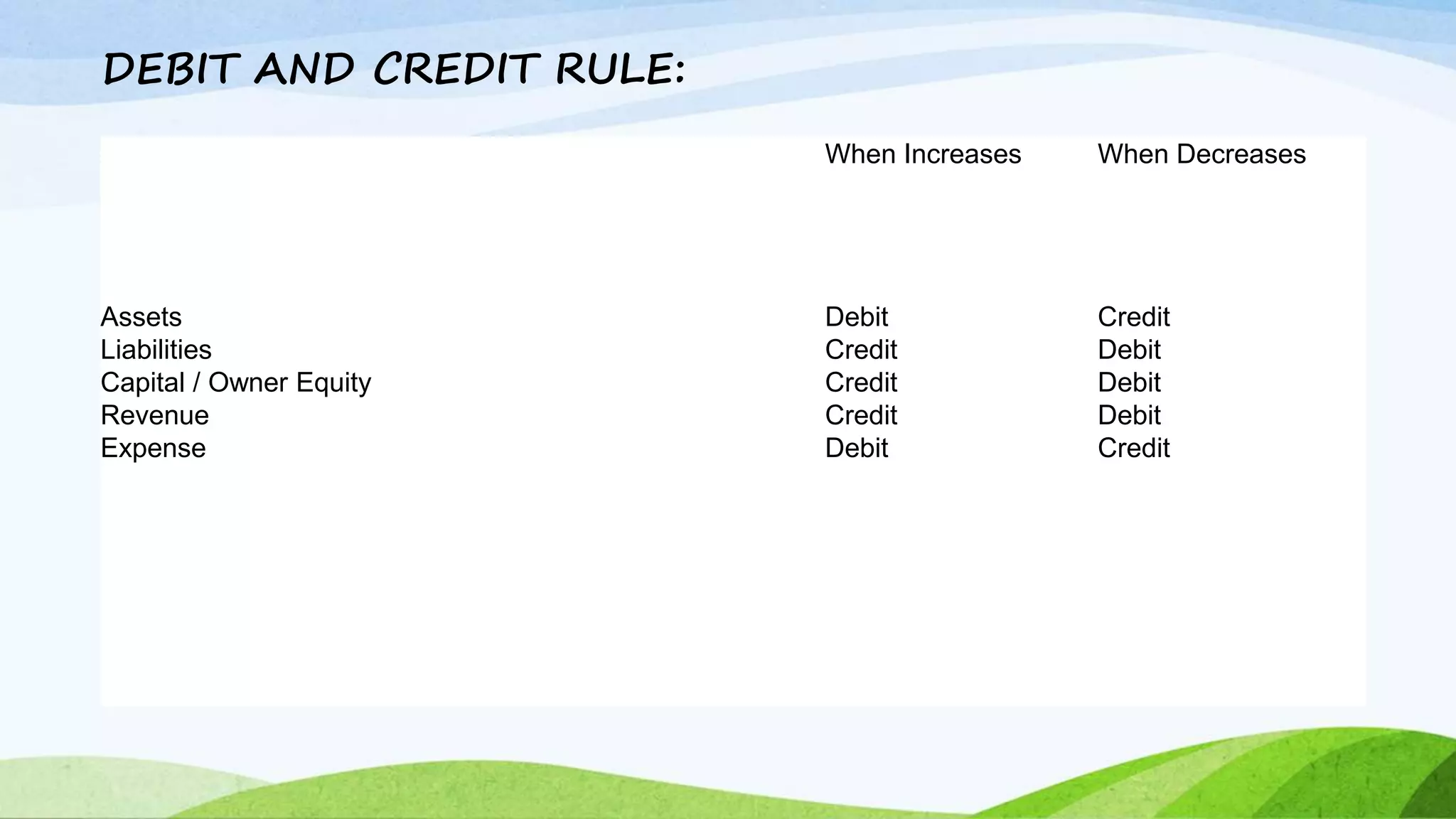

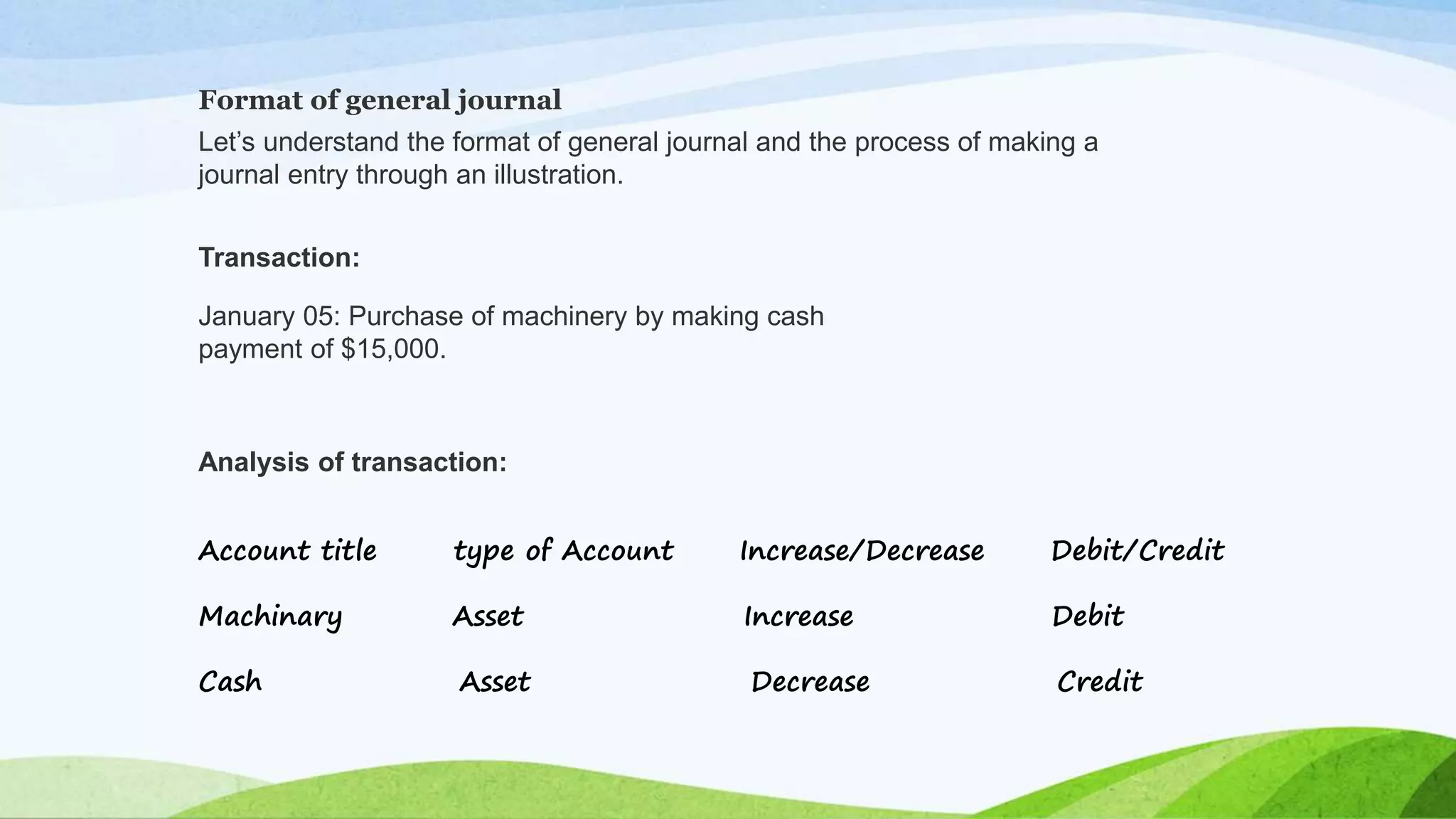

