This document outlines key concepts related to forecasting, including:

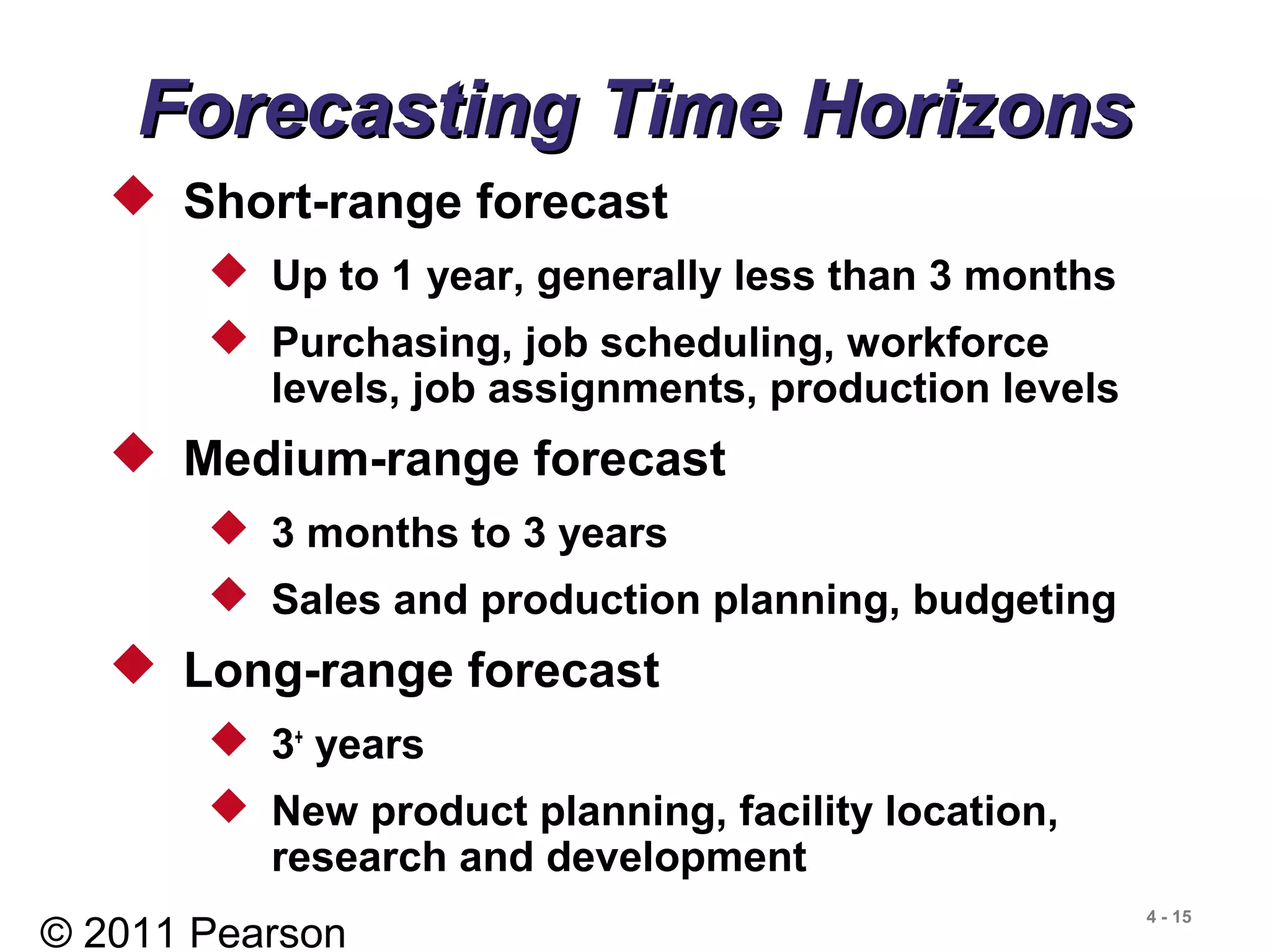

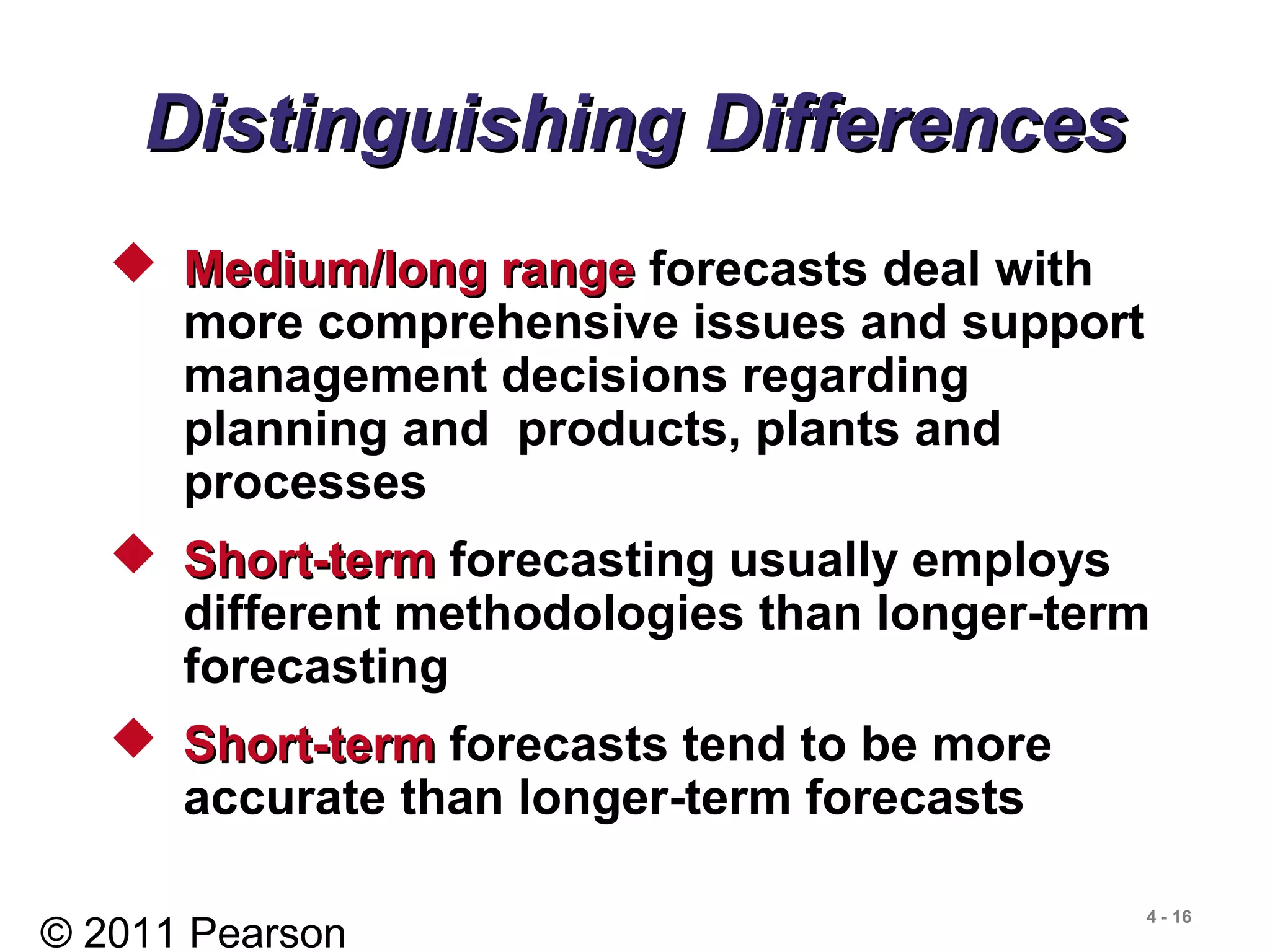

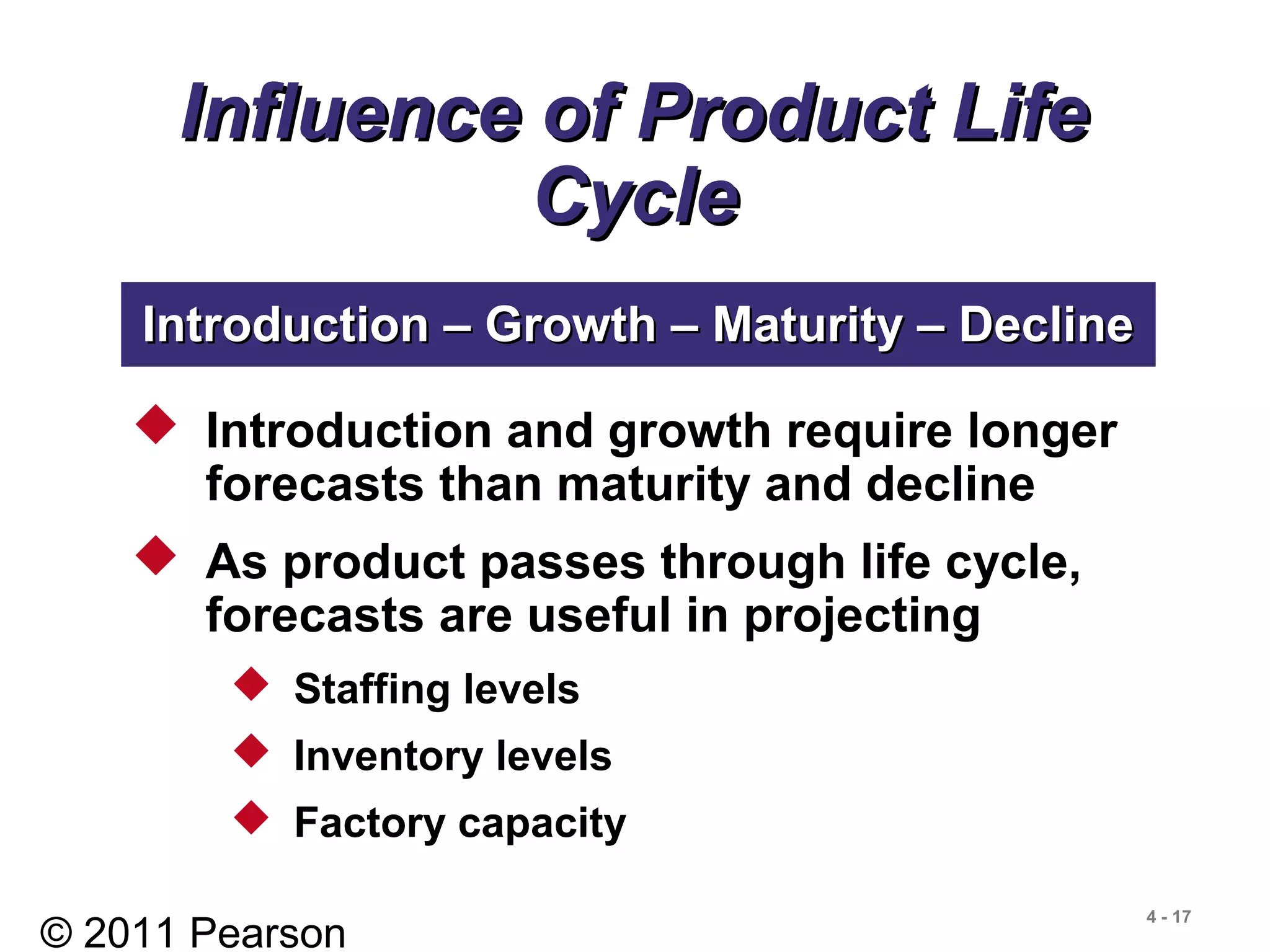

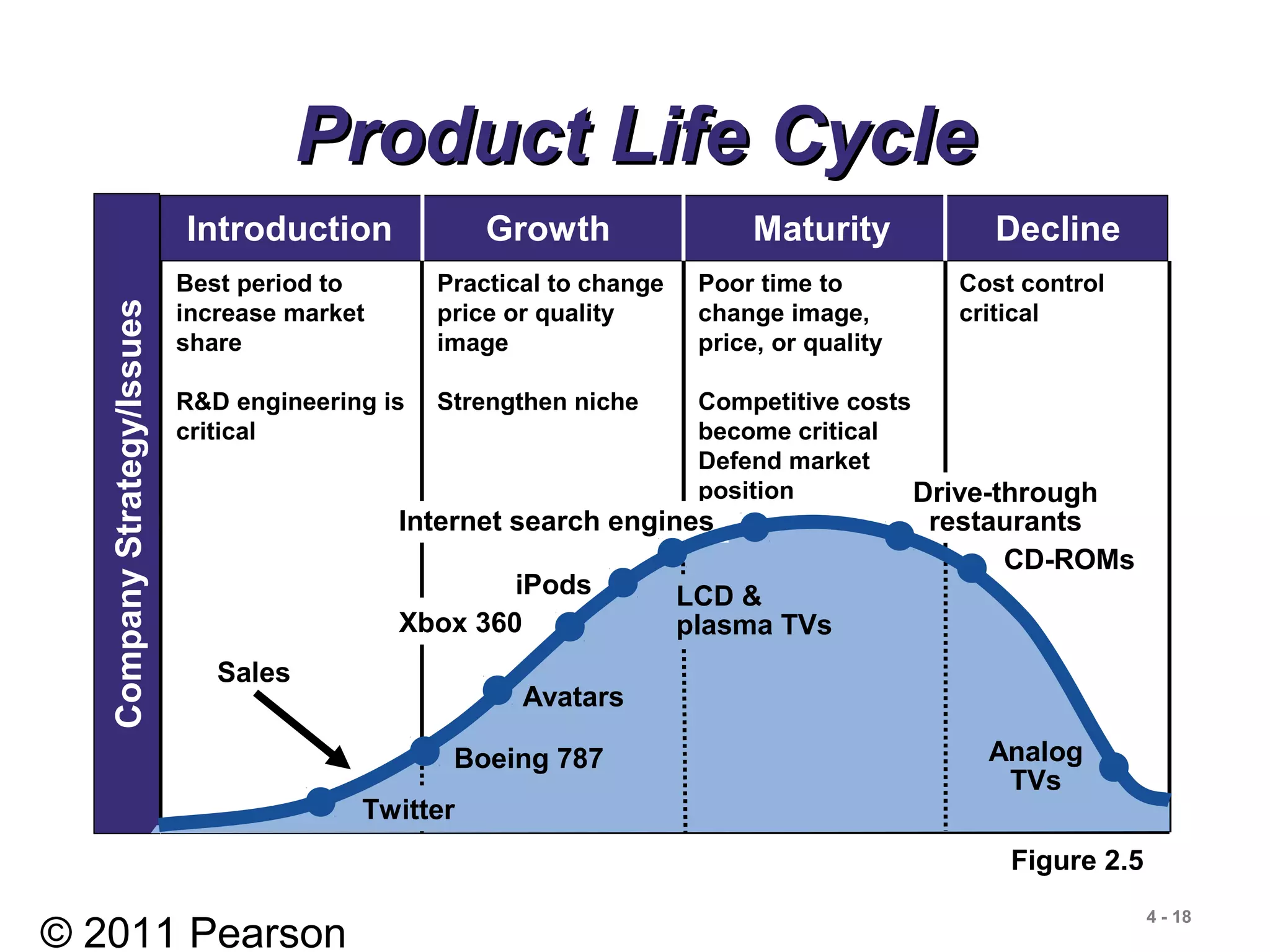

- The three time horizons for forecasting: short, medium, and long range.

