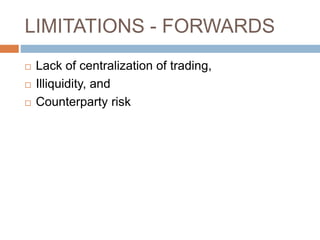

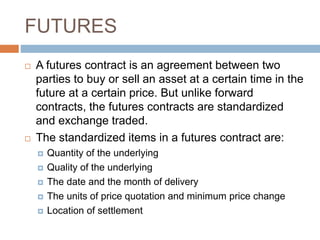

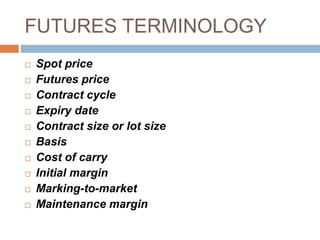

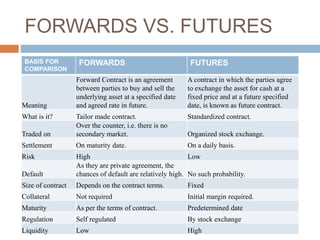

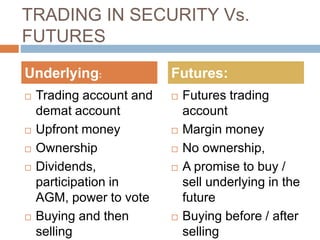

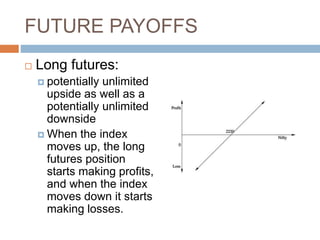

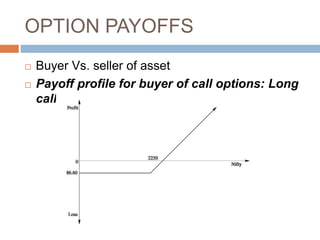

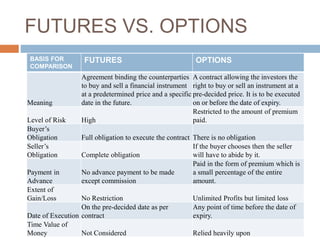

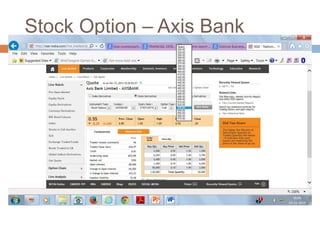

The document discusses various derivatives instruments like forwards, futures, and options. Forwards are bilateral contracts where the underlying asset is delivered on maturity. Futures are exchange-traded standardized contracts that are cash settled daily. Options give the holder the right but not obligation to buy/sell the underlying at a strike price. Derivatives allow for hedging against price risks and speculating on market movements. They provide flexibility and leverage compared to trading the actual underlying assets.