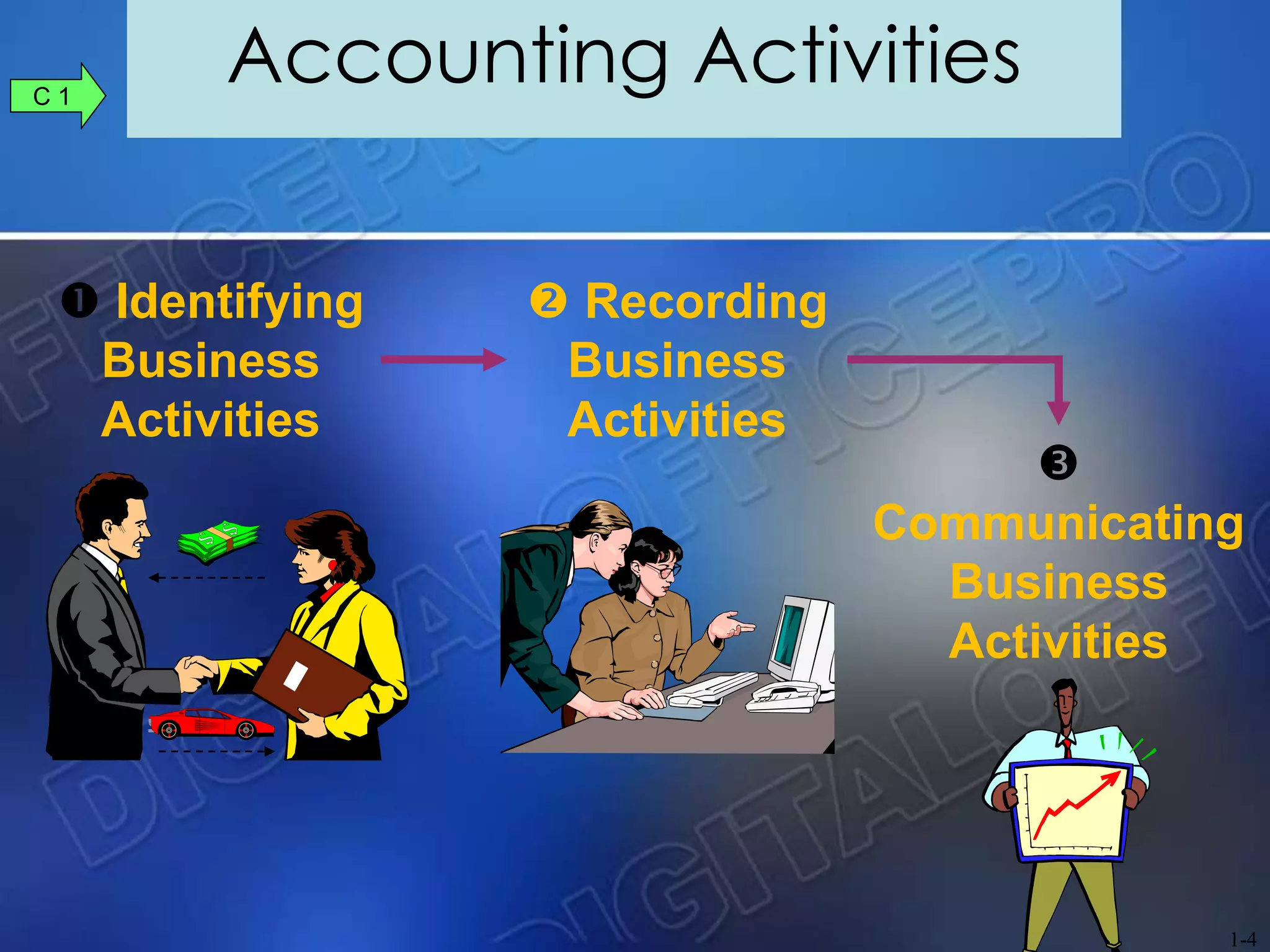

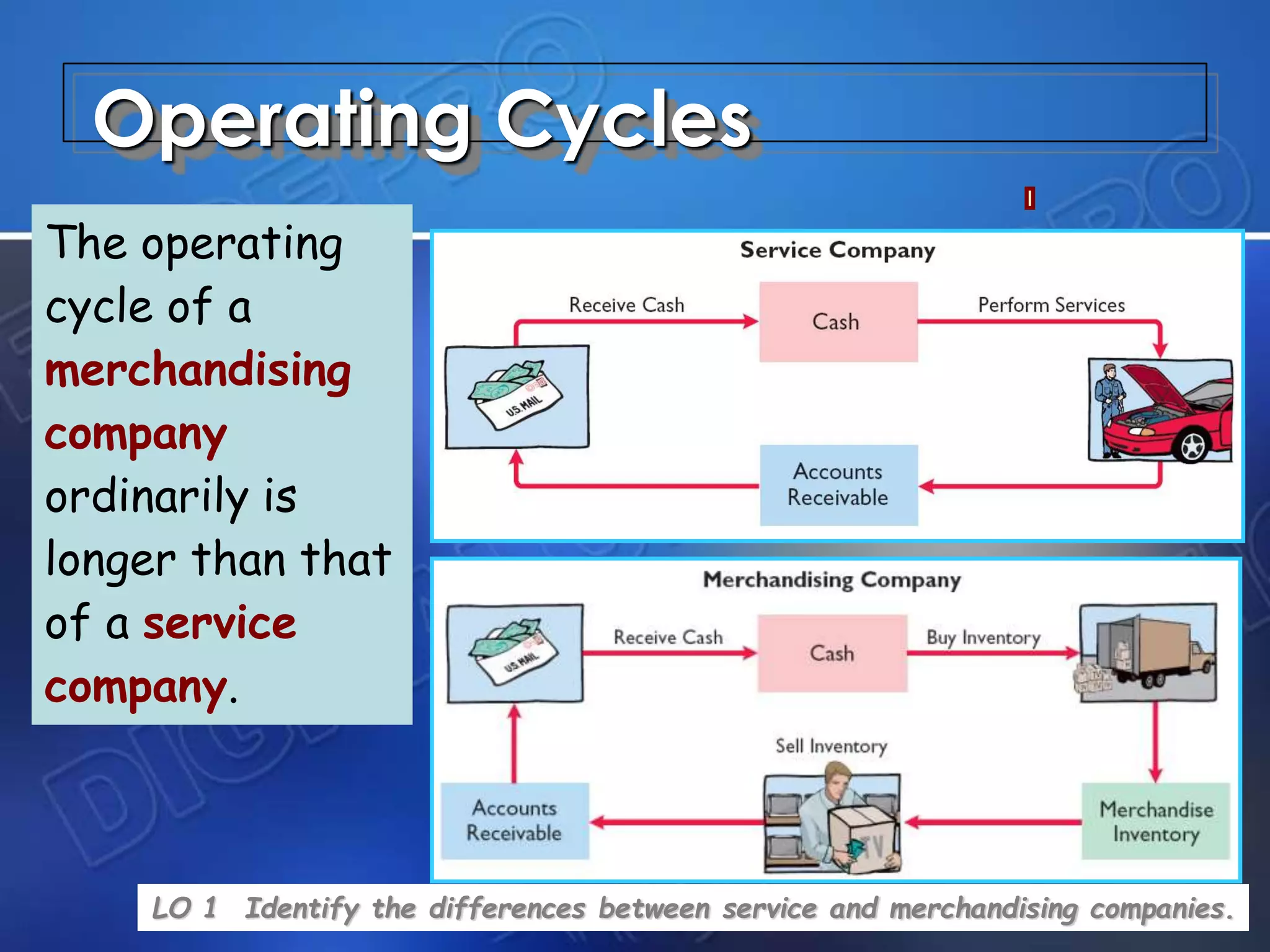

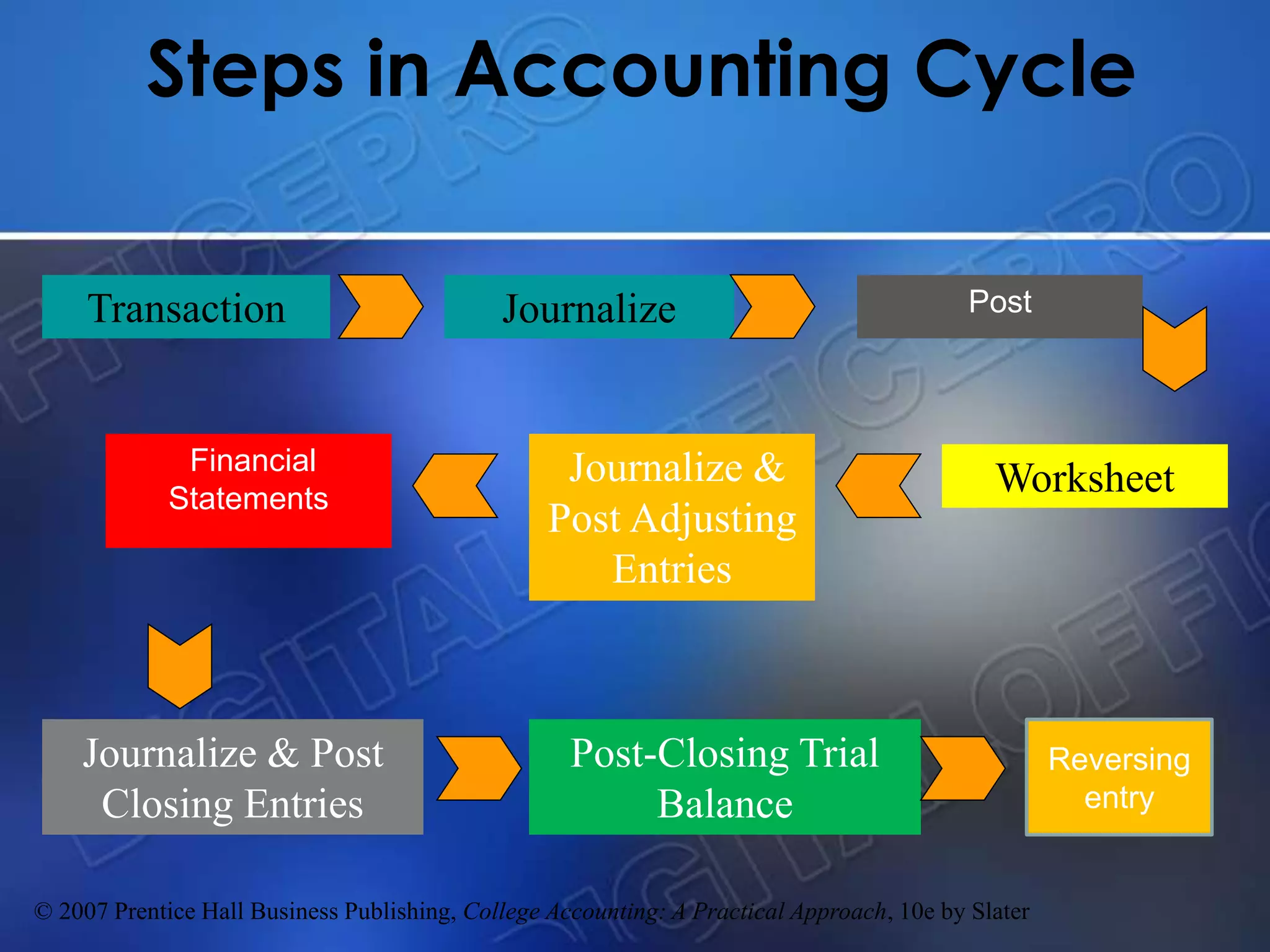

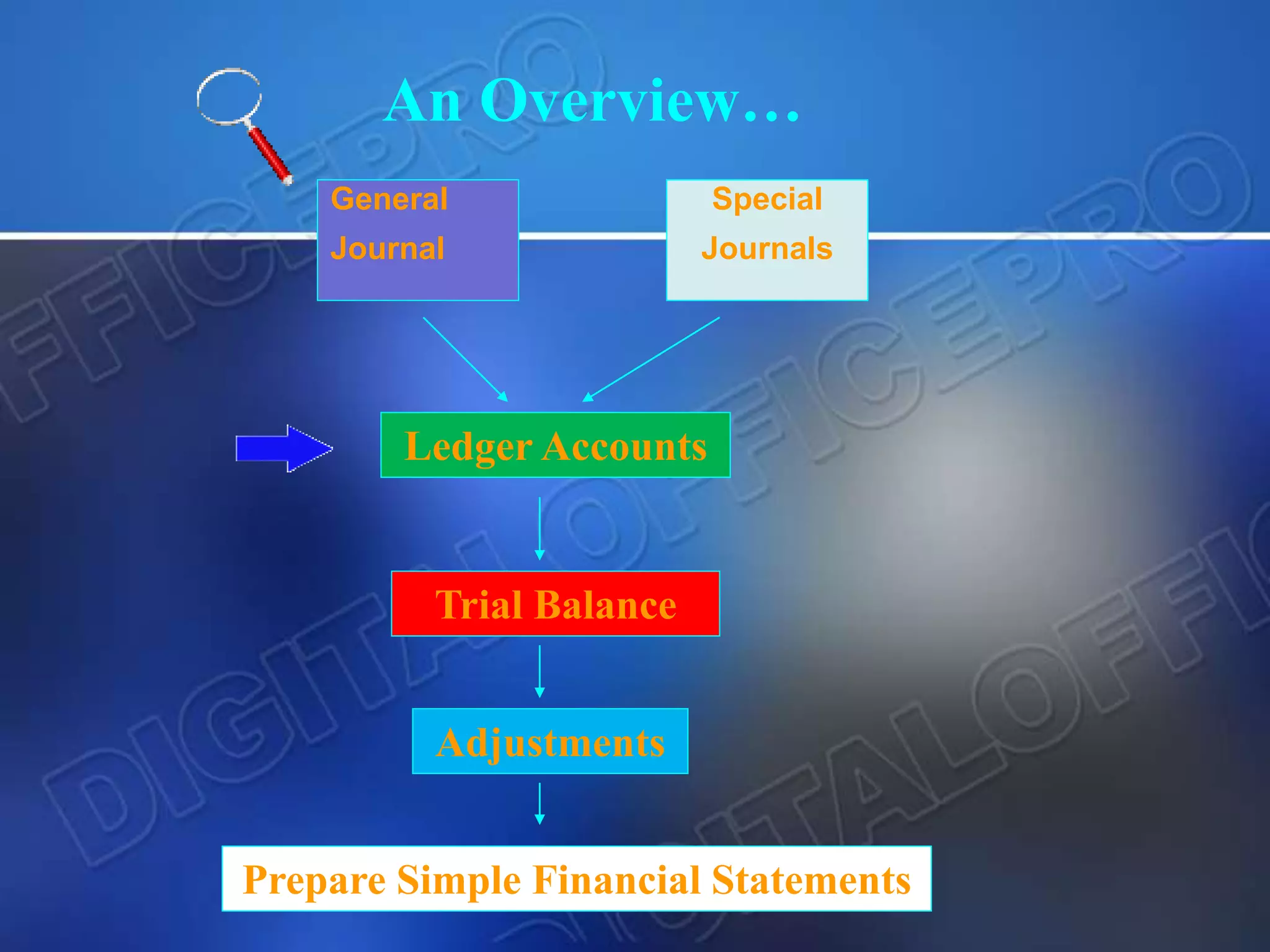