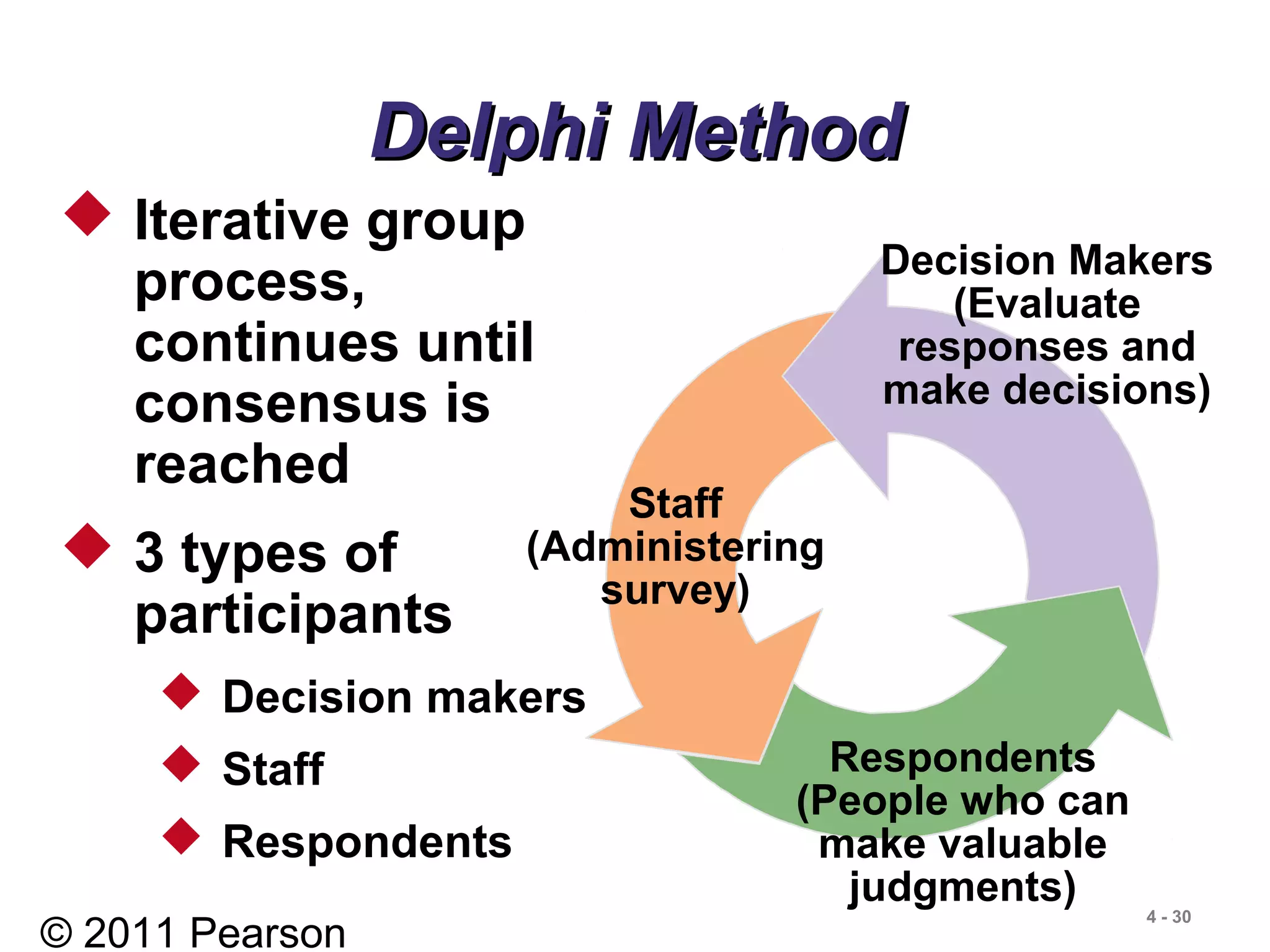

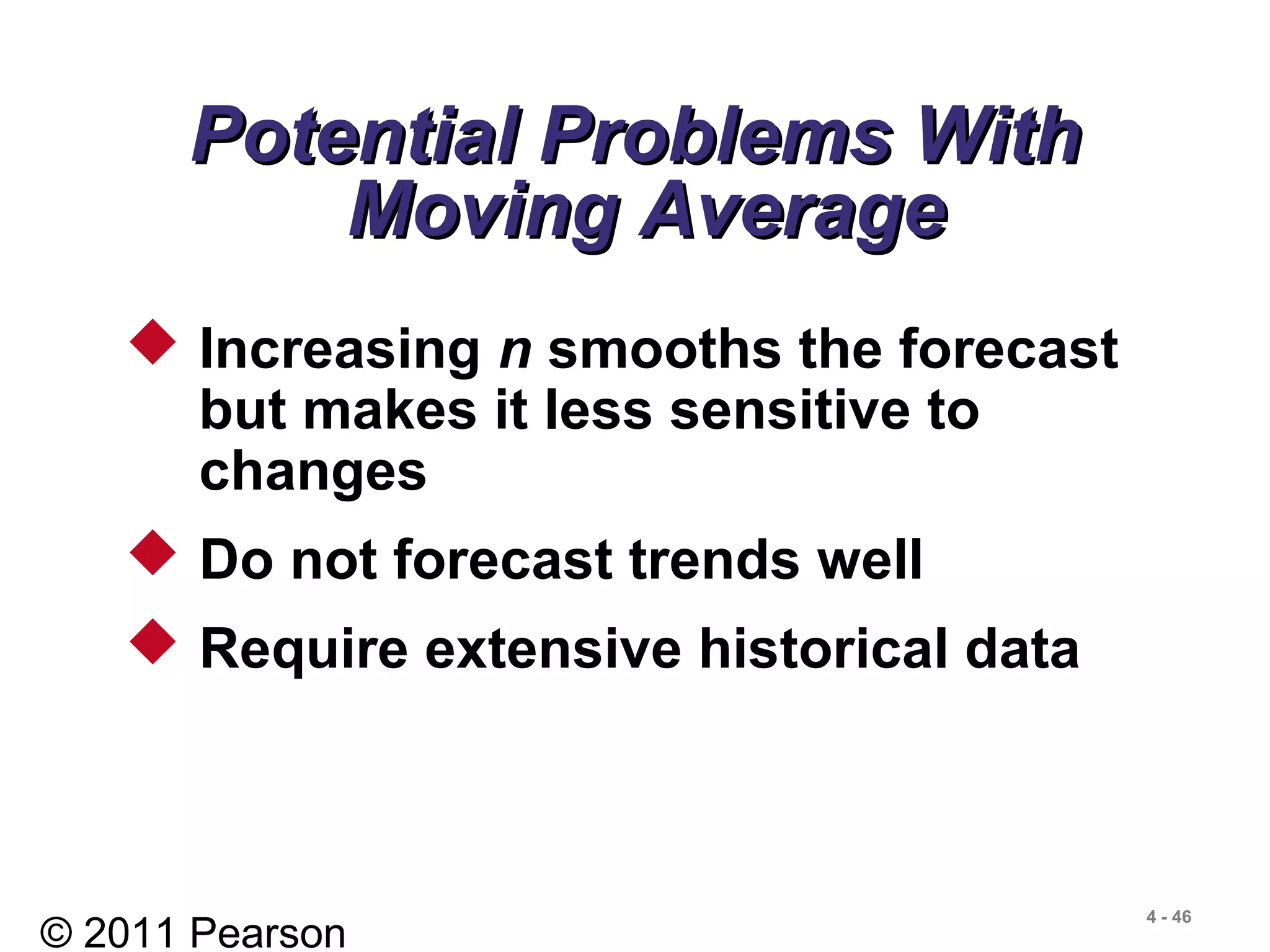

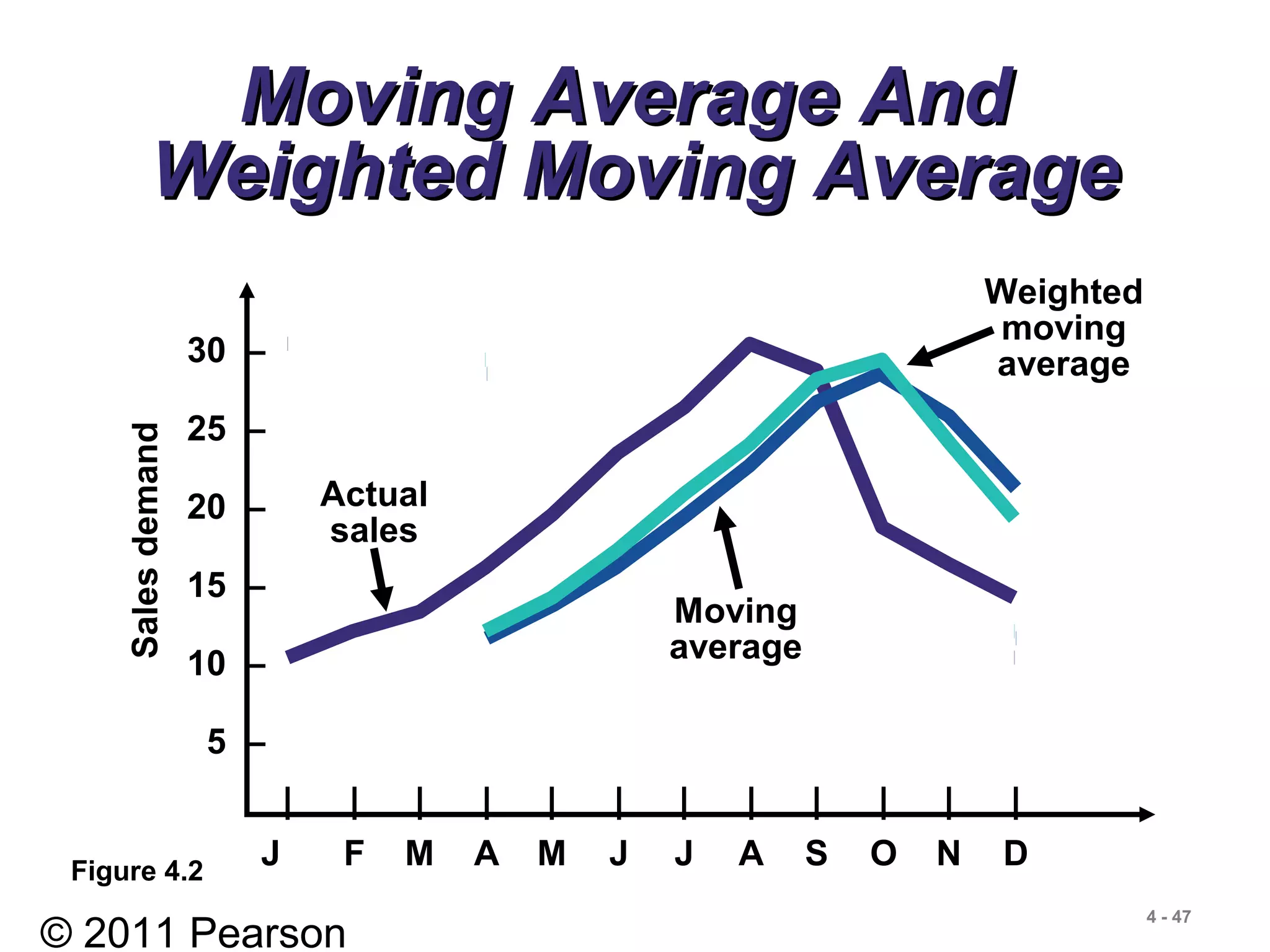

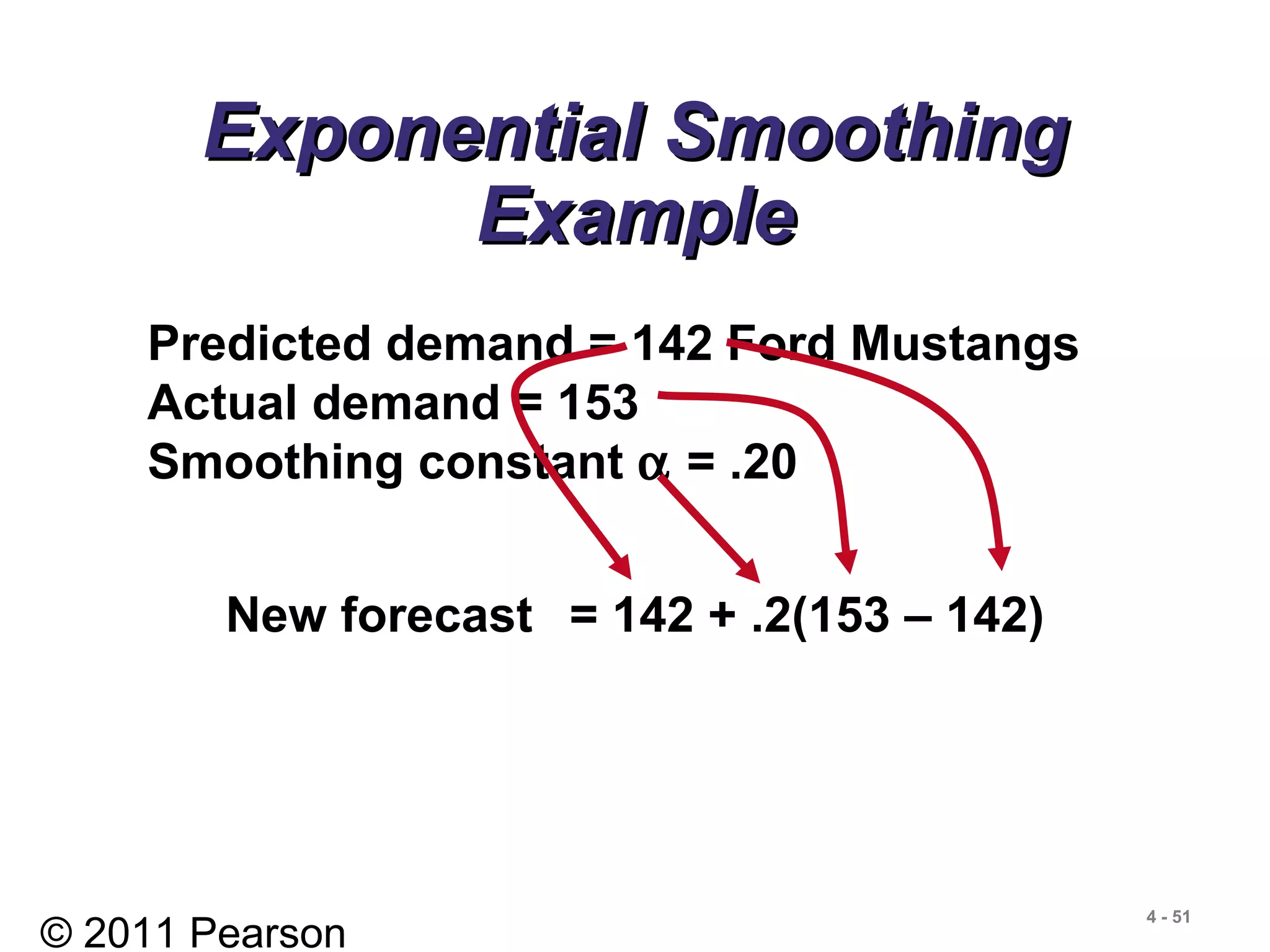

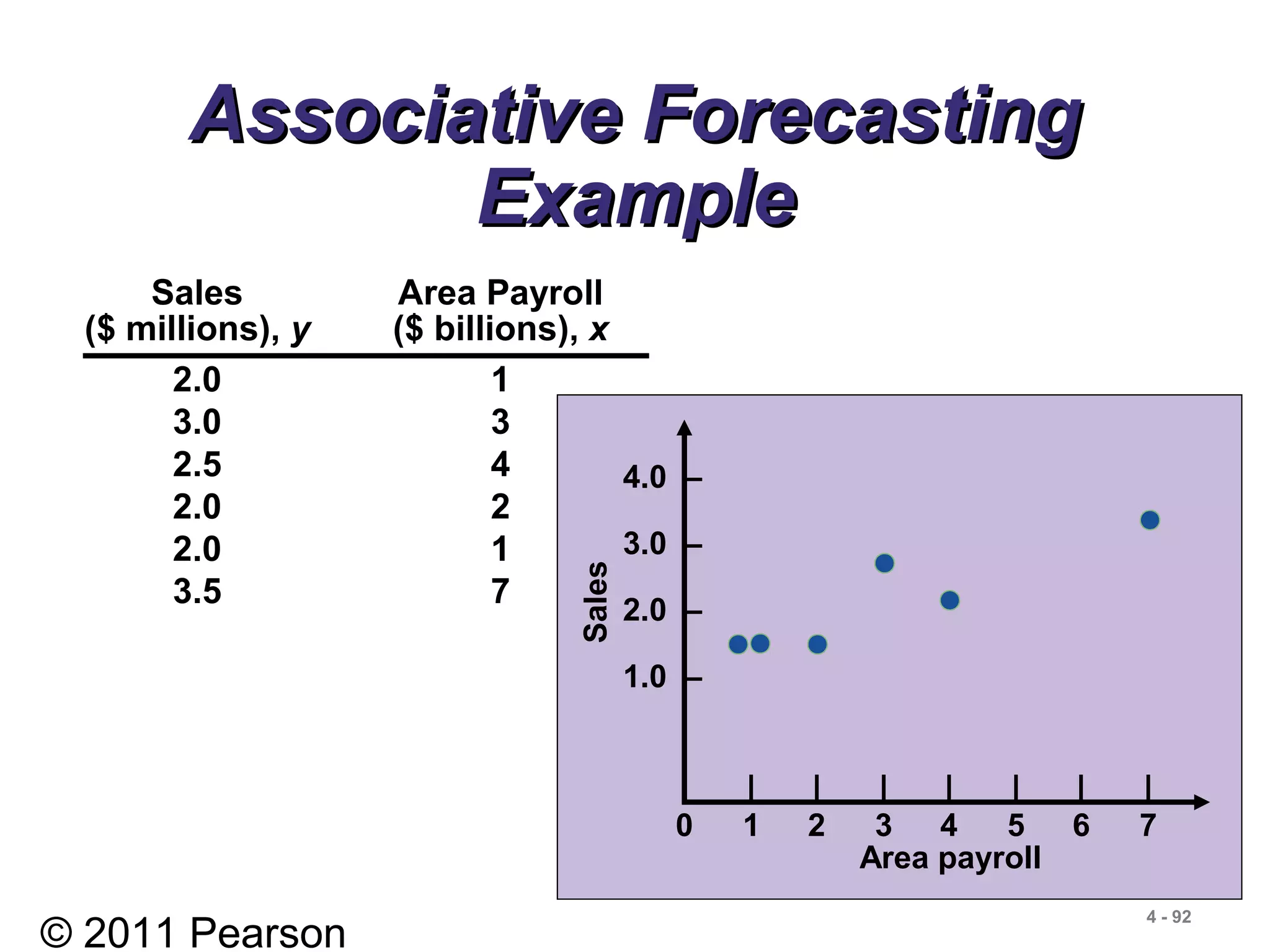

- Qualitative and quantitative forecasting methods such as jury of executive opinion, Delphi method, moving averages, and exponential smoothing.

