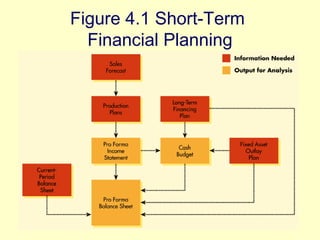

This chapter discusses financial planning and forecasting. It covers developing long-term and short-term financial plans, including preparing pro forma income statements, balance sheets, and cash budgets. The cash budget forecasts cash inflows and outflows to determine short-term cash needs. Pro forma statements are used to evaluate future financial performance and determine external financing requirements. Different approaches for preparing these statements are described, along with addressing uncertainties in forecasts.