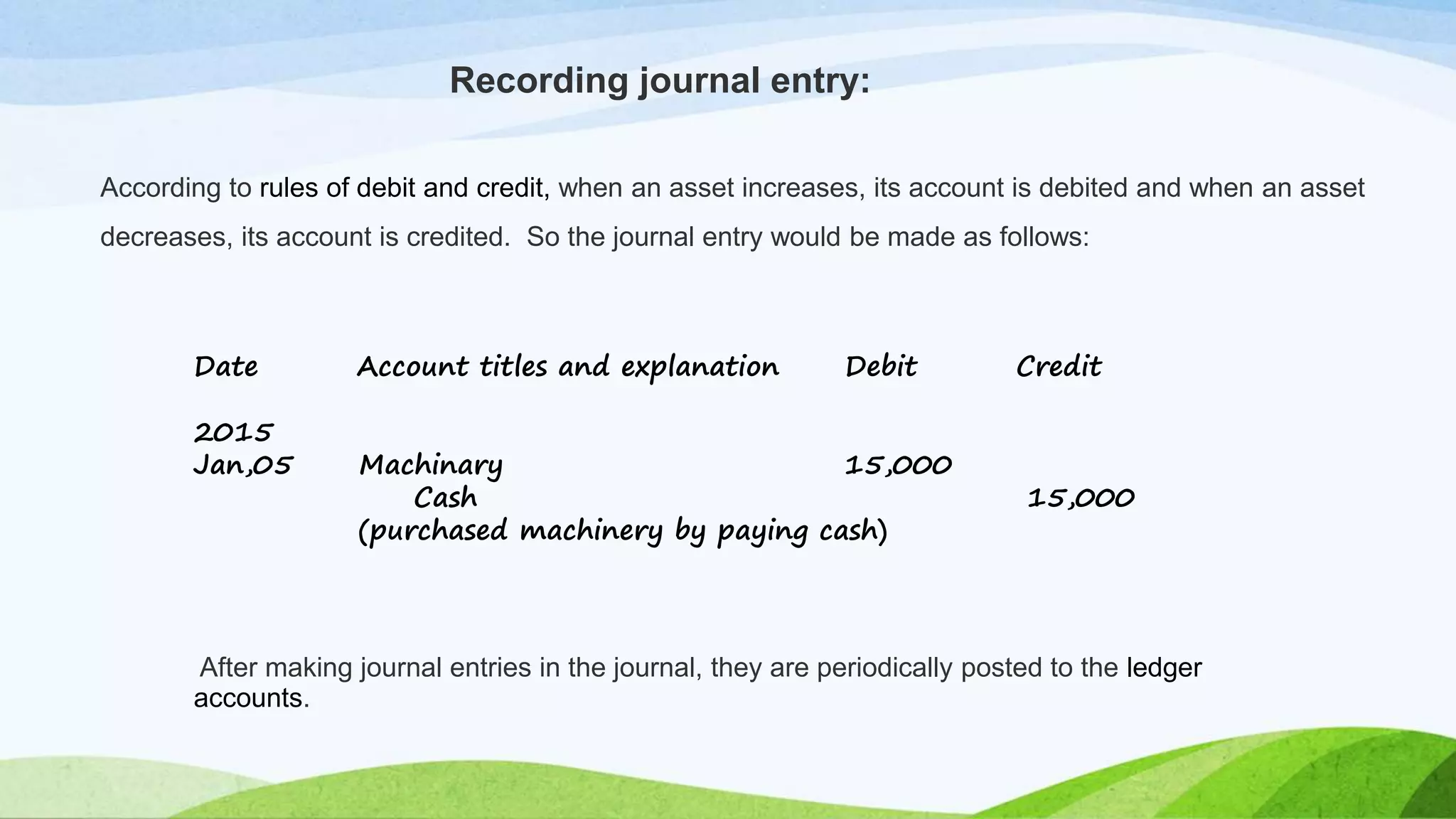

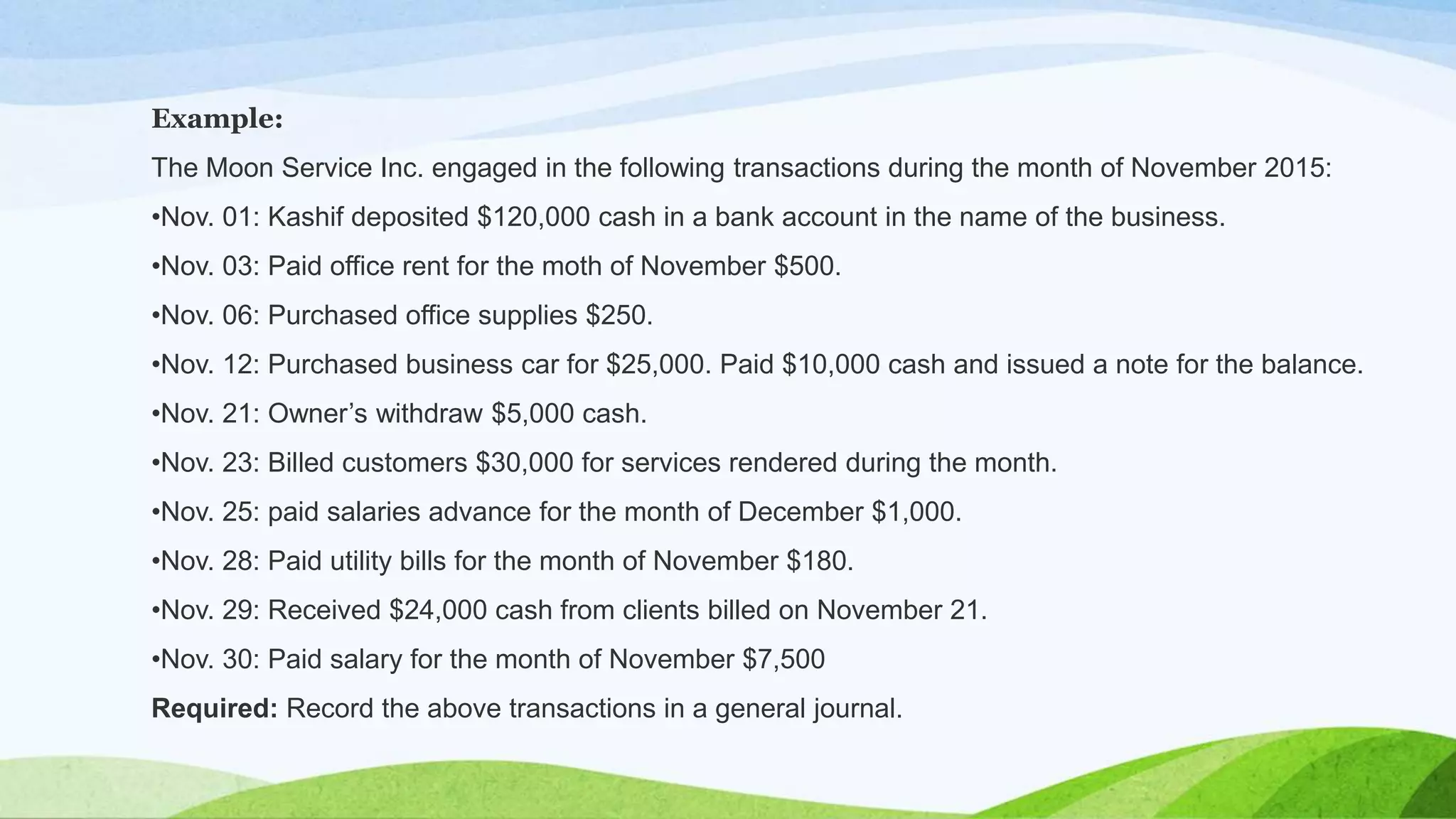

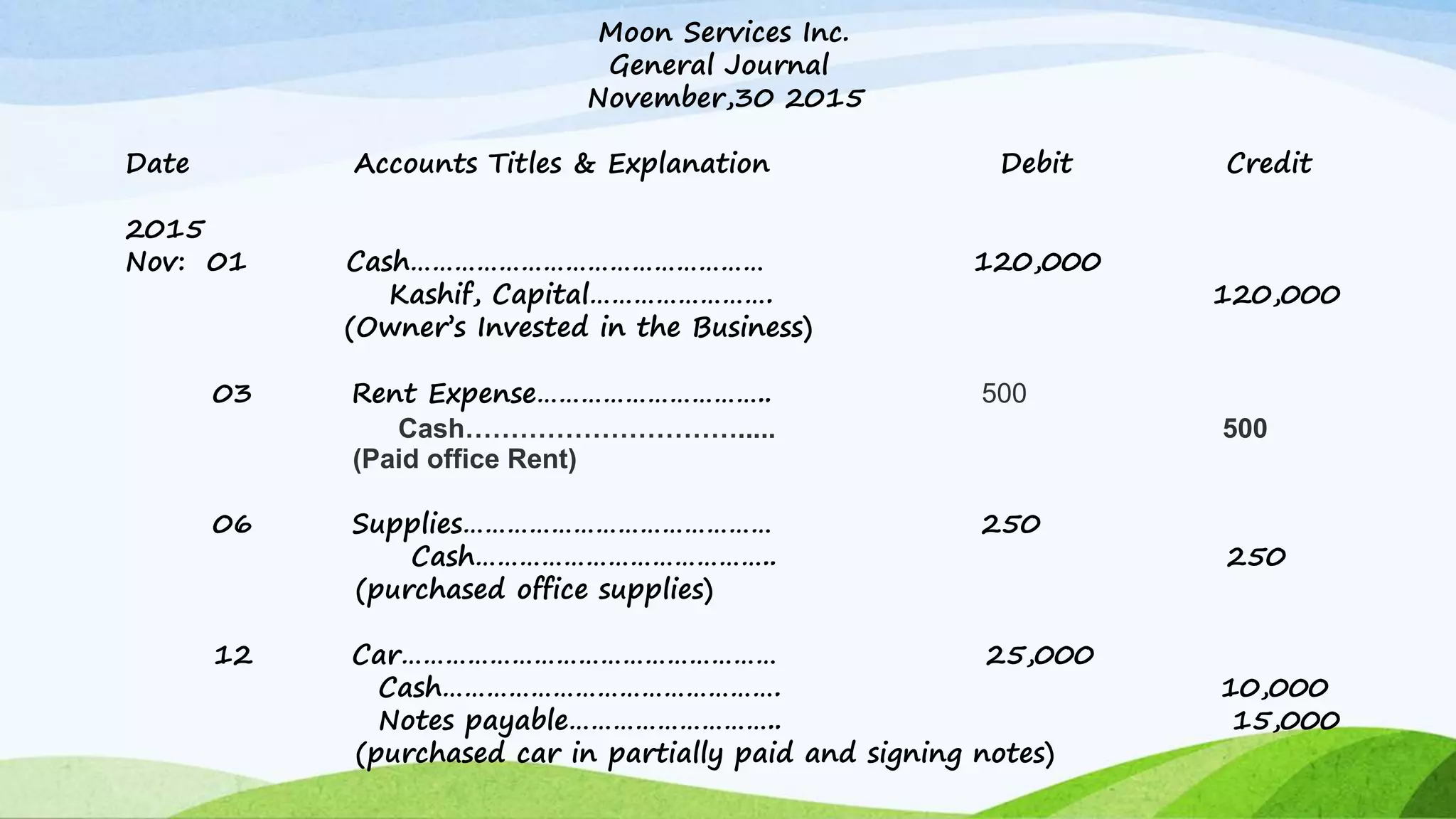

