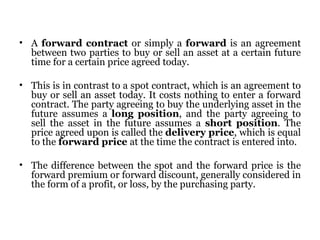

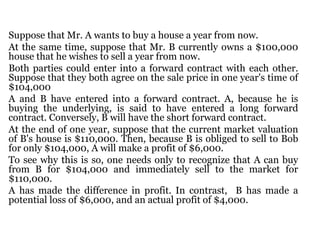

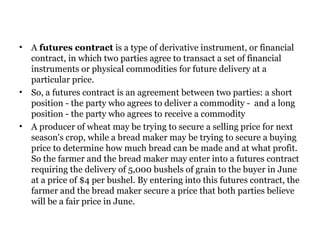

Derivatives can be categorized based on their underlying asset, relationship to the underlying, and market in which they trade. The major classes of derivatives are futures/forwards, options, and swaps. Futures/forwards involve an obligation to buy or sell an asset at a future date. Options provide the right but not obligation to buy or sell an asset. Swaps involve an agreement to exchange cash flows of underlying assets. Forwards are customized non-exchange traded contracts while futures are standardized exchange-traded contracts.