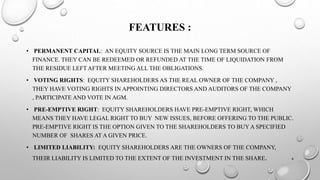

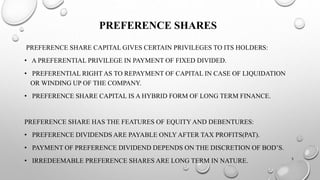

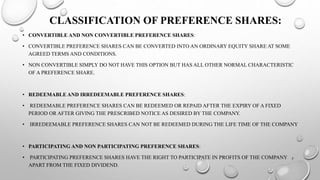

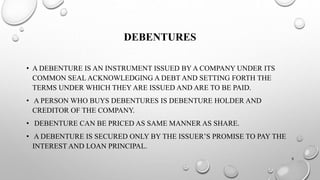

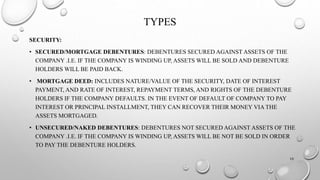

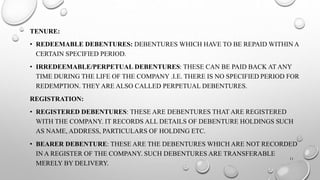

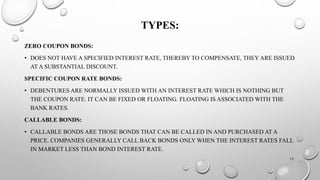

This document discusses various types of financial instruments, including capital market instruments like equity shares and preference shares, as well as money market instruments. Equity shares represent ownership in a company and give shareholders voting rights and a claim on residual assets. Preference shares have preferential rights to dividends and repayment of capital. The document also covers debentures, bonds, derivatives and money market instruments like treasury bills, certificates of deposit, commercial paper, repurchase agreements, and banker's acceptances.