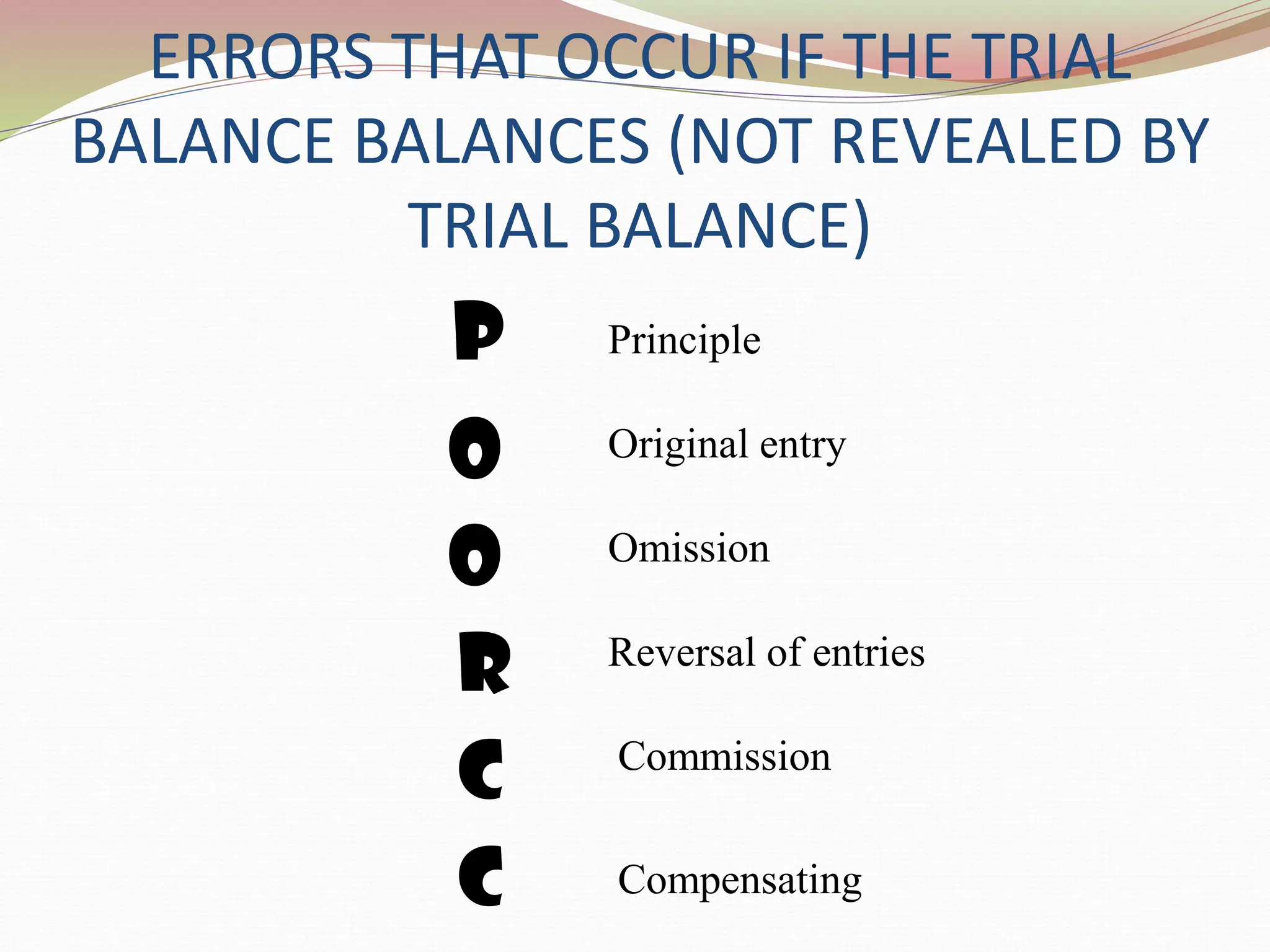

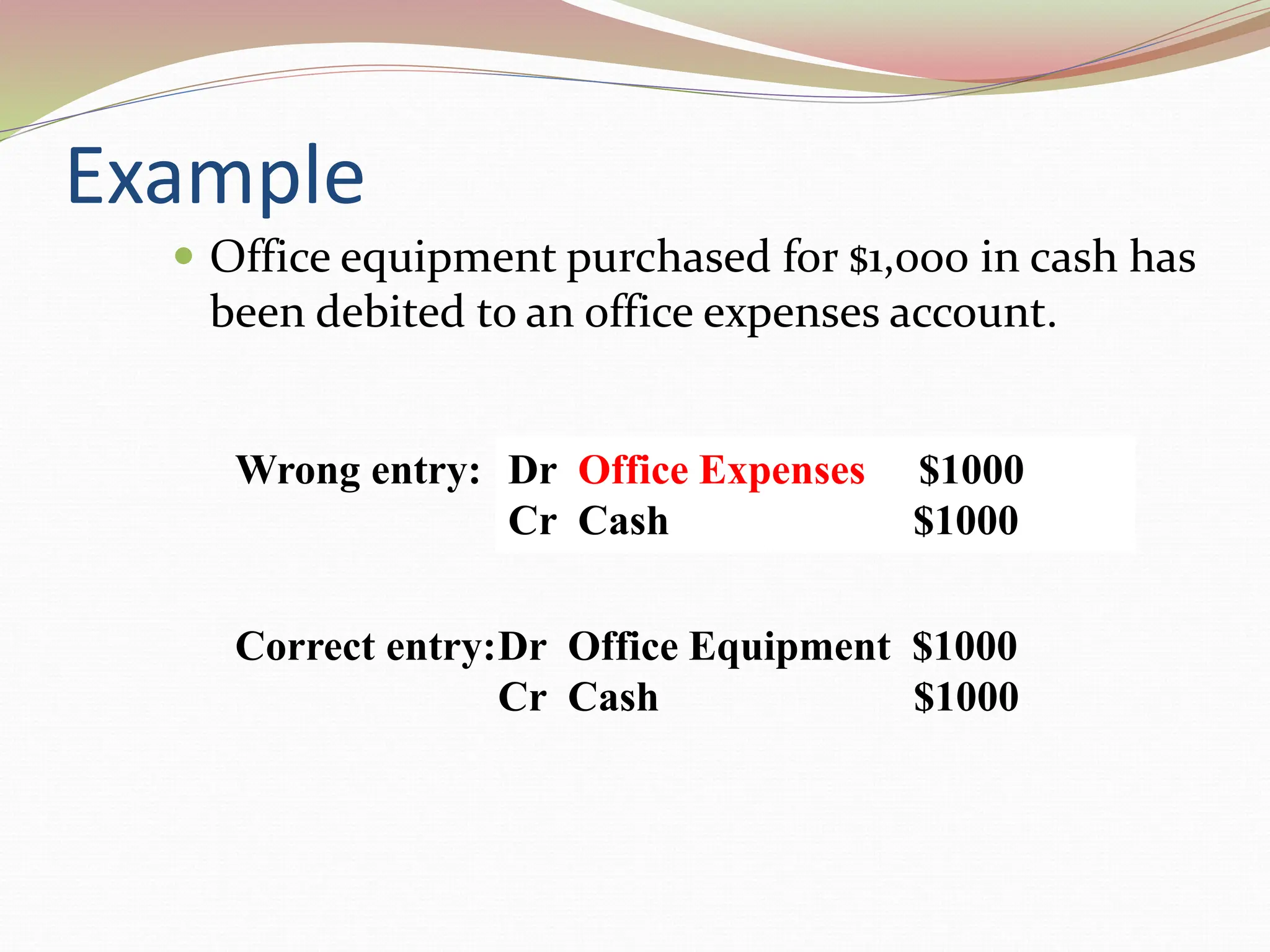

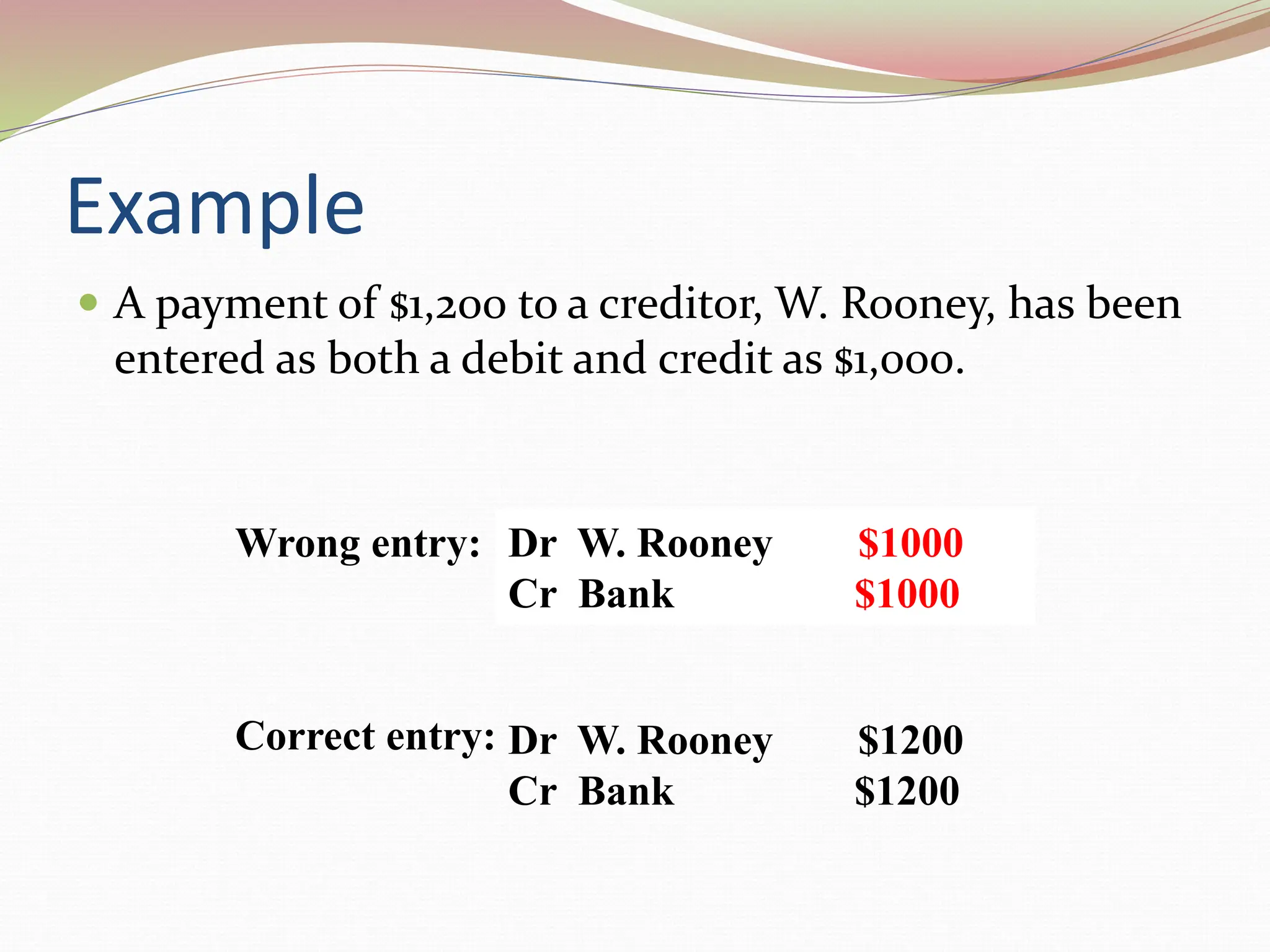