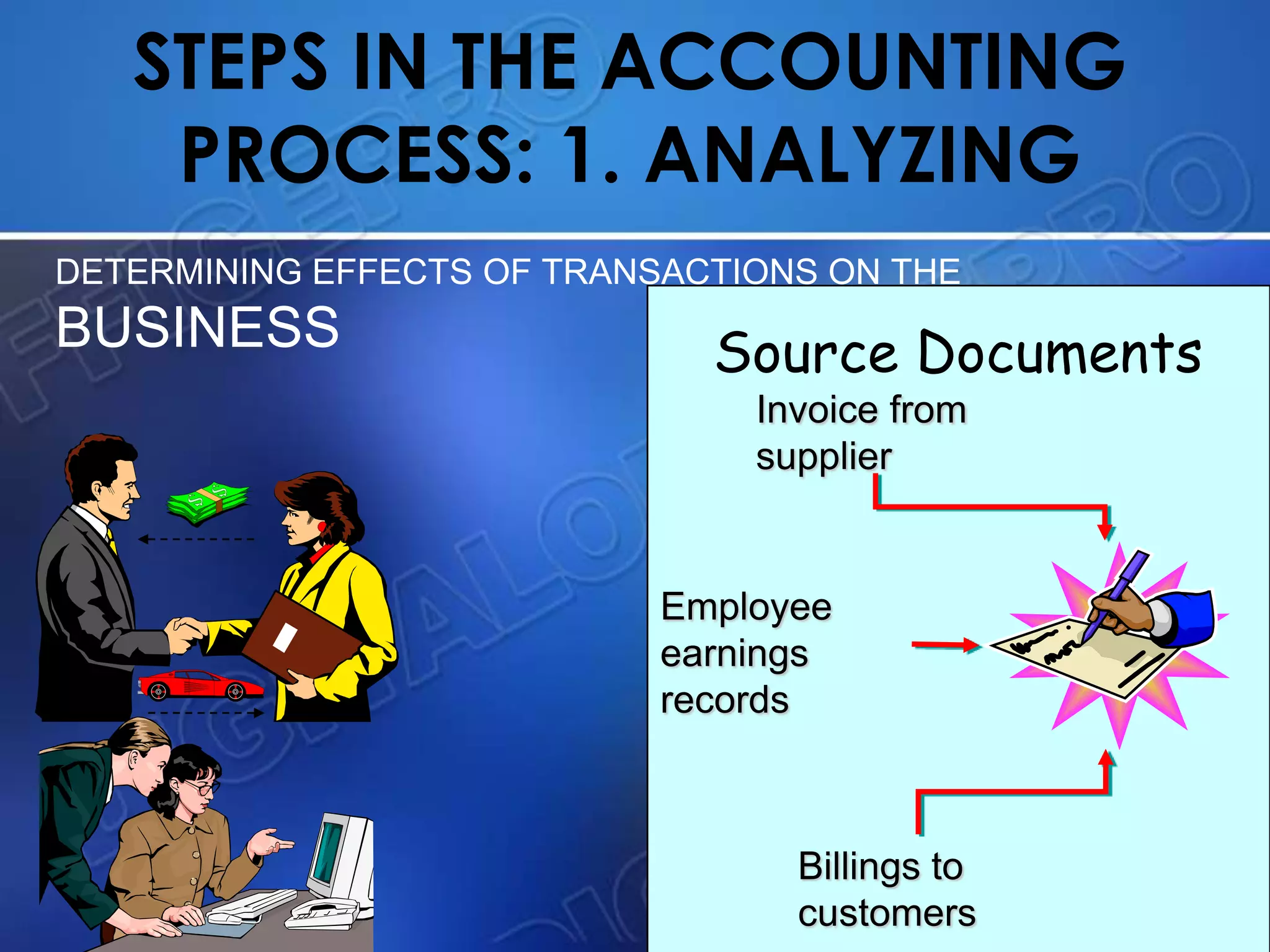

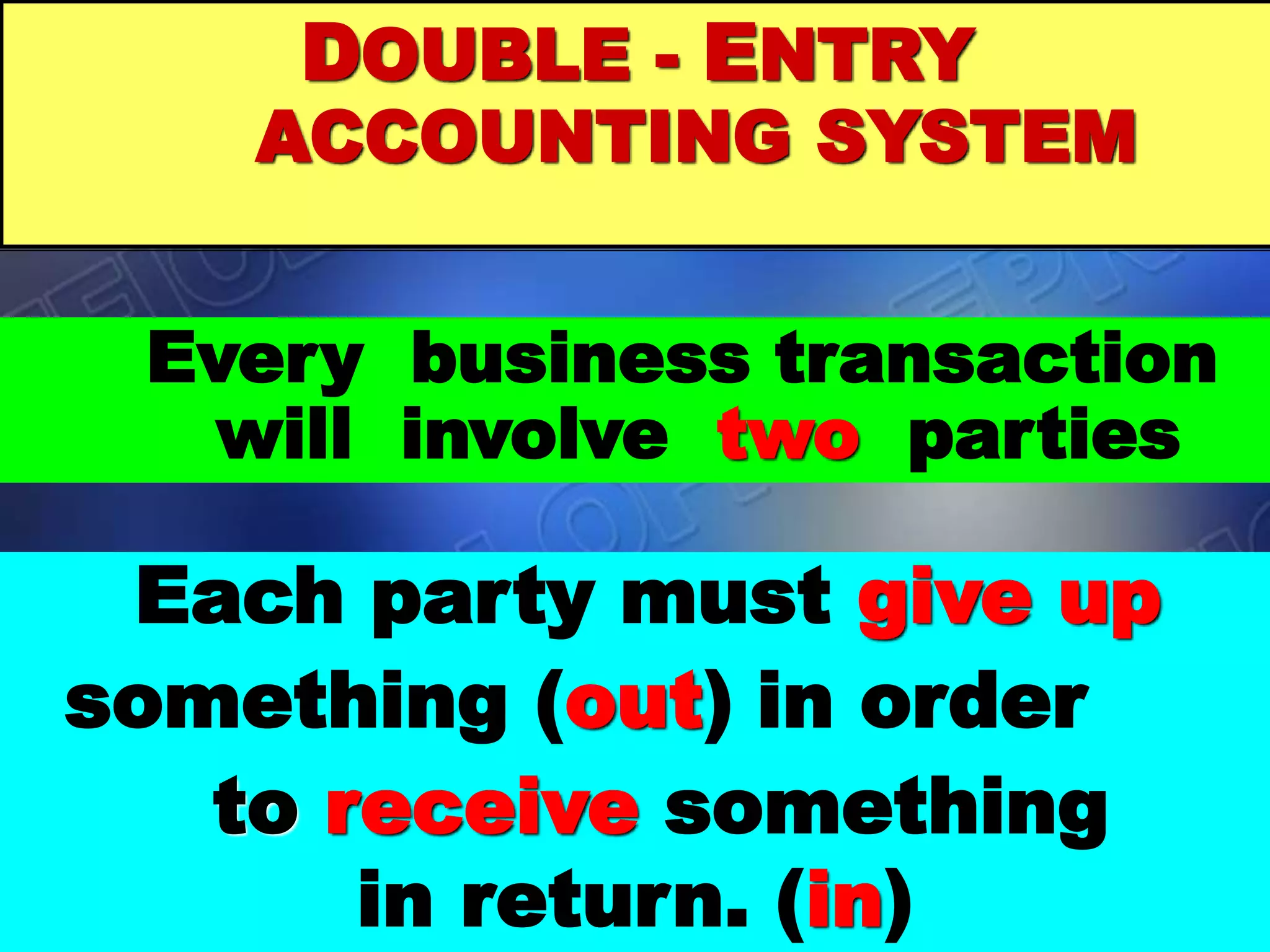

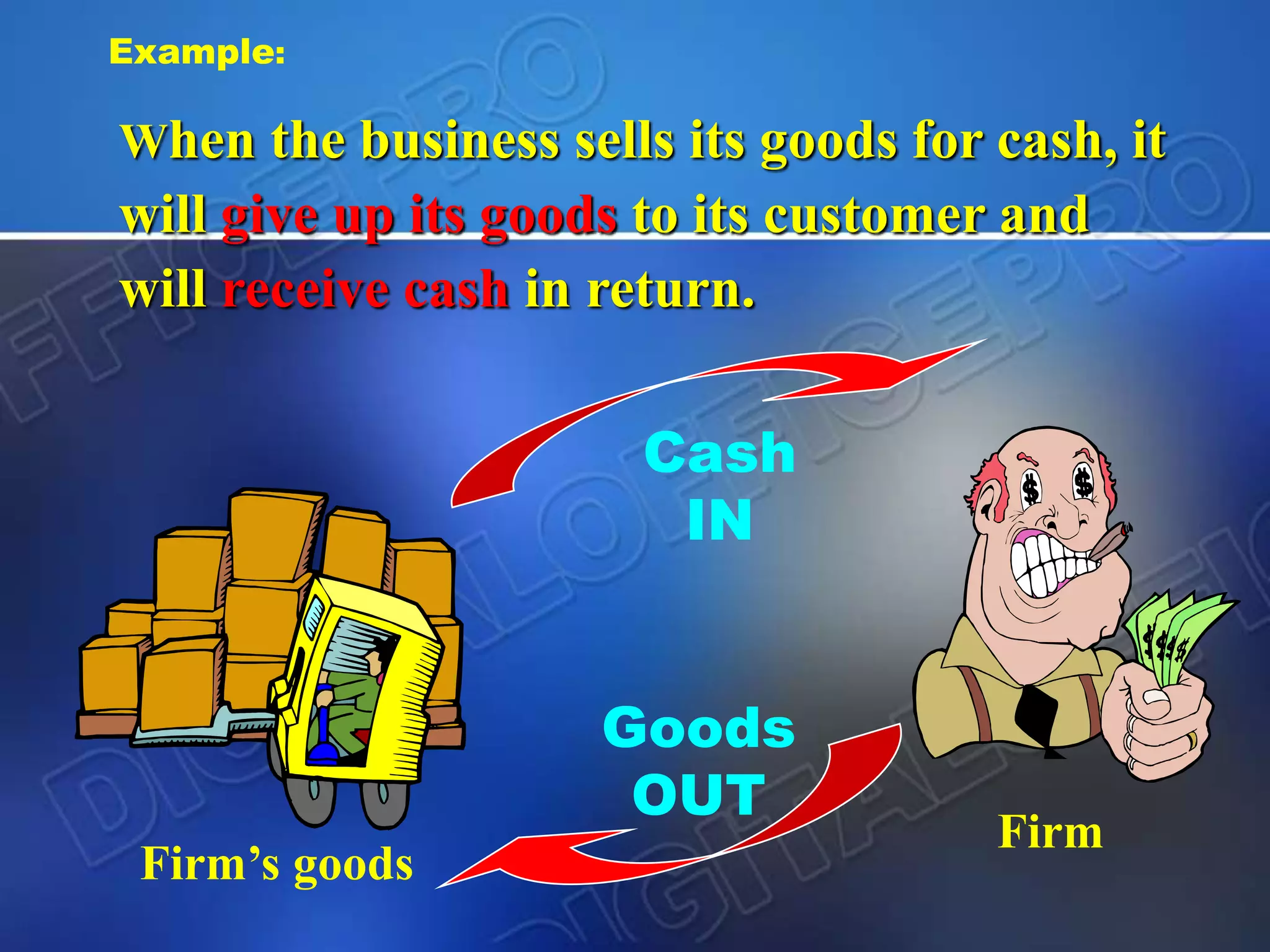

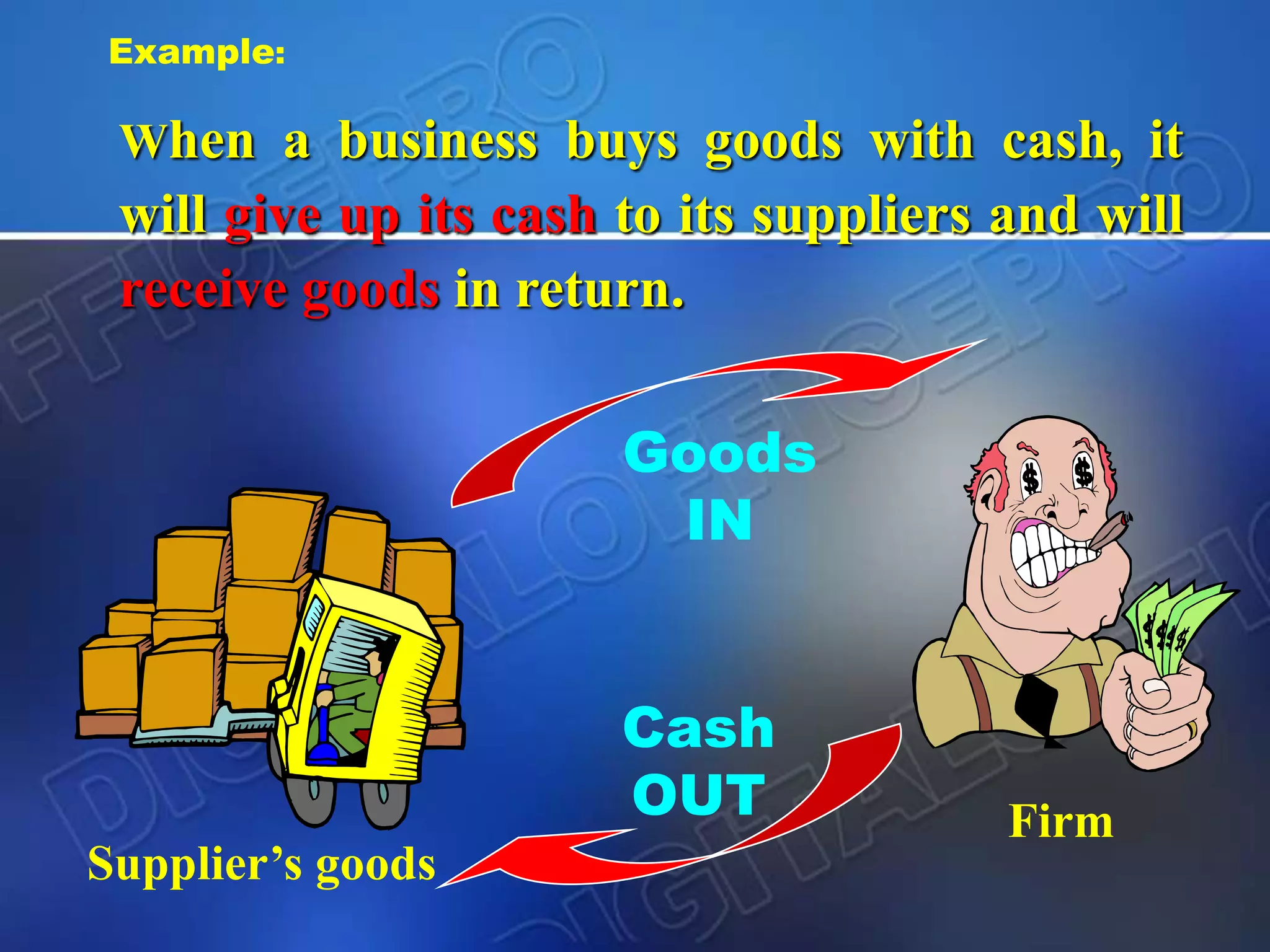

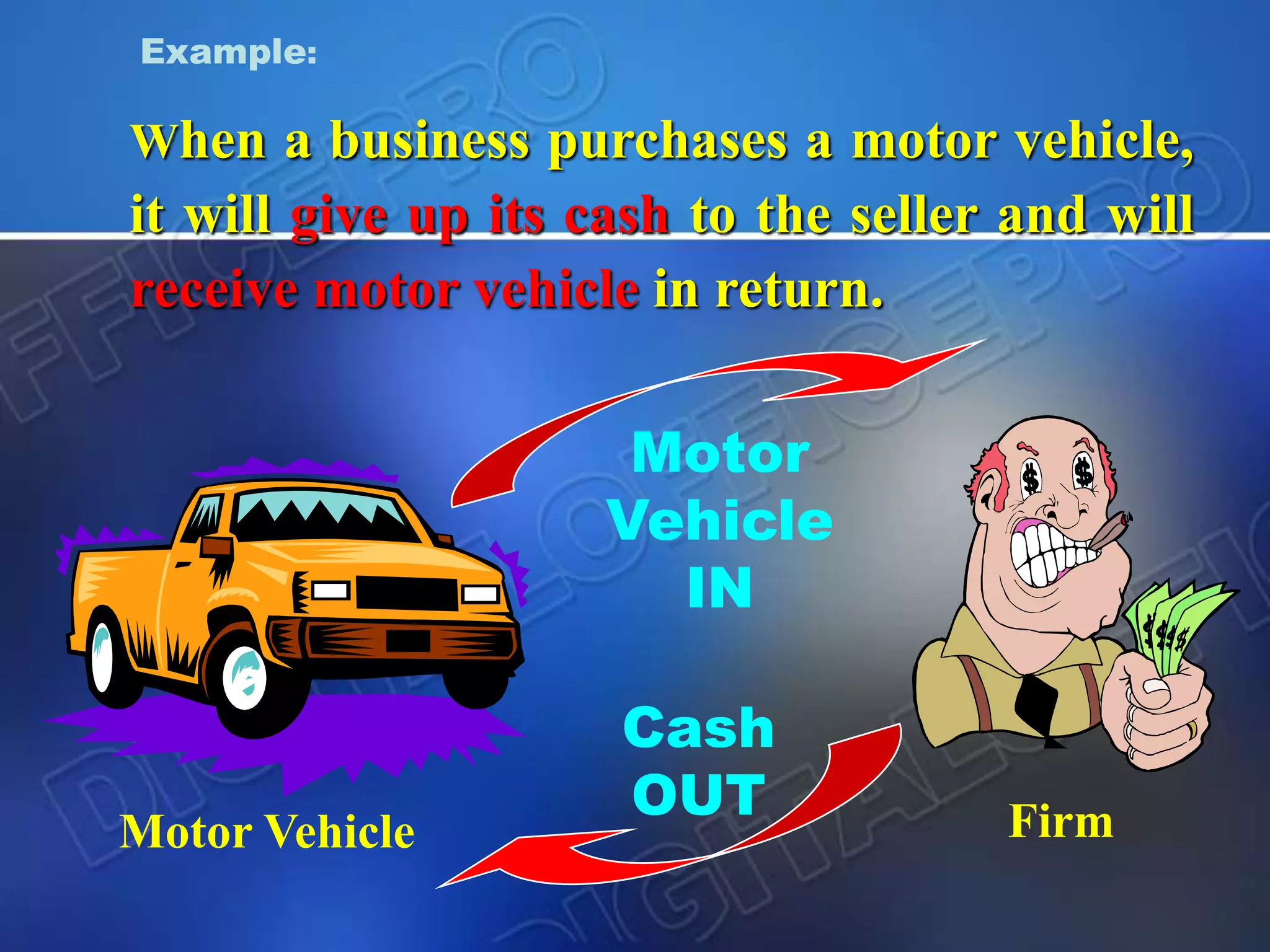

