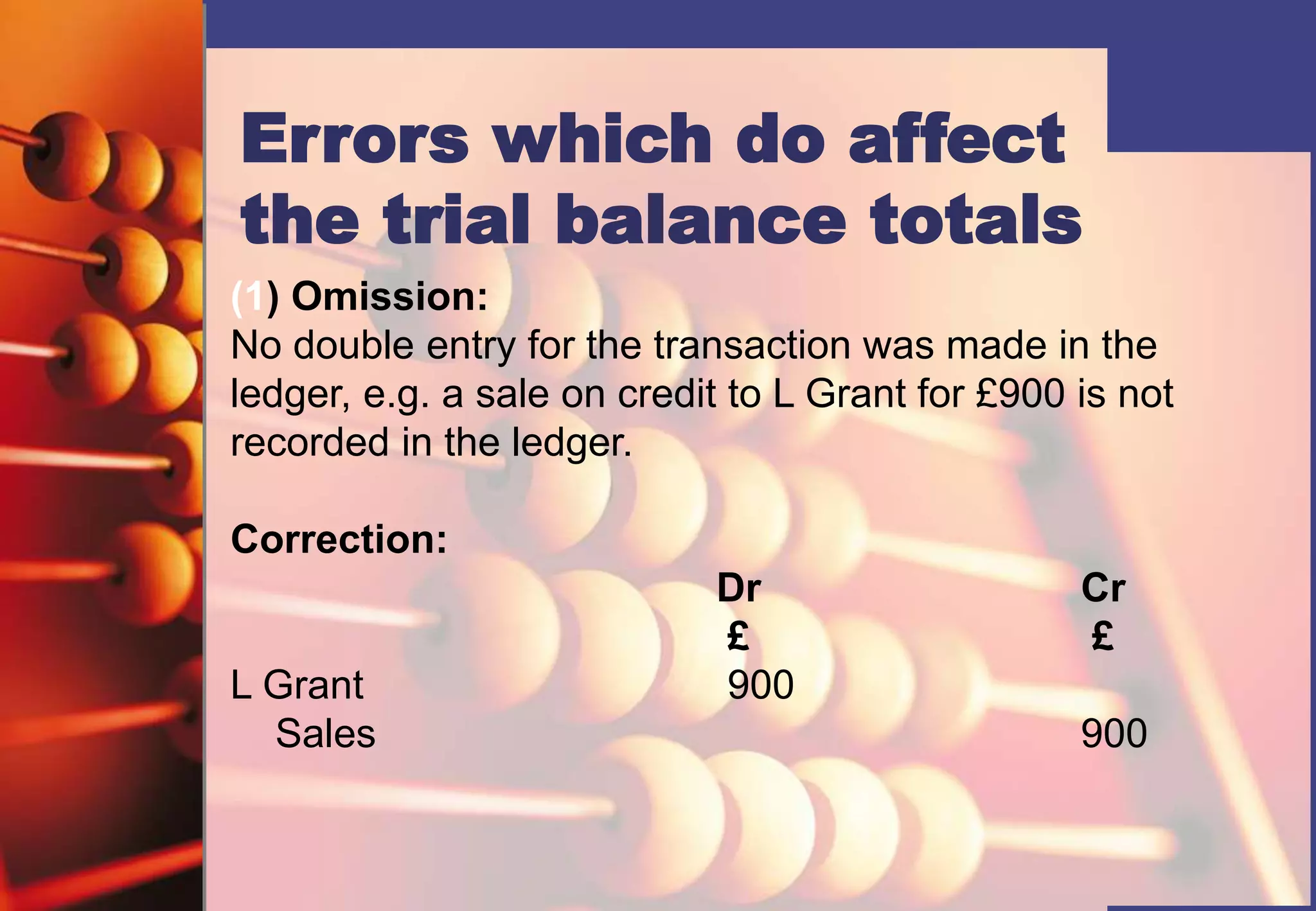

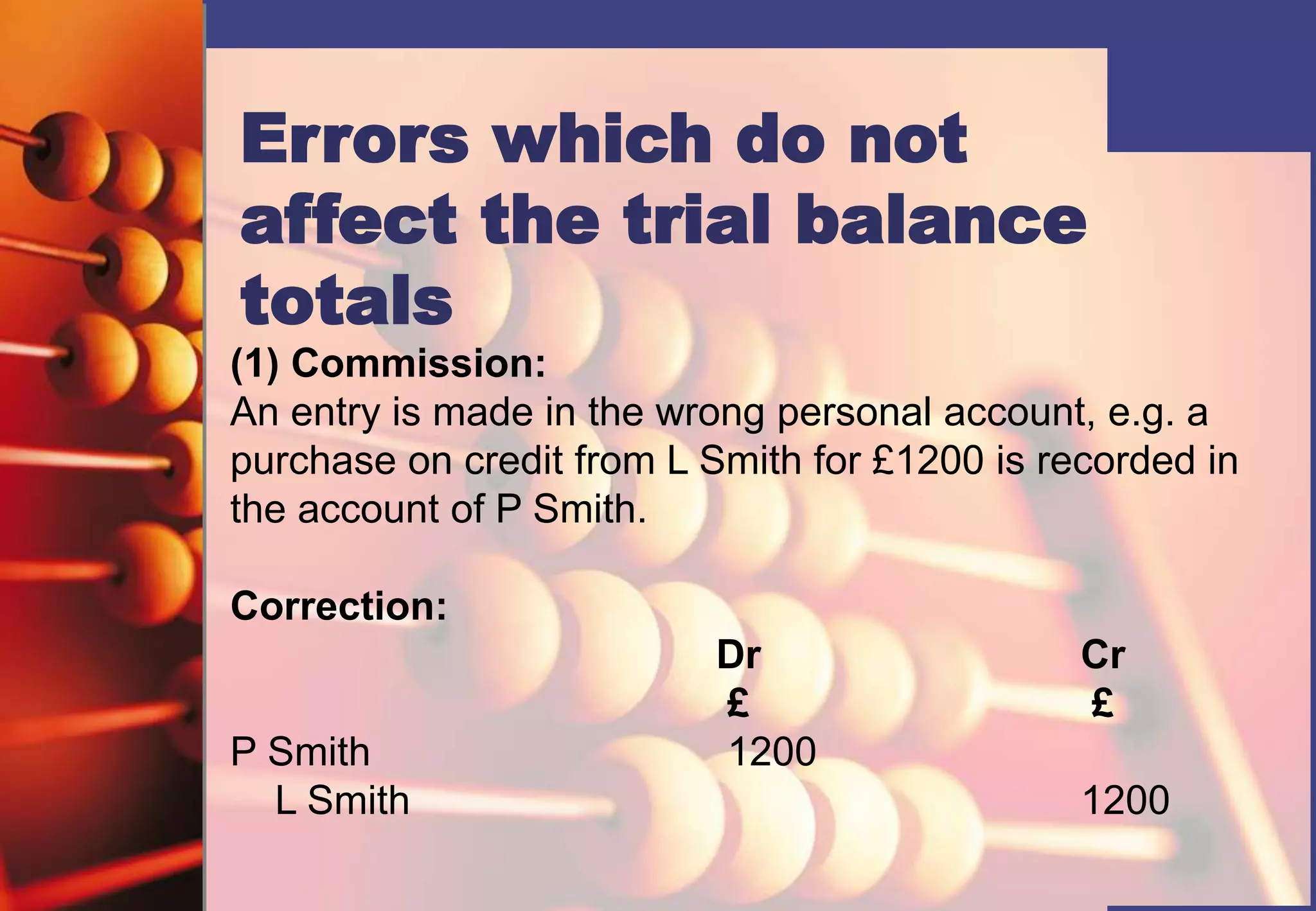

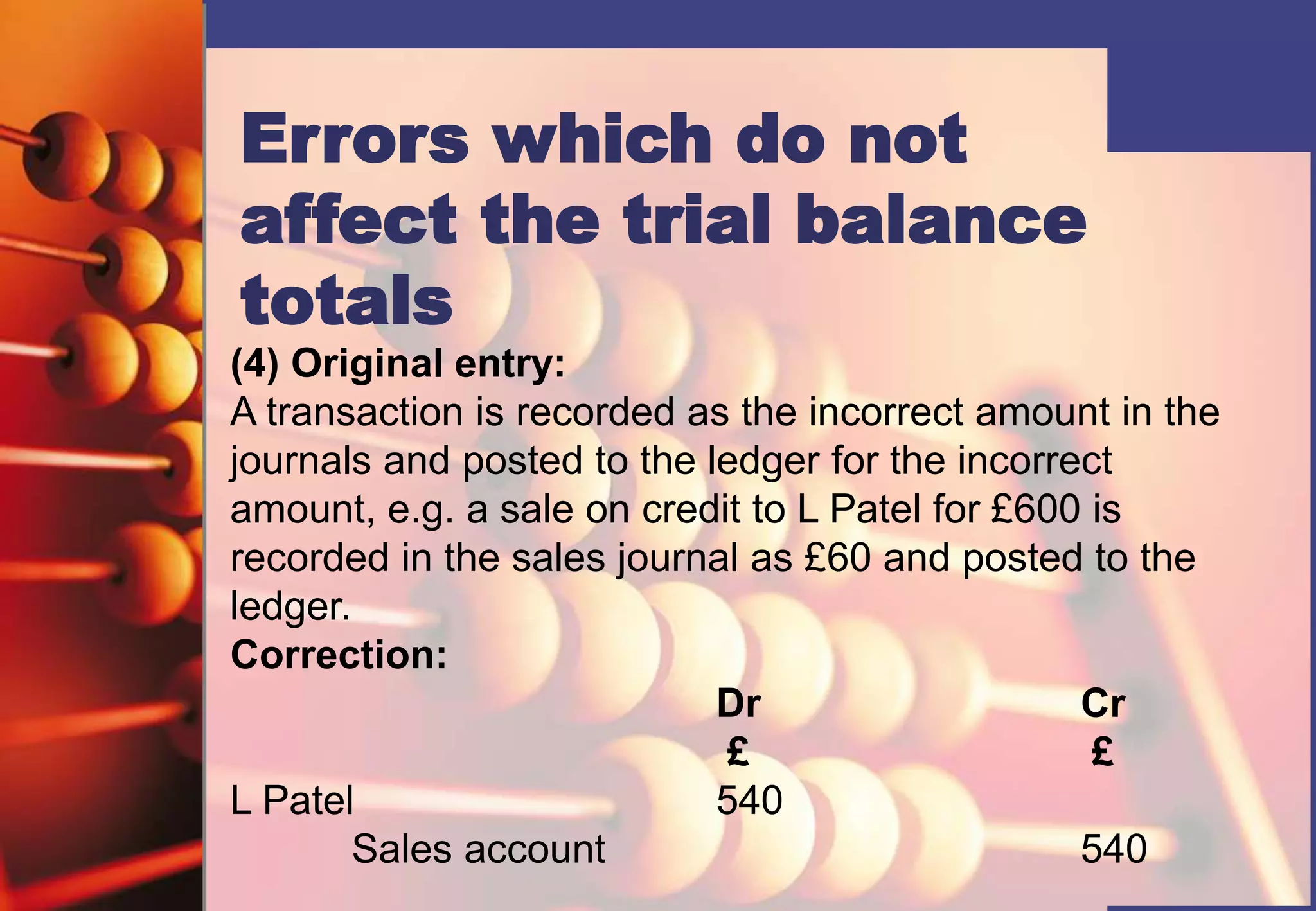