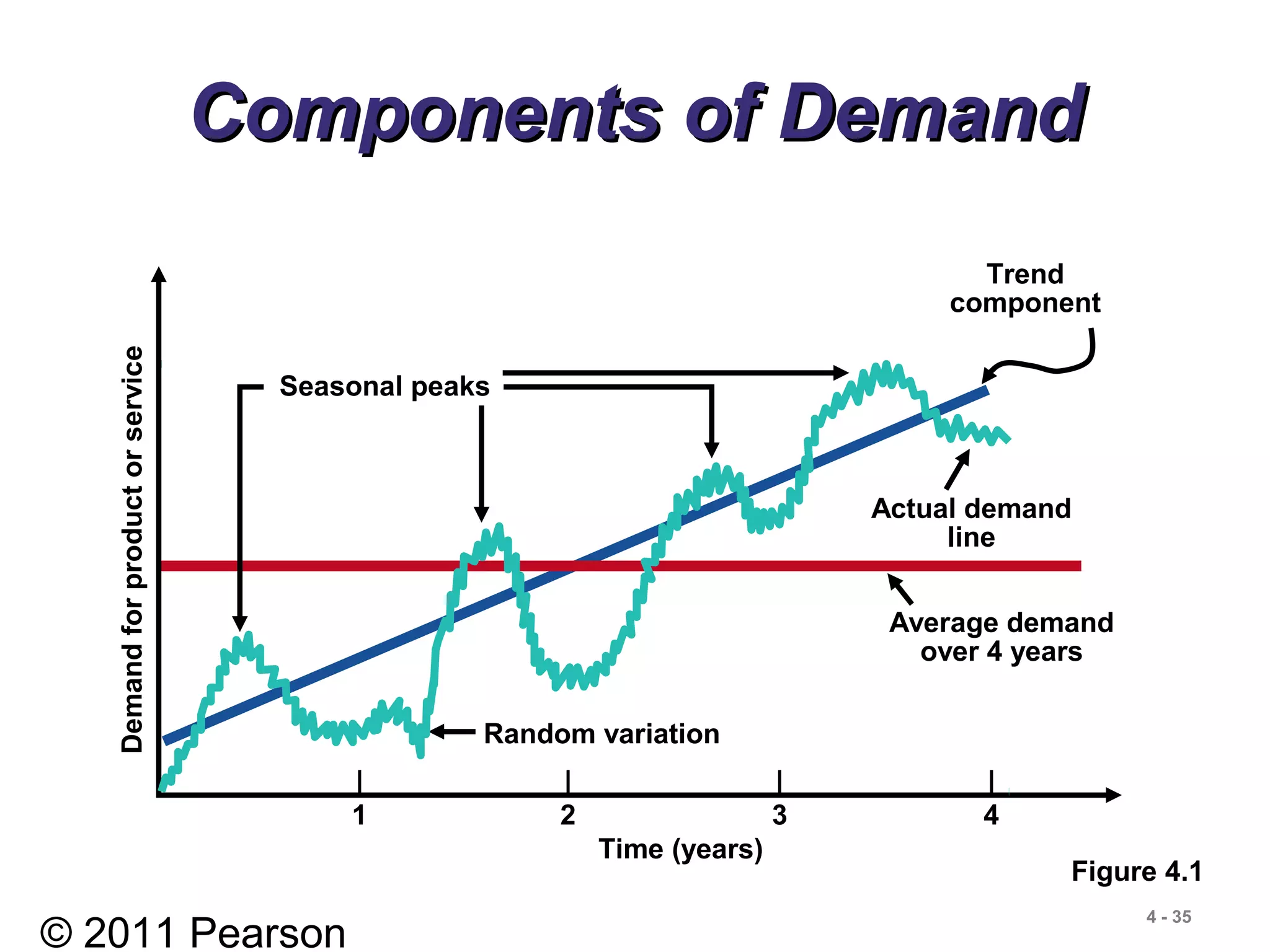

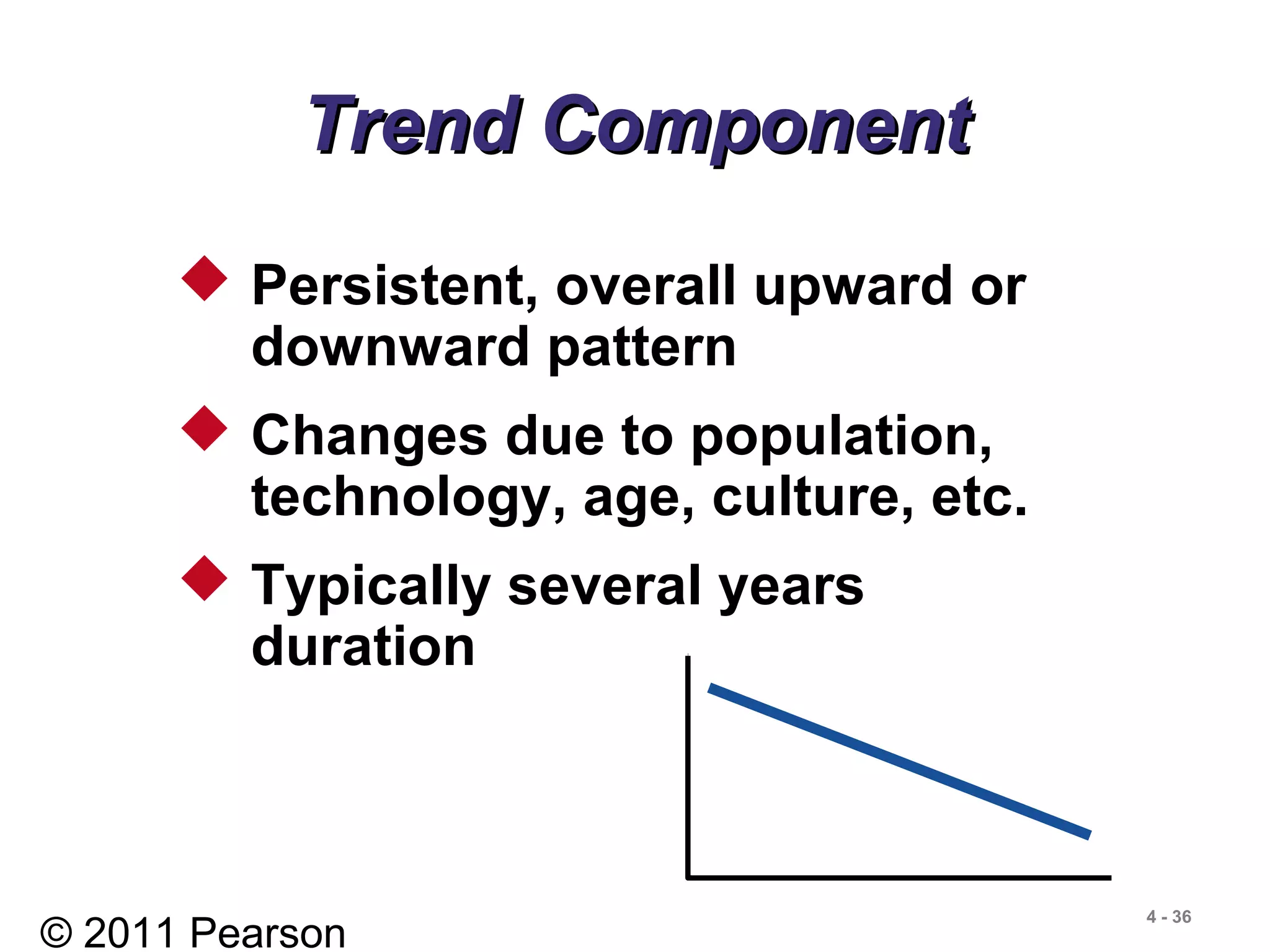

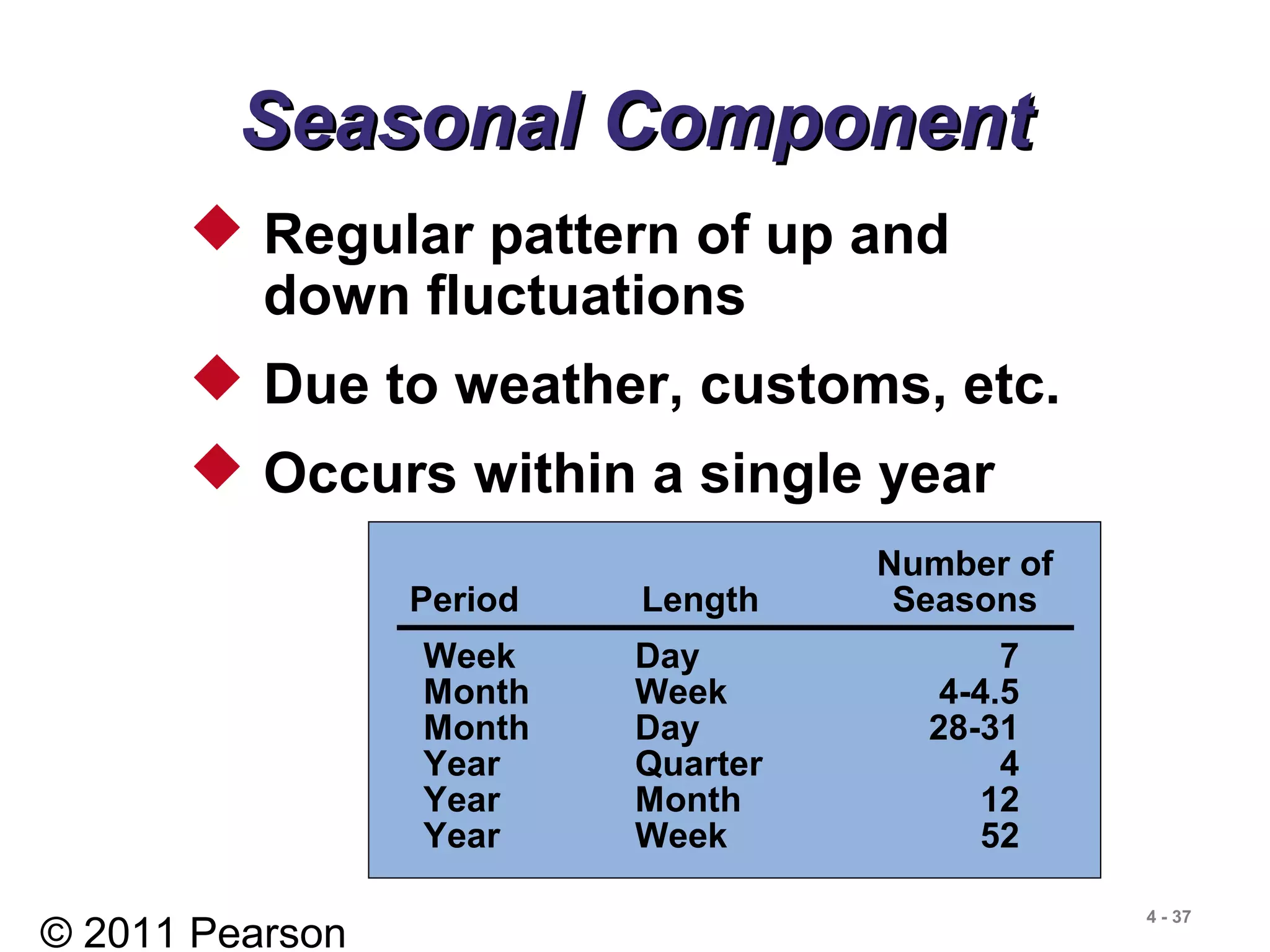

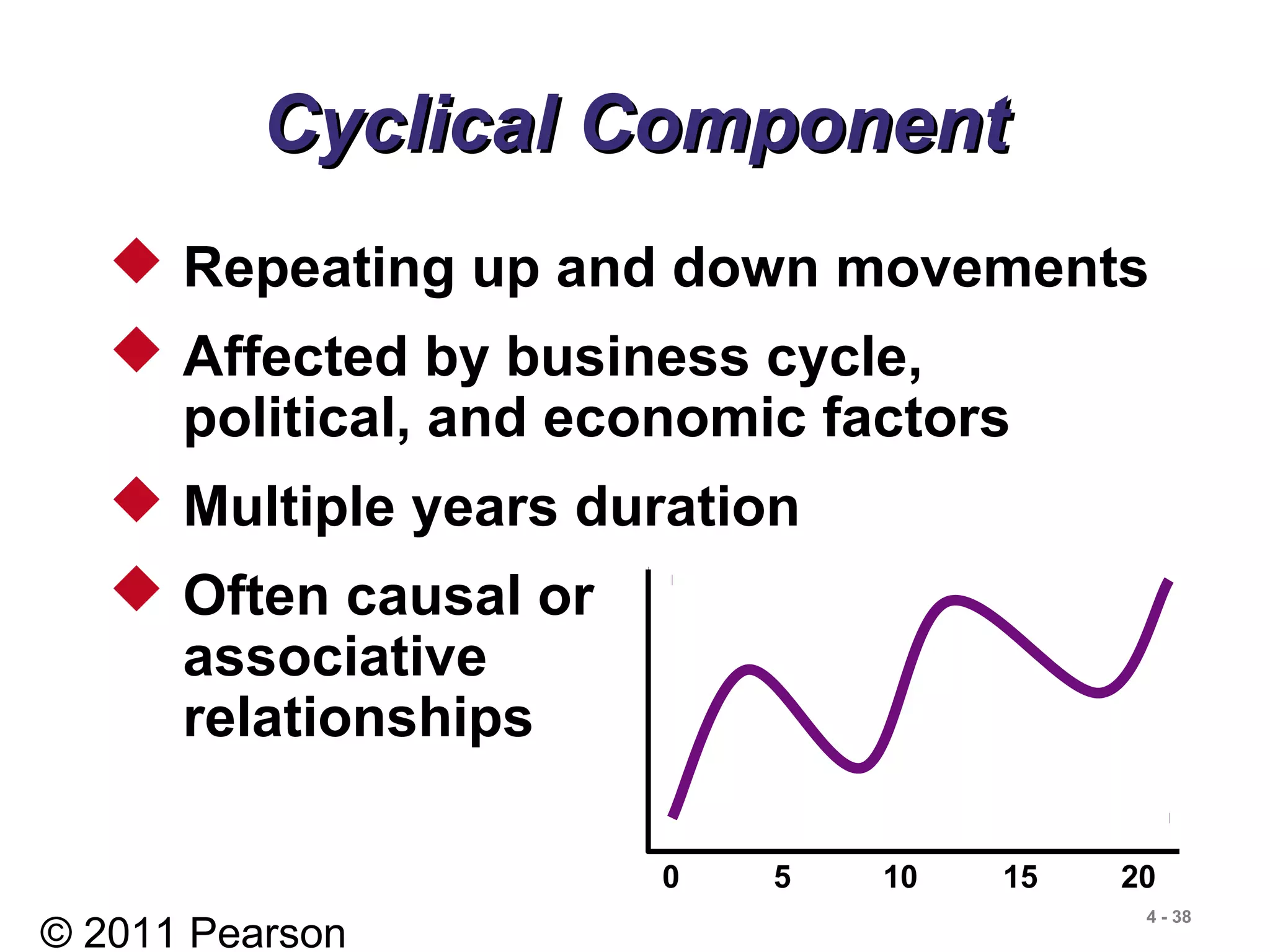

- Components of time series data including trend, seasonality, cyclicality, and randomness.

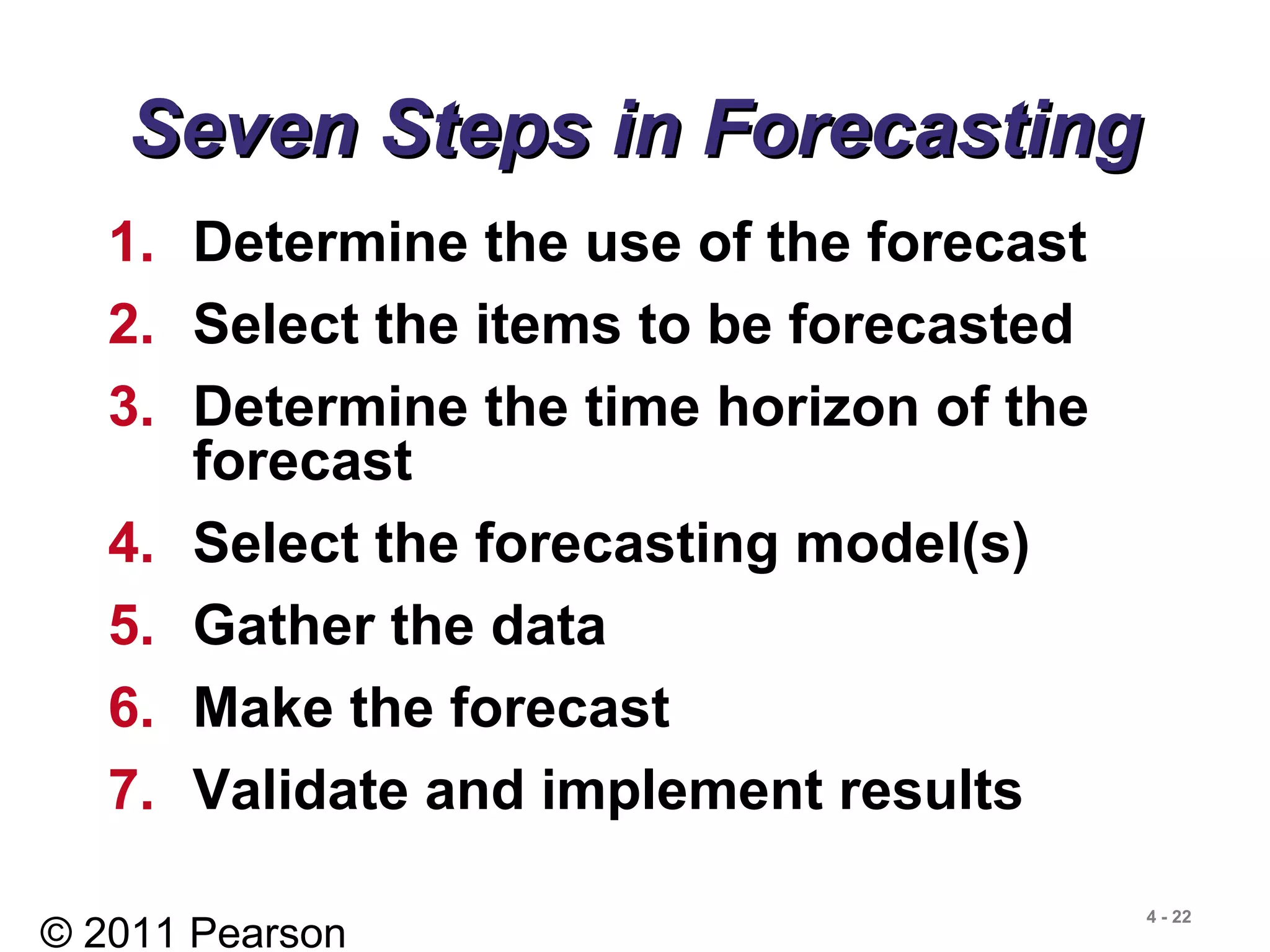

- Steps in a forecasting system and challenges with producing accurate forecasts.

- How Disney uses forecasting across its global operations to inform decisions.

