This document provides an overview of accounting principles including:

- A brief history of accounting from 4th century India to the development of double-entry bookkeeping in 1494.

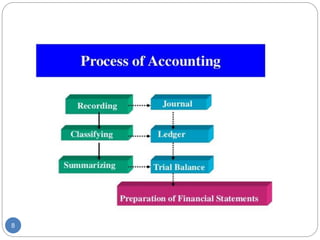

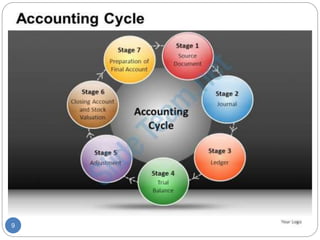

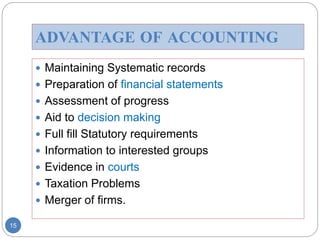

- Definitions of bookkeeping and accounting as the recording and summarizing of business transactions.

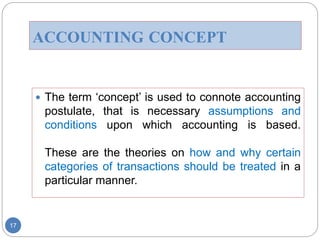

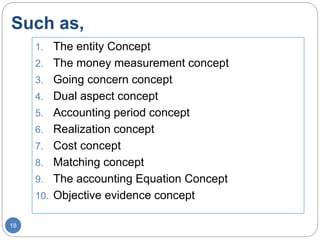

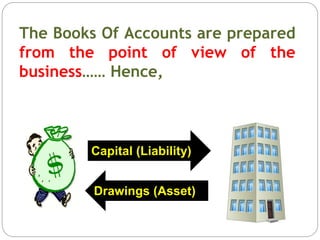

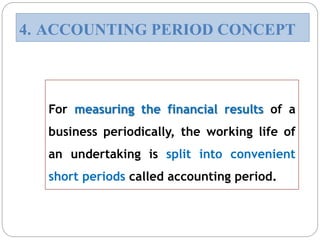

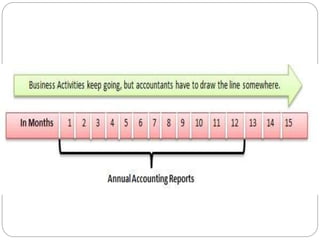

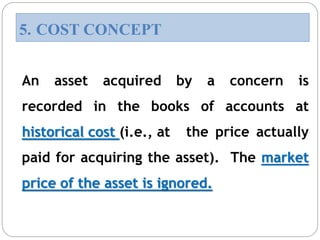

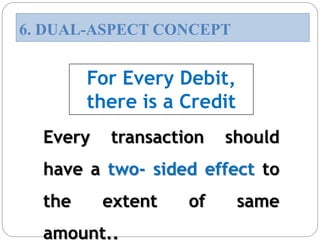

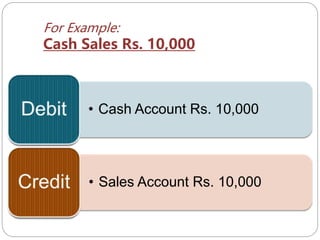

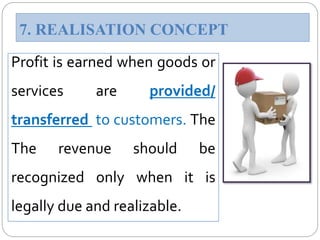

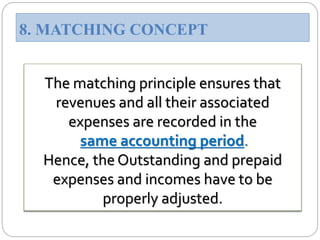

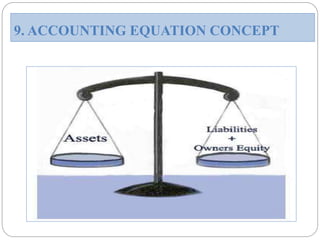

- An explanation of key accounting concepts like the accounting equation, realization principle, and matching principle.

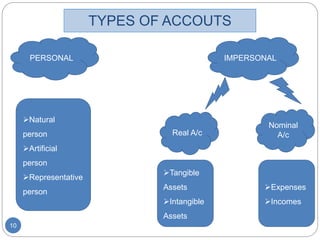

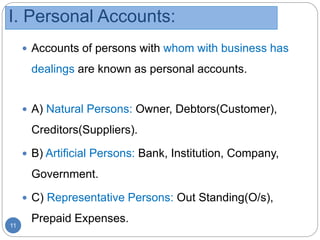

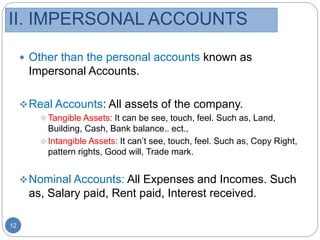

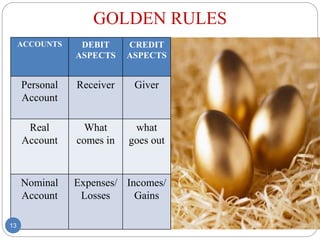

- Descriptions of different types of accounts like personal, real, and nominal accounts and the golden rules for debit and credit.

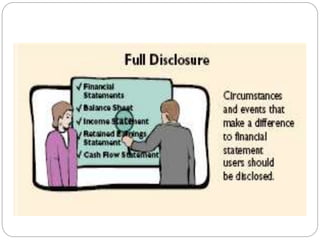

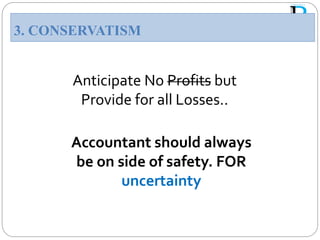

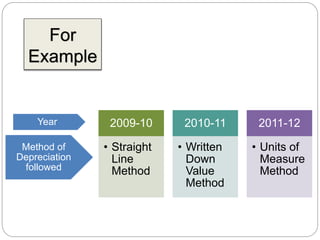

- An outline of accounting conventions regarding materiality, full disclosure, conservatism, and consistency.