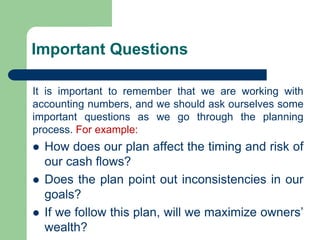

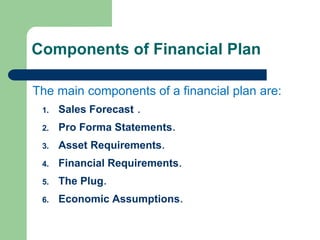

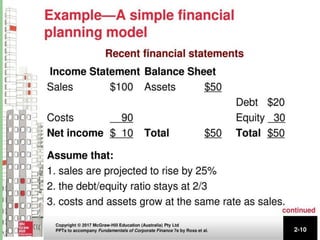

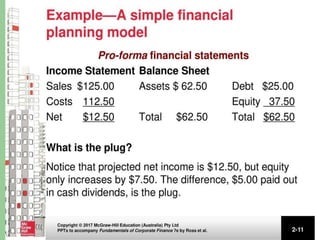

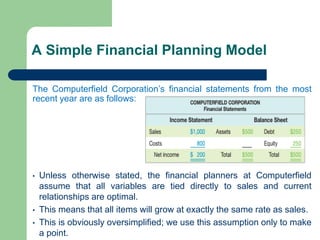

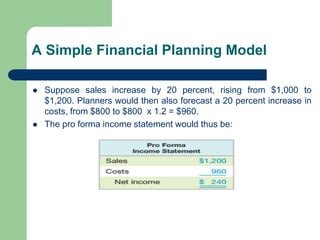

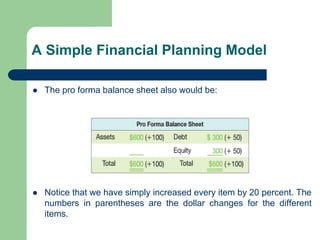

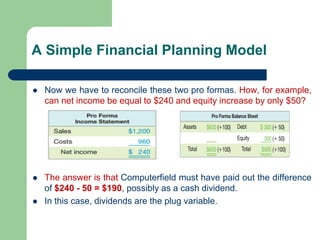

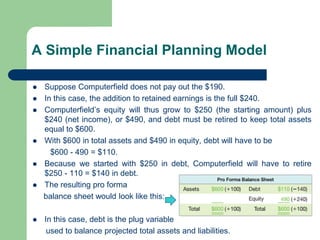

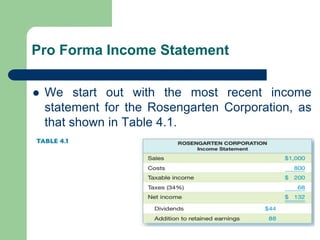

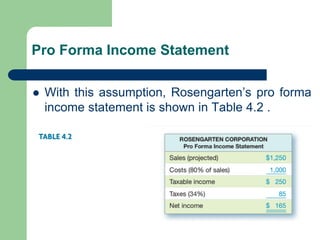

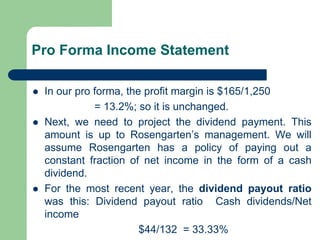

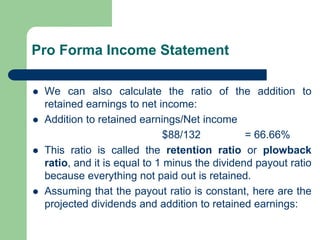

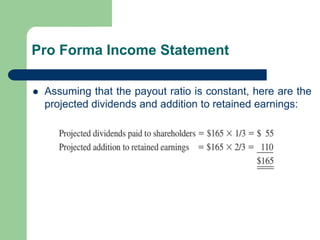

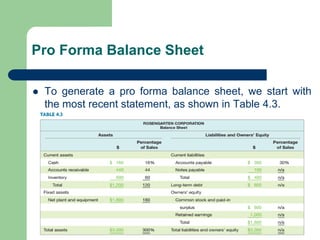

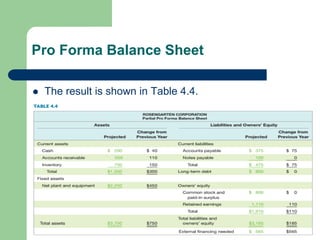

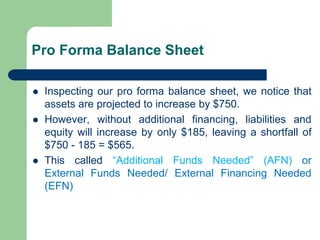

This document provides an overview of long-term financial planning principles and processes. It discusses key concepts like financial goals, growth objectives, planning horizons, and worst-case/normal/best-case scenarios. Examples are given of real companies that failed to properly consider long-term planning, prioritizing growth over profitability. The document also demonstrates how to create pro forma financial statements by linking income statement and balance sheet items to sales forecasts and maintaining consistent ratios over time.