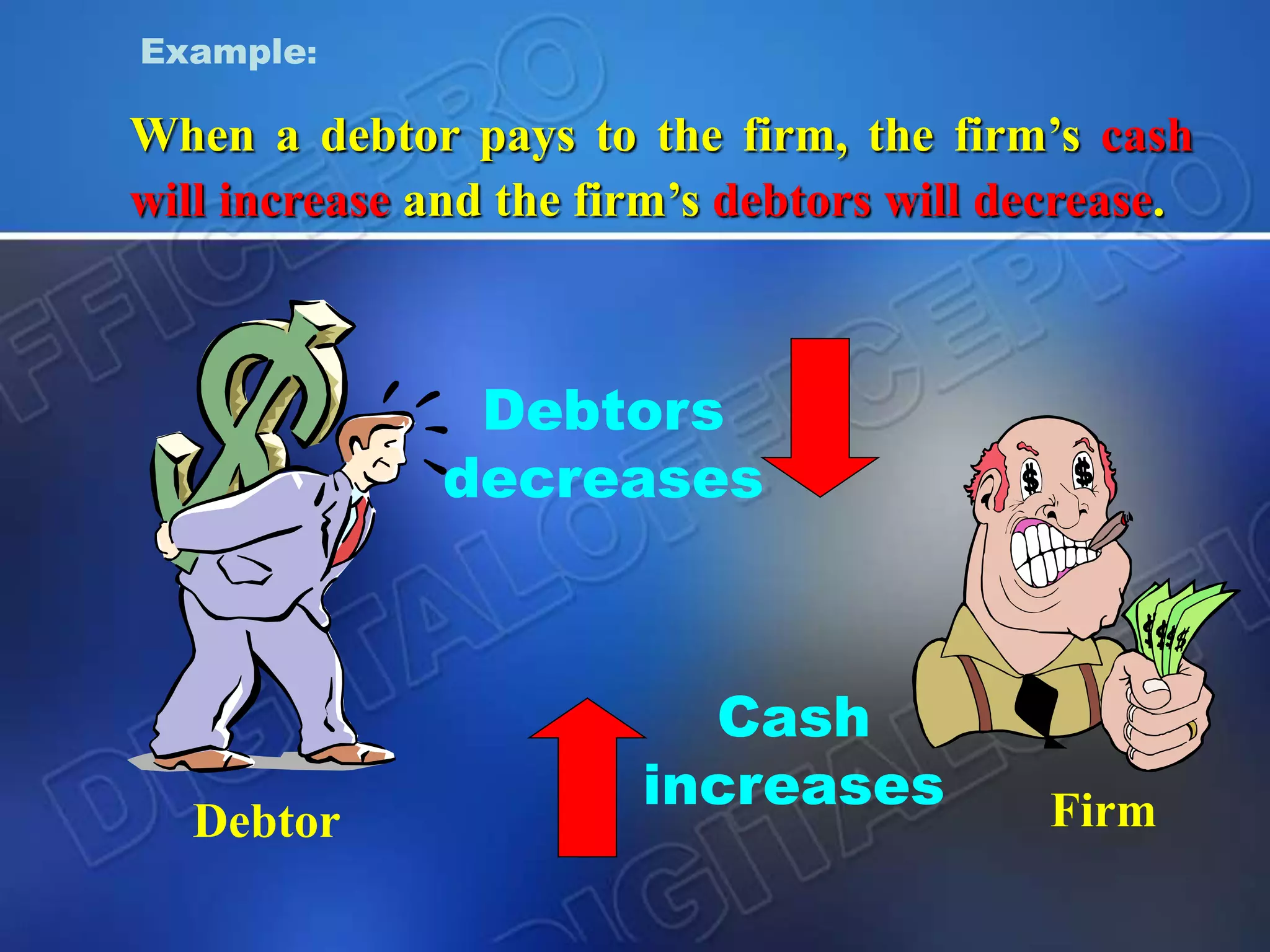

- The accounting process and cycle including identifying transactions, recording them, and communicating financial statements.