![© 2011 Pearson

4 - 45

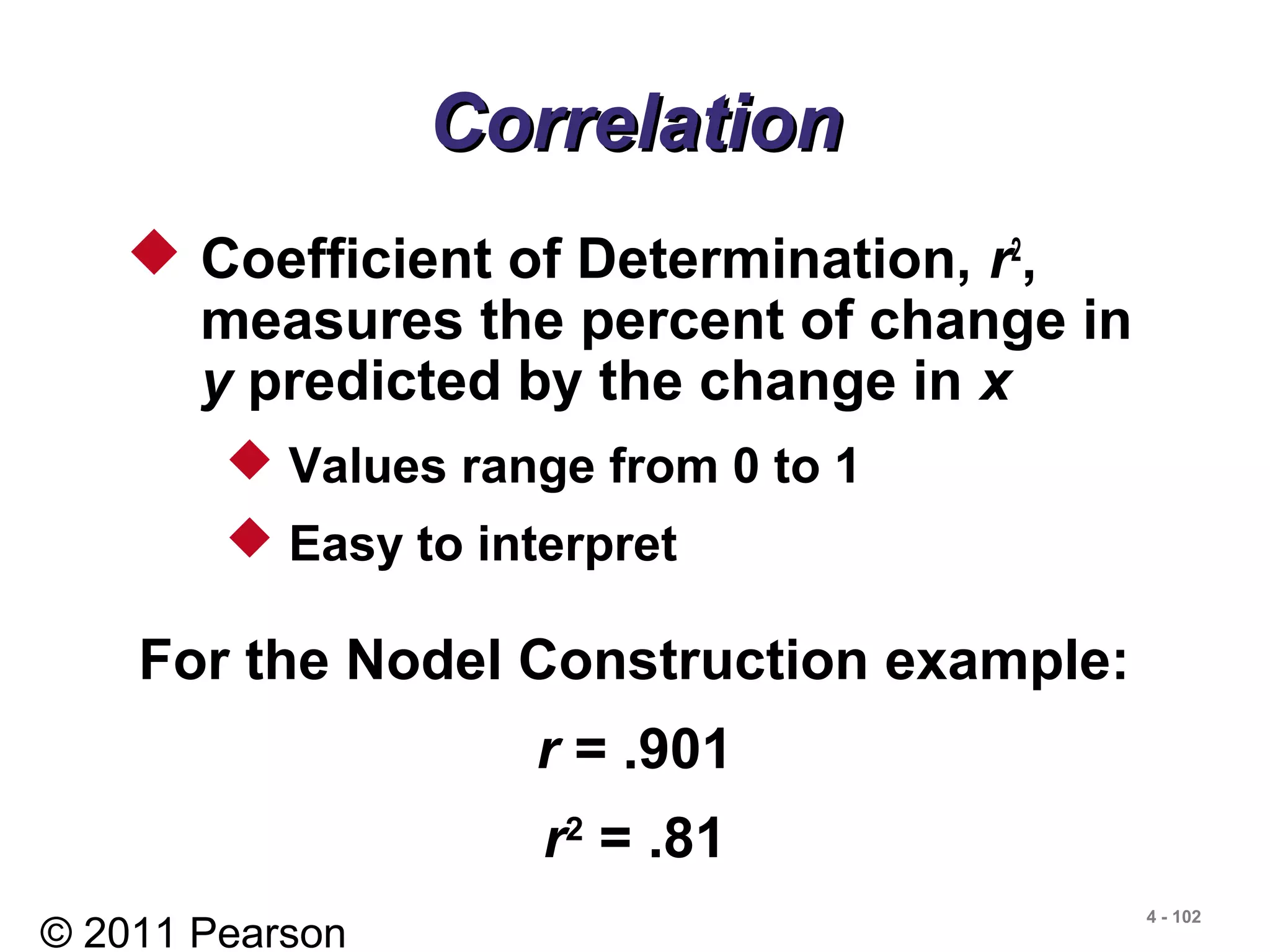

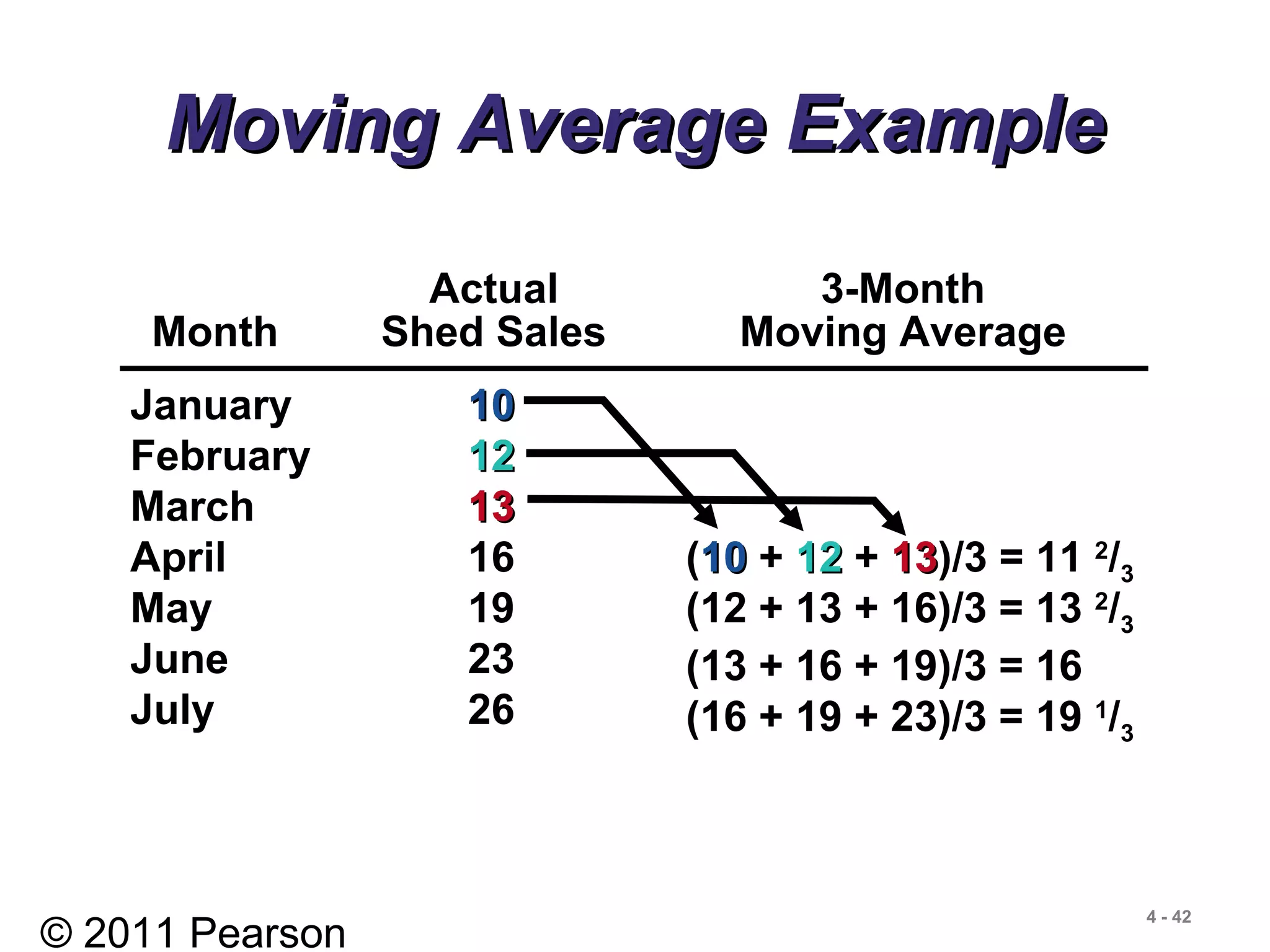

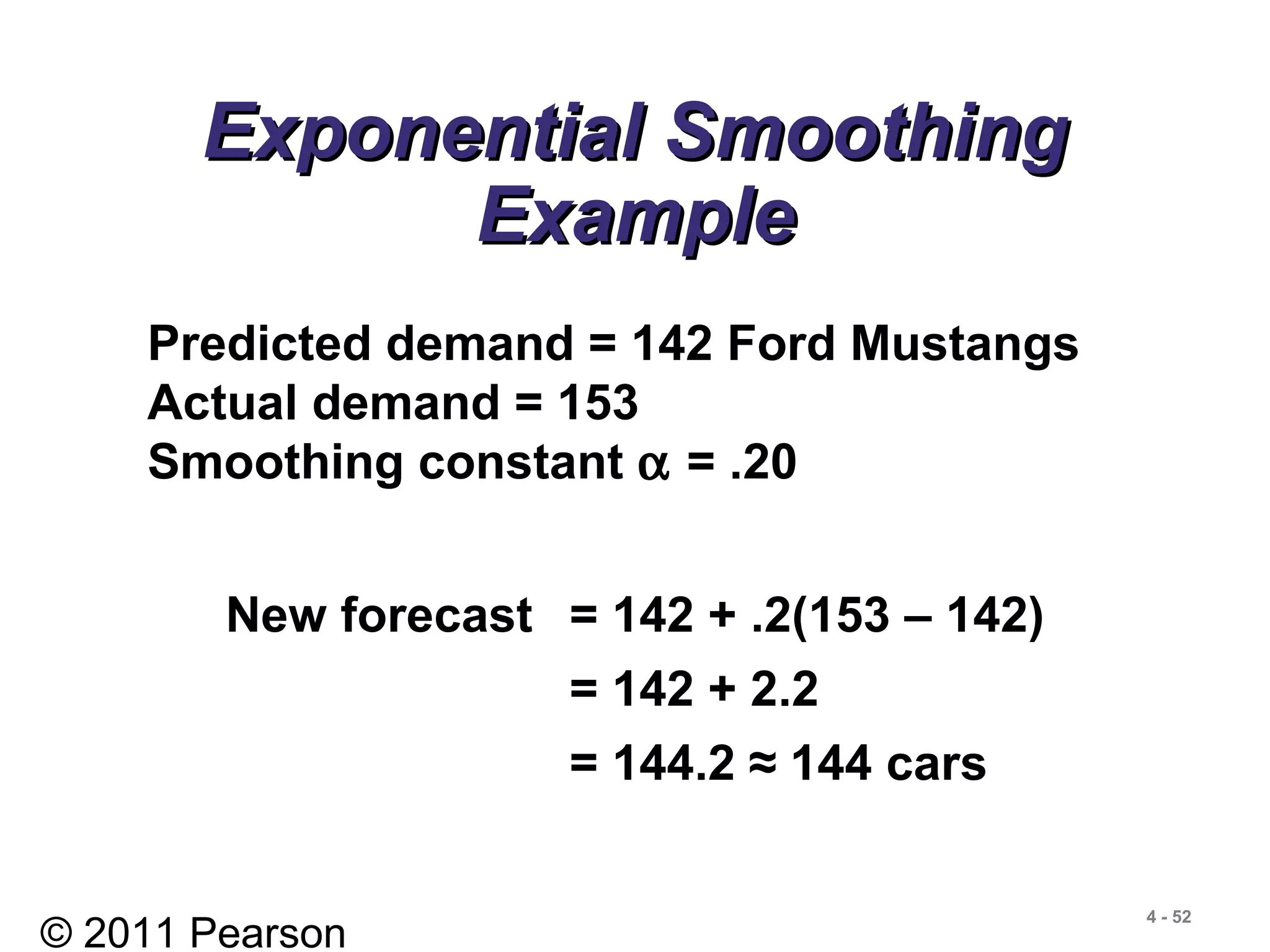

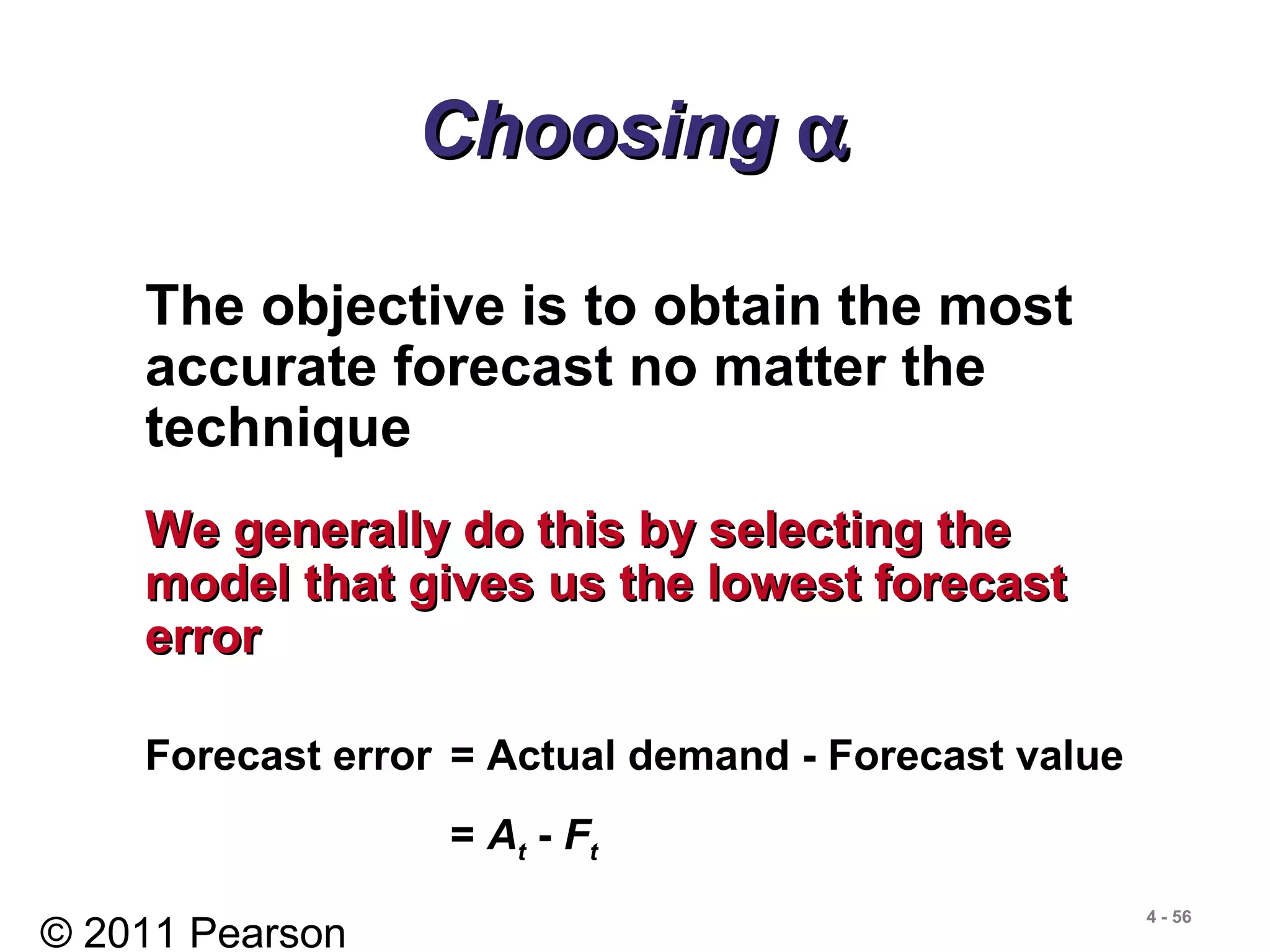

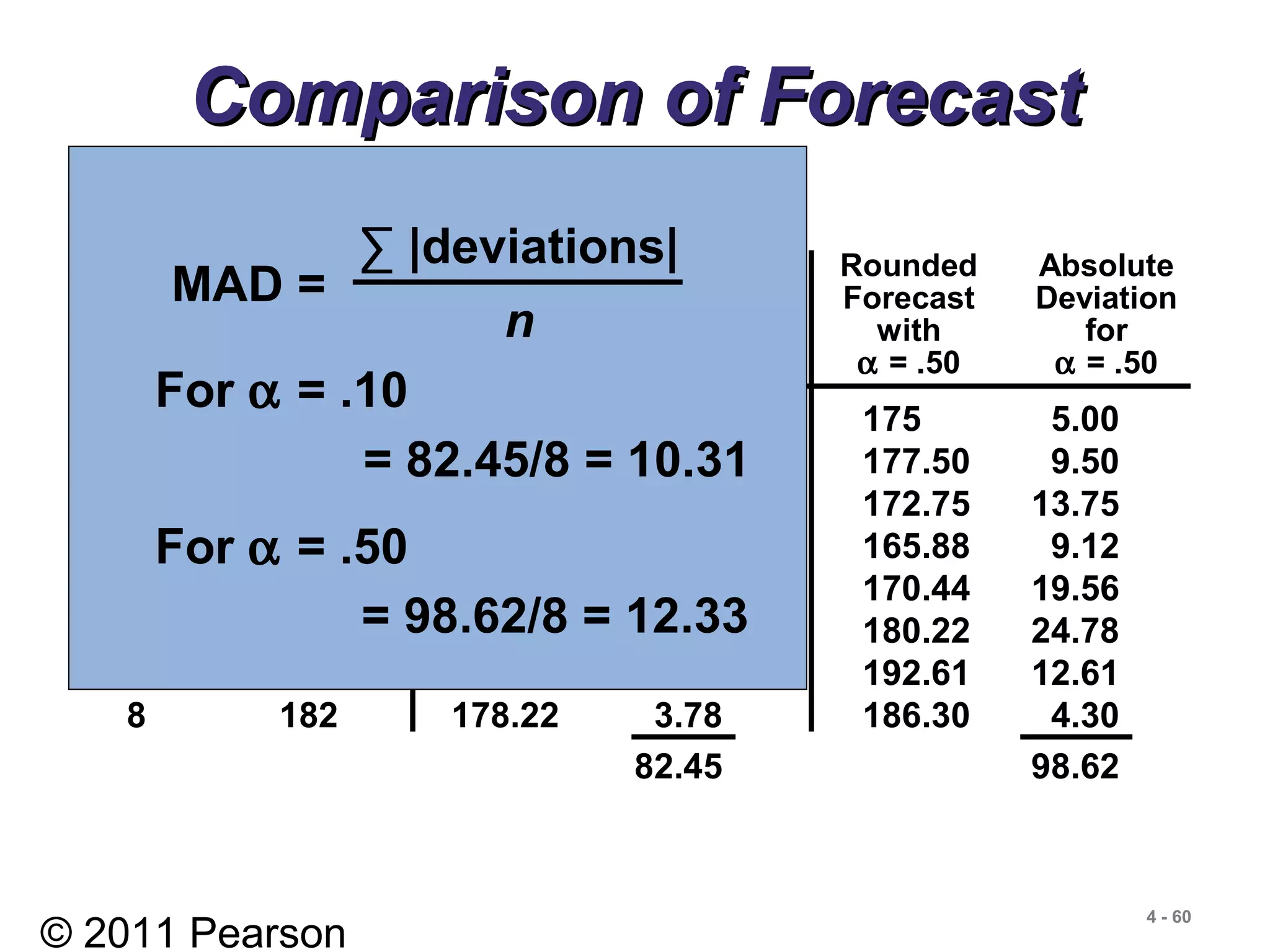

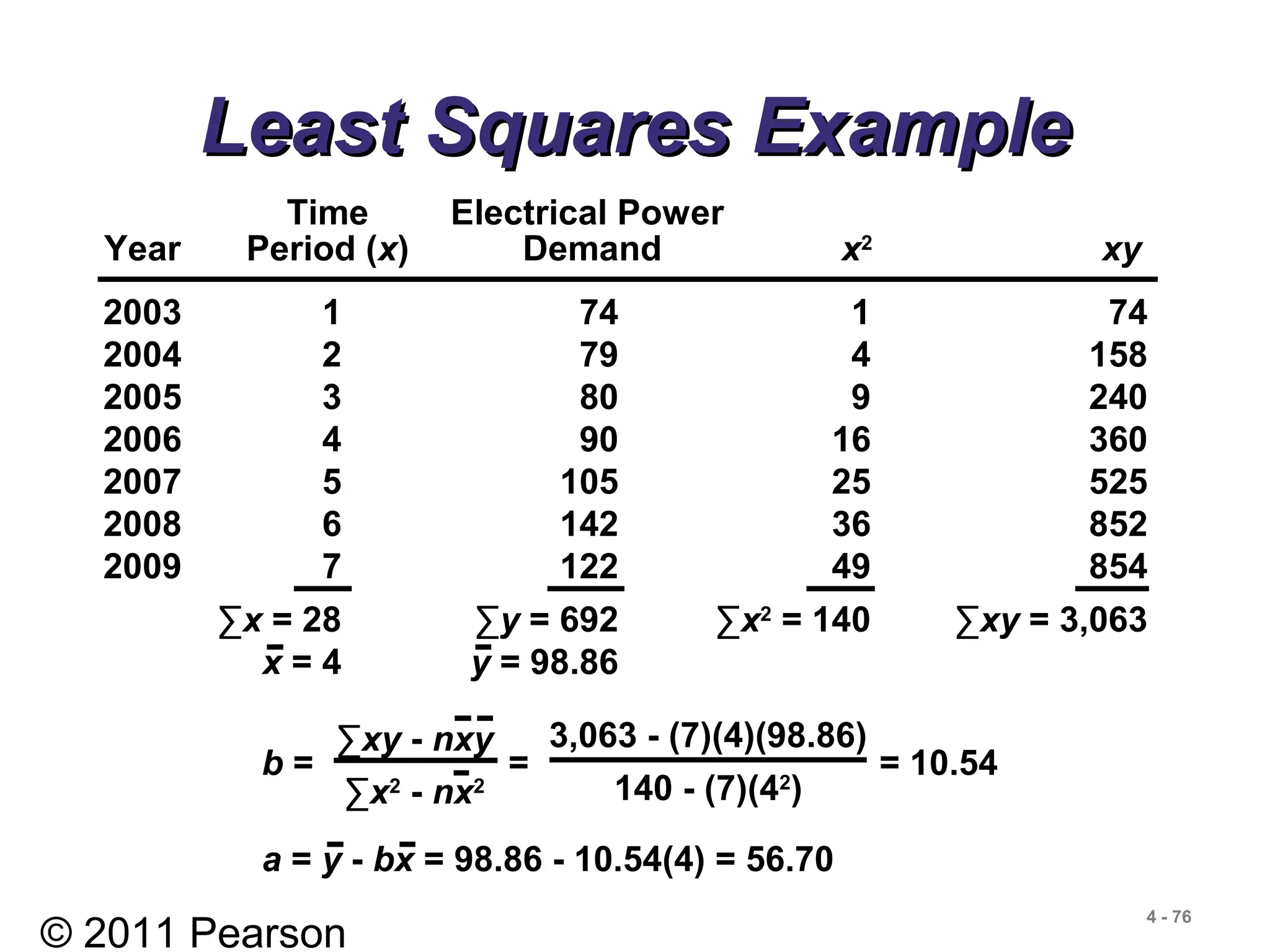

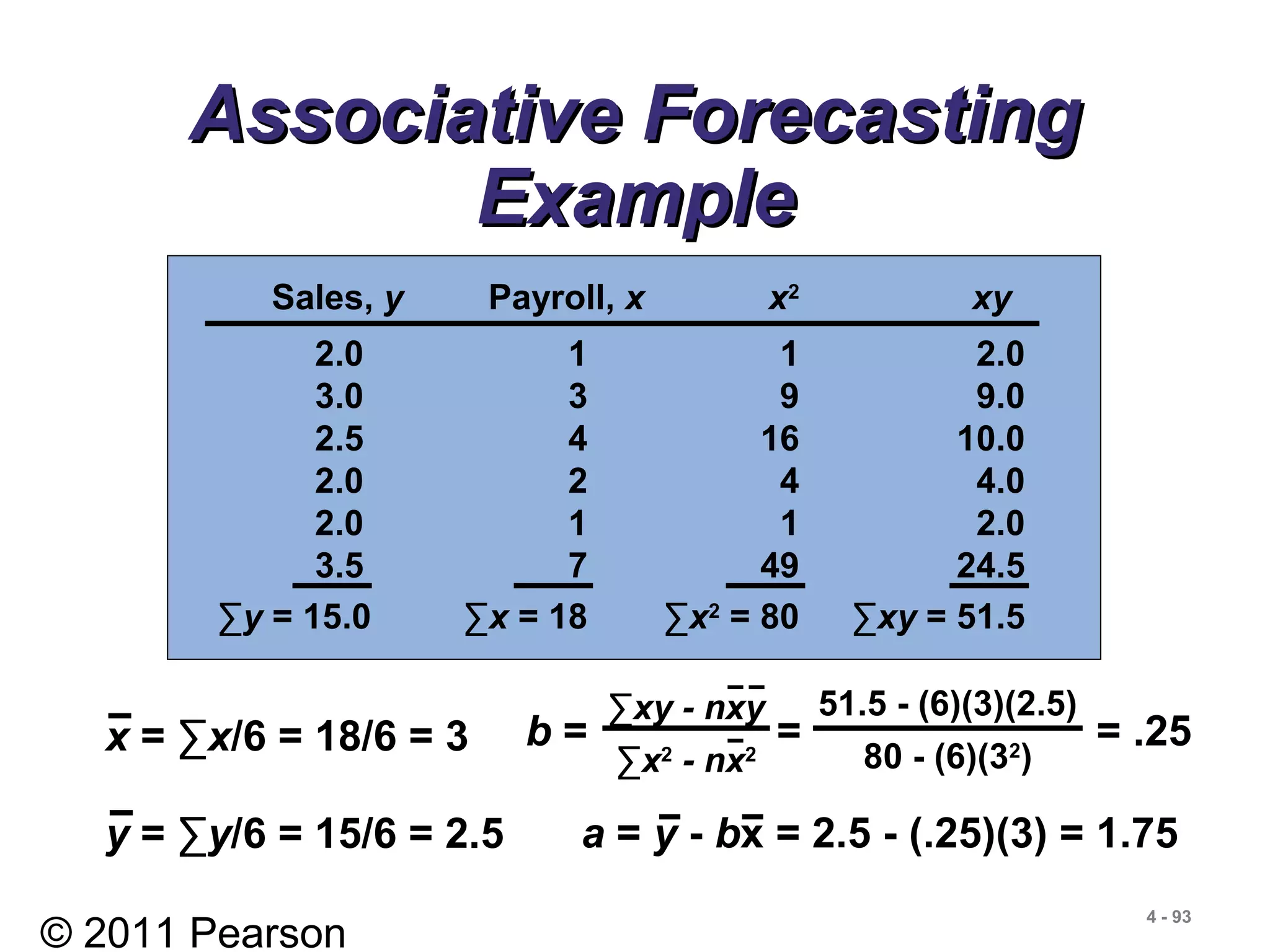

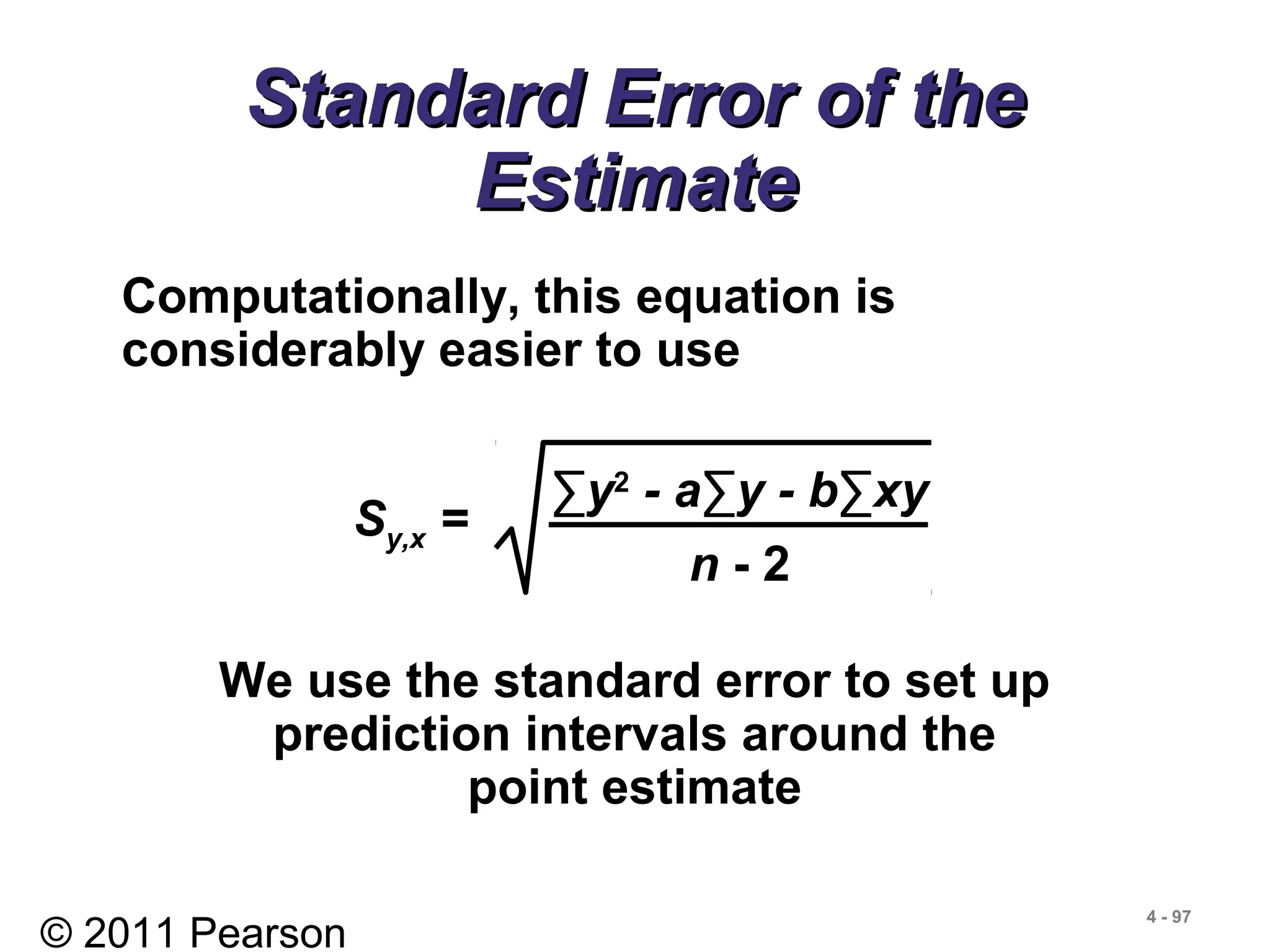

January 10

February 12

March 13

April 16

May 19

June 23

July 26

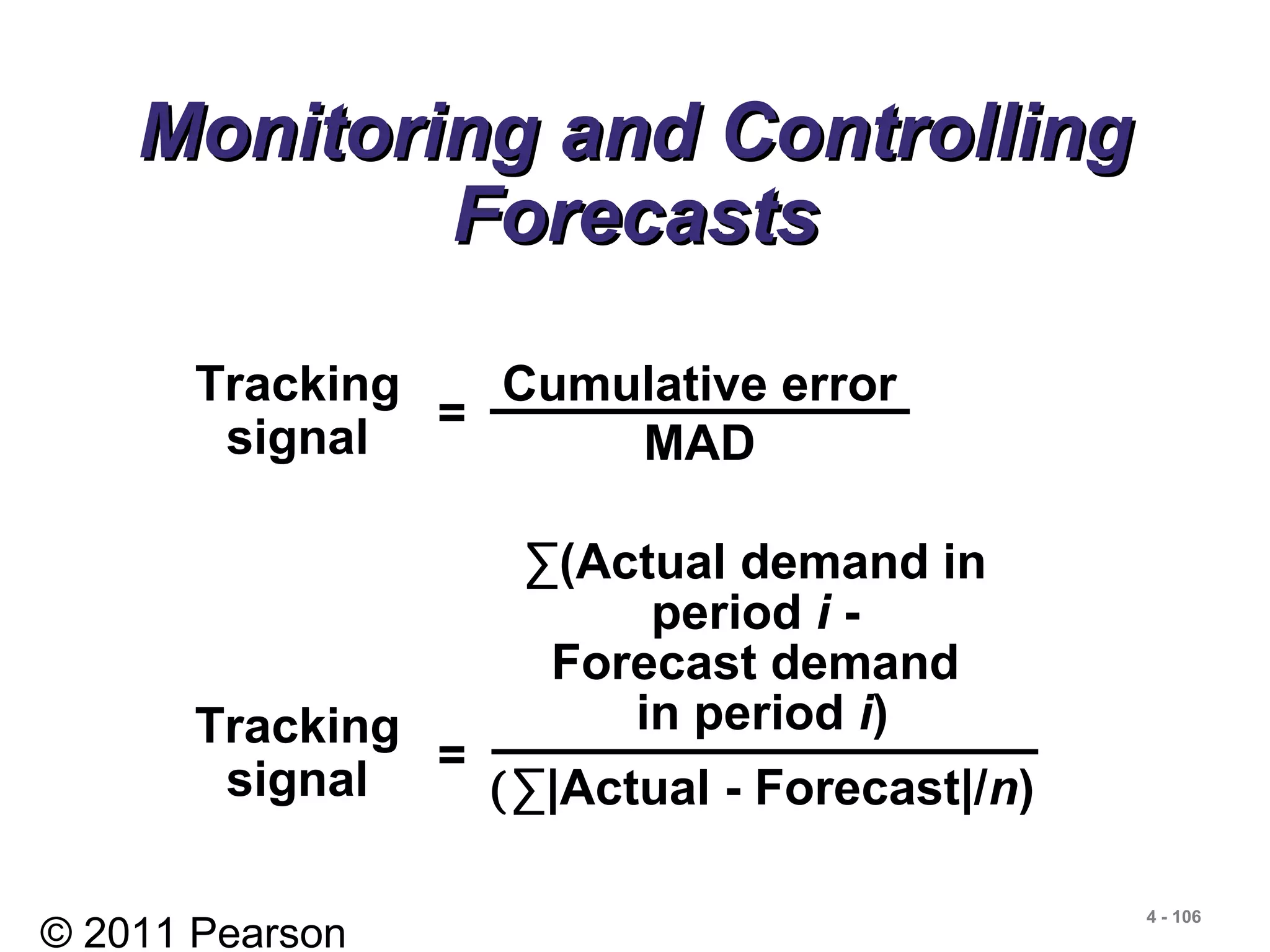