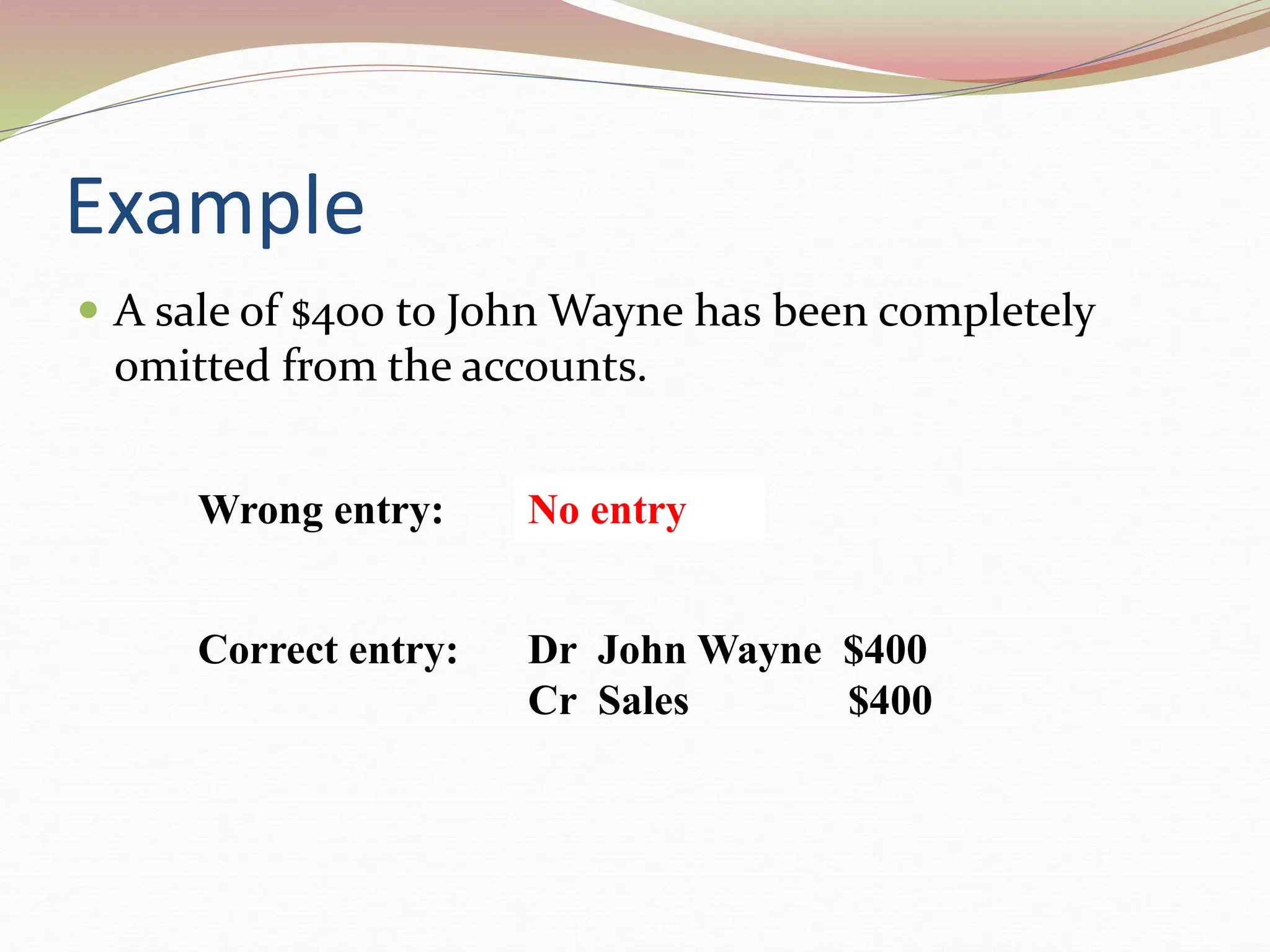

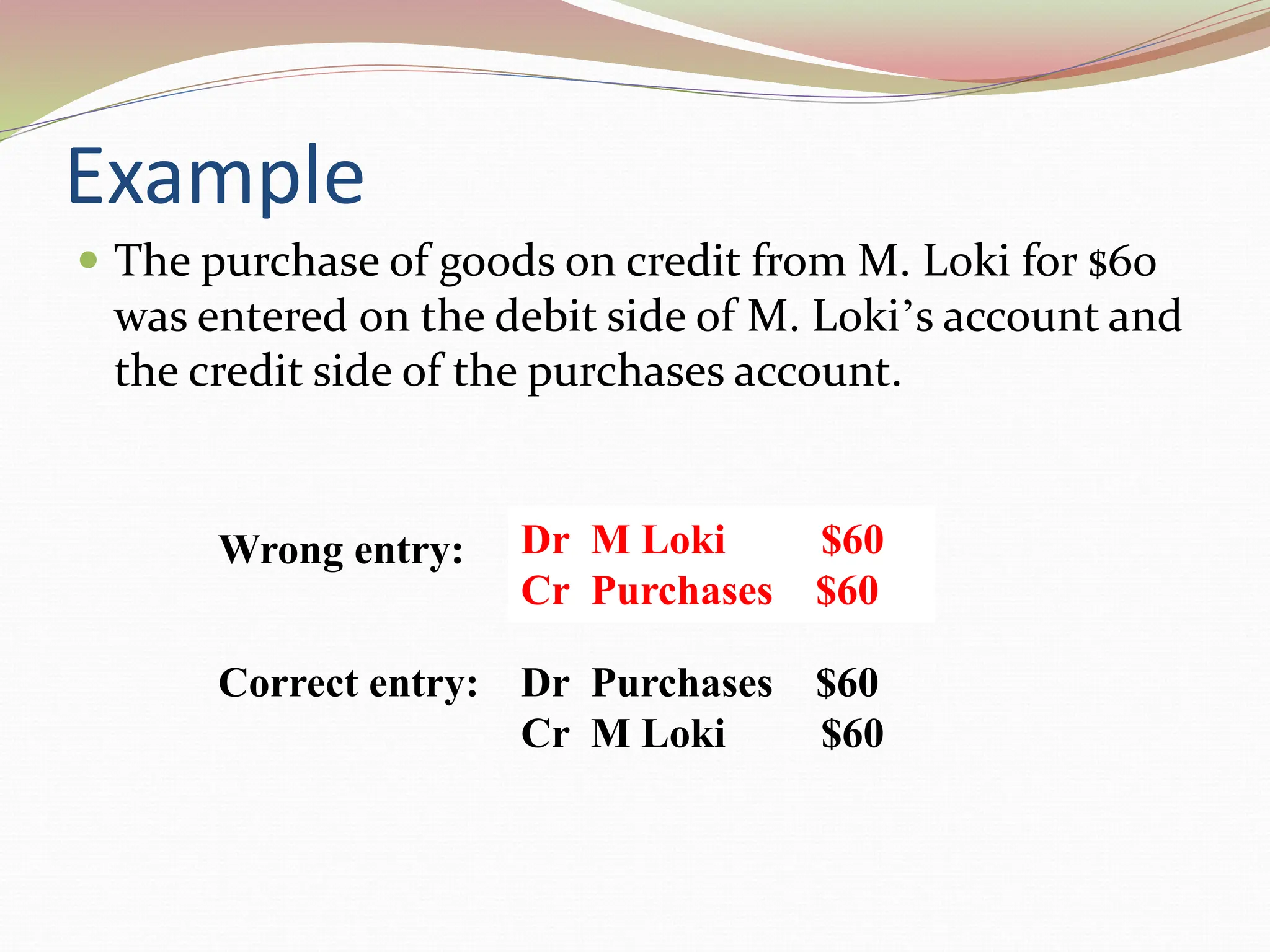

