1) The capital structure of a firm refers to how it finances its operations and growth through different sources of funds, including debt, equity, and retained earnings.

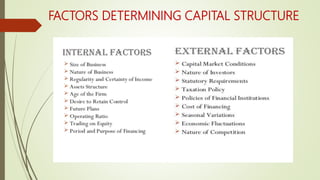

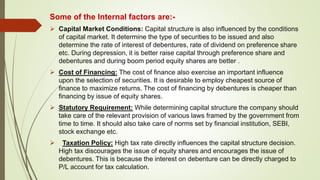

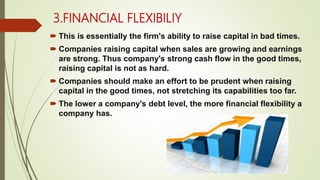

2) Several factors influence a firm's capital structure decisions, including business risk, tax exposure, financial flexibility, management style, growth rate, and market conditions.

3) Business risk, tax rates, financial flexibility, management aggressiveness, growth needs, and market access all impact the optimal mix of debt and equity financing for firms.