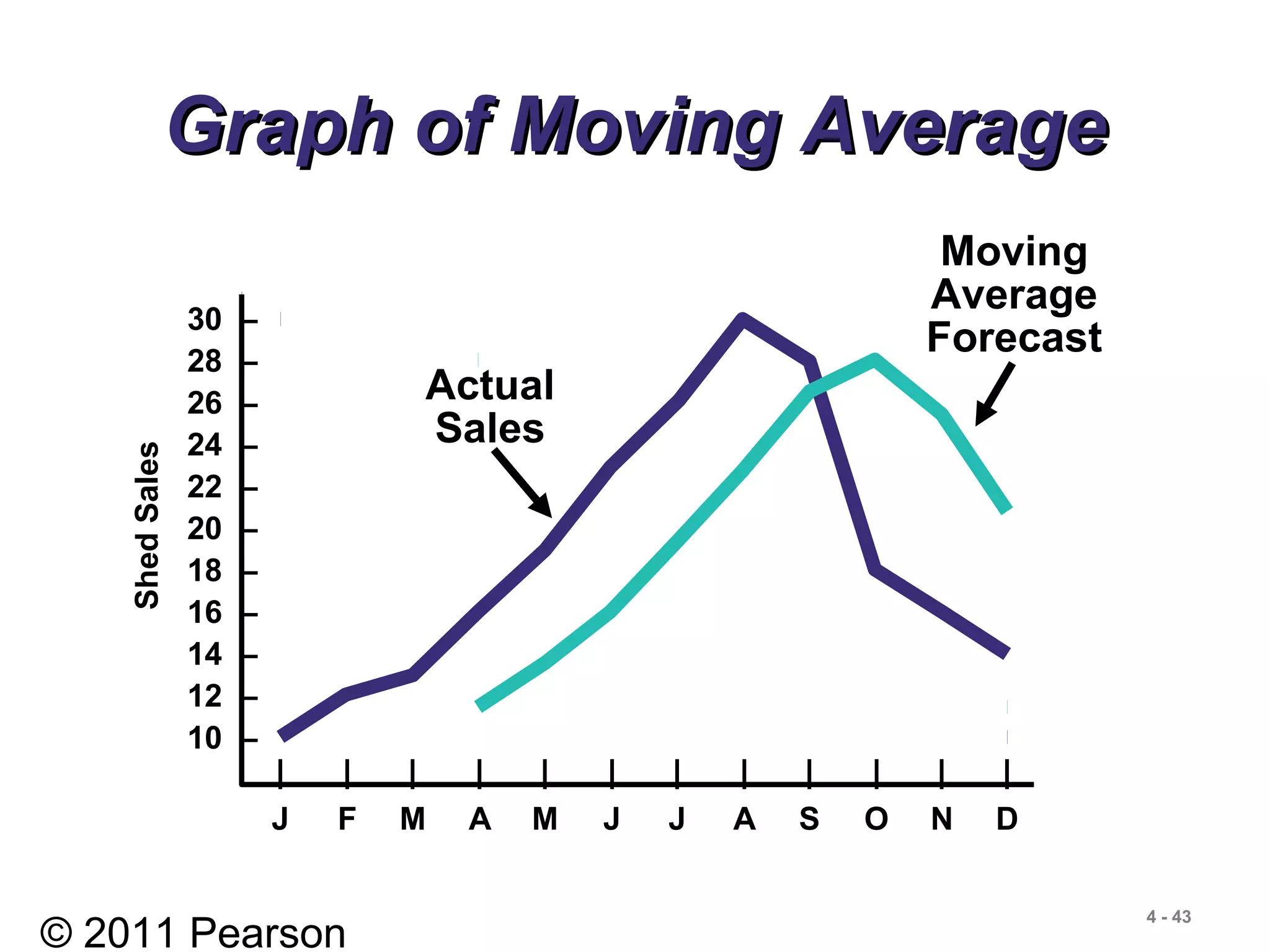

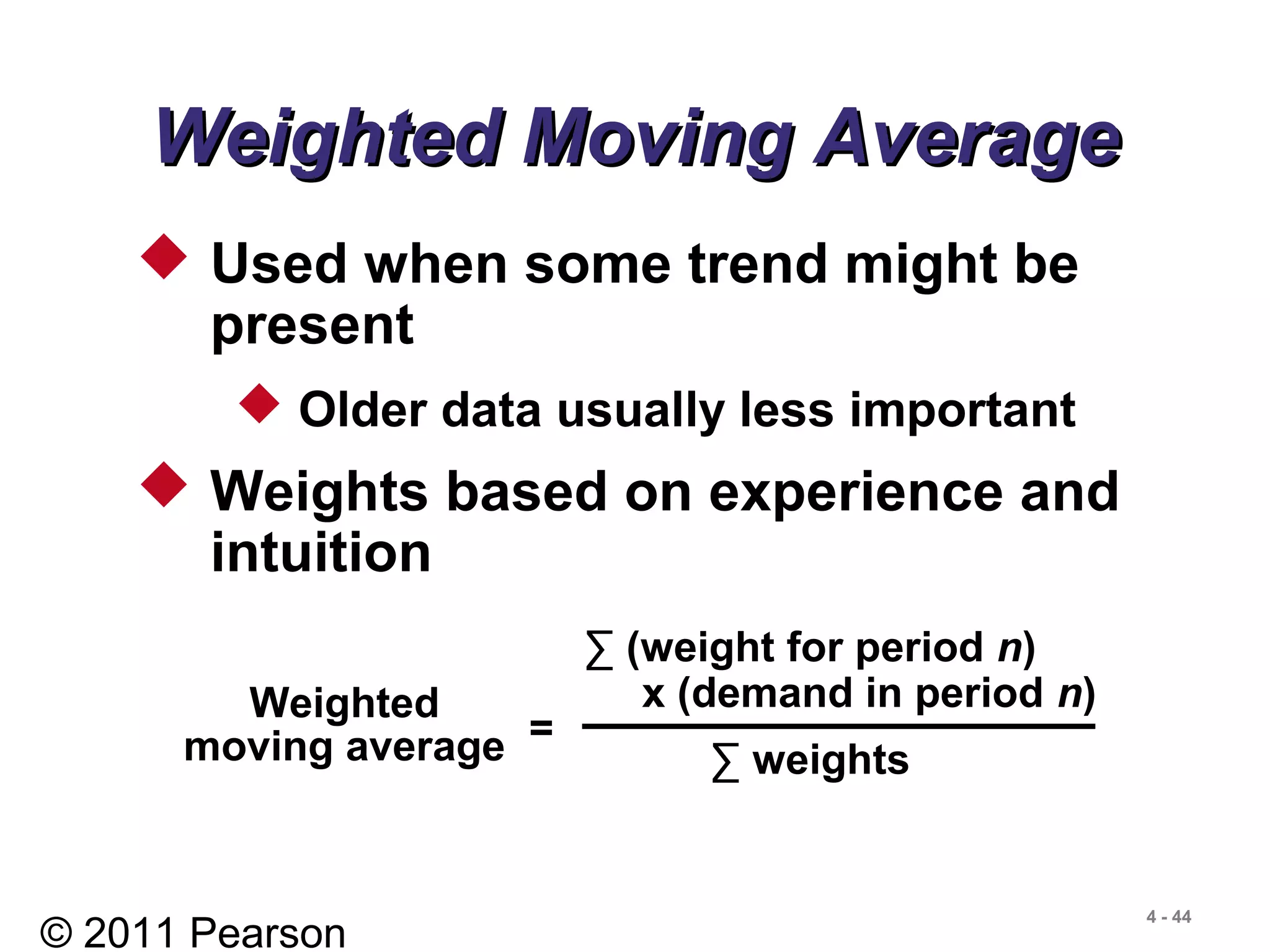

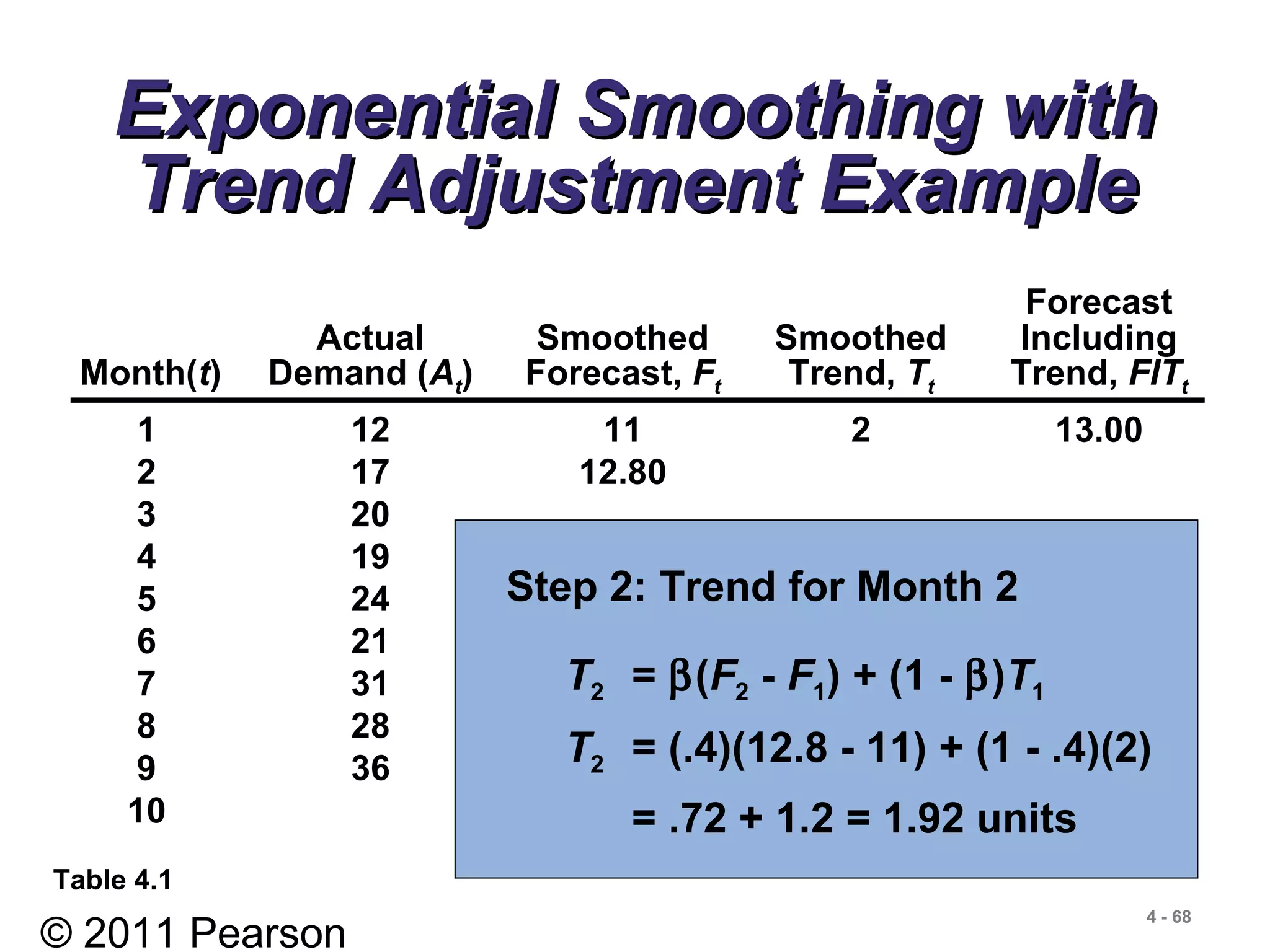

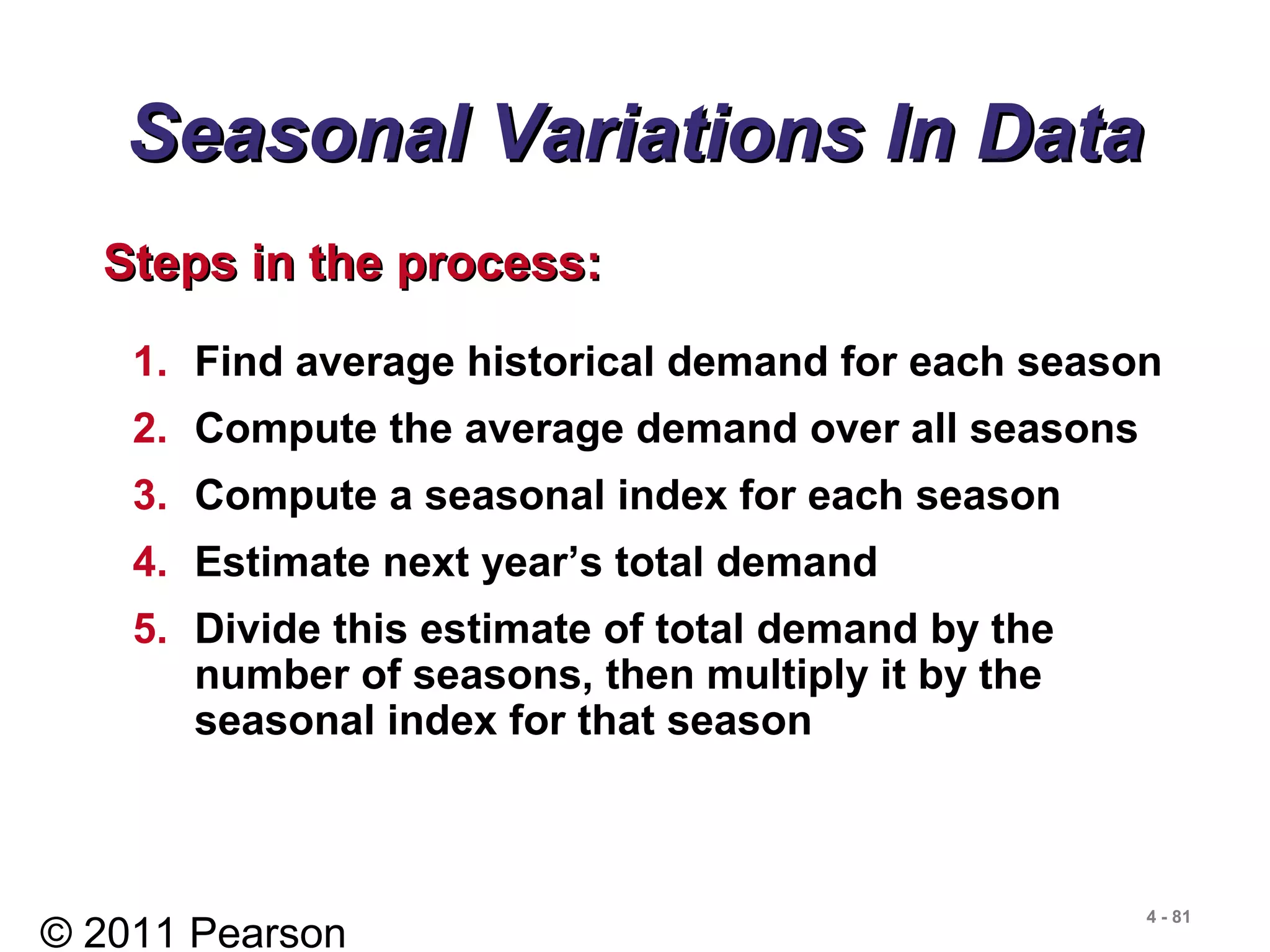

Actual 3-Month Weighted

Month Shed Sales Moving Average

[(3 x 16) + (2 x 13) + (12)]/6 = 141

/3

[(3 x 19) + (2 x 16) + (13)]/6 = 17

[(3 x 23) + (2 x 19) + (16)]/6 = 201

/2

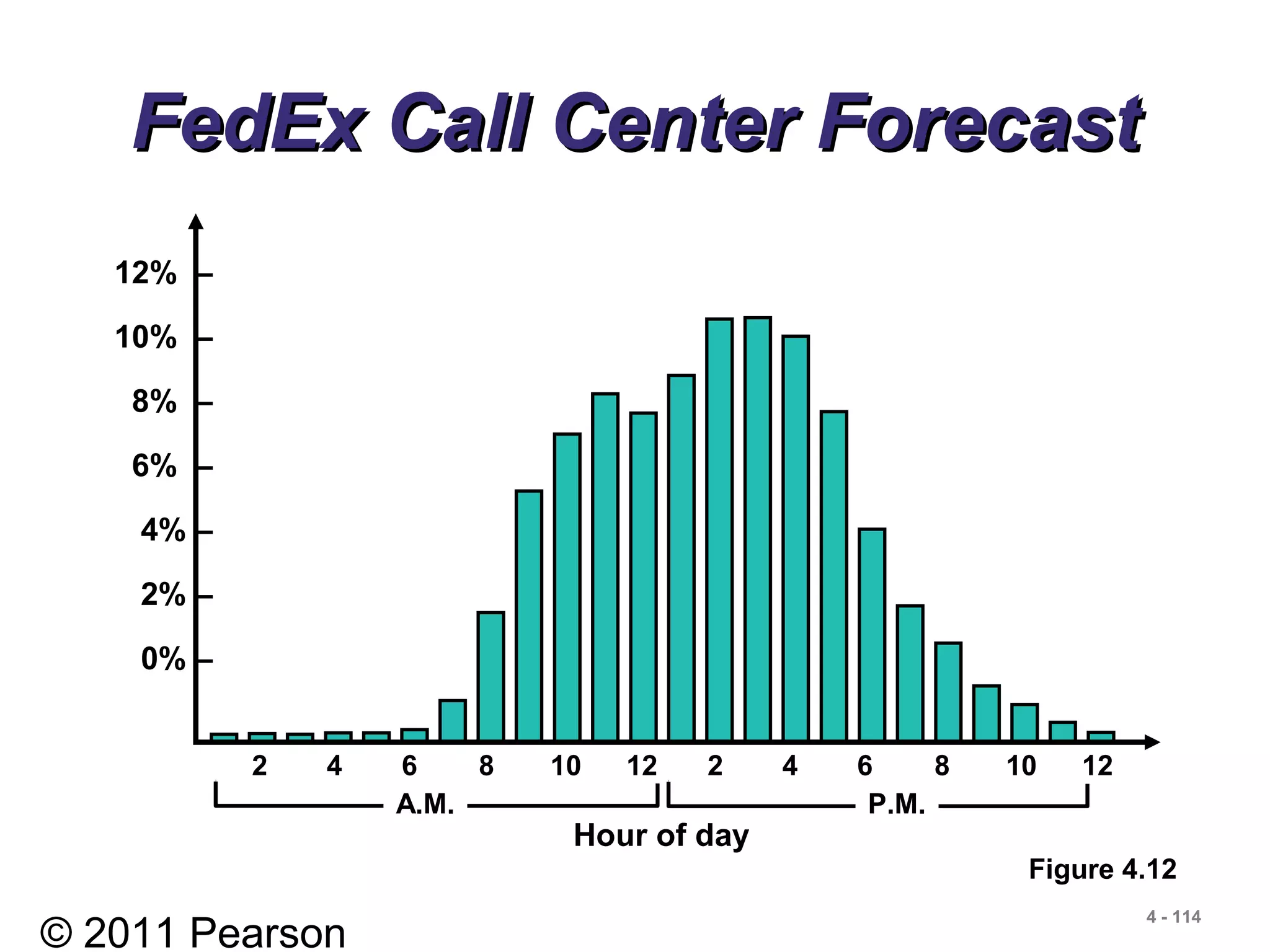

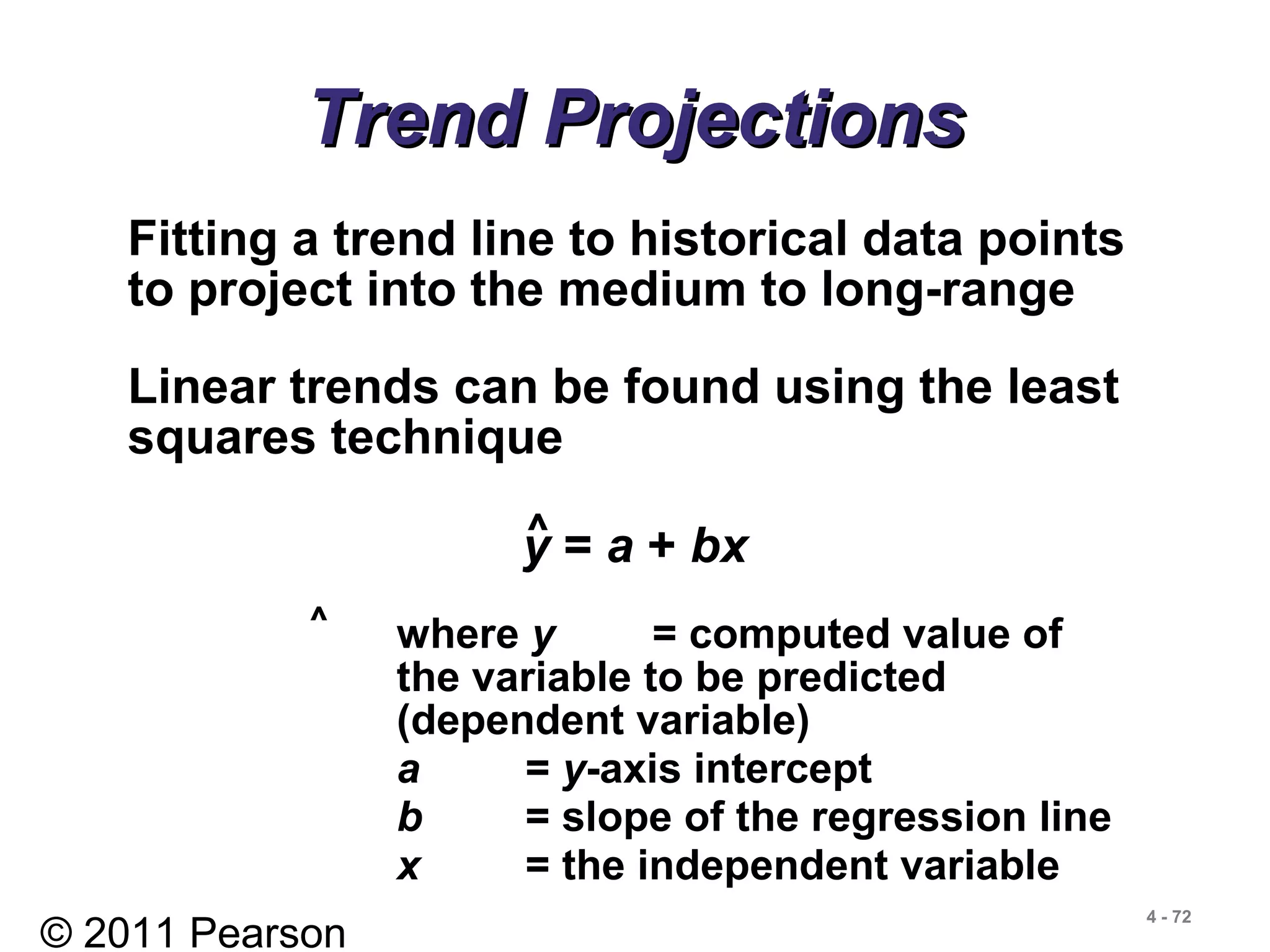

Weighted Moving AverageWeighted Moving Average