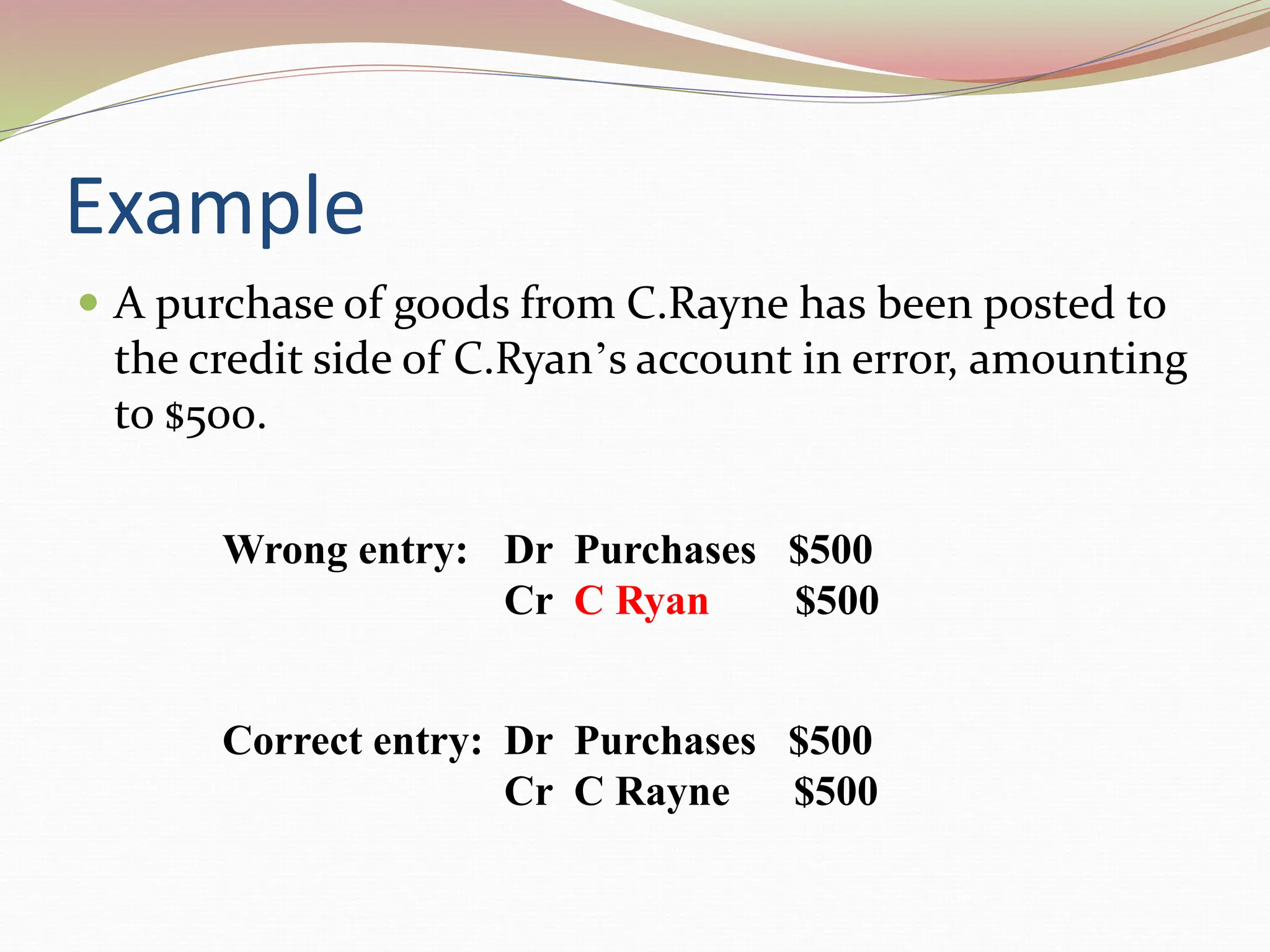

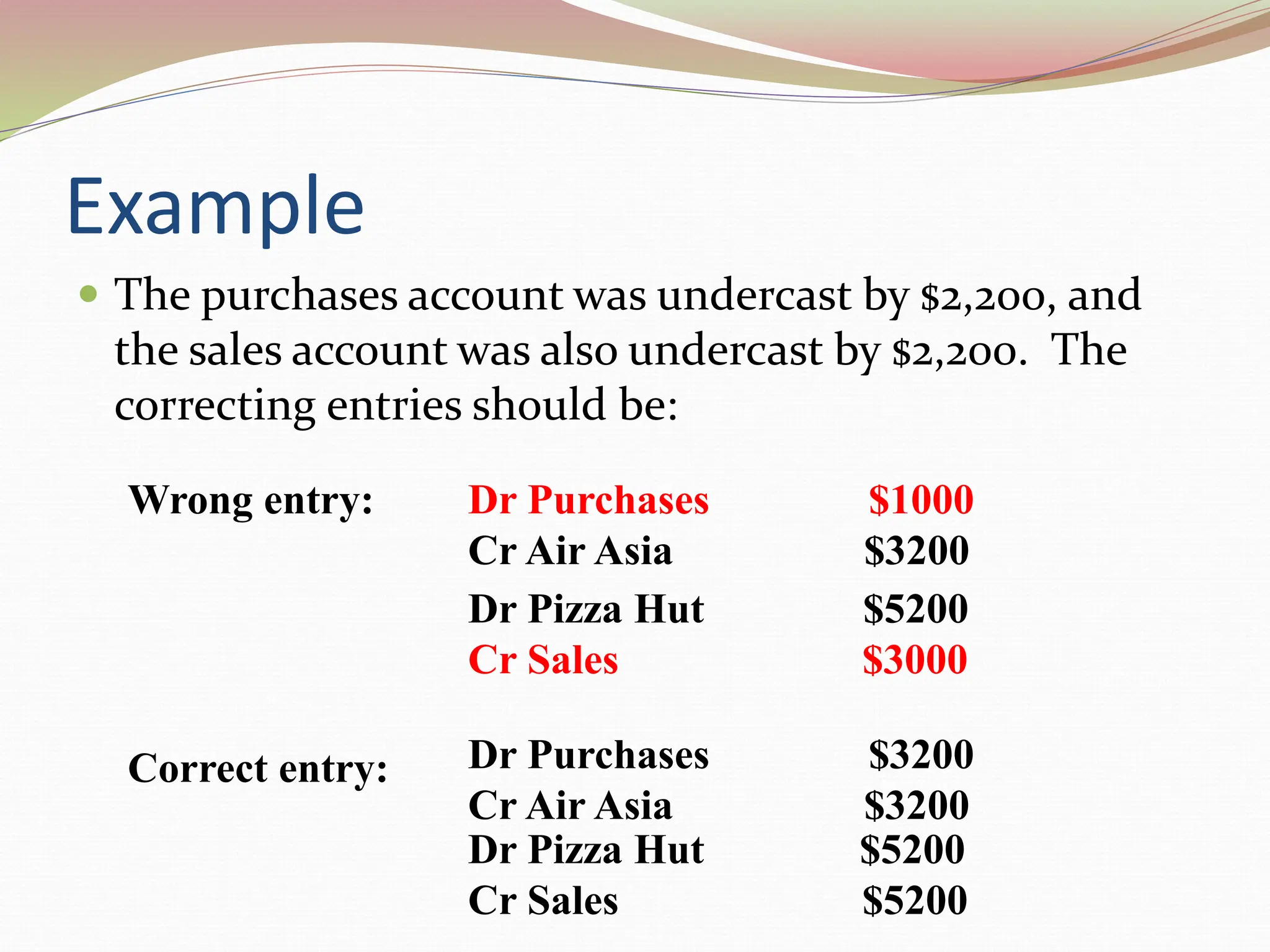

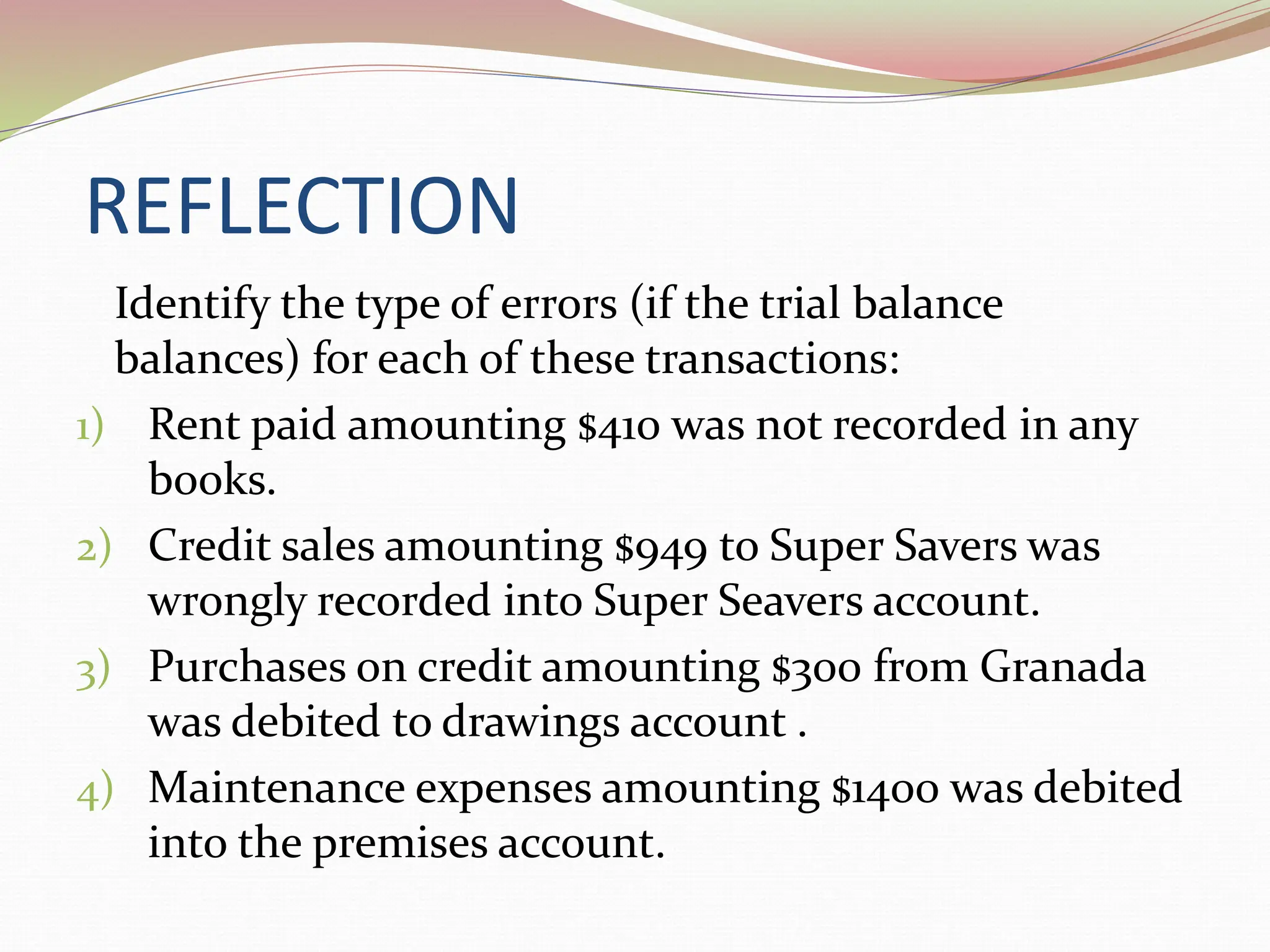