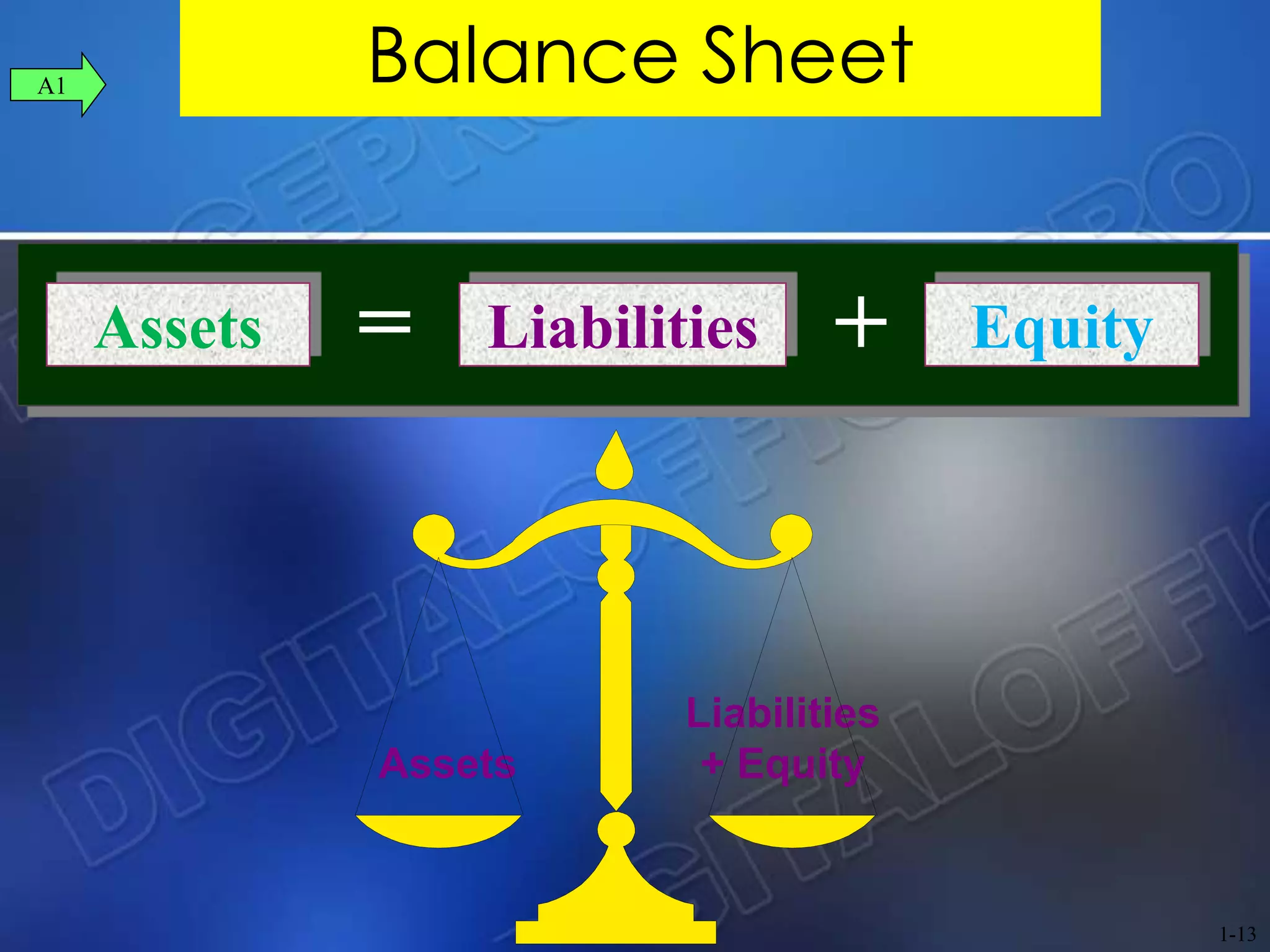

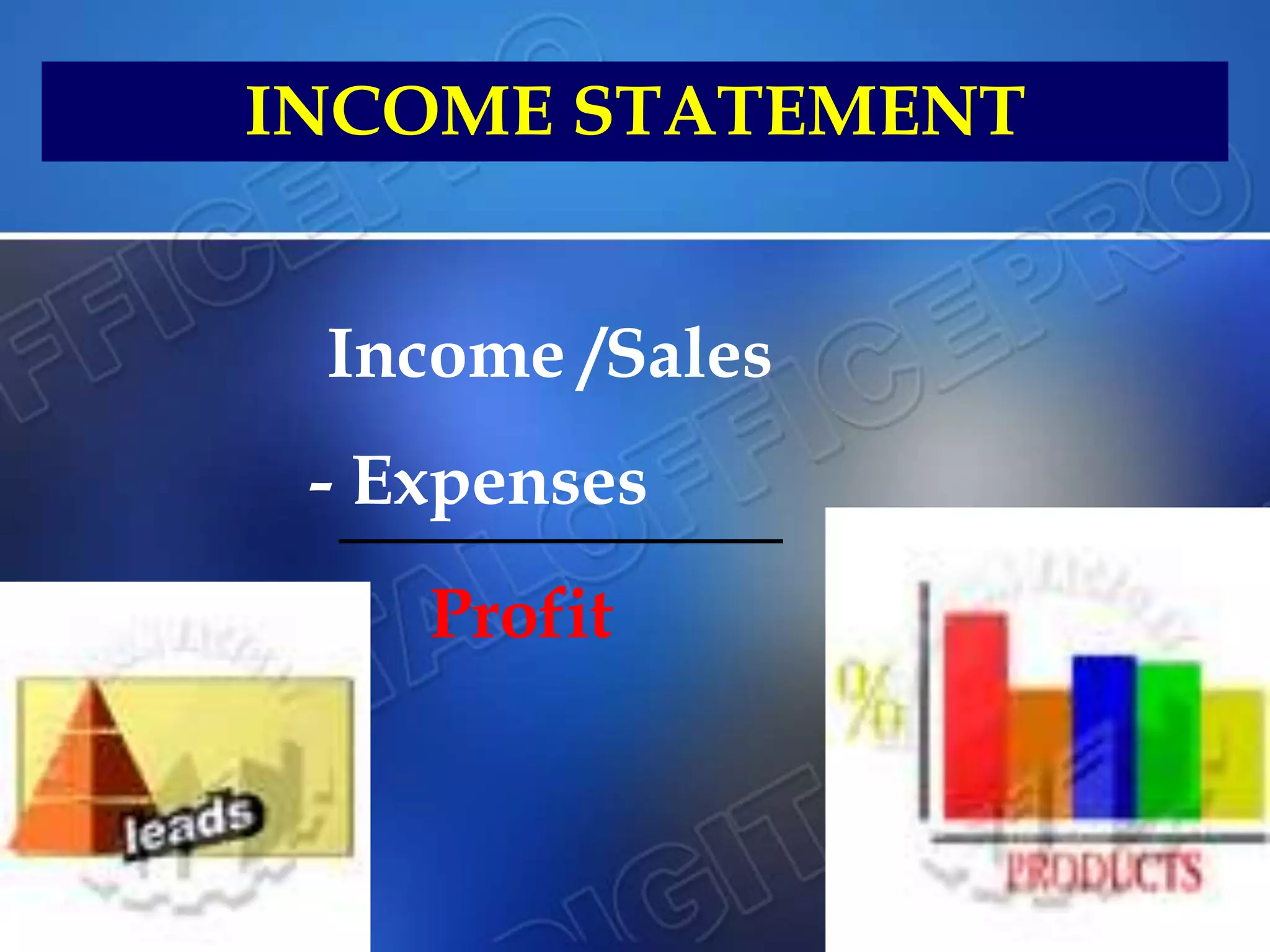

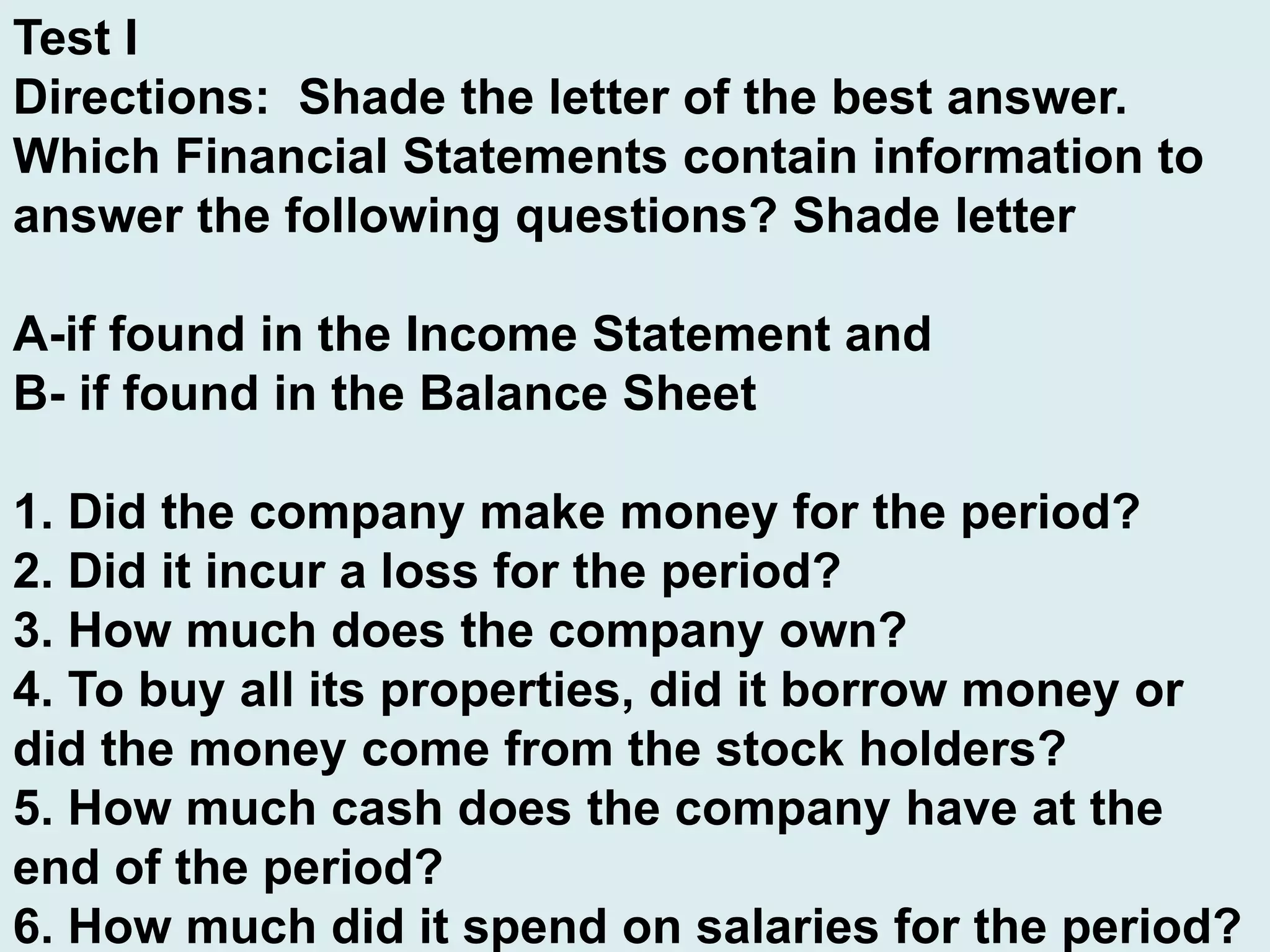

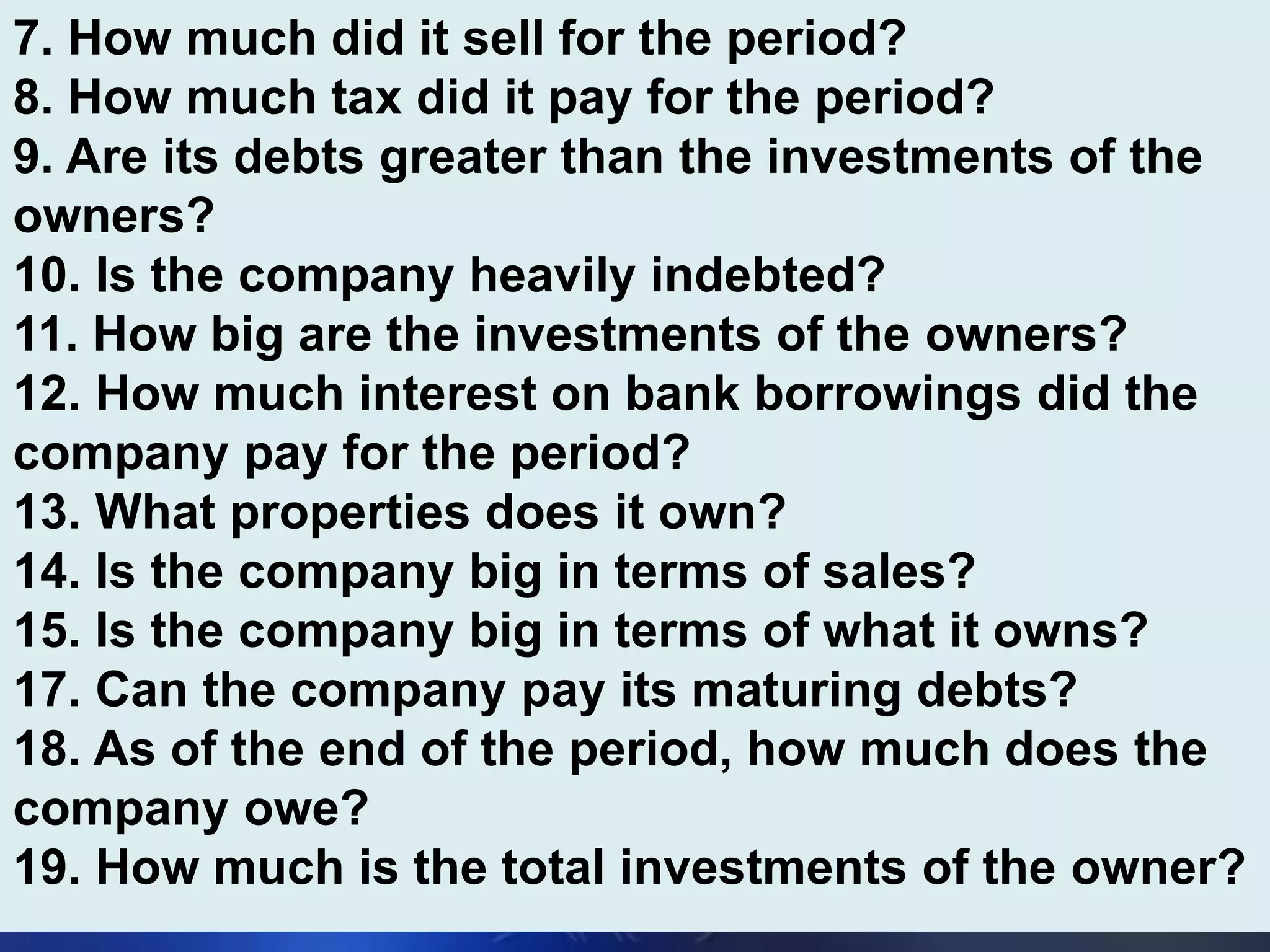

- The key financial statements - balance sheet, income statement, statement of cash flows - and what financial information they provide.

