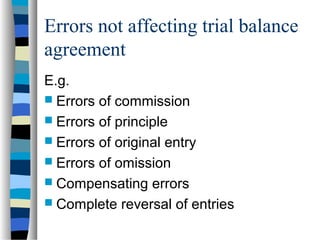

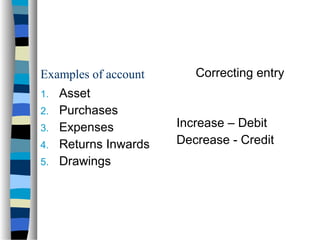

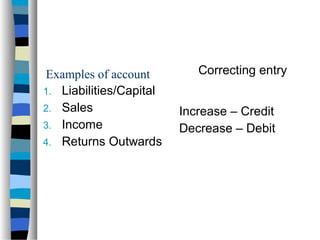

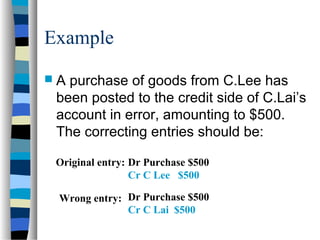

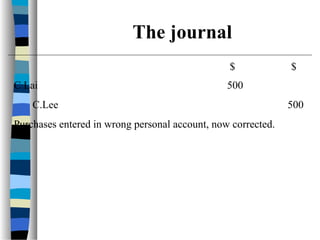

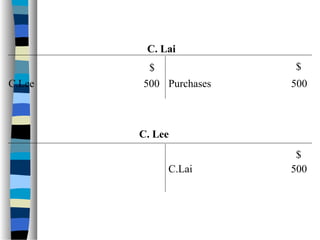

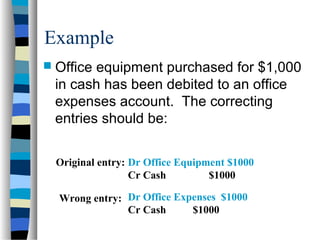

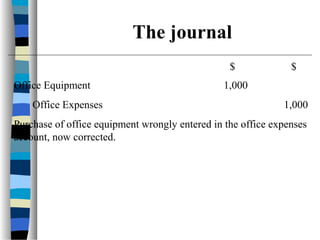

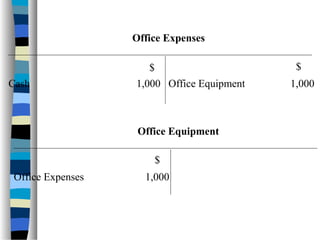

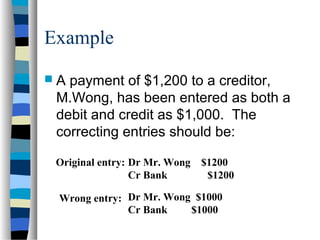

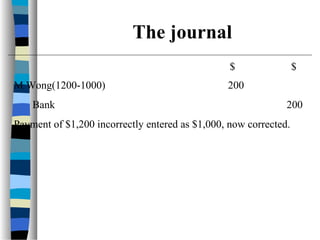

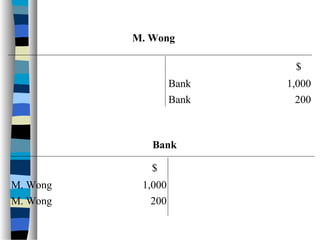

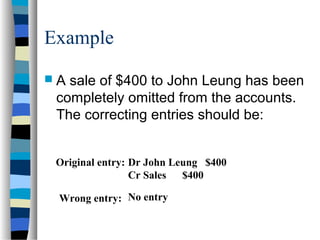

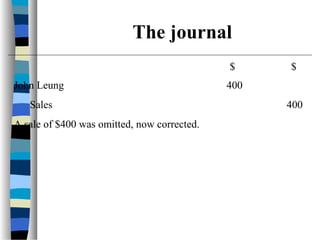

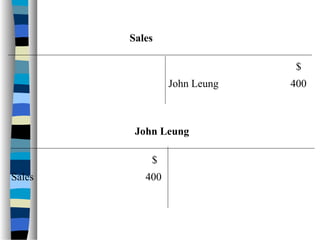

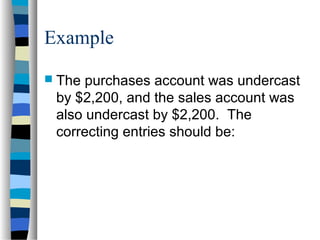

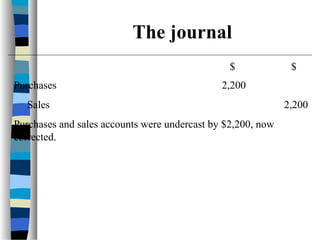

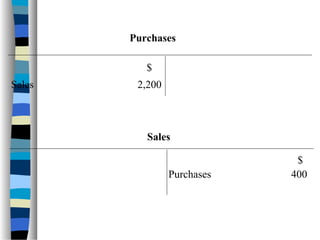