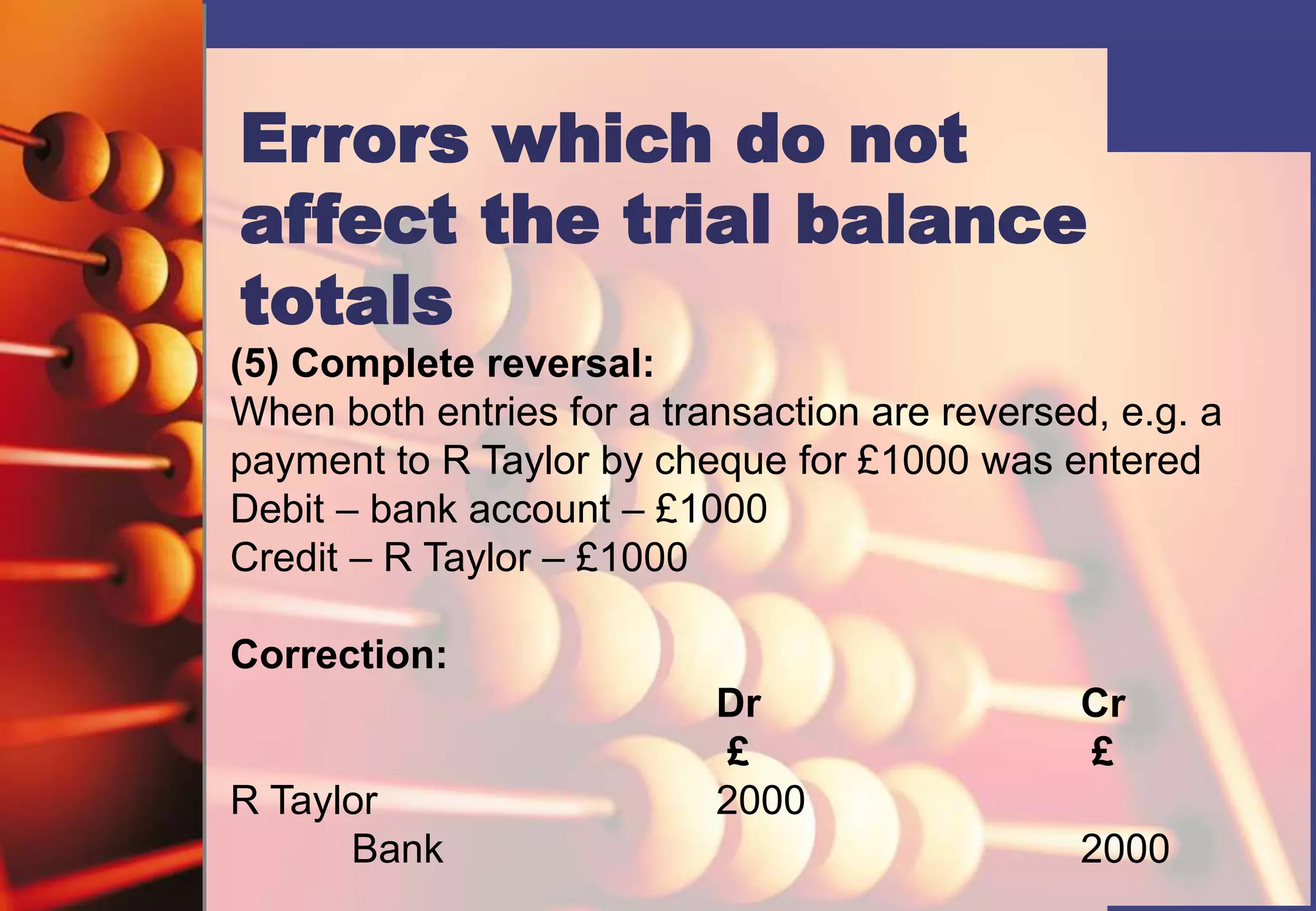

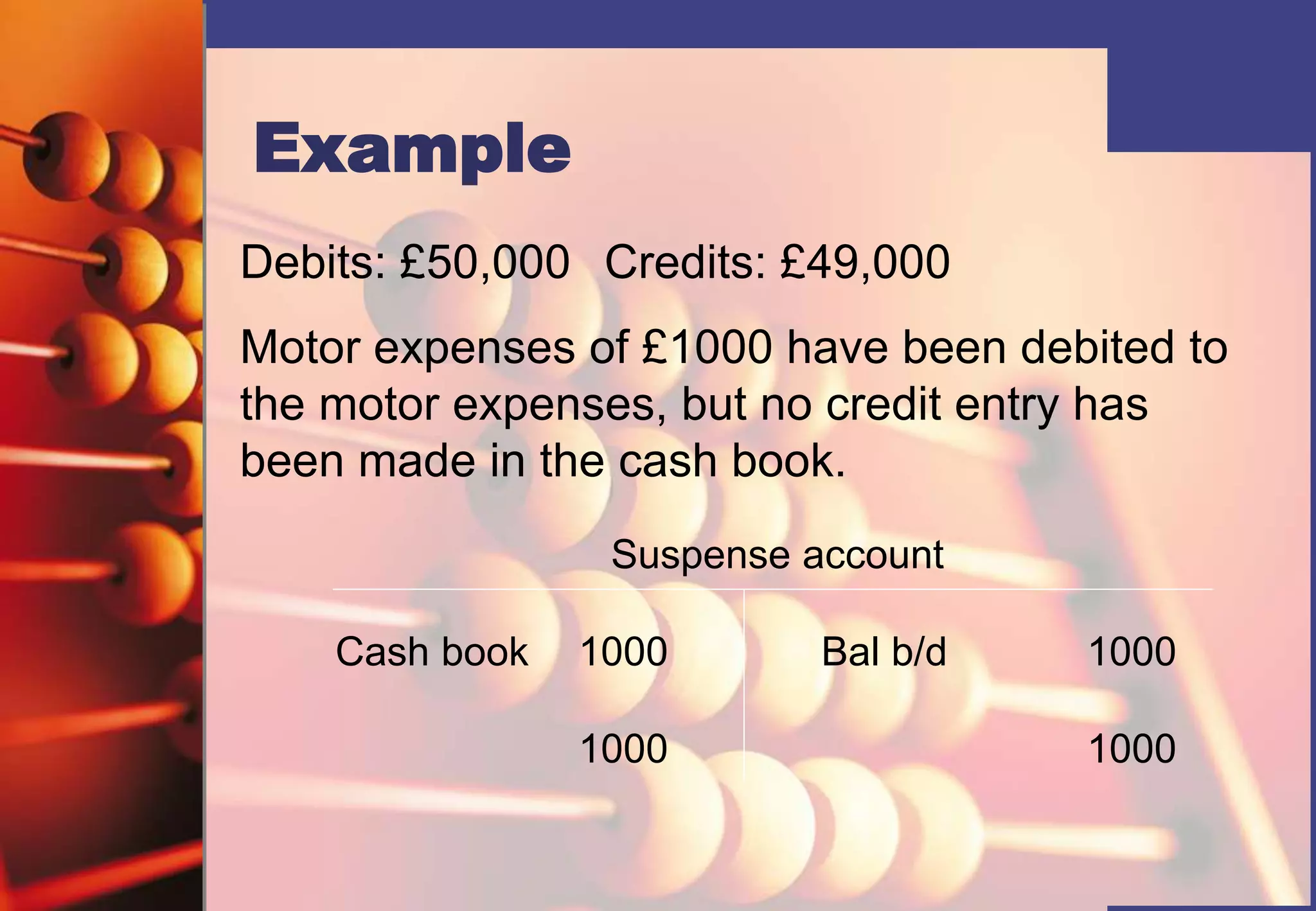

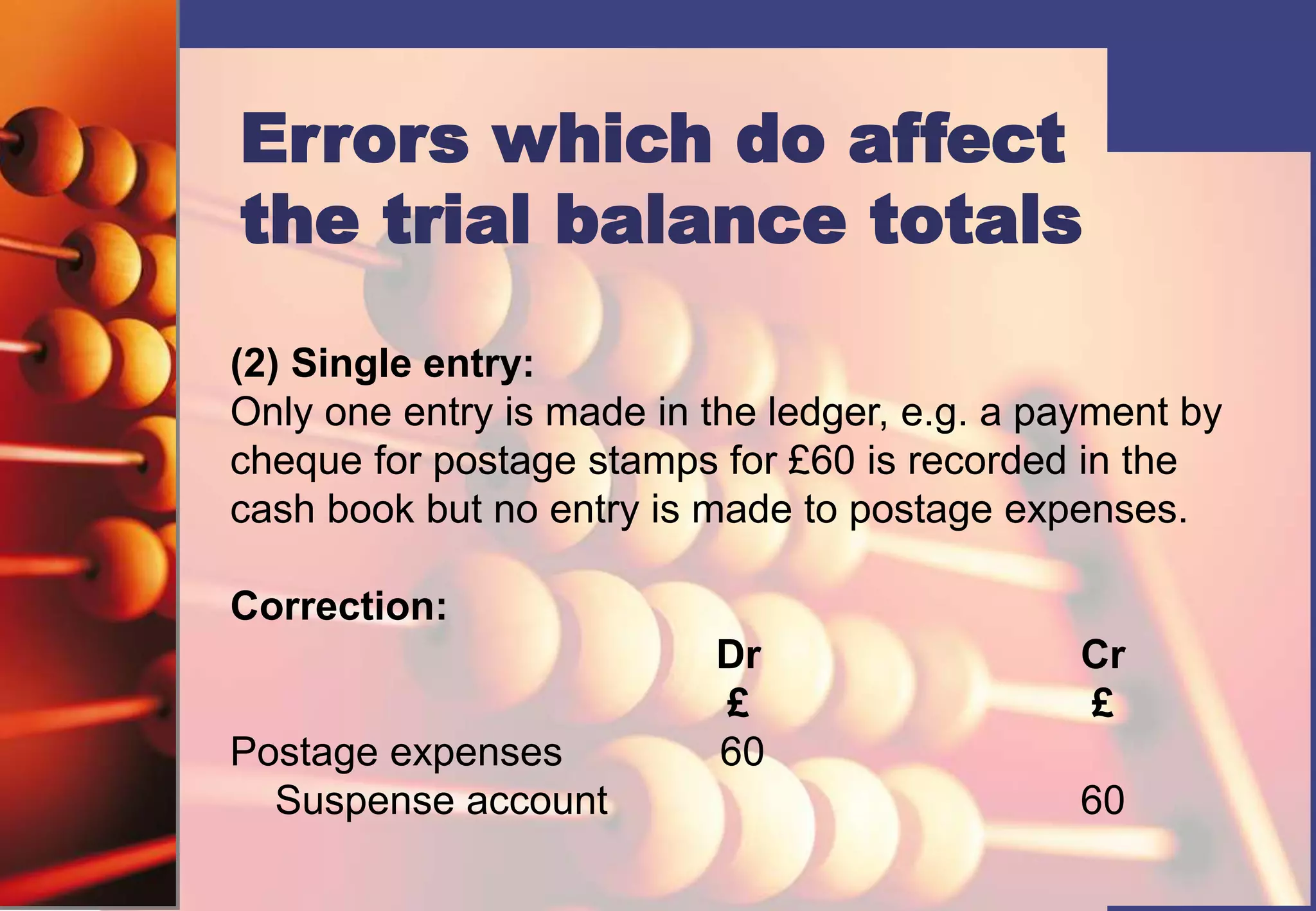