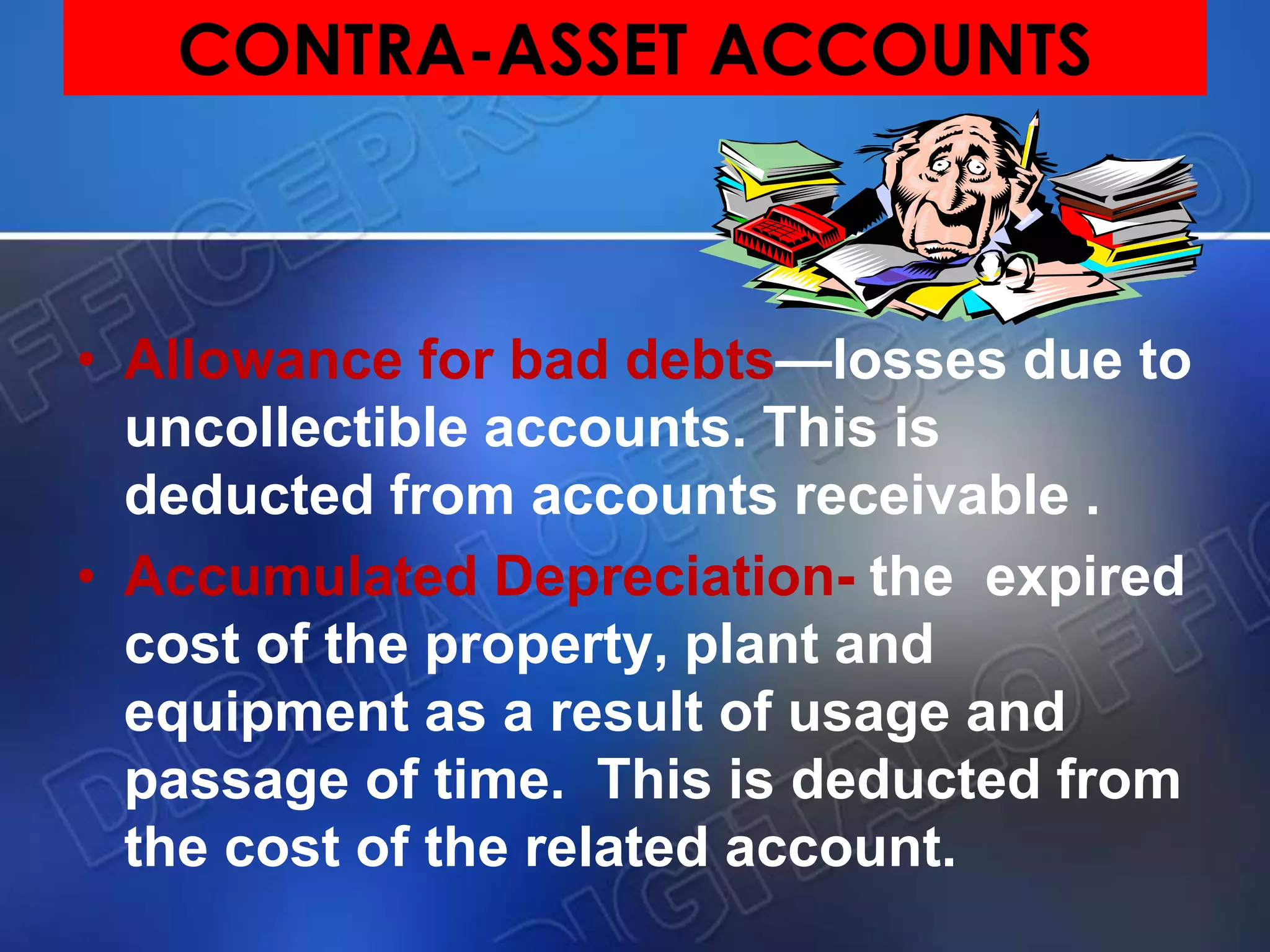

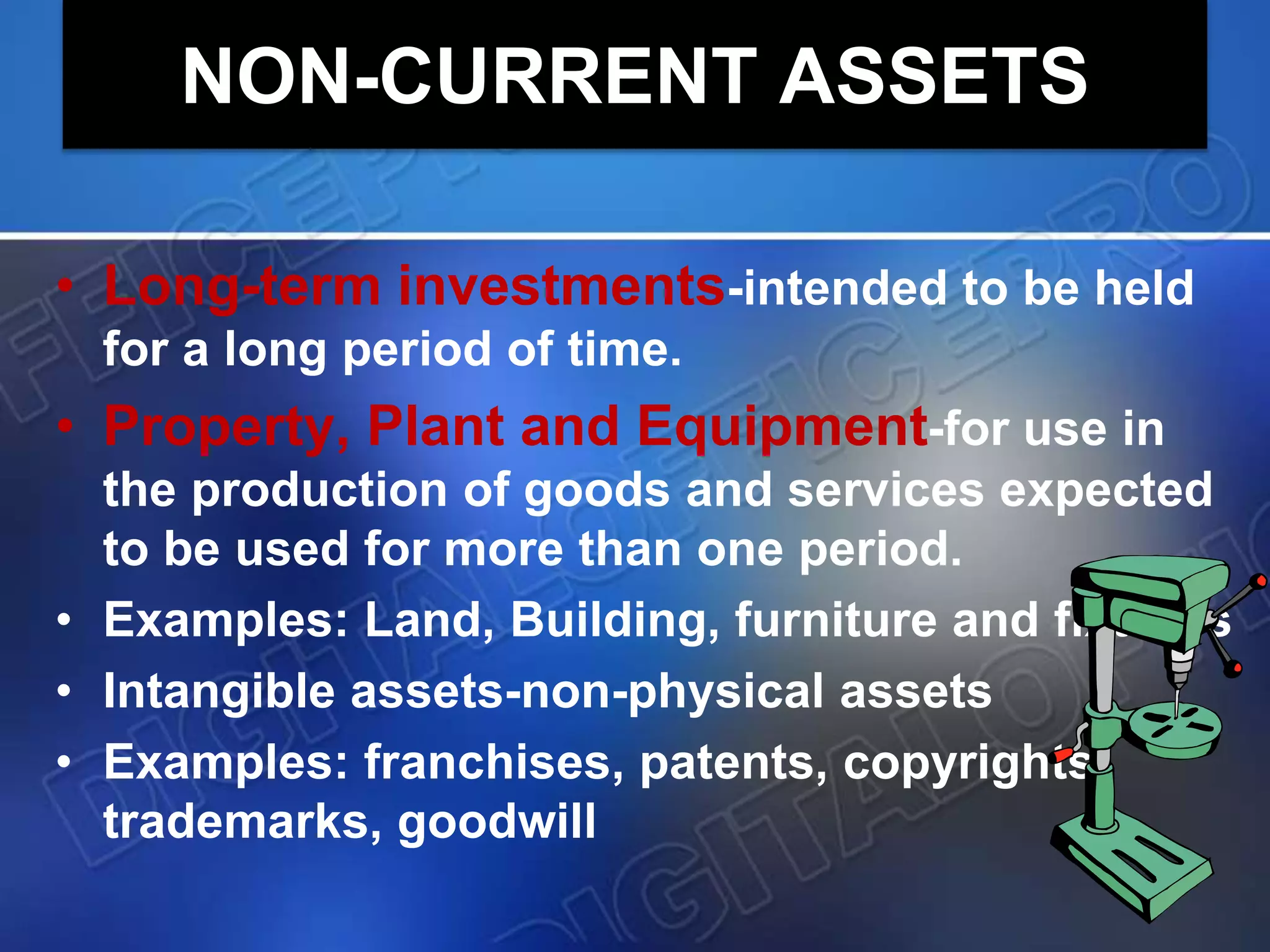

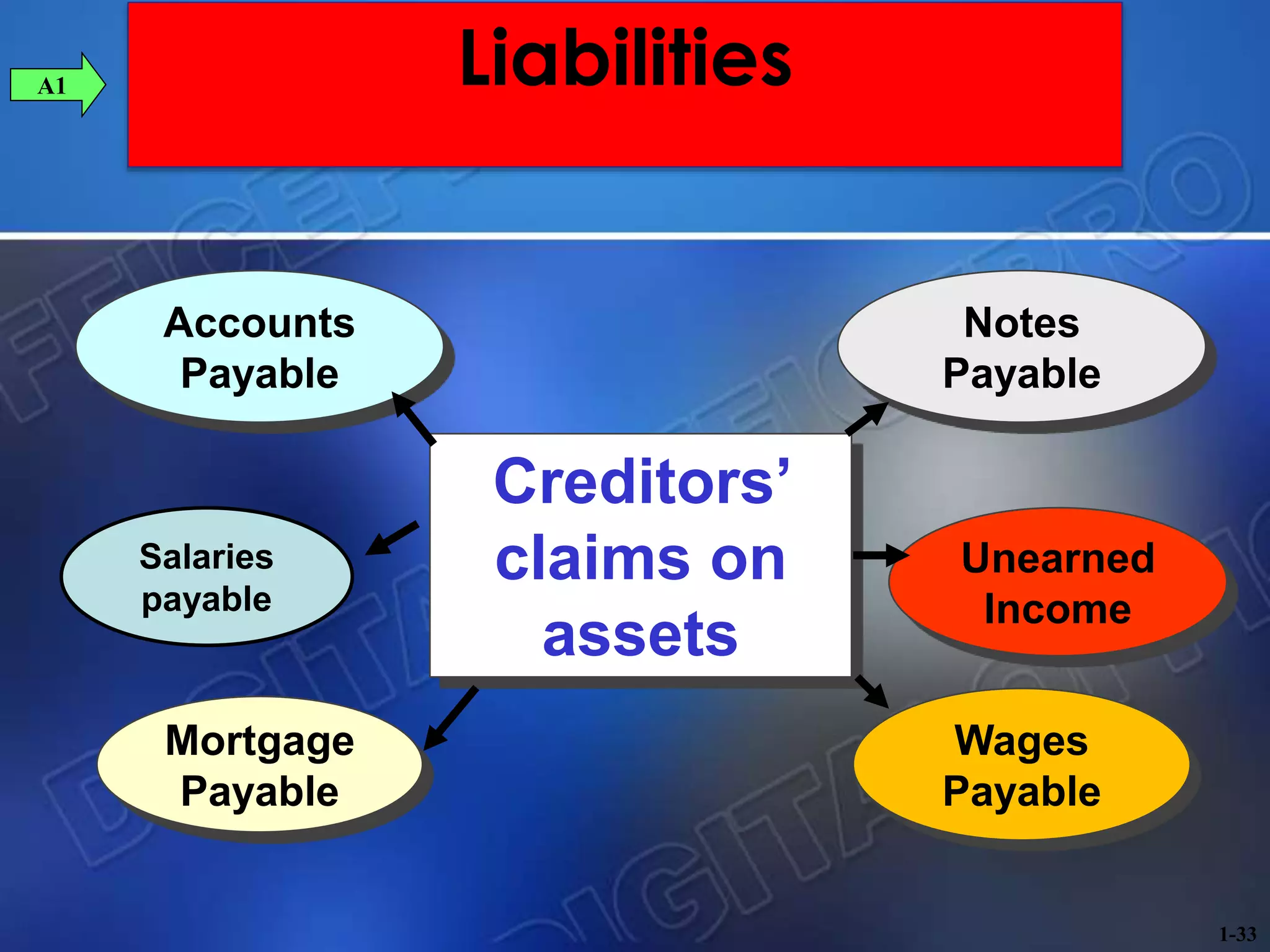