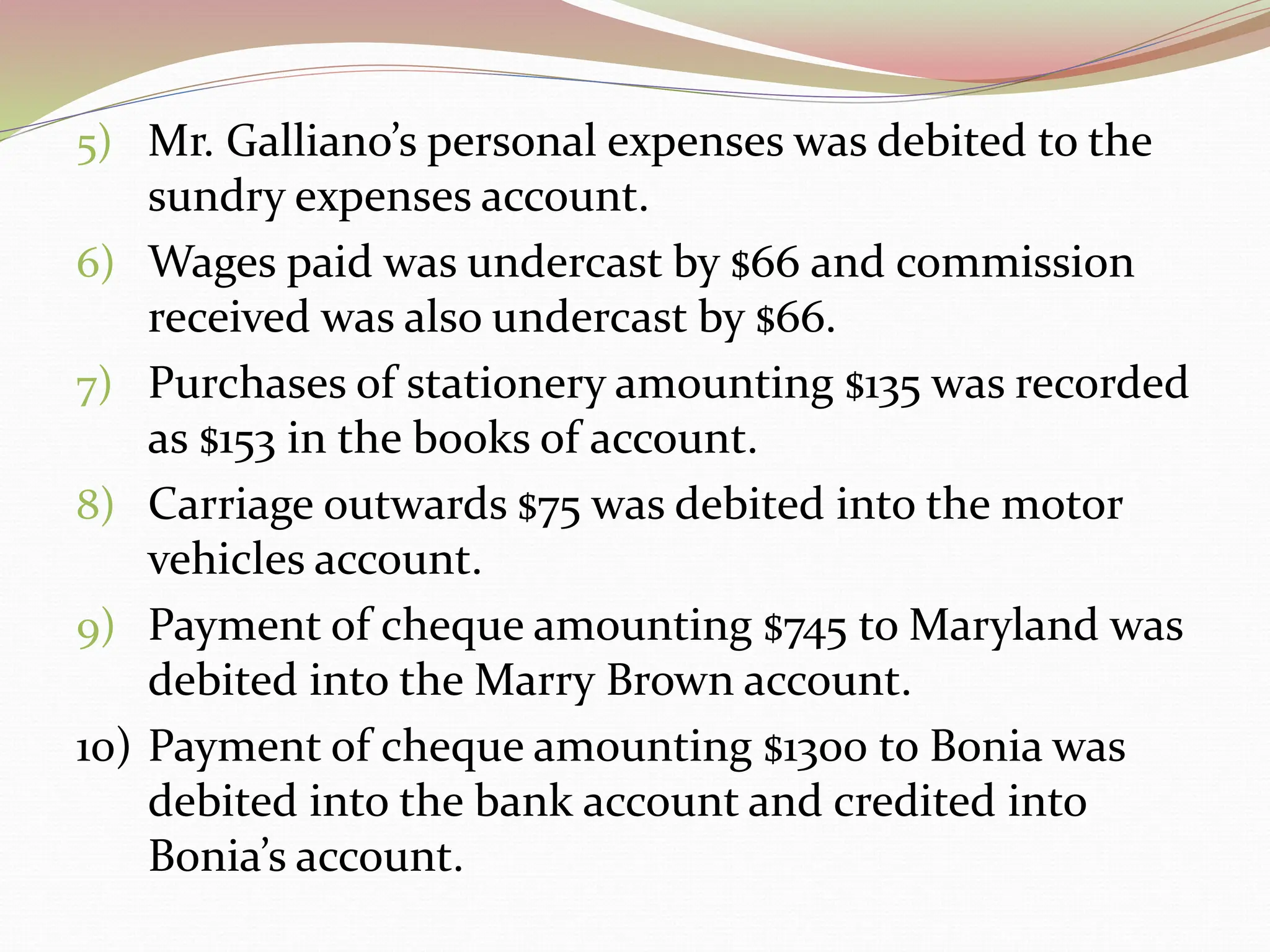

The document outlines different categories of accounting errors that do not affect the trial balance, categorized as principle errors, original entry errors, omissions, reversal of entries, commission errors, and compensating errors. Each type is illustrated with examples and correct entries versus incorrect entries. Additionally, it provides a reflection section with multiple transactions for students to identify the type of error present if the trial balance is balanced.