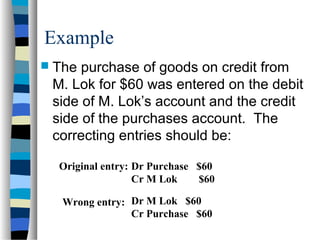

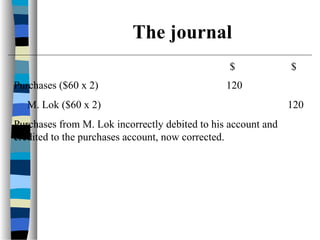

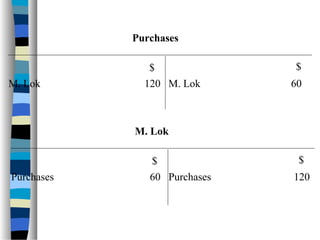

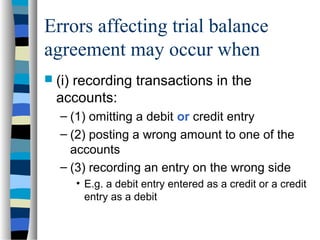

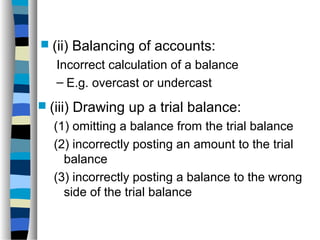

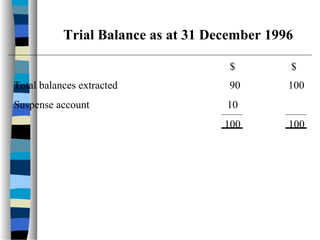

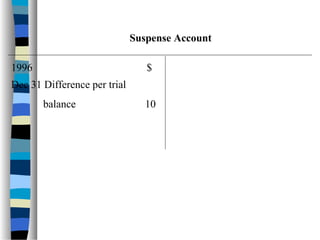

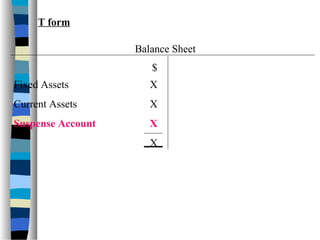

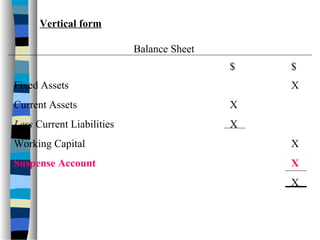

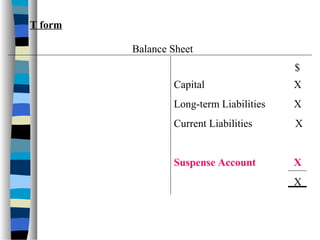

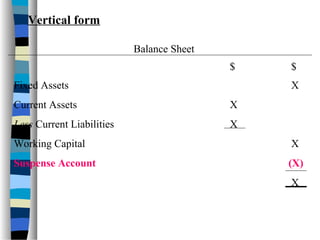

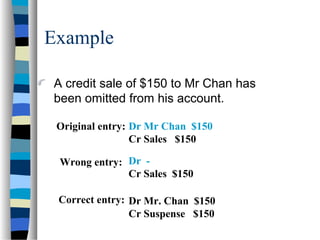

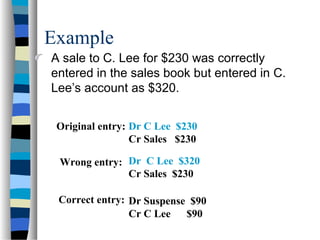

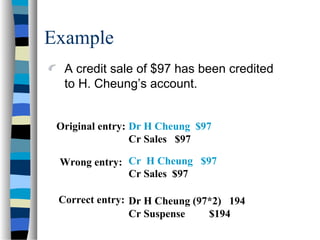

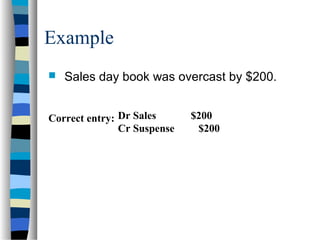

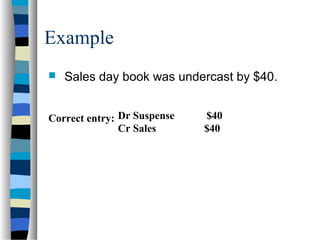

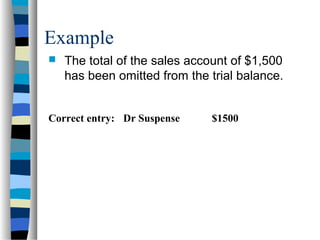

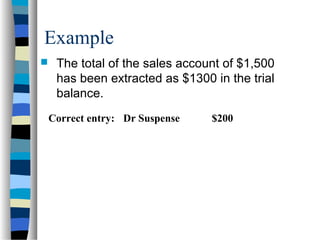

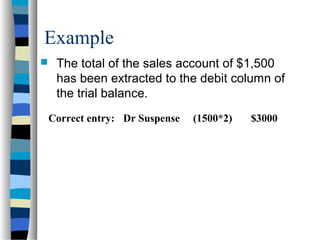