1010

1212

1313

[(3 x 1313) + (2 x 1212) + (1010)]/6 = 121

/6

Weights Applied Period

33 Last month

22 Two months ago

11 Three months ago

6 Sum of weights](https://image.slidesharecdn.com/heizerom10ch04-130523204113-phpapp02/75/360_ch04-45-2048.jpg)

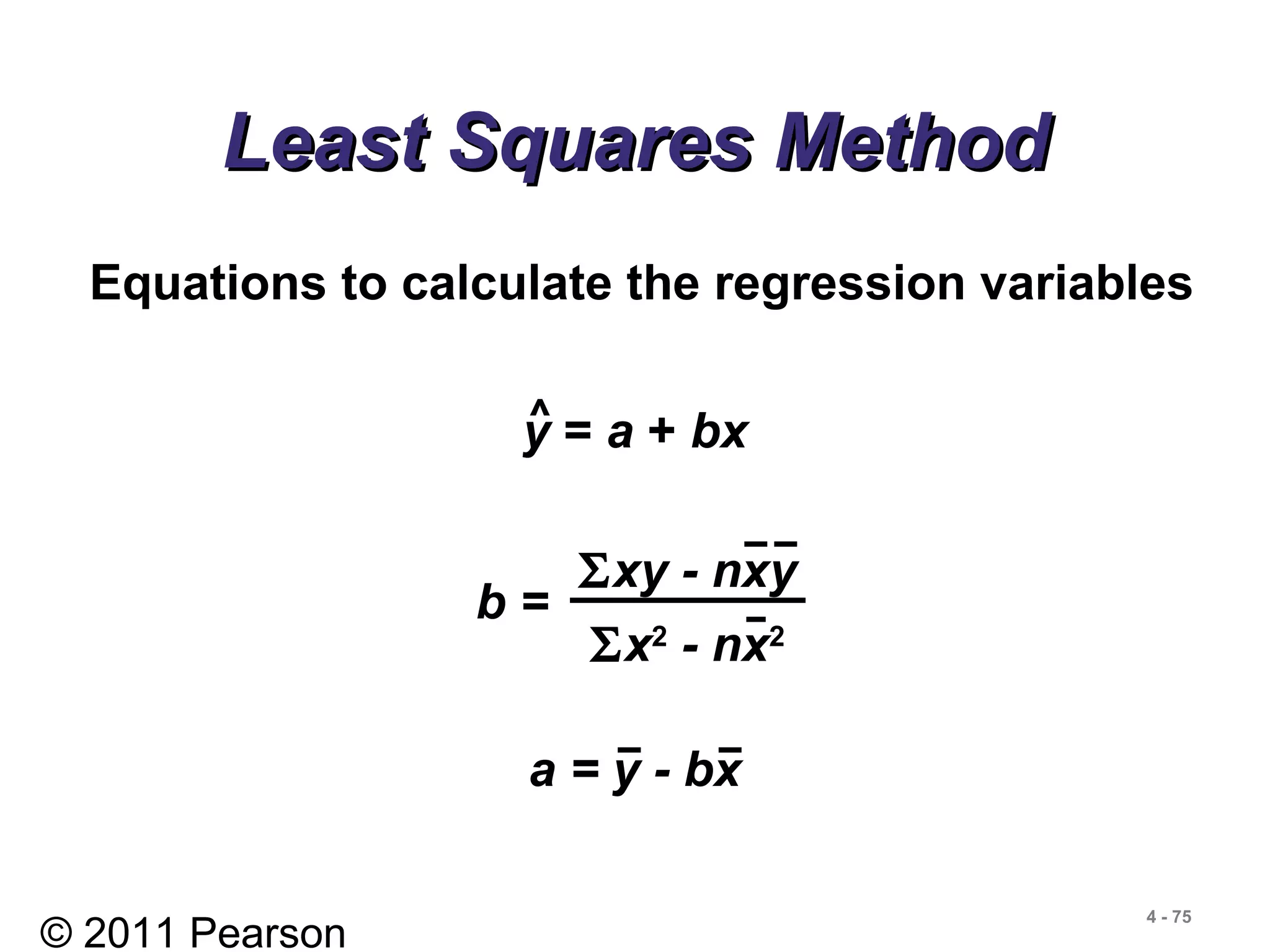

![© 2011 Pearson

4 - 100

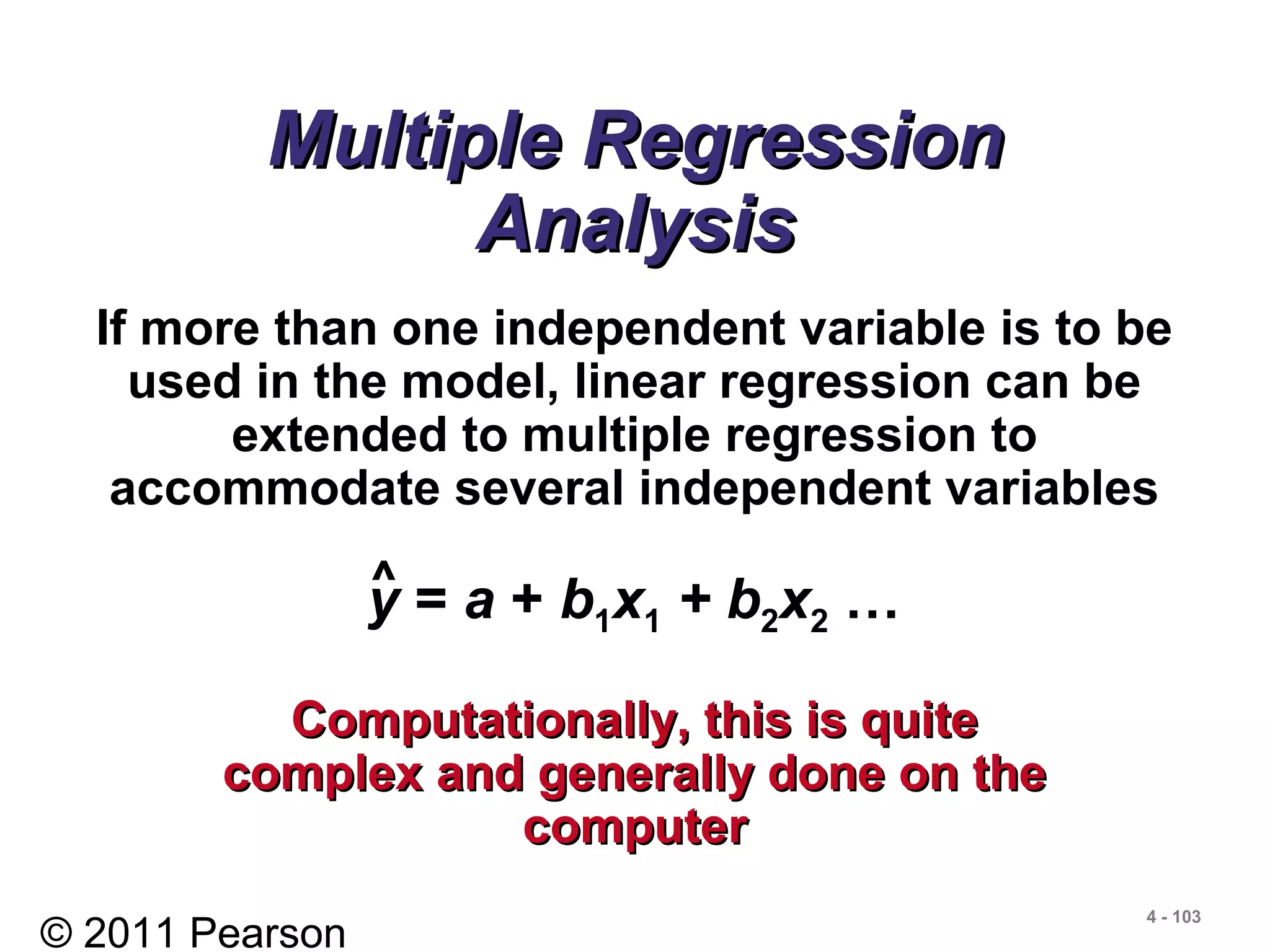

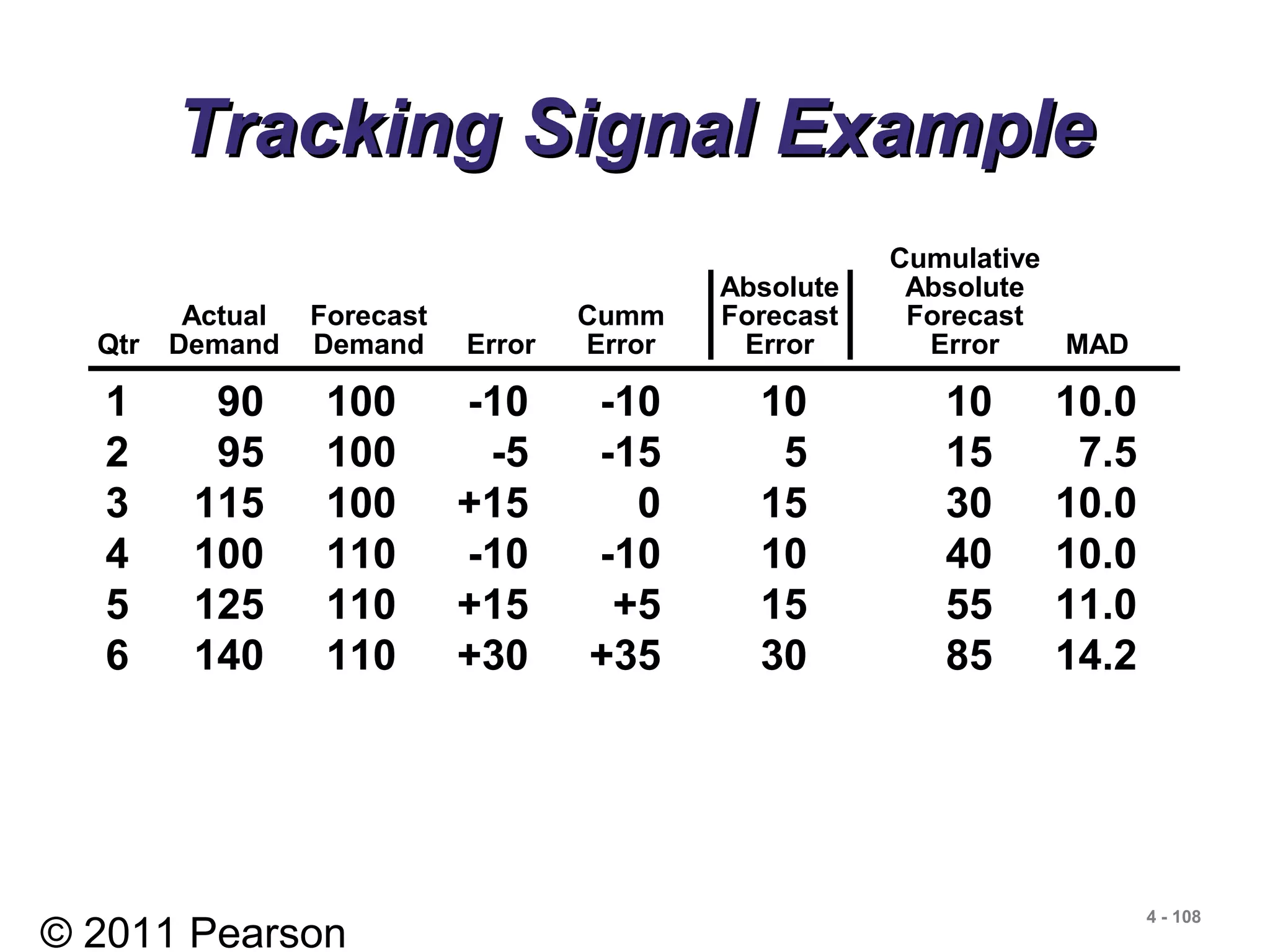

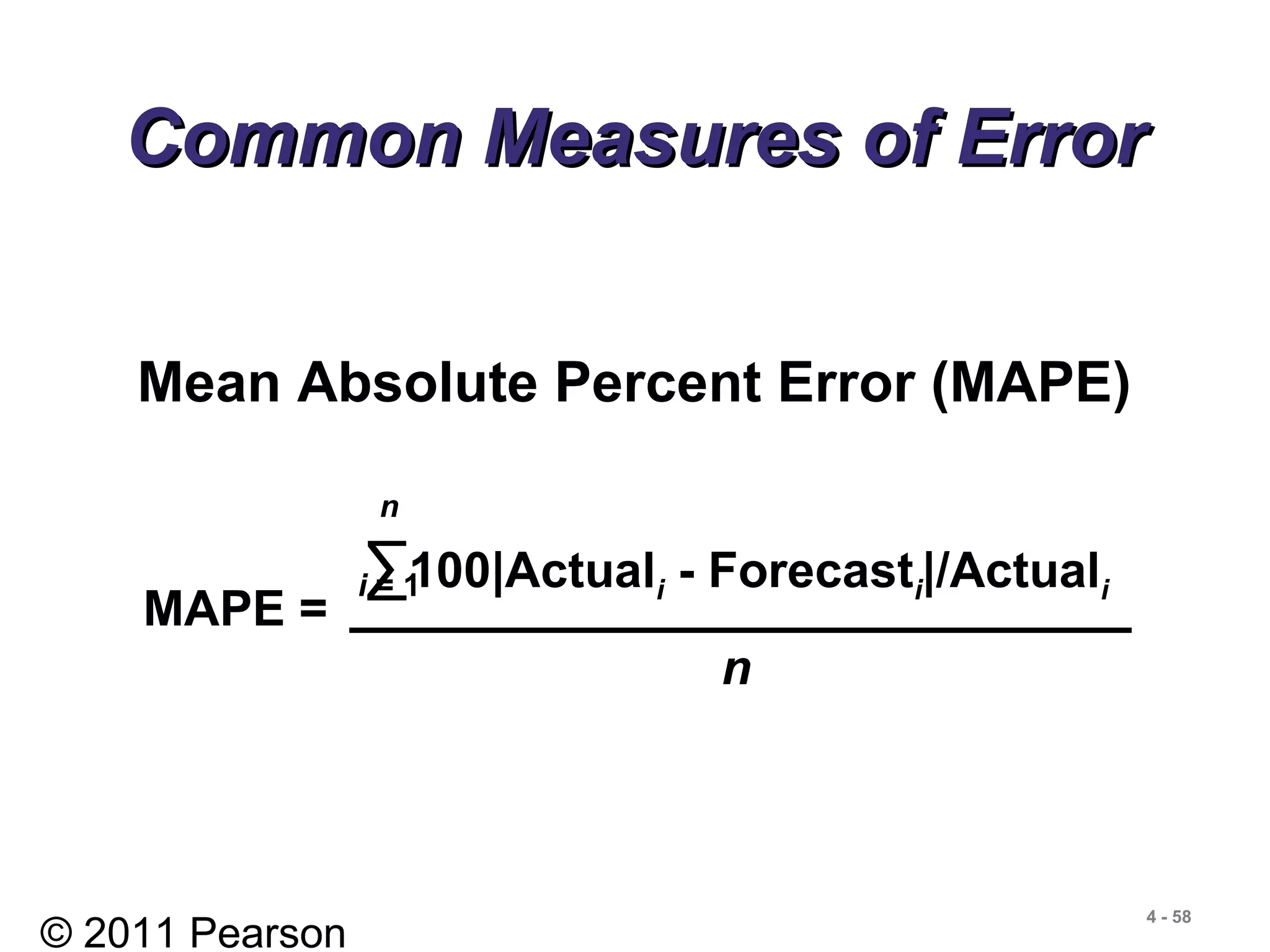

