This document discusses various types of money market instruments, including:

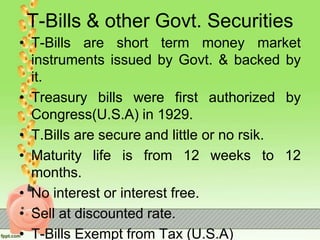

- Government securities like treasury bills with maturities less than 1 year that are considered very low risk.

- Commercial paper which are unsecured short-term notes issued by large corporations to fund expenses like payroll.

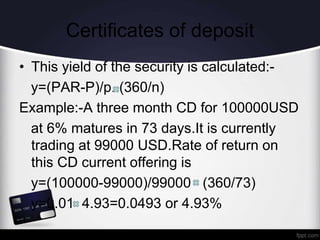

- Certificates of deposit that are time deposits held at banks for a fixed period that offer interest.

- Interbank loans between financial institutions that have maturities of less than a week.

- Repurchase agreements (repos) where securities are sold with an agreement to buy them back, used by banks and funds.