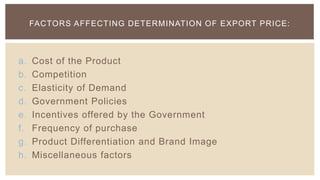

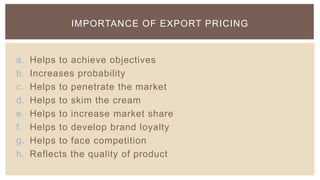

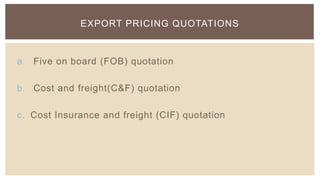

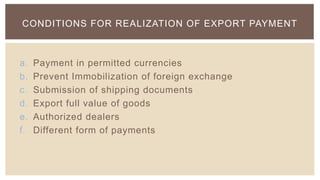

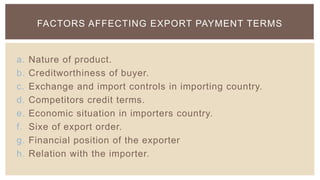

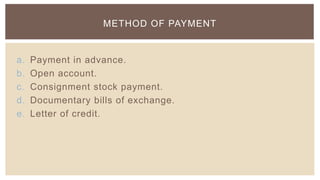

This document discusses export pricing and methods of payment. It defines price and lists factors that affect export price determination like costs, competition, demand elasticity and government policies. It then outlines various export pricing strategies and methods of payment like letters of credit. Letters of credit are described as advantageous for both exporters and importers by guaranteeing payment while avoiding blocked funds or bad debts.