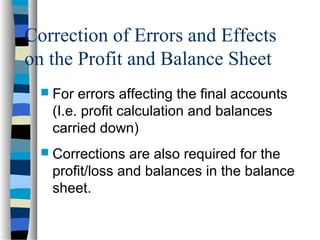

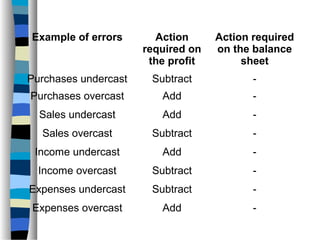

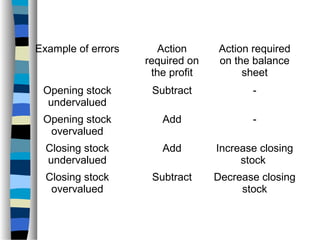

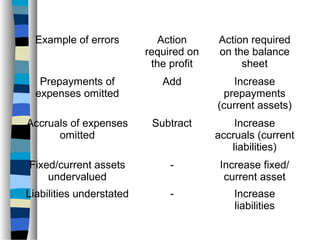

This document discusses different types of accounting errors and how to correct them. It describes errors that do not affect the trial balance, such as errors of commission, principle, original entry, omission, and compensating errors. It also covers errors that do affect the trial balance, such as omitting entries or posting wrong amounts. These errors are corrected by using a suspense account. The document provides examples of correcting journal entries to clear the suspense account. It also explains how correcting errors impacts the profit calculation and balance sheet figures.