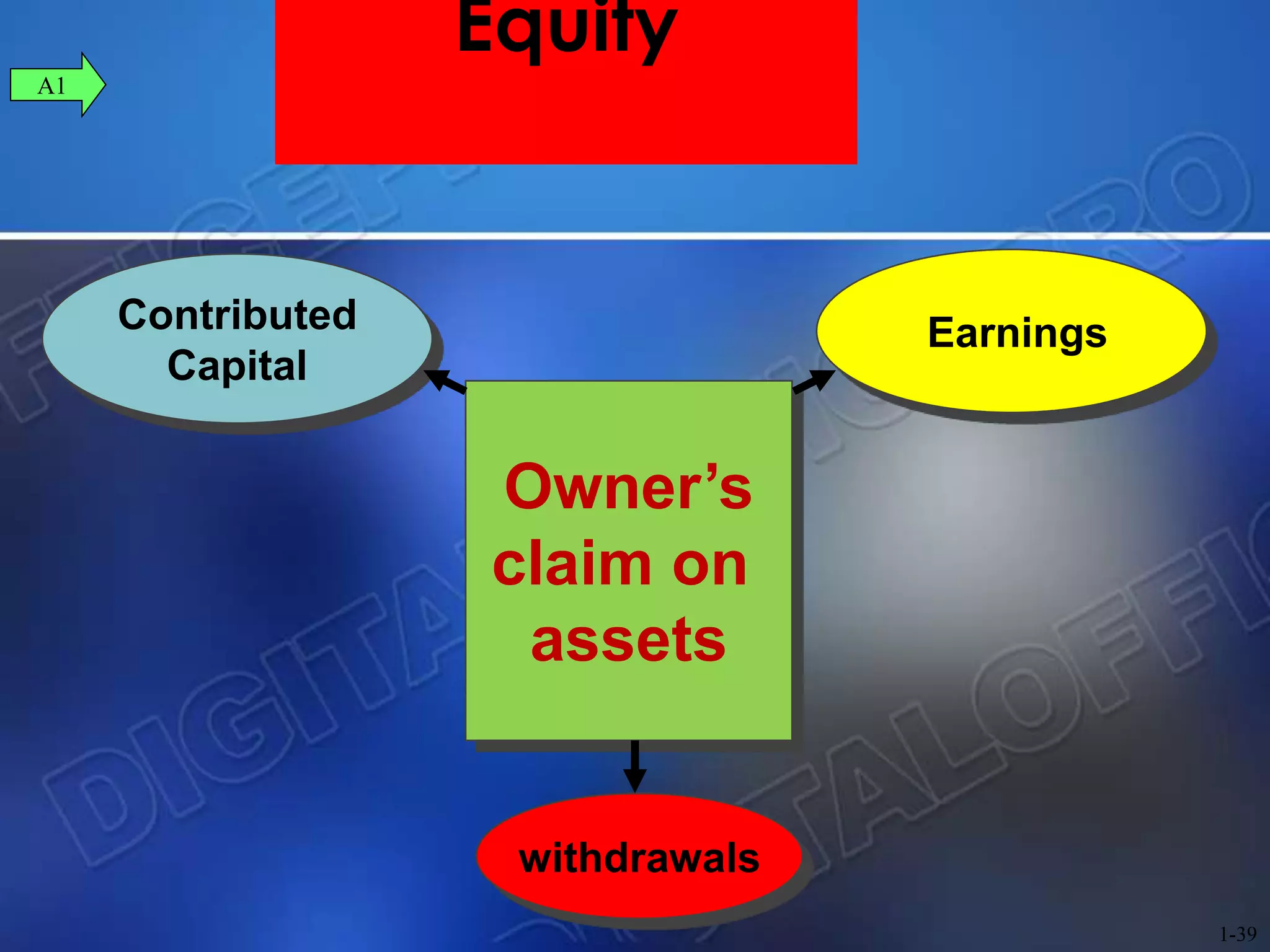

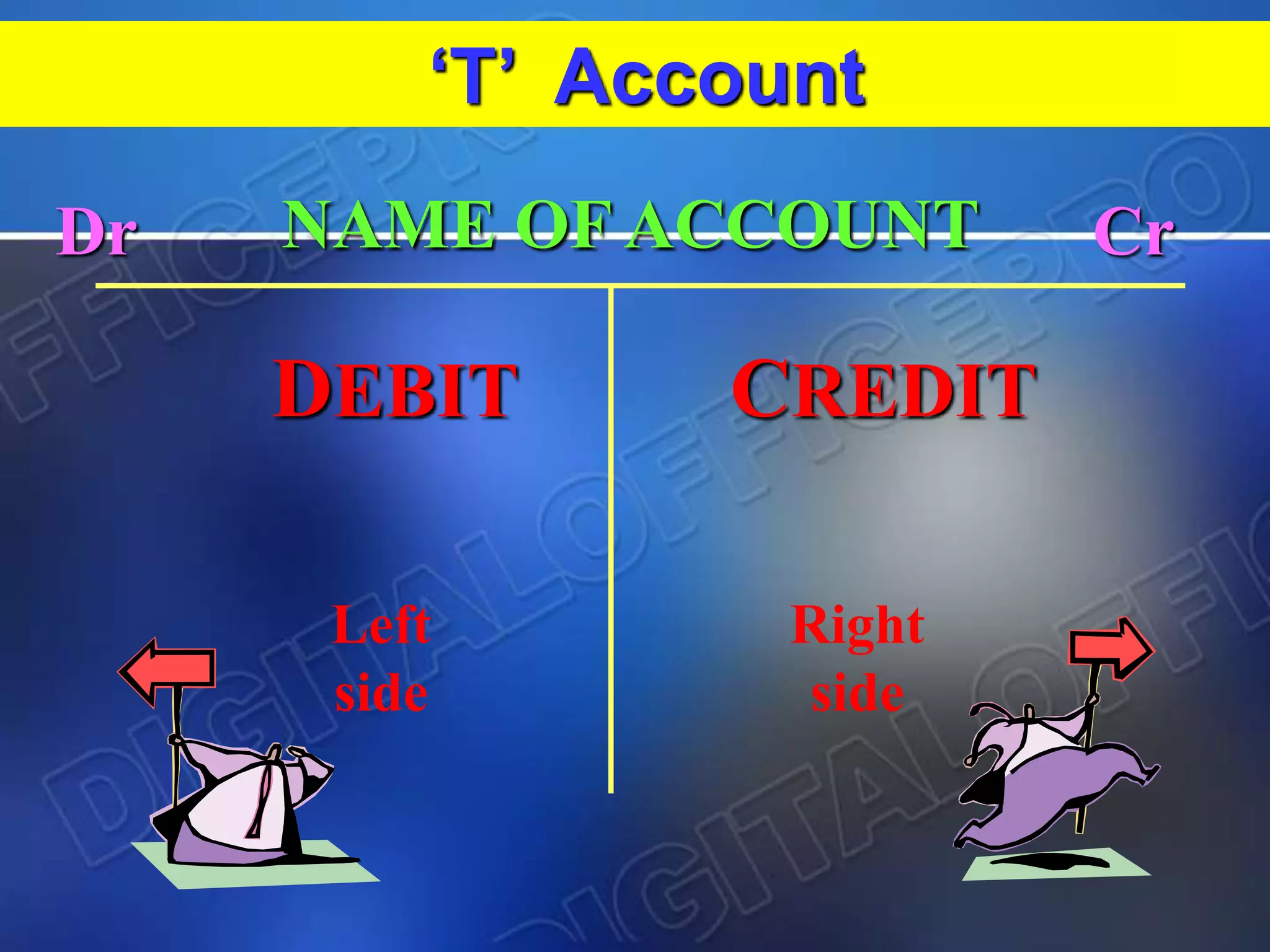

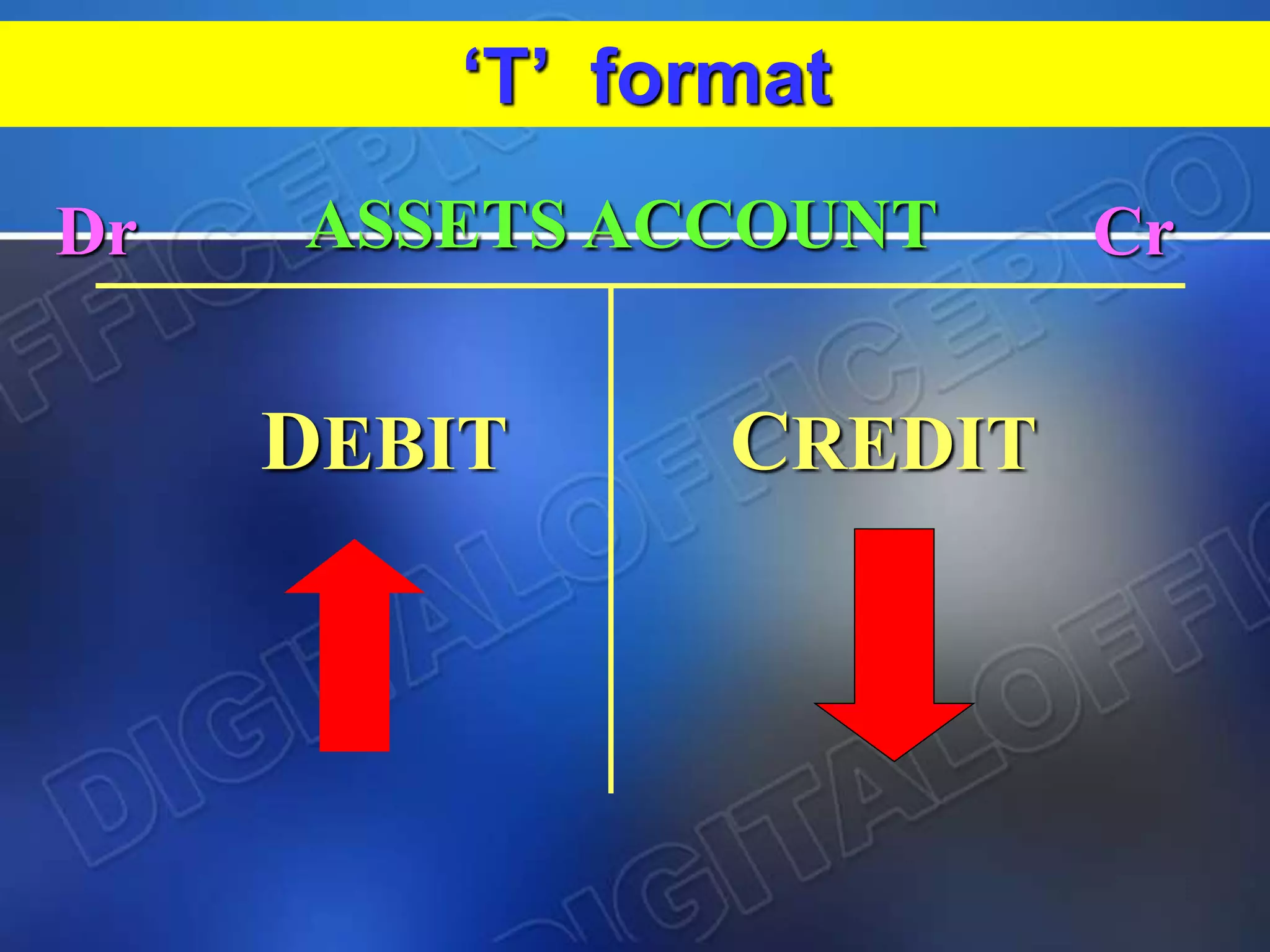

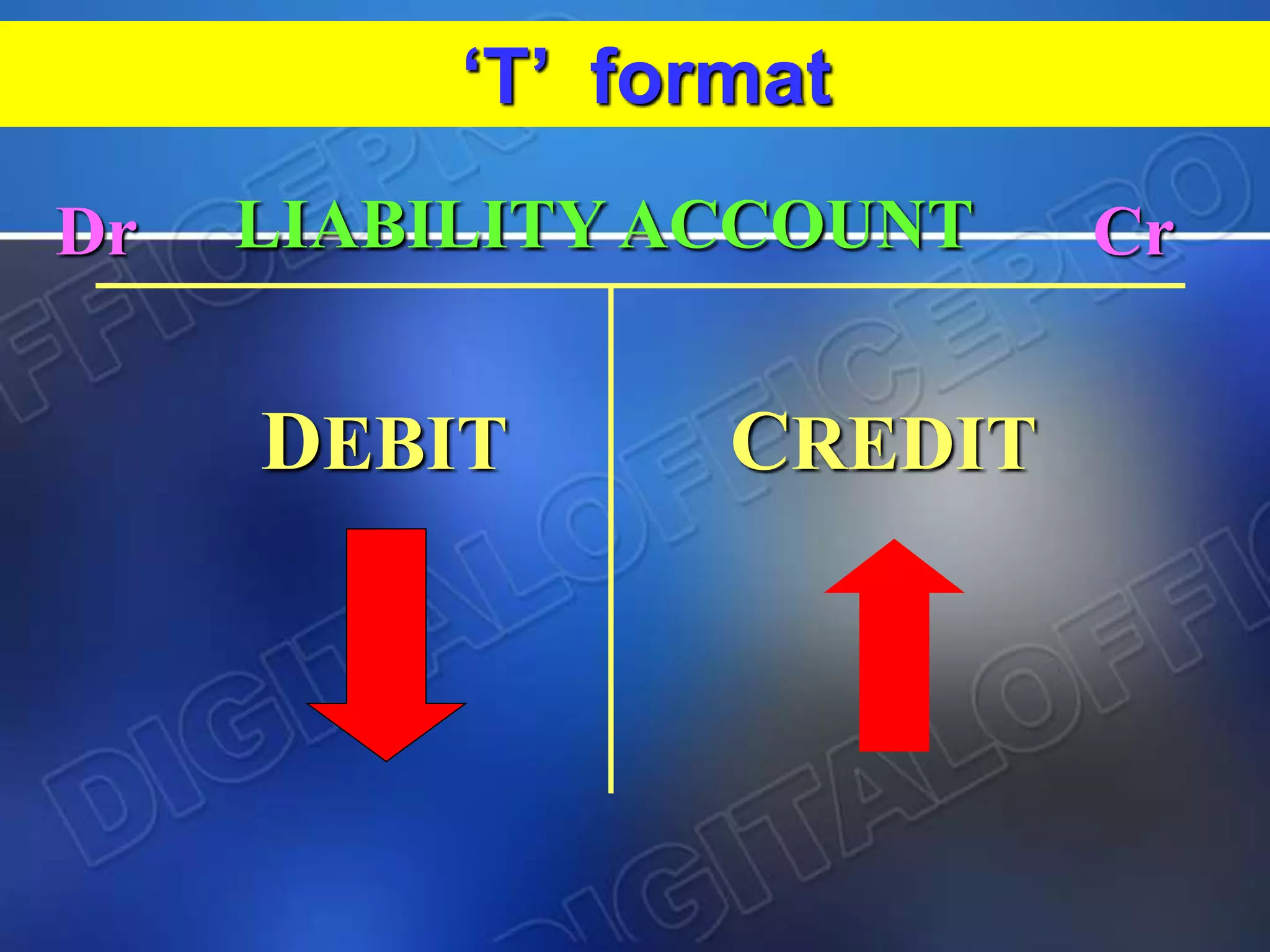

