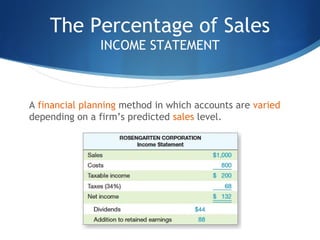

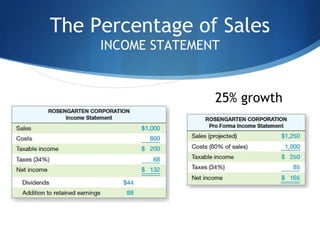

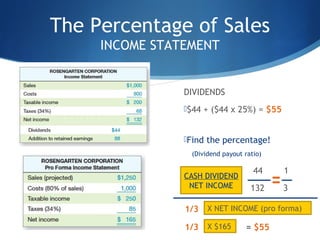

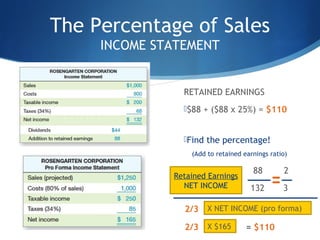

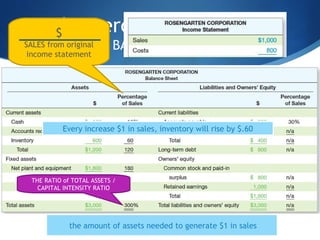

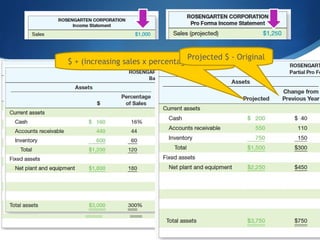

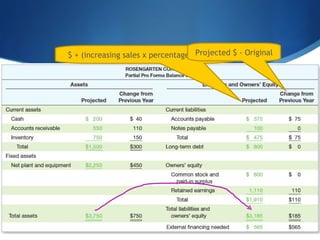

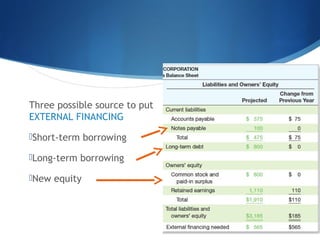

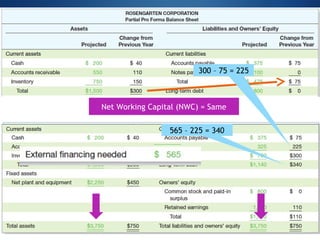

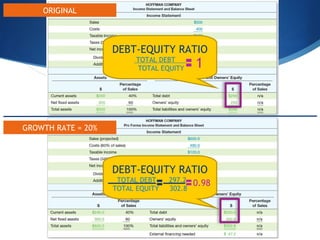

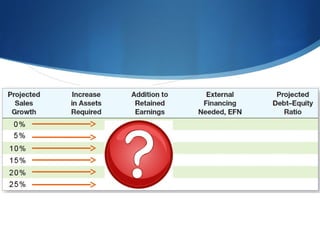

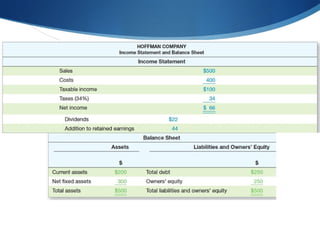

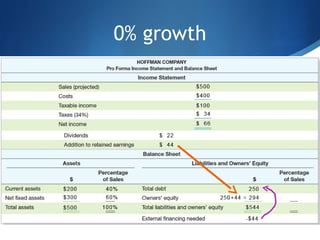

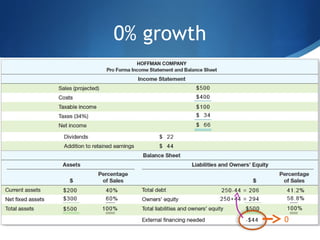

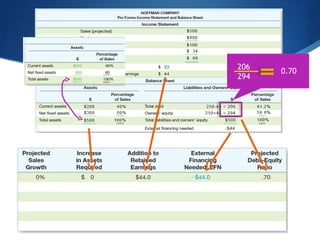

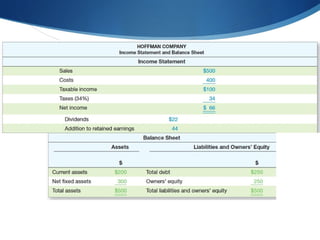

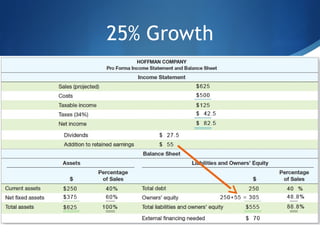

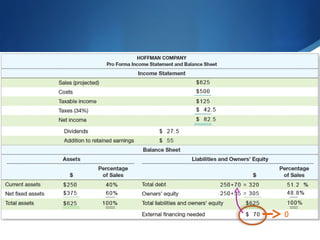

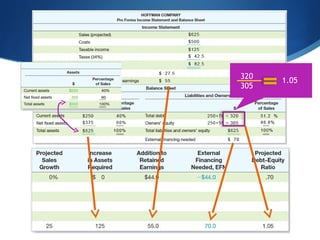

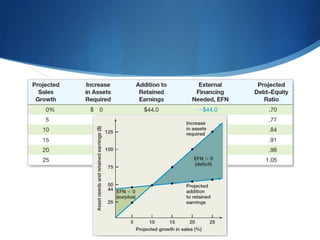

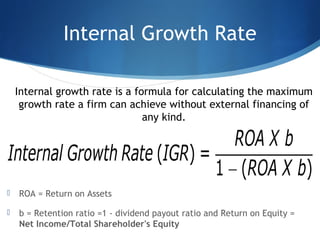

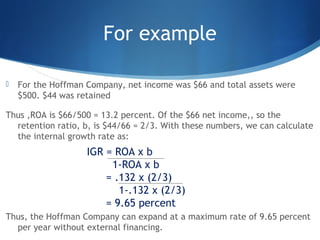

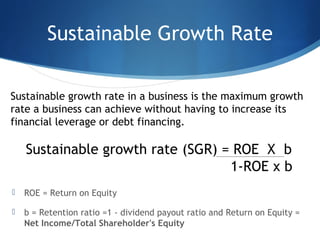

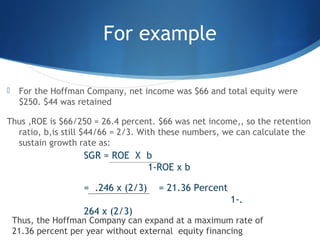

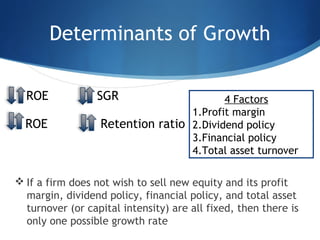

This document discusses pro forma financial statements and growth projections. It explains how to create pro forma income statements and balance sheets by varying accounts based on predicted sales growth, such as increasing dividends and retained earnings by 25% of the original amounts. It also discusses external financing options for growth, including debt and equity. The internal growth rate and sustainable growth rate formulas are provided to calculate the maximum growth a company can achieve without external financing based on its return on assets, retention ratio and return on equity. Determinants of a company's growth like profit margin, dividend policy, financial policy and asset turnover are also summarized.