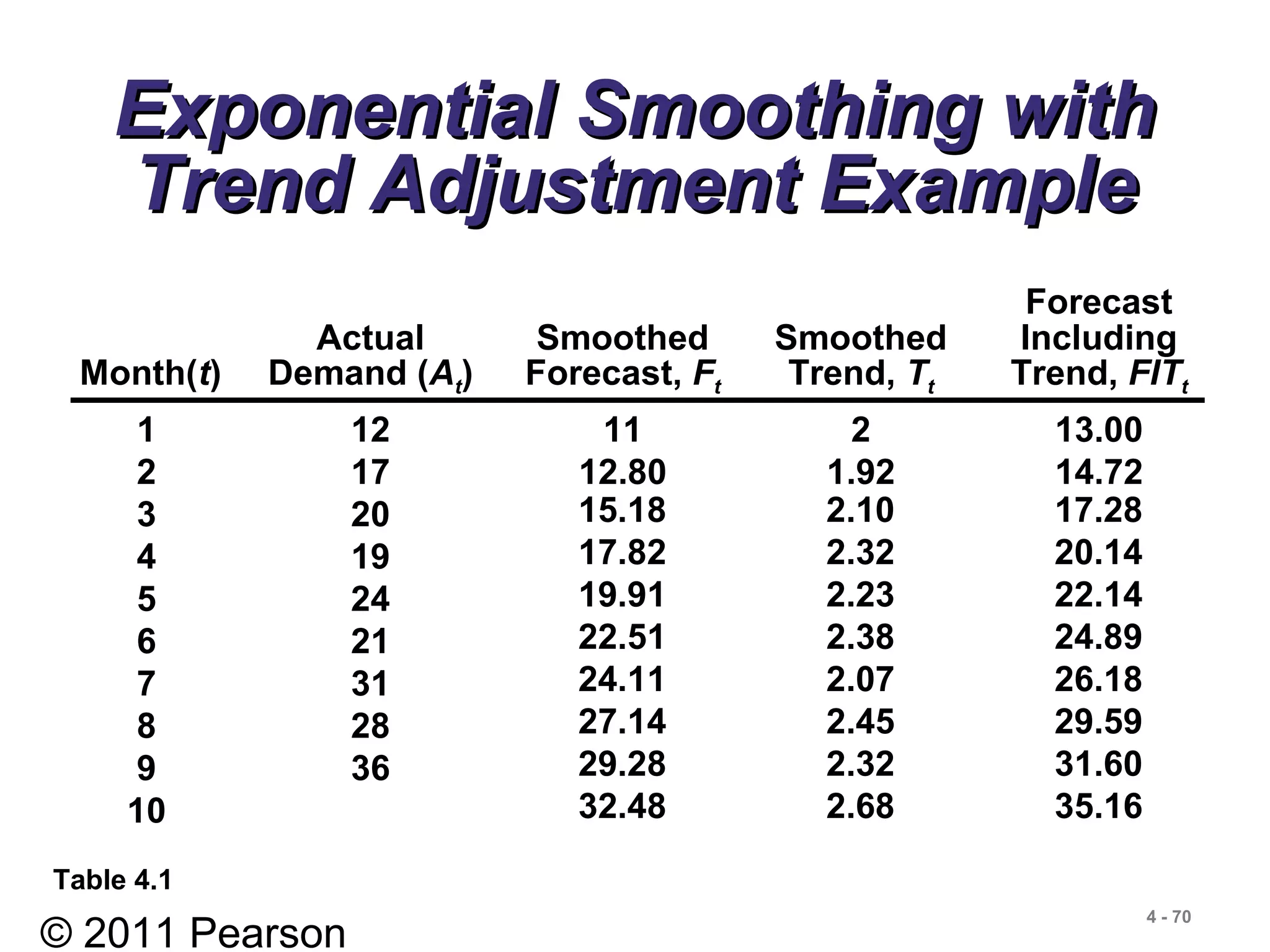

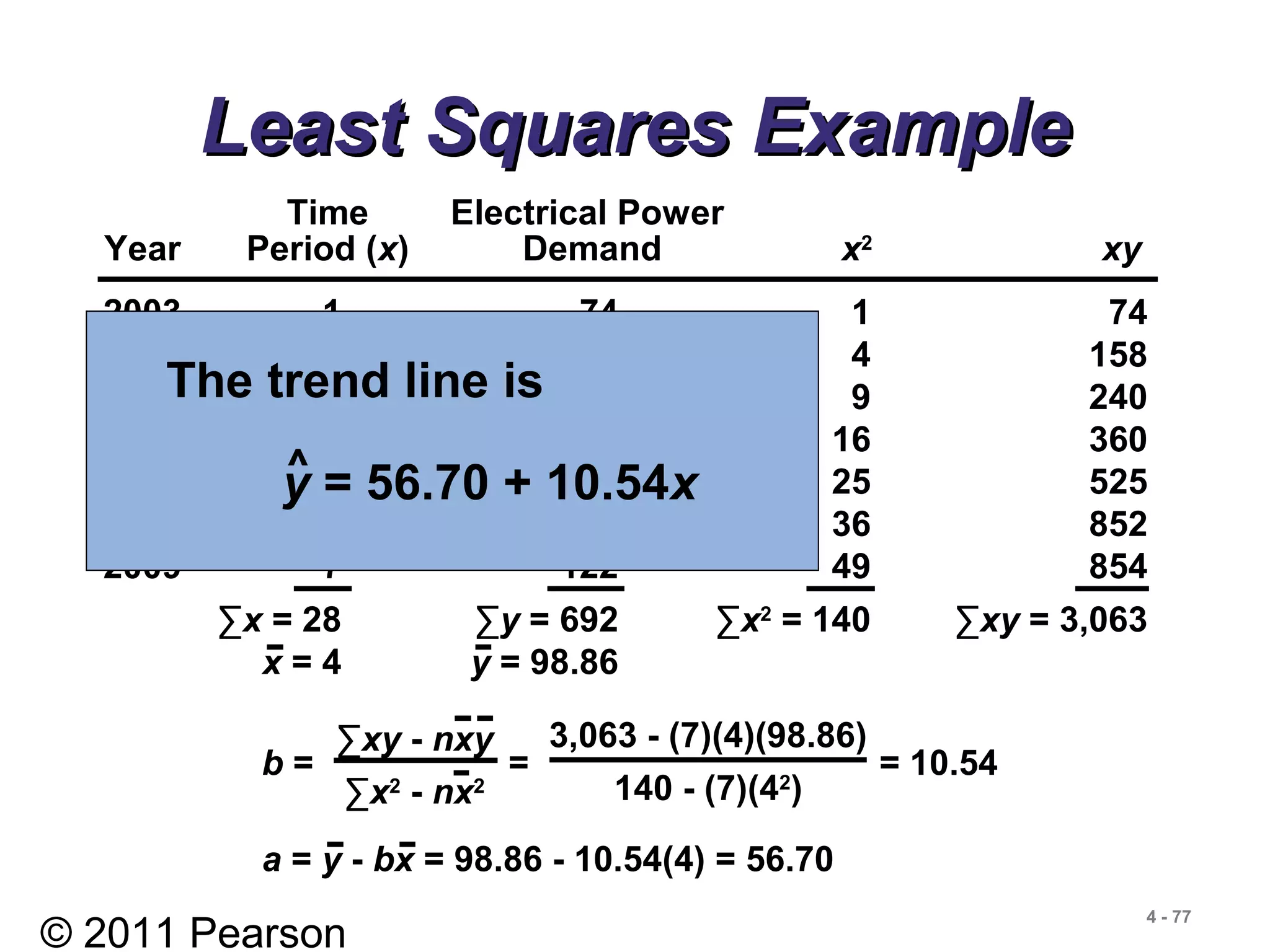

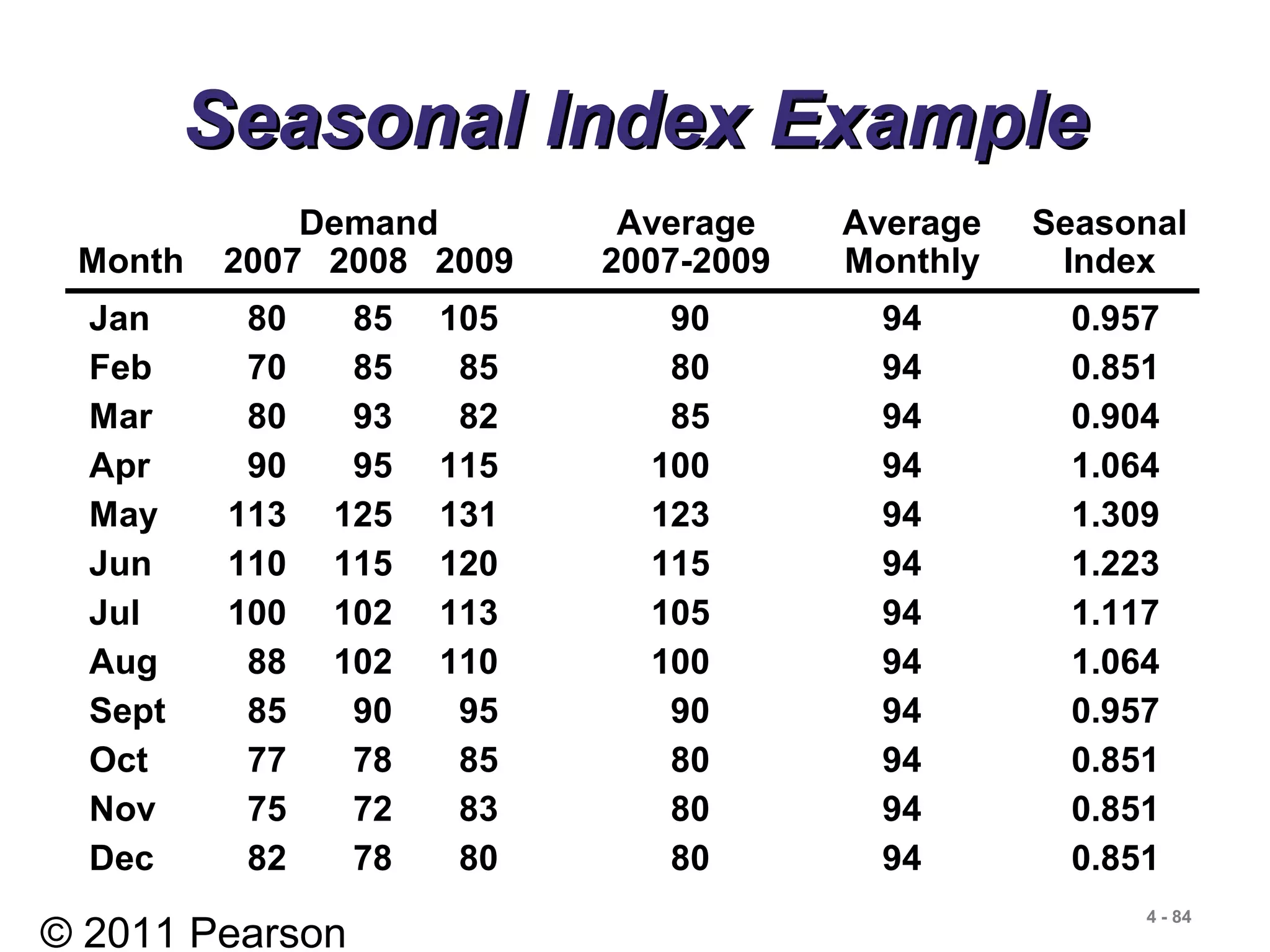

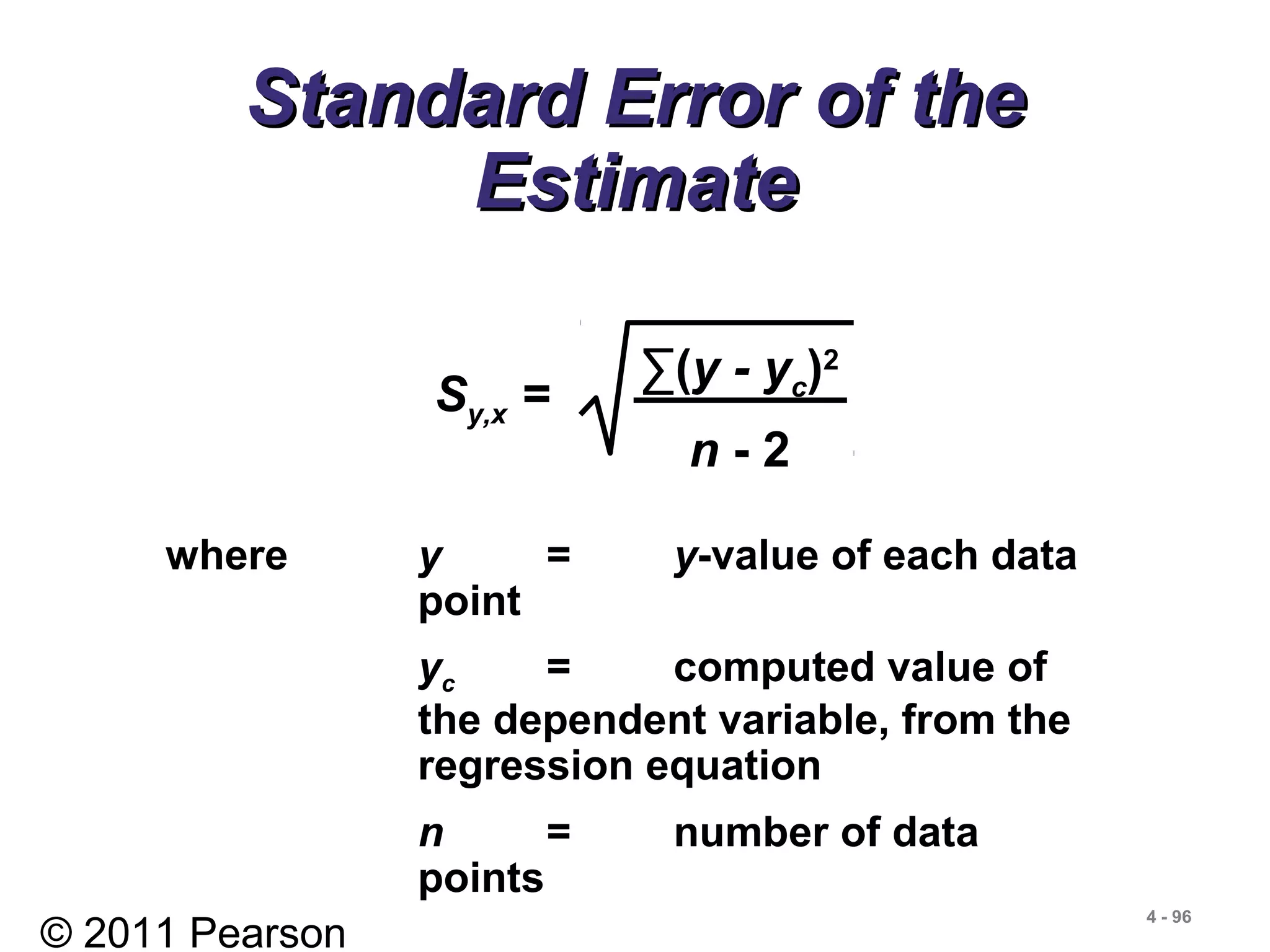

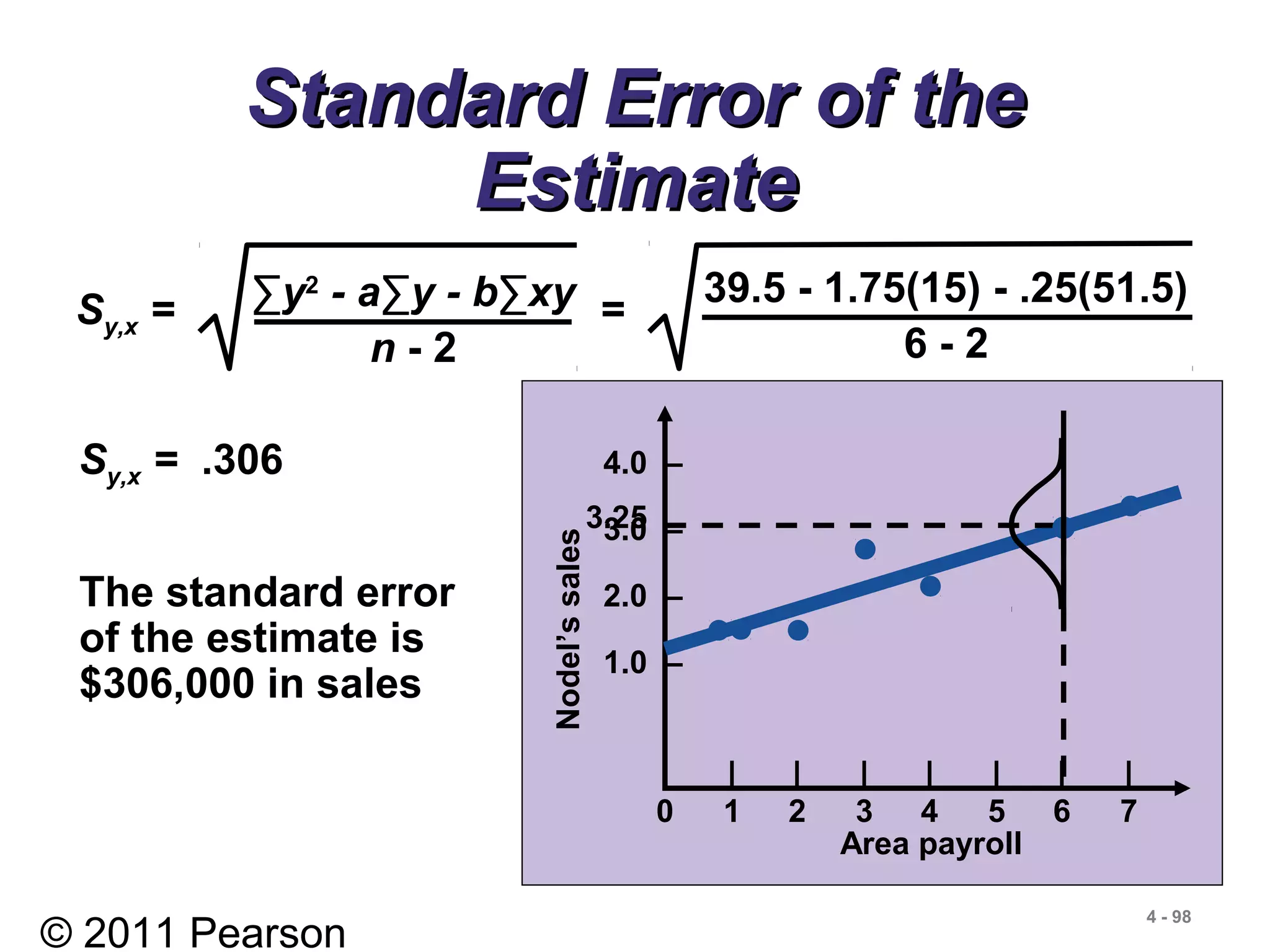

Correlation CoefficientCorrelation Coefficient

r =

nΣxy - ΣxΣy

[nΣx2

- (Σx)2

][nΣy2

- (Σy)2

]](https://image.slidesharecdn.com/heizerom10ch04-130523204113-phpapp02/75/360_ch04-99-2048.jpg)

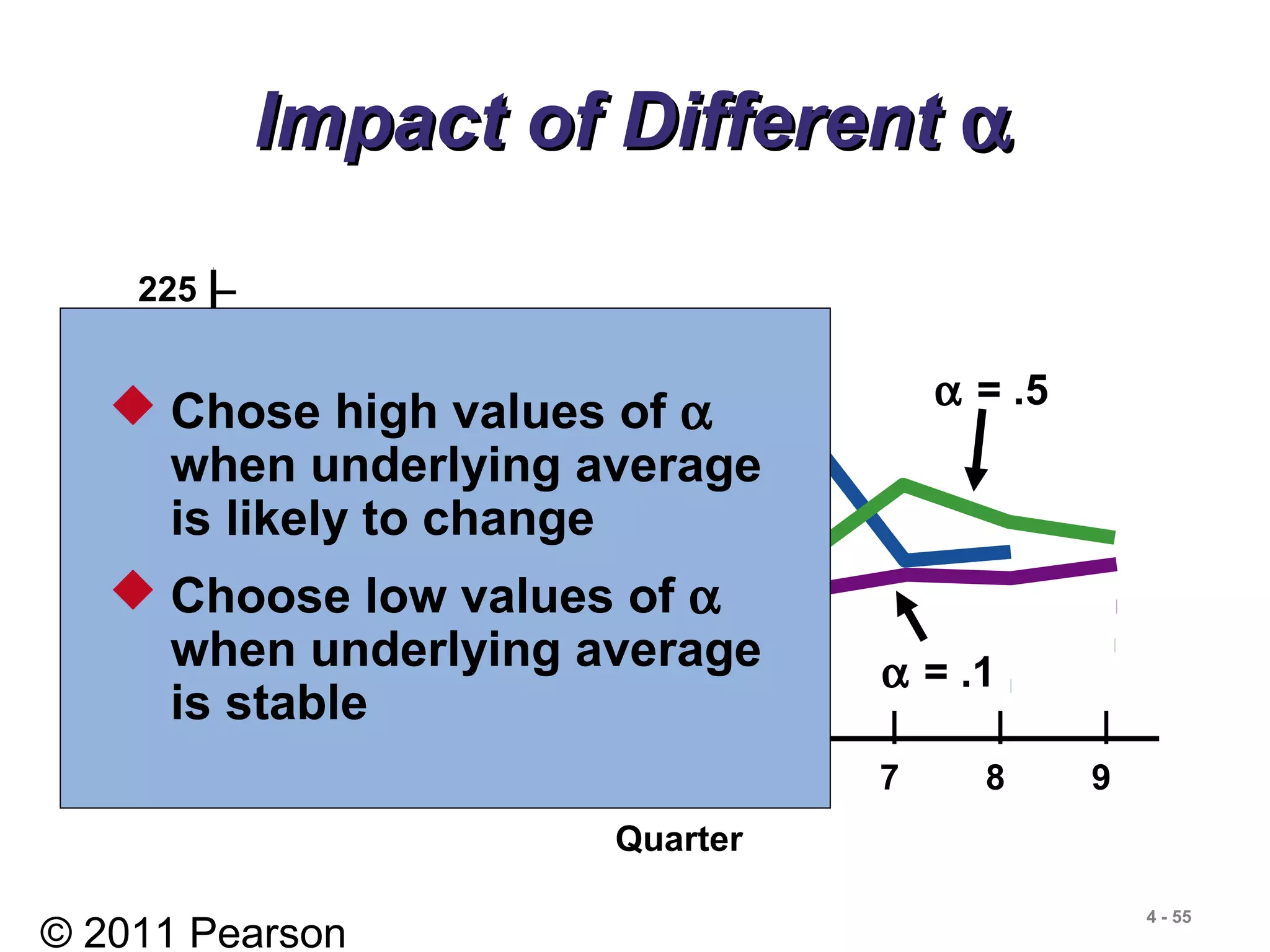

![© 2011 Pearson

4 - 101