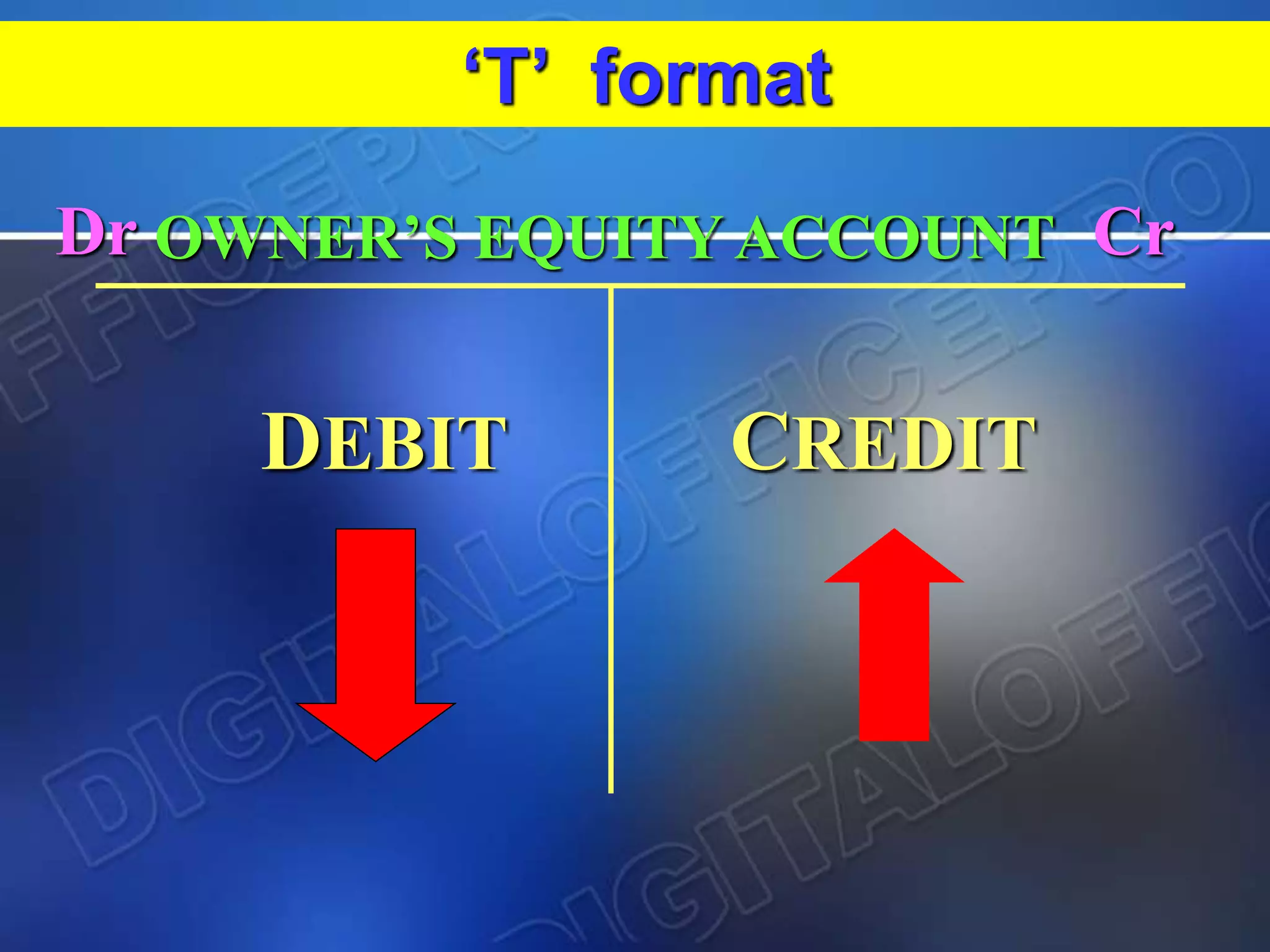

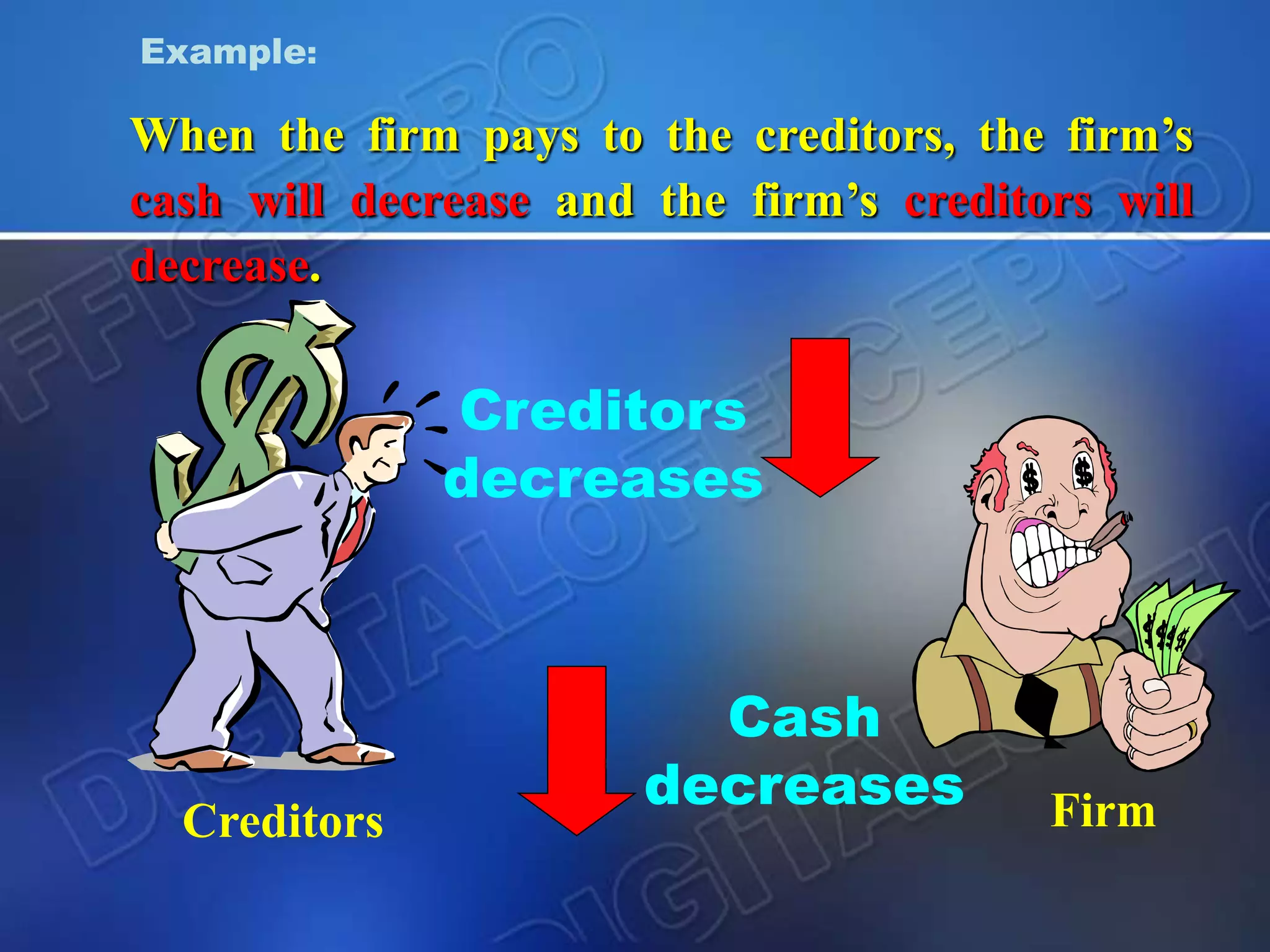

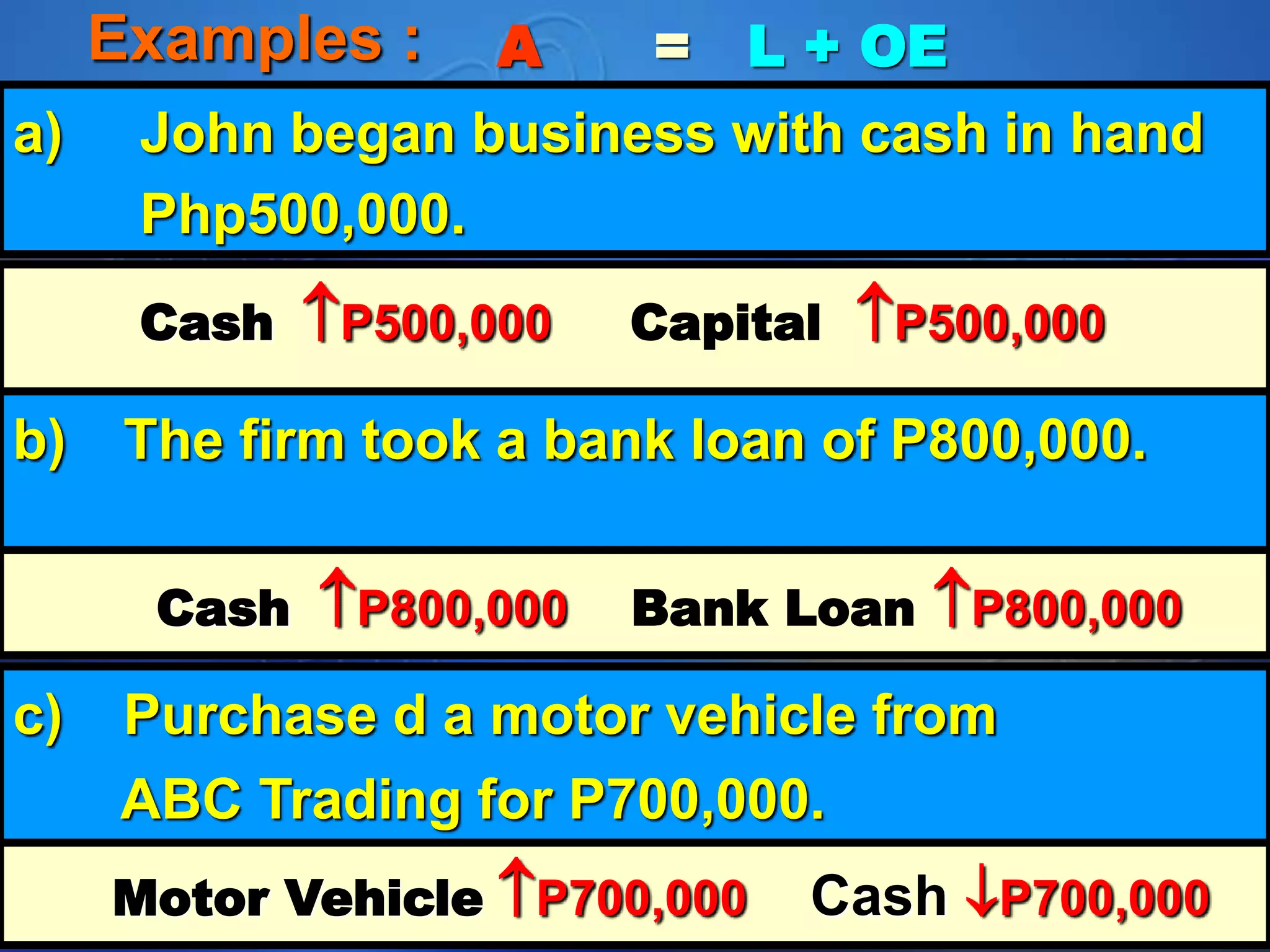