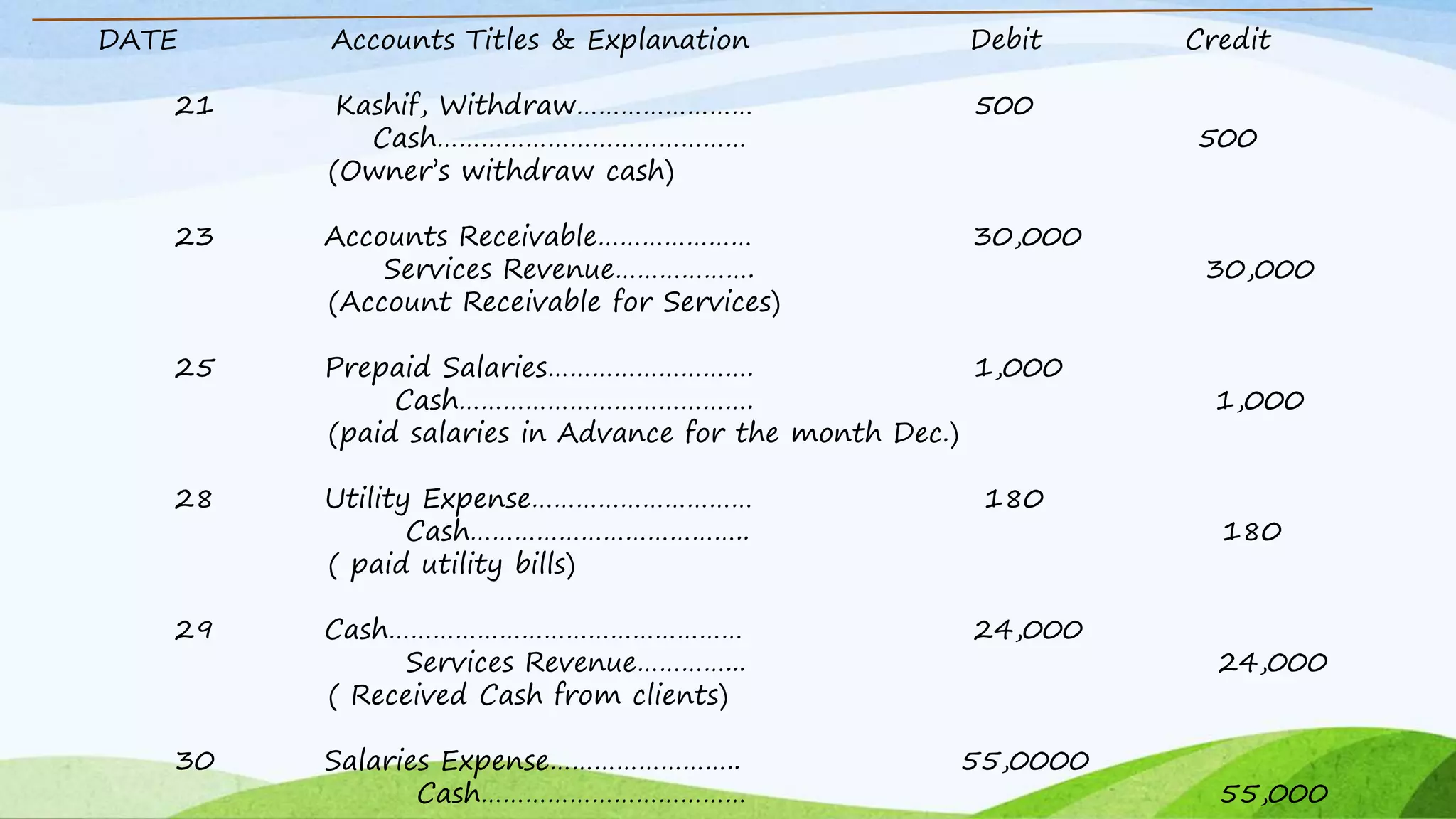

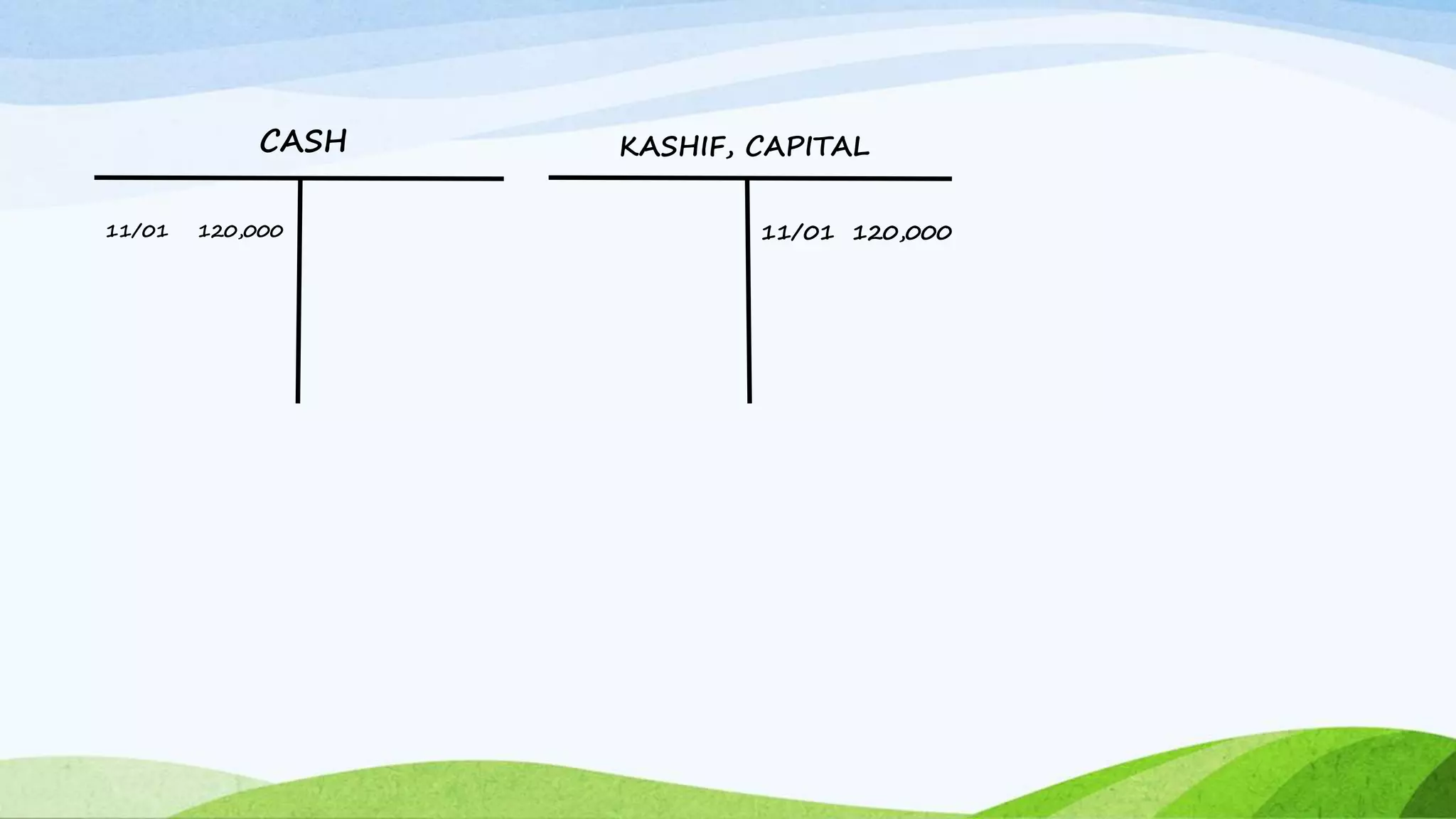

The document outlines the principles of accounting, focusing on the general journal as the initial record for all accounting transactions. It details the process of journalizing transactions, including analysis and posting to ledger accounts, using an example from Moon Services Inc. The document also provides specific transaction entries into a general journal for November 2015.