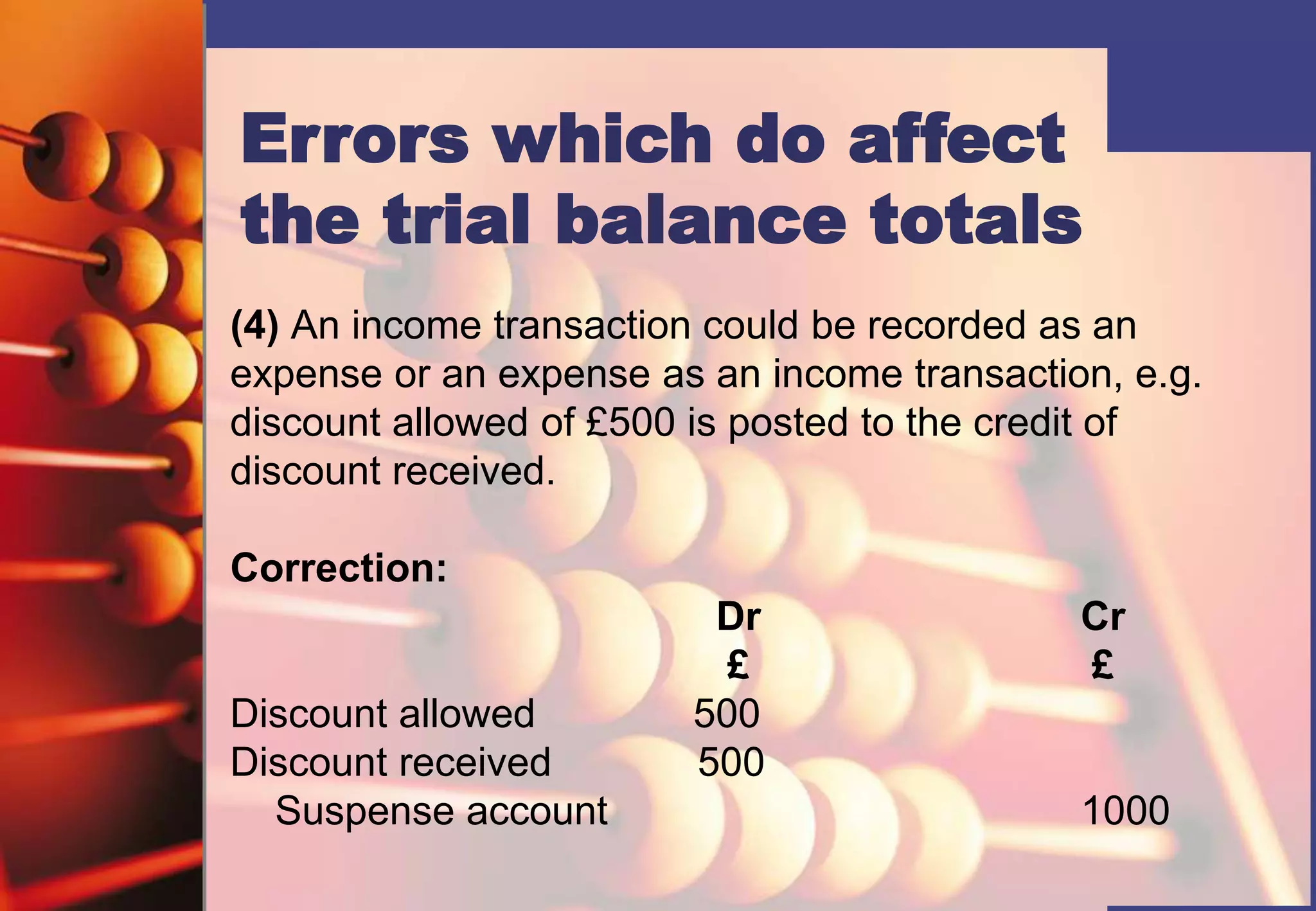

This document discusses different types of accounting errors that can occur when keeping financial records. It describes errors that do not affect the trial balance totals, such as omissions, commissions, principles, compensating errors, original entries, and complete reversals. It also explains errors that do affect the trial balance totals, such as overcasting or undercasting accounts, single entries, and recording income as expenses or vice versa. When errors affect the trial balance, a suspense account must be used to balance the totals until the errors are found and corrected.