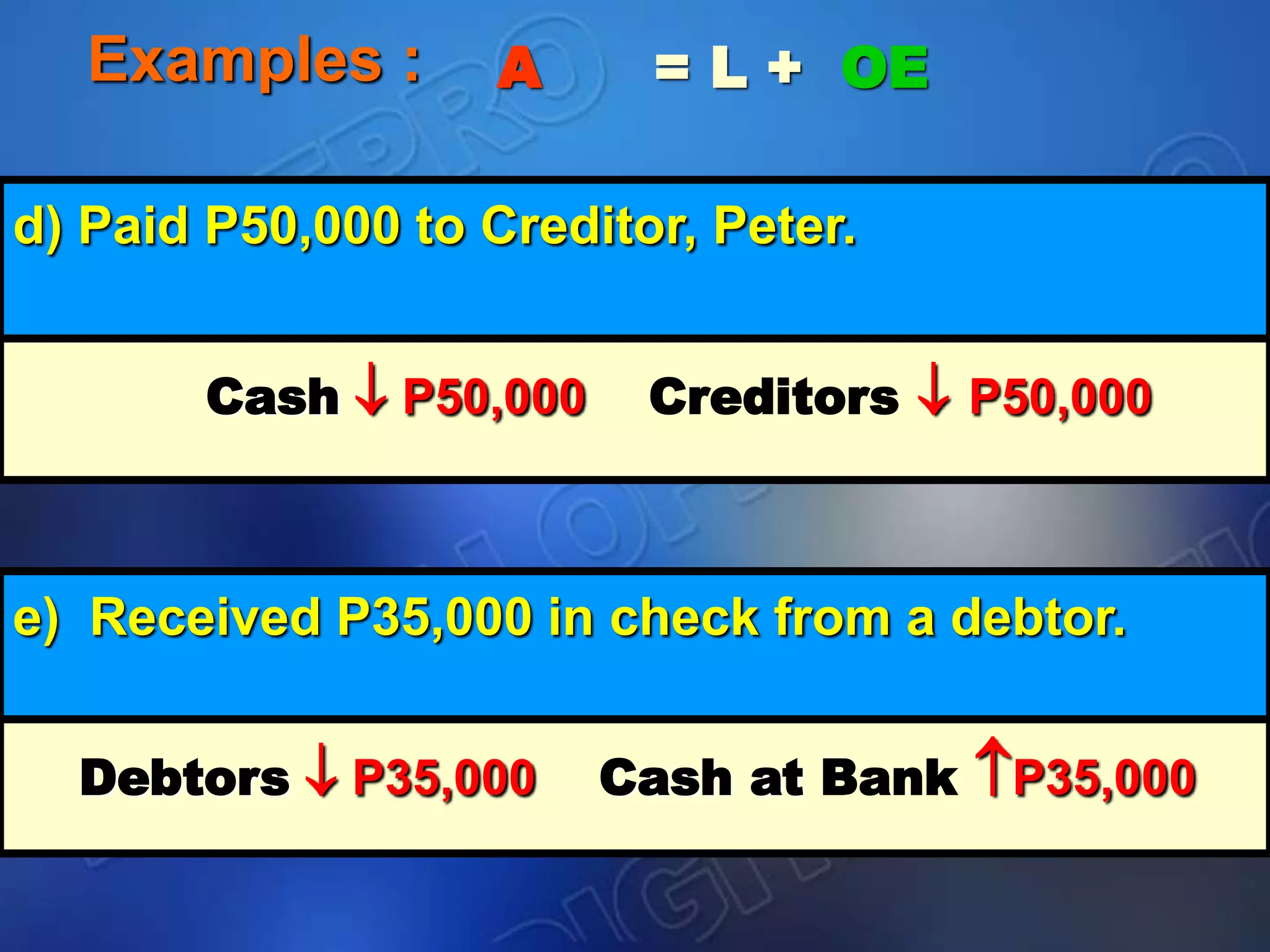

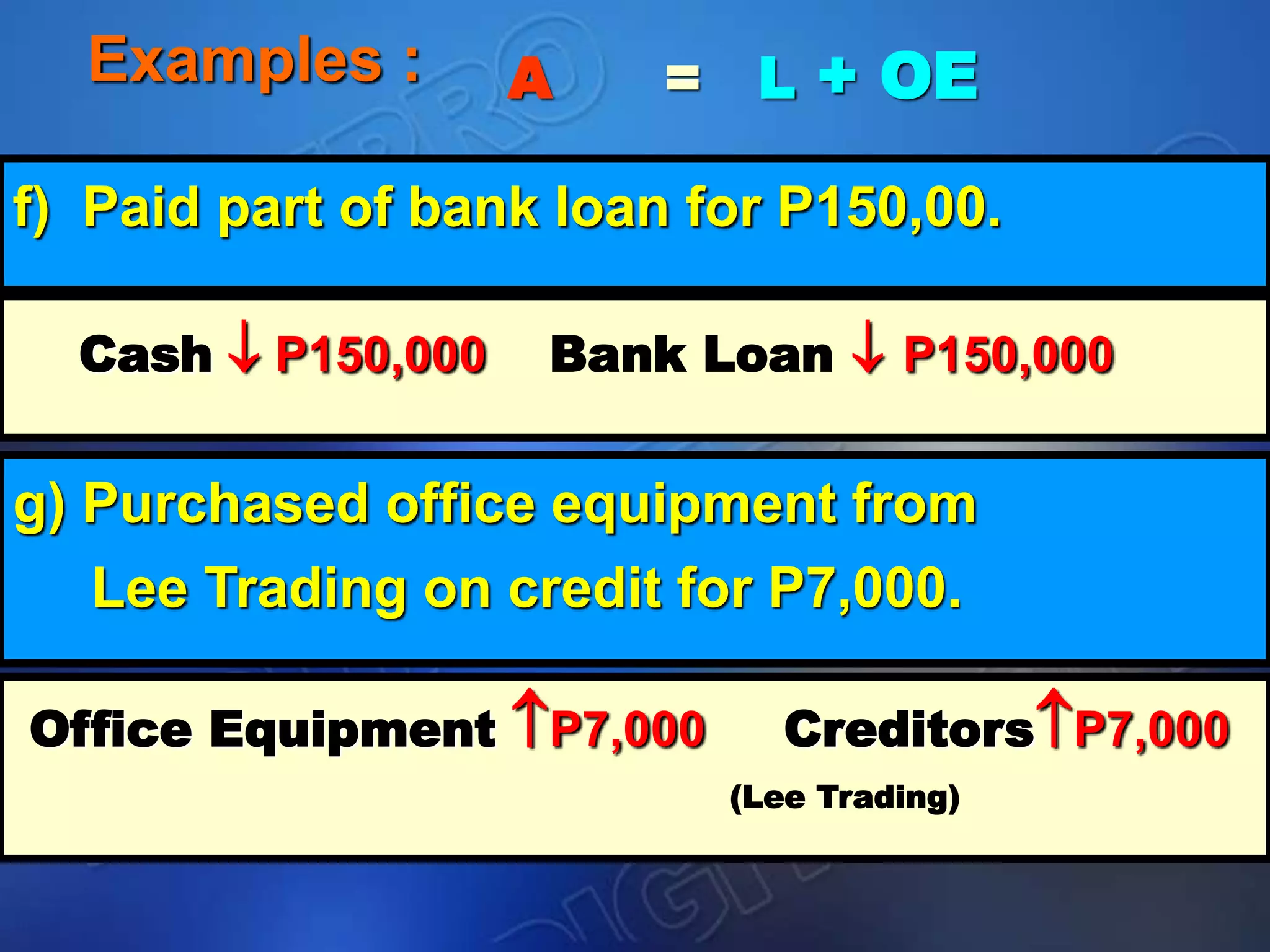

- Common accounts and how transactions affect the accounting equation.