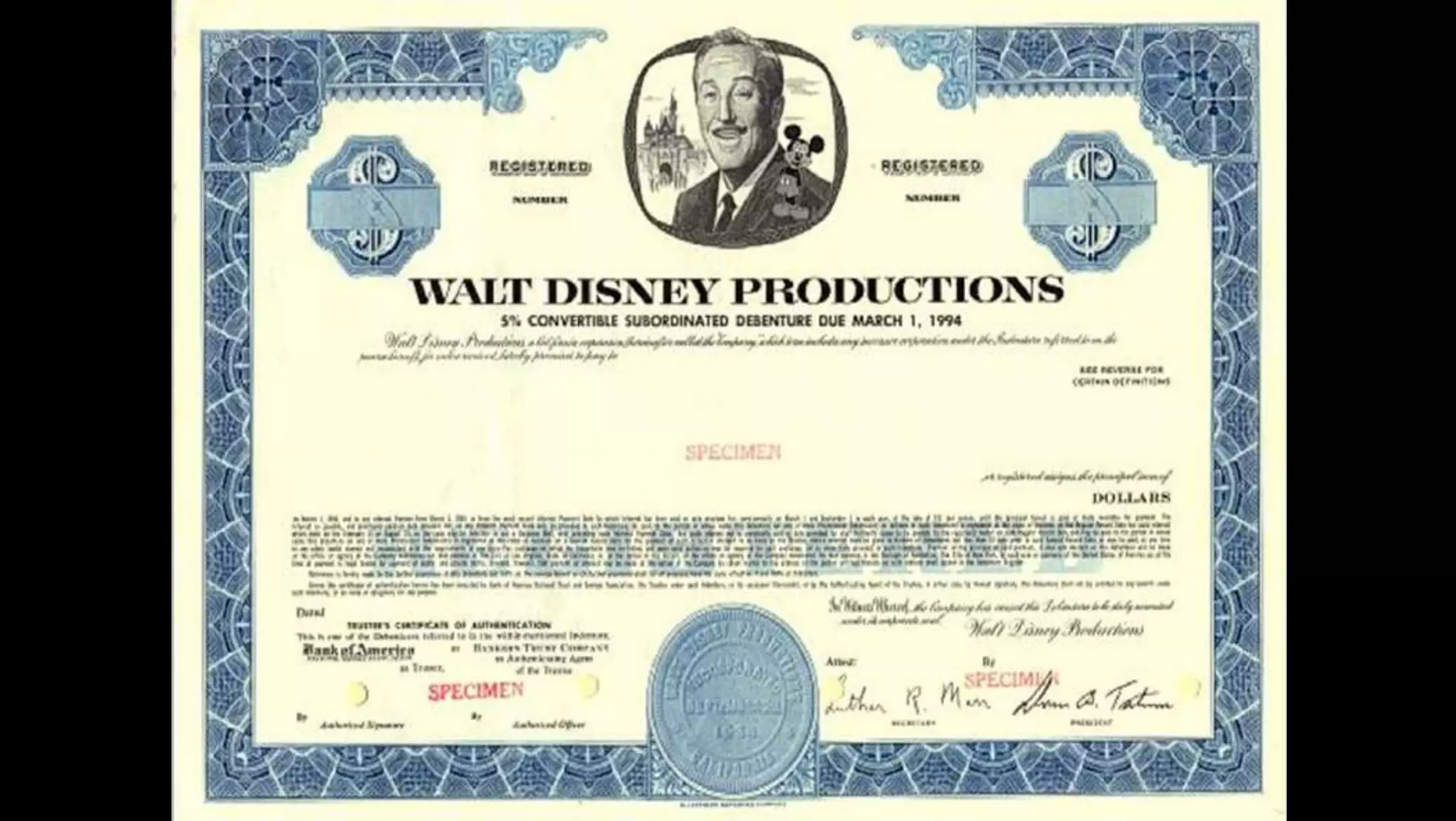

This document discusses conventional sources of long-term finance. It covers topics like shares, debentures, and retained earnings. Shares are divided into preference shares and equity shares, with preference shares having preferential rights over dividends and capital. Debentures are debt instruments used by companies to borrow money at a fixed rate of interest. Retained earnings refer to undistributed profits that are retained and reinvested in the business. Conventional long-term financing allows companies to raise fixed capital without creating charges on assets.