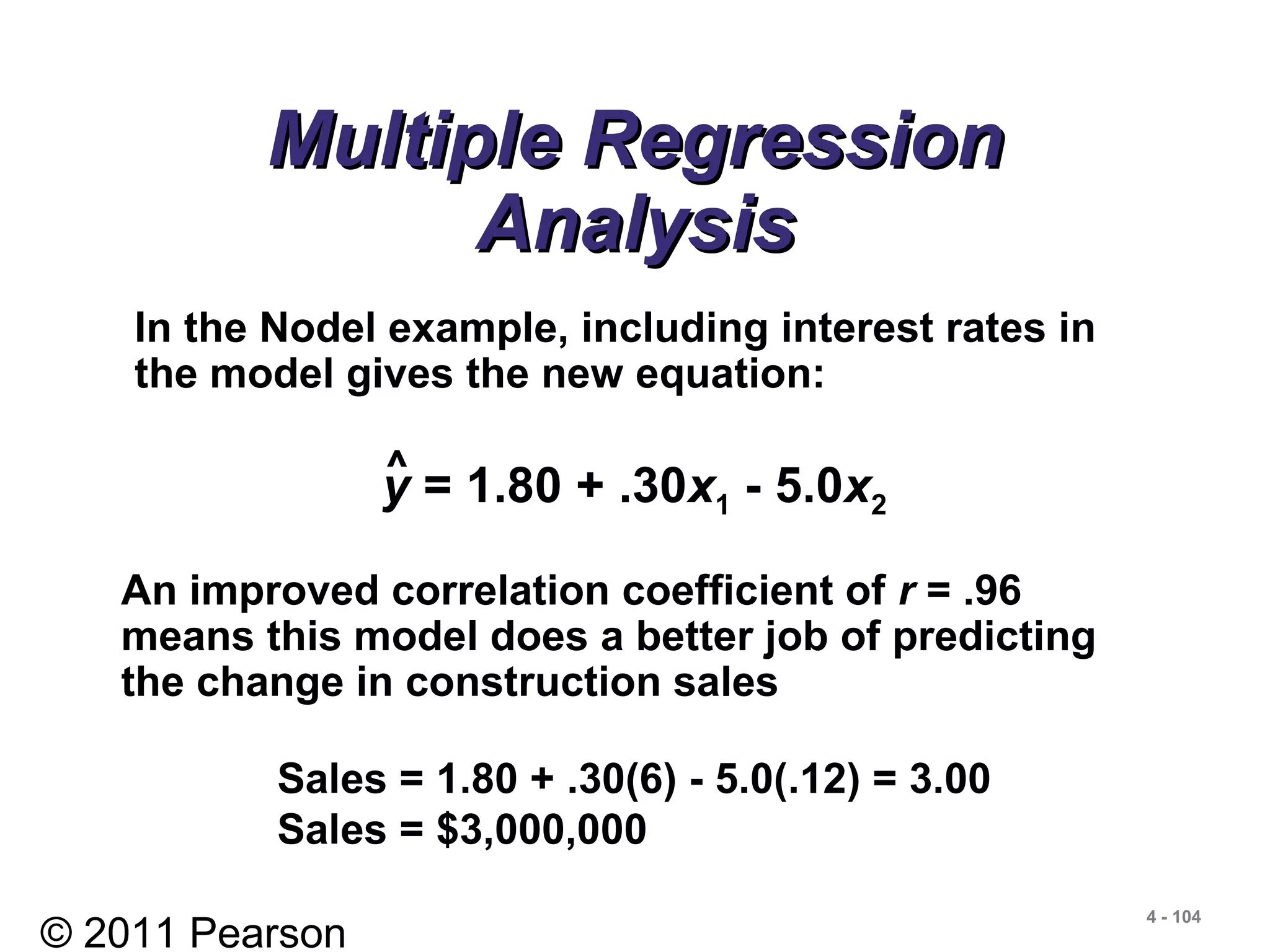

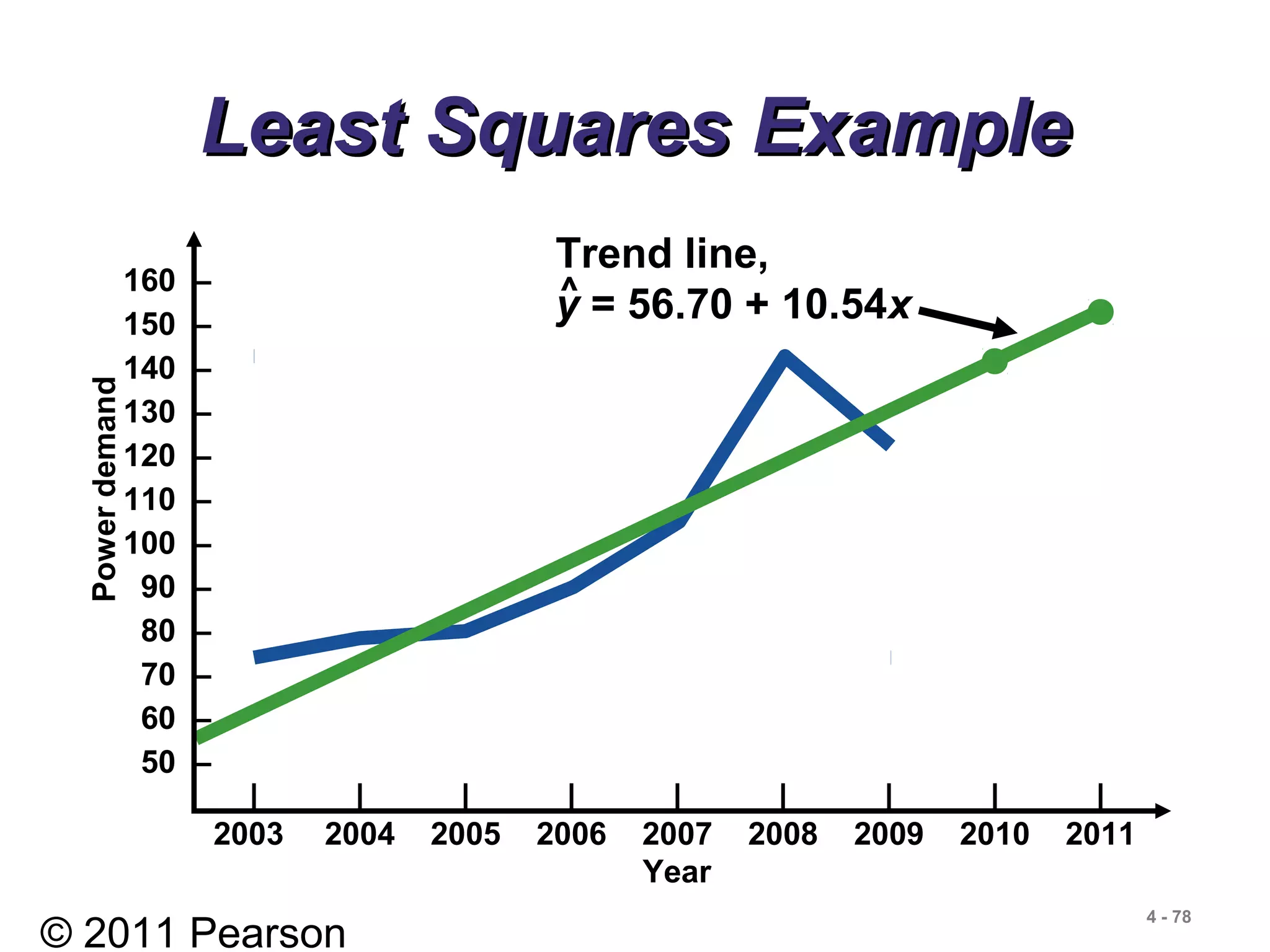

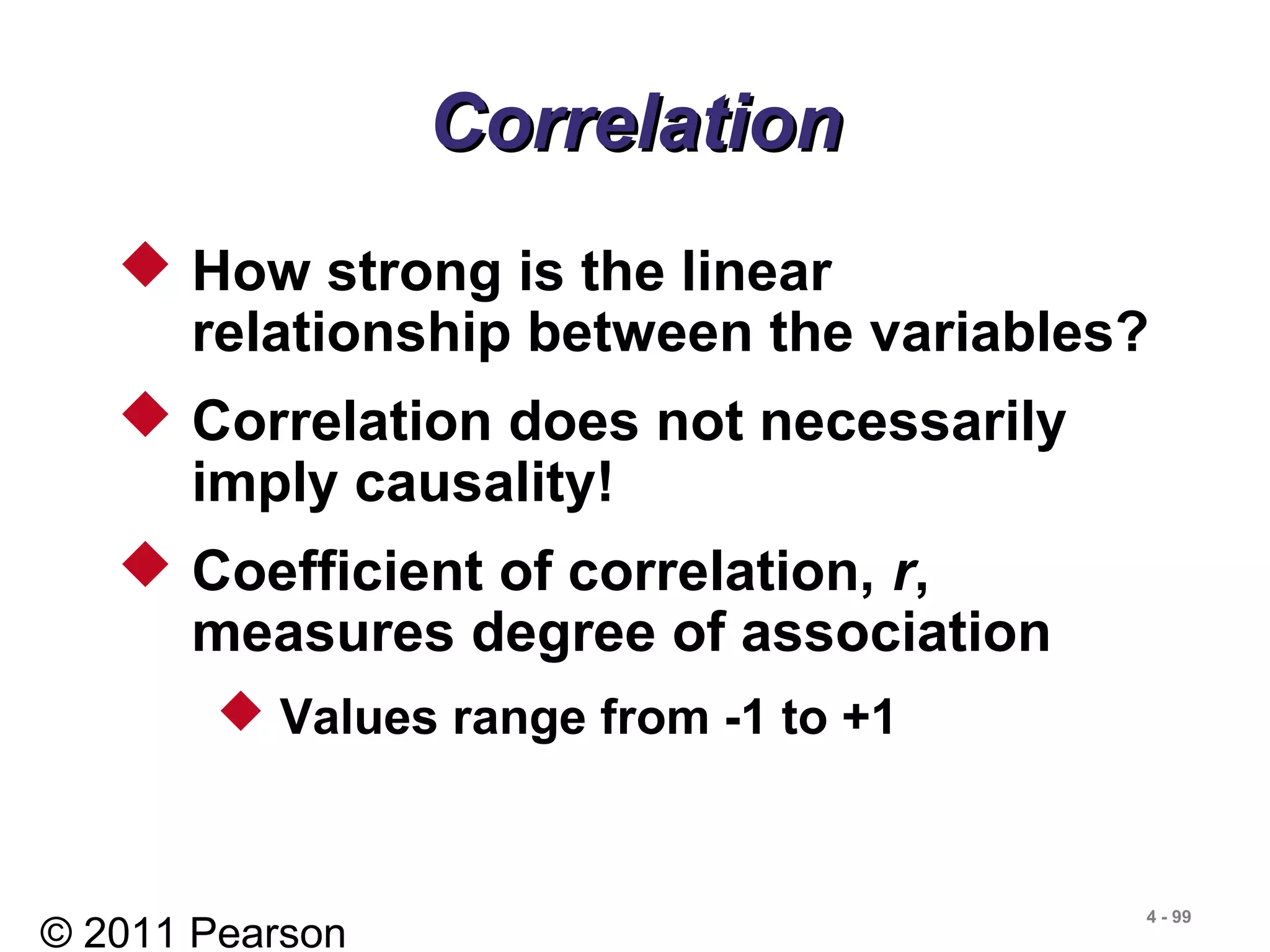

Correlation CoefficientCorrelation Coefficient

r =

nΣxy - ΣxΣy

[nΣx2

- (Σx)2

][nΣy2

- (Σy)2

]

y

x(a) Perfect positive

correlation:

r = +1

y

x(b) Positive

correlation:

0 < r < 1

y

x(c) No correlation:

r = 0

y

x(d) Perfect negative

correlation:

r = -1](https://image.slidesharecdn.com/heizerom10ch04-130523204113-phpapp02/75/360_ch04-100-2048.jpg)